Fiber Optic Cable Assemblies Market Size, Share, Trends, Growth and Forecast 2034

Fiber Optic Cable Assemblies Market By Fiber Optic Connector Product (SC Connector, LC Connector, FC Connector, ST Connector, MTP/MPO Connector, and Others), By Fiber Optic Connector Application (Telecom, Oil and Gas, Military and Aerospace, BFSI, Medical, Railway, and Others), By Cable Length Outlook (Custom, Standard), By Fiber Mode (Single Mode, Multiple Mode), By Distribution Channel (Direct Sales, Channel Sales), By End Use Industry (Telecom, Oil and Gas, Utilities/Energy, Transportation, Aerospace and Aviation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

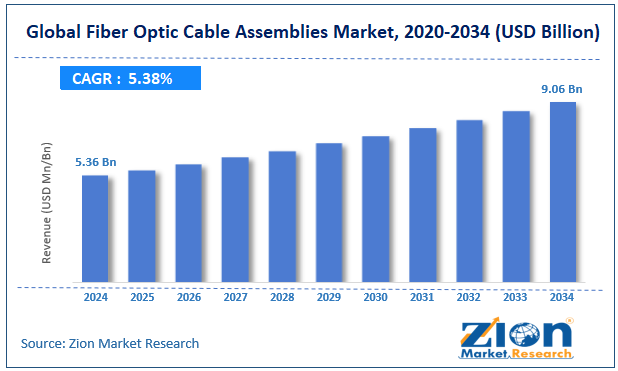

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.36 Billion | USD 9.06 Billion | 5.38% | 2024 |

Fiber Optic Cable Assemblies Industry Prospective:

The global fiber optic cable assemblies market size was valued at approximately USD 5.36 billion in 2024 and is expected to reach around USD 9.06 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 5.38% between 2025 and 2034.

Fiber Optic Cable Assemblies Market: Overview

Fiber optic cable assemblies consist of optical fibers wrapped in protective coverings and terminated with connectors that enable quick and reliable connections. They transmit data through light signals, not electrical pulses, offering more bandwidth, longer distances, and immunity to electromagnetic interference. These assemblies are the backbone of modern telecommunications infrastructure and data centers and are increasingly used in many industrial applications. With the explosion of data globally, fiber optic cable assemblies have become the backbone of high-speed networks.

The demand for more bandwidth and faster data rates, along with increasing investments in telecommunications infrastructure and data centers, is expected to drive the growth of the fiber optic cable assembly market over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global fiber optic cable assemblies market is estimated to grow annually at a CAGR of around 5.38% over the forecast period (2025-2034)

- In terms of revenue, the global fiber optic cable assemblies market size was valued at around USD 5.36 billion in 2024 and is projected to reach USD 9.06 billion by 2034.

- The fiber optic cable assemblies market is projected to grow significantly due to rising demands for high-speed internet connectivity, increasing investments in telecommunications infrastructure, and the rapid expansion of data centers globally.

- Based on fiber optic connector products, LC connectors lead the segment and will continue to dominate the global market per industry projections.

- Based on fiber mode, single-mode fiber optic connectors are anticipated to command the largest market share.

- Based on distribution channels, direct sales are expected to lead the market during the forecast period.

- Based on the end-use industry, telecom will remain dominant during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Fiber Optic Cable Assemblies Market: Growth Drivers

Rising demand for high bandwidth and faster data transmission

In the fiber optic cable assemblies industry, there is a growing demand for data-intensive applications like cloud computing, 4K/8K video streaming, virtual reality, and the Internet of Things (IoT), driving higher bandwidth and faster data transmission. Fiber optic cable assemblies that can transmit data up to 100 Gbps and above are essential to meet these demands.

For example, a study published in the Journal of Light Wave Technology found that fiber optic networks can deliver up to 1,000 times more bandwidth than traditional copper-based networks, making them a must-have for modern data infrastructure.

Expansion of 5G networks and telecommunications infrastructure

The global rollout of 5G networks is creating massive demand in the fiber optic cable assemblies market, as fiber is required for the backhaul infrastructure of these high-speed wireless networks. Telecommunication companies are investing heavily in upgrading their infrastructure to support 5G, with companies like Verizon and AT&T laying thousands of miles of fiber optic cable annually.

Fiber Optic Cable Assemblies Market: Restraints

High initial installation costs and technical complexity

Fiber optic cable assemblies have higher initial costs than conventional copper-based solutions despite their numerous advantages. The specialized equipment, skilled labor, and precise installation techniques required for fiber optic systems add to the price. The cost of the fiber optic termination equipment alone can be substantial, and the special training needed for the technicians adds to the overall cost.

Plus, fiber optic cables are more fragile than copper alternatives and require more careful handling during installation and maintenance, increasing the price.

Fiber Optic Cable Assemblies Market: Opportunities

Increasing adoption of industrial automation and smart manufacturing

The Industrial Internet of Things (IIoT) and Industry 4.0 are creating significant opportunities for the fiber optic cable assemblies industry in the manufacturing environment. Fiber optic systems are immune to electromagnetic interference, critical in factory environments with many motors, generators, and high-power equipment. Companies implementing innovative manufacturing solutions need reliable high-speed networks to connect sensors, actuators, and control systems across the factory floor.

Fiber Optic Cable Assemblies Market: Challenges

Materials shortages and supply chain disruptions

The fiber optic cable assemblies market faces challenges in raw material availability and supply chain stability. Key components such as high-purity glass, specialized polymers for cable jacketing, and rare earth elements used in certain connector types are subject to supply fluctuations and price volatility. Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted the vulnerability of complex global supply chains. Disruptions in major producing countries can lead to extended lead times and production delays.

Fiber Optic Cable Assemblies Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fiber Optic Cable Assemblies Market |

| Market Size in 2024 | USD 5.36 Billion |

| Market Forecast in 2034 | USD 9.06 Billion |

| Growth Rate | CAGR of 5.38% |

| Number of Pages | 213 |

| Key Companies Covered | Corning Incorporated, CommScope Holding Company Inc., Prysmian Group, Amphenol Corporation, Molex LLC, TE Connectivity Ltd., Sumitomo Electric Industries Ltd., Radiall, AFL (Fujikura Ltd.), Huber+Suhner AG, FURUKAWA ELECTRIC CO. LTD., Belden Inc., Hitachi Cable America Inc., Nexans S.A., Broadcom Inc., Fischer Connectors SA, Glenair Inc., Leviton Manufacturing Co. Inc., L-com Inc., OFS Fitel LLC, Panduit Corp., Rosenberger, Siemon Company, 3M Company, LAPP Group, and others. |

| Segments Covered | By Fiber Optic Connector Product, By Fiber Optic Connector Application, By Cable Length Outlook,By Fiber Mode, By Distribution Channel, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fiber Optic Cable Assemblies Market: Segmentation

The global fiber optic cable assemblies market is segmented based on fiber optic connector product, application, cable length outlook, fiber mode, distribution channel, end-use industry, and region.

Based on fiber optic connector products, the industry is segregated into SC Connector, LC Connector, FC Connector, ST Connector, MTP/MPO Connector, and Others. LC Connectors dominate the market as they offer a smaller form factor that allows for higher port density, which is crucial in data centers and telecommunications equipment where space is at a premium.

Based on fiber mode, the fiber optic cable assemblies market is divided into single mode and multiple mode. Single-mode fiber optic connectors dominate the market as they support longer transmission distances and higher bandwidths, which are increasingly required for telecommunications infrastructure and long-haul networks.

Based on distribution channels, the fiber optic cable assemblies industry is categorized into direct and channel sales. Direct Sales are expected to lead the market during the forecast period since they offer manufacturers better control over product quality, customization options, and after-sales service.

Based on the end-use industry, the market is segregated into telecom, oil and gas, utilities/energy, transportation, aerospace and aviation, and others. The telecom sector dominates the market due to the ongoing global expansion of telecommunications networks, including 5G infrastructure deployment and fiber-to-the-home (FTTH) initiatives.

Fiber Optic Cable Assemblies Market: Regional Analysis

North America to lead the market

North America will lead the global fiber optic cable assemblies market due to significant investments in telecommunications infrastructure, data centers, and advanced manufacturing. The US alone accounts for around 35% of global fiber optic consumption, with data center expansion and 5G network deployments driving demand.

Big tech companies like Google, Amazon, Microsoft, and Facebook are building massive data centers that require extensive fiber optic connectivity. The region's focus on high-speed internet access, including federal initiatives to expand broadband to underserved areas, further strengthens the market.

Plus, the presence of big fiber optic manufacturers and assembly specialists like Corning, CommScope, and Amphenol drives innovation and product development. Defense and aerospace are other significant market segments, with high-performance fiber optic assemblies critical to modern military and aviation systems.

Asia Pacific to grow significantly.

Asia Pacific is growing fast in the fiber optic cable assemblies market, with key players such as China, Japan, South Korea, and India. The region benefits from massive telecommunications infrastructure projects, including fiber-to-the-home initiatives in China and Japan. Chinese fiber optic installation has grown over 40% in the last 5 years and is the world's most extensive fiber market.

Advanced manufacturing in countries like Japan, South Korea, and Taiwan drives demand for industrial-grade fiber optic assemblies for automation and process control. The digital transformation across Southeast Asian economies creates new telecommunications and enterprise network infrastructure markets.

Recent Market Developments:

- In January 2024, Corning Incorporated introduced a new series of high-density MTP/MPO connectors that reduce rack space requirements by 40% while maintaining optical performance.

- In March 2024, CommScope launched enhanced single-mode fiber assemblies specifically designed for 5G front-haul applications, featuring improved environmental protection and reduced bending loss.

- In June 2024, Amphenol Fiber Optic Products unveiled a proprietary connector design that reduces insertion loss by 30% for high-speed data center applications.

Fiber Optic Cable Assemblies Market: Competitive Analysis

The global fiber optic cable assemblies industry is led by players like:

- Corning Incorporated

- CommScope Holding Company Inc.

- Prysmian Group

- Amphenol Corporation

- Molex LLC

- TE Connectivity Ltd.

- Sumitomo Electric Industries Ltd.

- Radiall

- AFL (Fujikura Ltd.)

- Huber+Suhner AG

- FURUKAWA ELECTRIC CO. LTD.

- Belden Inc.

- Hitachi Cable America Inc.

- Nexans S.A.

- Broadcom Inc.

- Fischer Connectors SA

- Glenair Inc.

- Leviton Manufacturing Co. Inc.

- L-com Inc.

- OFS Fitel LLC

- Panduit Corp.

- Rosenberger

- Siemon Company

- 3M Company

- LAPP Group

The global fiber optic cable assemblies market is segmented as follows:

By Fiber Optic Connector Product

- SC Connector

- LC Connector

- FC Connector

- ST Connector

- MTP/MPO Connector

- Others

By Fiber Optic Connector Application

- Telecom

- Oil and Gas

- Military and Aerospace

- BFSI

- Medical

- Railway

- Others

By Cable Length Outlook

- Custom

- Standard

By Fiber Mode

- Single Mode

- Multiple Mode

By Distribution Channel

- Direct Sales

- Channel Sales

By End-Use Industry

- Telecom

- Oil and Gas

- Utilities/Energy

- Transportation

- Aerospace and Aviation

- Other

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fiber optic cable assemblies consist of optical fibers wrapped in protective coverings and terminated with connectors that enable quick and reliable connections.

The fiber optic cable assemblies market is expected to be driven by increasing demand for high-speed internet connectivity, 5G network deployments, data center expansion, and growing adoption in industrial automation and smart manufacturing.

According to our study, the global fiber optic cable assemblies market was worth around USD 5.36 billion in 2024 and is predicted to grow to around USD 9.06 billion by 2034.

The CAGR value of the fiber optic cable assemblies market is expected to be around 5.38% during 2025-2034.

The global fiber optic cable assemblies market will register the highest growth in North America during the forecast period.

Key players in the fiber optic cable assemblies market include Corning Incorporated, CommScope Holding Company, Inc., Prysmian Group, Amphenol Corporation, Molex LLC, TE Connectivity Ltd., Sumitomo Electric Industries, Ltd., Radiall, AFL (Fujikura Ltd.), Huber+Suhner AG, FURUKAWA ELECTRIC CO., LTD., Belden Inc., Hitachi Cable America Inc., Nexans S.A., Broadcom Inc., Fischer Connectors SA, Glenair, Inc., Leviton Manufacturing Co., Inc., L-com, Inc., OFS Fitel, LLC, Panduit Corp., Rosenberger, Siemon Company, 3M Company, and LAPP Group.

The report provides a comprehensive analysis of the fiber optic cable assemblies market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and regulatory factors shaping the manufacturing, distribution, and application of fiber optic cable assemblies across various industries.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed