Filter Coatings Market Size, Share, Trends, Growth 2030

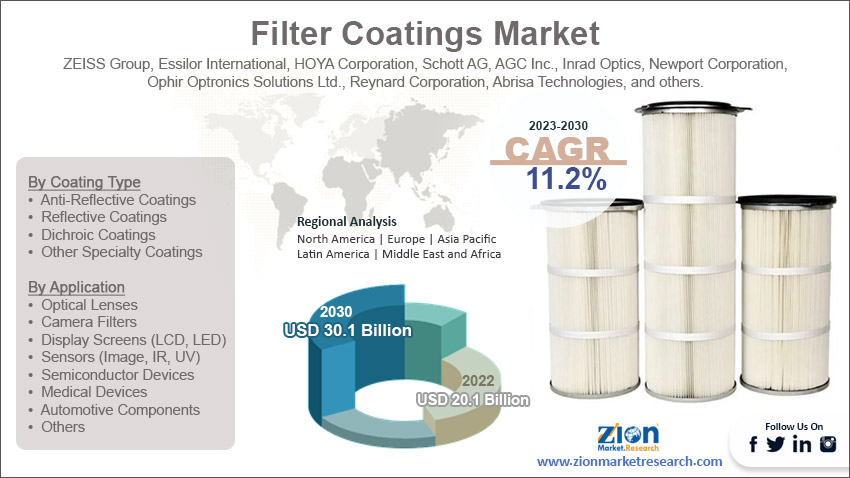

Filter Coatings Market By Coating Type (Anti-Reflective Coatings, Reflective Coatings, Dichroic Coatings and Other Specialty Coatings), By Application (Optical Lenses, Camera Filters, Display Screens (LCD and LED), Sensors (Image, IR, and UV), Semiconductor Devices, Medical Devices, Automotive Components, and Other Specialized Applications), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.1 Billion | USD 30.1 Billion | 11.2% | 2022 |

Filter Coatings Industry Prospective:

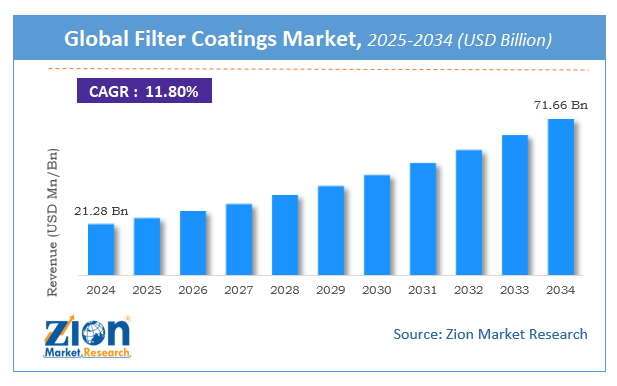

The global filter coatings market size was worth around USD 20.1 billion in 2022 and is predicted to grow to around USD 30.1 billion by 2030 with a compound annual growth rate (CAGR) of roughly 11.2% between 2023 and 2030.

Filter Coatings Market: Overview

Filter coatings are specialized layers applied to optical components, such as lenses and filters, to modify their optical properties. These coatings are designed to interact with light in a controlled manner, allowing certain wavelengths or frequencies to pass through while blocking or attenuating others. One common type of filter coating is an anti-reflective coating, which helps to minimize reflections on the surface of an optical element. This is particularly important in improving the overall transmission of light through the component, thereby enhancing image clarity and reducing glare. Another important category of filter coatings is dichroic coatings, which are designed to selectively transmit or reflect specific wavelengths. These coatings find extensive use in applications like fluorescence microscopy and optical filters for cameras, where precise control over the spectral characteristics of the transmitted light is crucial. By strategically applying these coatings, optical systems can be tailored to meet specific requirements, enabling a wide range of scientific, industrial, and consumer applications. In summary, filter coatings play a fundamental role in customizing the behavior of optical components, ultimately contributing to the performance and functionality of various optical devices and systems.

Key Insights

- As per the analysis shared by our research analyst, the global filter coatings industry is estimated to grow annually at a CAGR of around 11.2% over the forecast period (2023-2030).

- In terms of revenue, the global filter coatings market size was valued at around USD 20.1 billion in 2022 and is projected to reach USD 30.1 billion, by 2030.

- The global filter coatings market is projected to grow at a significant rate due to increasing demand for advanced optical technologies in various industries.

- Based on coating type segmentation, anti-reflective coatings was predicted to hold maximum market share in the year 2022.

- Based on application segmentation, optical lenses were the leading revenue generator in 2022.

- On the basis of region, Asia Pacific was the leading revenue generator in 2022.

Request Free Sample

Request Free Sample

Filter Coatings Market: Growth Drivers

The increasing demand for advanced optical technologies in various industries is boosting growth of the filter coatings market.

The filter coatings market is experiencing robust growth, primarily driven by the escalating demand for advanced optical technologies across a diverse range of industries. Industries such as electronics, automotive, healthcare, and telecommunications are increasingly relying on cutting-edge optical components to enhance performance and functionality. This surge in demand is fueled by technological advancements and a growing awareness of the benefits that filter coatings bring to optical systems. In the electronics sector, there is a rising need for high-quality display screens, sensors, and semiconductor devices. Filter coatings play a pivotal role in improving light transmission, reducing reflections, and enhancing overall optical performance in these applications. Additionally, the automotive industry is witnessing a transformation with the integration of advanced driver-assistance systems (ADAS) and smart displays. This trend further amplifies the requirement for superior filter coatings to optimize visibility and image quality. Furthermore, the healthcare industry relies heavily on optical systems for medical imaging, diagnostics, and surgical procedures. Filter coatings are instrumental in ensuring accuracy and clarity in these critical applications. With the increasing prevalence of medical technologies, the demand for high-performance filter coatings in healthcare is expected to continue its upward trajectory.

There are some specific examples of government support for the development of advanced optical technologies: The US government has launched a number of programs to support the development of advanced optical technologies, including the Defense Advanced Research Projects Agency (DARPA) Optical Sciences Program and the National Science Foundation (NSF) Engineering Research Centers Program. The European Commission has launched a number of initiatives to support the development of advanced optical technologies, including the Horizon Europe program and the European Innovation Council (EIC) Pathfinder program. The Chinese government has launched a number of programs to support the development of advanced optical technologies, including the National Major Science and Technology Projects Program and the National Key Basic Research Program of China. Overall, the expanding footprint of advanced optical technologies across industries is a key driver propelling the growth of the filter coatings market.

Filter Coatings Market: Restraints

The complexity and cost associated with the manufacturing process may restrain the market growth.

The filter coatings market faces a significant restraint in the form of the complexity and cost associated with the manufacturing process. Producing high-quality filter coatings demands specialized knowledge, precise deposition techniques, and sophisticated equipment. These factors collectively contribute to a more intricate and resource-intensive production process. As a consequence, manufacturers often incur higher operational costs, which can potentially be passed on to end-users. This increased cost of production may deter potential buyers or lead them to seek more cost-effective alternatives, thus impacting the market's growth potential. Furthermore, the intricate nature of the coating process can result in longer lead times and heightened production variability. Achieving consistent and uniform coatings across a range of optical components can be challenging, and any deviation from desired specifications can lead to quality issues. This can pose challenges for manufacturers in meeting stringent quality assurance standards and timely delivery requirements. The combination of these factors underscores the significance of addressing the complexity and cost constraints associated with filter coatings production to unlock the market's full growth potential.

Filter Coatings Market: Opportunities

The growing demand for advanced coatings in emerging technologies like AR, VR, and autonomous vehicles, to provide growth opportunities

The escalating demand for advanced coatings in cutting-edge technologies such as augmented reality (AR), virtual reality (VR), and autonomous vehicles is poised to offer significant growth opportunities for the filter coatings market. As these industries continue to evolve, there is an increasing need for high-performance optical components that can enhance the functionality and efficiency of sensors, displays, and lenses. Filter coatings, in particular, play a pivotal role in optimizing the performance of these components by reducing glare, improving light transmission, and enhancing overall image quality. This surge in demand opens up a lucrative market segment for filter coating manufacturers to cater to the specific requirements of these emerging technologies. Moreover, the integration of filter coatings in AR, VR, and autonomous vehicle applications can lead to advancements in user experience, safety, and performance. In AR and VR, high-quality optics are crucial for providing immersive and realistic experiences, while in autonomous vehicles, precision optics are essential for enabling accurate sensing and perception systems. This convergence of advanced technologies with filter coatings presents an exciting frontier for innovation and growth in the filter coatings market, positioning it at the forefront of technological advancements across various industries.

Filter Coatings Market: Challenges

The need for continuous research and development to challenge market growth

The demand for continuous research and development (R&D) presents a significant challenge for the filter coatings market. As technology advances at a rapid pace, industries that rely on optical components are constantly seeking improved performance, durability, and adaptability. This necessitates a proactive approach to R&D efforts to keep up with evolving requirements. Additionally, staying ahead of emerging trends, such as the integration of advanced coatings in augmented reality and autonomous vehicles, requires ongoing innovation. Companies that invest in robust R&D capabilities will be better positioned to address these challenges and seize opportunities for growth in the competitive landscape of the filter coatings market. Furthermore, the complexity of coating technologies demands a deep understanding of material science, optical physics, and deposition techniques. Achieving consistent and high-quality coatings across a wide range of substrates and applications requires substantial expertise and resources. This challenge is further amplified by the need to develop coatings that can withstand harsh environmental conditions and meet stringent industry-specific standards. Consequently, companies in the filter coatings market must commit to a sustained investment in R&D to not only meet current demands but also anticipate and adapt to future market dynamics.

Filter Coatings Market: Segmentation

The global filter coatings market is segmented based on coating type, application, and region.

Based on coating type, the global market segments are anti-reflective coatings, reflective coatings, dichroic coatings and other specialty coatings at present, the global market is dominated by the anti-reflective coatings segment. The dominance of the anti-reflective coatings segment in the global market can be attributed to its widespread application in various industries. These coatings play a crucial role in minimizing undesirable reflections on optical surfaces, thereby improving overall light transmission and enhancing image quality. With applications ranging from optical lenses to display screens, anti-reflective coatings are integral in modern technology. Their effectiveness in reducing glare and increasing the efficiency of optical systems has made them a preferred choice, driving their high demand and market dominance. While other coating types like reflective and dichroic coatings have specific applications, the versatility and widespread use of anti-reflective coatings have solidified their position as the leading segment in the global market.

Based on application the global filter coatings market categorized as optical lenses, camera filters, display screens (LCD, LED), sensors (image, IR, UV), semiconductor devices, medical devices, automotive components, and other specialized applications. Out of these, optical lenses was the largest shareholding segment in the global market. The optical lenses segment holds the largest share in the global filter coatings market due to its extensive use across a wide array of industries. Optical lenses are fundamental components in various optical systems, including cameras, microscopes, telescopes, and eyeglasses. The application of filter coatings on optical lenses is essential for improving light transmission, reducing reflections, and enhancing image quality. This widespread use and the critical role they play in a diverse range of fields such as healthcare, photography, astronomy, and industrial imaging have propelled optical lenses to the forefront of the market. As a result, it commands the largest share in the global filter coatings market.

Filter Coatings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Filter Coatings Market |

| Market Size in 2022 | USD 20.1 Billion |

| Market Forecast in 2030 | USD 30.1 Billion |

| Growth Rate | CAGR of 11.2% |

| Number of Pages | 216 |

| Key Companies Covered | ZEISS Group, Essilor International, HOYA Corporation, Schott AG, AGC Inc., Inrad Optics, Newport Corporation, Ophir Optronics Solutions Ltd., Reynard Corporation, Abrisa Technologies, and others. |

| Segments Covered | By Coating Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Filter Coatings Market: Regional Analysis

Asia Pacific to lead the market during the forecast period

Asia Pacific is likely to dominate the global filter coatings market during the forecast period. This dominance can be attributed to several key factors. Firstly, the region is a hub for electronics manufacturing, with countries like China, Japan, South Korea, and Taiwan being major players in the industry. The demand for filter coatings is substantial in the production of electronic components, including display screens, sensors, and semiconductor devices. Additionally, the automotive industry in Asia Pacific is experiencing robust growth, further driving the need for filter coatings in automotive components. Moreover, the increasing adoption of advanced technologies in sectors like healthcare and consumer electronics is fueling the demand for optical lenses and sensors, which, in turn, boosts the market for filter coatings. Furthermore, favorable government policies, growing investments in research and development, and a rapidly expanding consumer base are contributing to the market's prominence in Asia Pacific. The region's economic dynamism and burgeoning middle class are driving factors for the increased consumption of consumer electronics, medical devices, and automobiles, all of which heavily rely on filter coatings for enhanced performance. As a result, Asia Pacific is positioned to be the frontrunner in the global filter coatings market over the forecast period.

Key Developments

In 2023, Pall Corporation launched a new line of filter coatings that are designed to be more effective at filtering out viruses and bacteria.

In 2022, 3M launched a new line of filter coatings that are designed to be more durable and easier to apply to industrial filters.

In 2021, Entegris Inc. acquired Versum Materials, Inc., a leading manufacturer of specialty materials for the semiconductor industry. This acquisition gave Entegris Inc. a strong foothold in the market for filter coatings for semiconductor manufacturing.

In 2020, Parker Hannifin Corporation acquired CLARCOR Inc., a leading manufacturer of filtration products. This acquisition gave Parker Hannifin Corporation a strong foothold in the market for filter coatings for the automotive industry.

Filter Coatings Market: Competitive Analysis

The global filter coatings market is dominated by players like:

- ZEISS Group

- Essilor International

- HOYA Corporation

- Schott AG

- AGC Inc.

- Inrad Optics

- Newport Corporation

- Ophir Optronics Solutions Ltd.

- Reynard Corporation

- Abrisa Technologies

The global filter coatings market is segmented as follows:

By Coating Type

- Anti-Reflective Coatings

- Reflective Coatings

- Dichroic Coatings

- Other Specialty Coatings

By Application

- Optical Lenses

- Camera Filters

- Display Screens (LCD, LED)

- Sensors (Image, IR, UV)

- Semiconductor Devices

- Medical Devices

- Automotive Components

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Filter coatings are specialized layers applied to optical components, such as lenses and filters, to modify their optical properties. These coatings are designed to interact with light in a controlled manner, allowing certain wavelengths or frequencies to pass through while blocking or attenuating others.

The global filter coatings market cap may grow owing to the due to increasing demand for advanced optical technologies in various industries.

According to study, the global filter coatings market size was worth around USD 20.1 billion in 2022 and is predicted to grow to around USD 30.1 billion by 2030.

The CAGR value of the filter coatings market is expected to be around 11.2% during 2023-2030.

The global filter coatings market growth is expected to be driven by Asia Pacific. It is currently the world’s highest revenue-generating market owing to the vast agricultural landscape and booming chemical sector.

The global filter coatings Market is led by players like ZEISS Group, Essilor International, HOYA Corporation, Schott AG, AGC Inc., Inrad Optics, Newport Corporation, Ophir Optronics Solutions Ltd., Reynard Corporation, and Abrisa Technologies.

The report analyzes the global filter coatings market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the filter coatings industry.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed