Financial Analytics Market Trend, Share, Growth, Size, Analysis and Forecast 2030

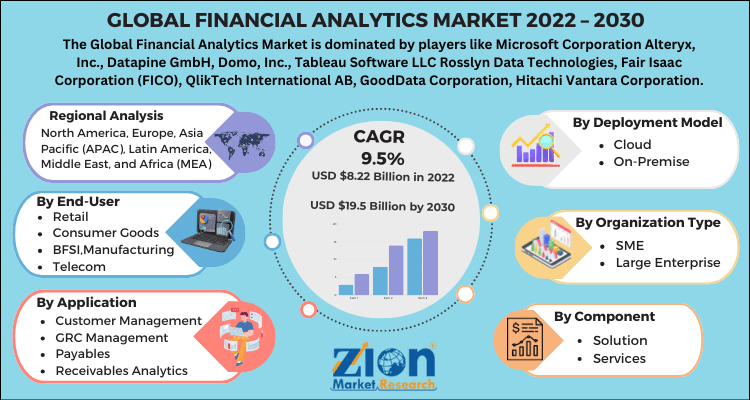

Financial Analytics Market - By Component (solution and services), By Deployment model (cloud and on-premise), By Organization type (SME and large enterprise), By Application (general ledger analytics, wealth management, budgetary control management, customer management, GRC management, payables & receivables analytics, transaction monitoring, and others.), By End-user (retail, consumer goods, BFSI, manufacturing, IT, telecom, government & public sector, transportation & logistics, and healthcare, among others.) And By Region: - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts, 2023-2030

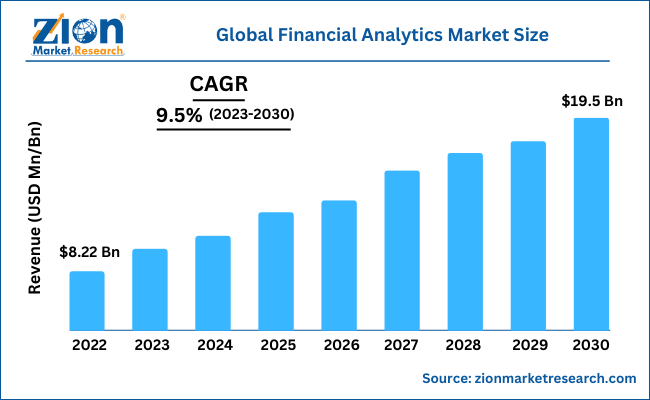

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.22 Billion | USD 19.5 Billion | 9.5% | 2022 |

Description

According to the report published by Zion Market Research, the global Financial Analytics Market size was valued at USD 8.22 Billion in 2022 and is predicted to reach USD 19.5 Billion by the end of 2030. The market is expected to grow with a CAGR of 9.5% during the forecast period.

Global Financial Analytics Market: Overview

The report analyzes the global Financial Analytics Market’s growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Financial Analytics Market Industry.

As the technological advancements are increasing, the need for cloud-based service is also increasing and, in light of this, the demand for financial analytics across numerous enterprises and verticals is expected to enhance the market presence. Financial planning, managing, and forecasting solutions give the user with speed, agility, and accuracy in today’s economic context of escalating volatility, expanding uncertainty, and risk. In today's competitive environment, customer satisfaction is critical for businesses, and thus implementing advanced solutions assists them in obtaining customer feedback. As businesses gain a better understanding of their customers' behavior, it becomes easier to create an omni-channel customer experience model.

Global Financial Analytics Market: Growth Factors

Financial analytics manages operations associated with business, presents the data and assists in making a quick report in graphical form which is straightforward to understand. The global financial analytics market is expected to witness a significant growth owing to technological advancements in business intelligence and data analytics sector across the globe. With the help of artificial intelligence, the results in financial sector can be improved drastically with respect to accuracy. Thus, adoption of artificial intelligence in financial analytics for better financial management can be a growth factor in the long run.

Finance sector is foremost in every industry and to maintain it with high business intelligence and strategy, the companies are progressing in financial analytics. It helps in gaining deep knowledge about financial data of business, thereby helping in improving overall performance of the business. Moreover, in wealth management firms, the data driven decisions are trusted and accepted more vividly, and thus financial analytics in the world is boosting in wealth creation and management applications. In addition to this, growing investments for financial analytics in healthcare sector in developed countries is also contributing towards the growth of the global financial analytics market.

Furthermore, increasing fraud cases in finance sector since past years and other monetary related risks paves an opportunity for the global financial analytics market. However, security issues related to data privacy is a risk in financial analytics and can hinder the market presence.

The COVID-19 pandemic has accelerated the adoption of artificial intelligence and advanced analytics by manifold. Such strategies have encouraged the customers to engage through digital channels, manage fragile & complex supply chains, and support workers through disruption to their work & lives. Amidst COVID-19, the financial services have revolutionized their business models with the penetration of digitalization and adoption of AI & machine learning. Thus, COVID-19 has had a steady impact on the global financial analytics market across the globe.

Financial Analytics Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Financial Analytics Market Research Report |

| Market Size in 2022 | USD 8.22 Billion |

| Market Forecast in 2030 | USD 19.5 Billion |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 185 |

| Key Companies Covered | Microsoft Corporation Alteryx, Inc., Datapine GmbH, Domo, Inc., Tableau Software LLC Rosslyn Data Technologies, Fair Isaac Corporation (FICO), QlikTech International AB, GoodData Corporation, Hitachi Vantara Corporation, Oracle Corporation, IBM Corporation, Information Builders, MicroStrategy, Inc., SAP SE, SAS Institute, Teradata Corporation, Salesforce.com, Inc., TIBCO Software, Inc., Zoho Corporation, among others. |

| Segments Covered | By Component, By Deployment Model, By Organization Type, By Application, By End-User and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Financial Analytics Market: Regional Factors

In the global financial analytics market, Asia Pacific is anticipated to contribute major growth factors owing to rapidly adopting digital technologies, usage of big data technologies, and service providers in the region. Deployment of big data technology across various sectors by China across several regions is growing the market for financial analytics. With the penetration of internet, requirement of storage for substantial information generated is another factor demanding financial analytics.

Favorable government initiatives are promoting data analytics, artificial intelligence and digital technologies in these enormously populated countries.

North America is said to be the second most dominant region, especially the US where rise in small and medium scale enterprises are growing the adoption of digital technologies and business intelligence, thus promoting the financial analytics sector. European countries such as the UK, France and Germany are also in line of adopting financial analytics for variety of purpose. In the UK, financial analytics market is expected to boom with the database management system work.

Global Financial Analytics Market: Competitive Players

Presence of large number of well-established and key companies in the global financial analytics market paves a way for competitiveness. The ever-growing startups, partnerships are becoming the strategy of key market players. Acquisition of start-ups by big giants is happening all-over for staying ahead in the competitive environment.

- Microsoft Corporation Alteryx, Inc.

- Datapine GmbH, Domo, Inc.

- Tableau Software LLC Rosslyn Data Technologies

- Fair Isaac Corporation (FICO)

- QlikTech International AB

- GoodData Corporation

- Hitachi Vantara Corporation

- Oracle Corporation

- IBM Corporation

- Information Builders

- MicroStrategy, Inc.

- SAP SE

- SAS Institute,

- Teradata Corporation

- Salesforce.com, Inc.

- TIBCO Software, Inc.

- Zoho Corporation

- among others.

Global Financial Analytics Market: Segmentation

By Component

- Solution

- Services

By Deployment Model

- Cloud

- On-Premise

By Organization Type

- SME

- Large Enterprise

By Application

- General Ledger Analytics

- Wealth Management

- Budgetary Control Management

- Customer Management

- GRC Management

- Payables

- Receivables Analytics

- Transaction Monitoring

- And Others

By End-User

- Retail

- Consumer Goods

- BFSI, Manufacturing

- IT

- Telecom

- Government

- Public Sector

- Transportation

- Logistics

- Healthcare

- Among Others

By Region:

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Financial analytics manages operations associated with business, presents the data and assists in making a quick report in graphical form which is straightforward to understand

Microsoft Corporation Alteryx, Inc., Datapine GmbH, Domo, Inc., Tableau Software LLC Rosslyn Data Technologies, Fair Isaac Corporation (FICO), QlikTech International AB, GoodData Corporation, Hitachi Vantara Corporation, Oracle Corporation, IBM Corporation, Information Builders, MicroStrategy, Inc., SAP SE, SAS Institute, Teradata Corporation, Salesforce.com, Inc., TIBCO Software, Inc., and Zoho Corporation, among others.

In the financial analytics market, Asia Pacific is anticipated to contribute major growth factors owing to rapidly adopting digital technologies, usage of big data technologies, and service providers in the region.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed