Financial Wellness Benefits Market Size, Share, Trends, Industry Analysis & Growth 2032

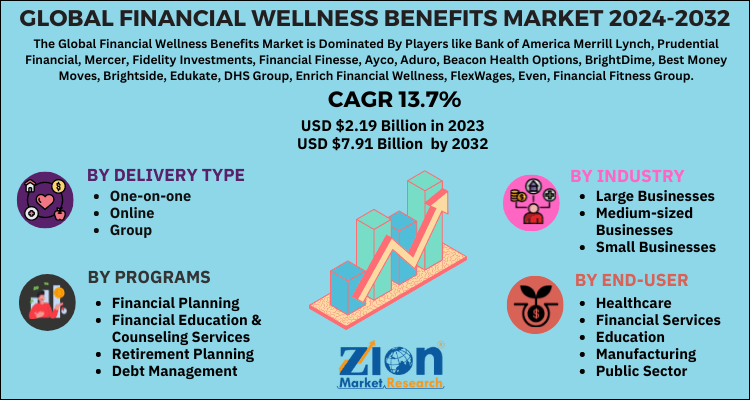

Financial Wellness Benefits Market By programs (financial planning, financial education & counseling services, retirement planning, debt management, and others), By delivery type (one-on-one, online, and group), By end user (healthcare, financial services, education, manufacturing, public sector, and others), By industry (large businesses, medium-sized businesses, and small businesses) And By Region: - Global And Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, And Forecasts, 2024-2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

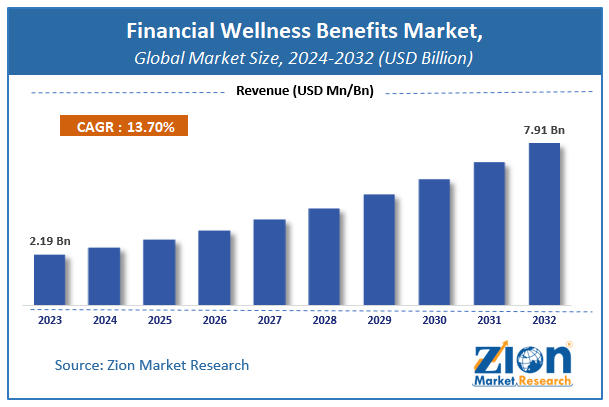

| USD 2.19 Billion | USD 7.91 Billion | 13.7% | 2023 |

Description

Financial Wellness Benefits Market Insights

According to the report published by Zion Market Research, the global Financial Wellness Benefits Market size was valued at USD 2.19 Billion in 2023 and is predicted to reach USD 7.91 Billion by the end of 2032. The market is expected to grow with a CAGR of 13.7% during the forecast period. The report analyzes the global Financial Wellness Benefits Market's growth drivers, restraints, and impact on demand during the forecast period. It will also help navigate and explore the arising opportunities in the Financial Wellness Benefits industry.

Global Financial Wellness Benefits Market: Overview

Monetary literacy is a vital survival skill in today’s world. The increasing debt management programs, high traction of online financial wellness programs across the world, and a vast array of benefits such as account aggregation options, personalized content, and progress tracking aid in the increase in the global financial wellness benefits market across the world. Moreover, a surge in awareness and acceptance among the developing as well as developed countries causes a boom in the financial wellness benefits market. Cigna’s global well-being survey of employees in Asia Pacific, Europe, Africa, the Middle East, and North America, stated that 87% of employees are stressed at work. Out of all the stress-inducing factors, personal finances were the top factor. Thus, such promising statistics point out to tremendous growth in the financial wellness benefits market over the next few years.

Global Financial Wellness Benefits Market: Growth Factors

Key contributors of the global financial wellness benefits market include rising acceptance of online platforms in financial sphere, a surge of requirement for convenient financing wellness models, and rising joint ventures by the prominent players. For instance, according to a survey from Morgan Stanley and the Financial Health Network, 42% of employees mentioned that they feel they are inadequately informed about the benefits and programs their employer offers. Thus, this directs towards rise in the awareness about financial wellness programs. Also, the rise in offering few services for less or no fees, facilitate the global financial wellness benefits market. In addition to this, several people are focusing on decision making backed up by substantial data. Further, data analytics and advanced technology incorporation is fueling the financial wellness benefits market to a huge extent. Many companies are expanding their existing human resource capabilities to calculate profits through big data methodologies. The rise in data planning for financial wellness permits the creation of a base for workforce financial requirements. Employers are keen on reviewing their productivity measures and outcomes to gain extensive insights on dynamics that spurs the financial sphere in their favor.

However, the COVID-19 pandemic outbreak drove the growth of financial wellness benefits market. There was a huge surge in areas, such as early wage access, financial planning, and loan repayment schemes, and these services were mostly backed by employers. The Covid-19 pandemic also pushed employees to focus and modify their financial goals, which increased the awareness about financial wellness benefits services across the world. However, the financial unease during the initial outbreak impacted the changing work paradigm and hence the financial wellness benefits area. The overall financial market is expected to recover with the occurrence of pre pandemic conditions and expected to set a remarkable growth during the forecast period.

Global Financial Wellness Benefits Market: Segmentation

The global financial wellness benefits market is segregated based on programs, delivery type, end user, industry and region.

The global financial wellness benefits market, on the basis of programs, has been segmented into financial planning, financial education & counseling services, retirement planning, debt management, and others.

The financial wellness benefits market, based on delivery type, is divided into one-on-one, online, and group.

The financial wellness benefits market, on the basis of industry, is classified into healthcare, financial services, education, manufacturing, public sector, and others.

The financial wellness benefits market, based on end user, is segmented into large businesses, medium-sized businesses, and small businesses.

Financial Wellness Benefits Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Financial Wellness Benefits Market |

| Market Size in 2023 | USD 2.19 Billion |

| Market Forecast in 2032 | USD 7.91 Billion |

| Growth Rate | CAGR of 13.7% |

| Number of Pages | 194 |

| Key Companies Covered | Bank of America Merrill Lynch, Prudential Financial, Mercer, Fidelity Investments, Financial Finesse, Ayco, Aduro, Beacon Health Options, BrightDime, Best Money Moves, Brightside, Edukate, DHS Group, Enrich Financial Wellness, FlexWages, Even, Financial Fitness Group, HealthCheck360, Financial Knowledge, Holberg Financial, LearnLux, Health Advocate, Limeade, PayActiv, Money Starts Here, Purchasing Power, Transamerica, and Ramsey Solutions, among others |

| Segments Covered | By Programs, By Delivery Type, By End User, By Industry And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Financial Wellness Benefits Market: Regional Analysis

The North American market is estimated to hold a substantial share and expected to contribute significant revenue in the global financial wellness benefits market. This is mainly due to rising financial wellness incentives and the democratization of financial wellness area for special groups. The European market for financial wellness benefits is expected to grow steadily owing to the ability of European countries to integrate and leverage the benefits from several schemes. Moreover, the Asia Pacific market growth rate attributes to the rising disposable income and widespread presence of prominent players in developed as well as developing countries, such as India, Australia, Japan, and China. Furthermore, a surge in the debt management programs by players employed in the Middle East, Africa, and South America, further boosts the growth of the financial wellness benefits market in these regions.

Global Financial Wellness Benefits Market: Competitive Players

The global financial wellness benefits market constitutes several players with cutting edge services and solutions. These players are implementing organic and inorganic strategies by offering advance services to the clients to stay ahead in the overall market. Some of the leading players in the global financial wellness benefits market comprise of :

- Bank of America Merrill Lynch

- Prudential Financial,

- Mercer

- Fidelity Investments

- Financial Finesse

- Ayco

- Aduro

- Beacon Health Options

- BrightDime

- Best Money Moves

- Brightside

- Edukate

- DHS Group

- Enrich Financial Wellness

- FlexWages

- Even

- Financial Fitness Group

- HealthCheck360

- Financial Knowledge

- Holberg Financial

- LearnLux

- Health Advocate

- Limeade

- PayActiv

- Money Starts Here

- Purchasing Power

- Transamerica

- Ramsey Solutions, among others.

The Global Financial Wellness Benefits Market is segmented as follows:

By programs

- financial planning

- financial education & counseling services

- retirement planning

- debt management

- and others

By delivery type

- one-on-one

- online

- group

By end user

- healthcare

- financial services

- education

- manufacturing

- public sector

- and others

By industry

- large businesses

- medium-sized businesses

- small businesses

Global Financial Wellness Benefits Market: Regional Segment Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

What Reports Provides

- Full in-depth analysis of the parent market

- Important changes in market dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional markets

- Testimonials to companies in order to fortify their foothold in the market.

Table Of Content

FrequentlyAsked Questions

Key contributors of the financial wellness benefits market include rising acceptance of online platforms in financial sphere, a surge of requirement for convenient financing wellness models, and rising joint ventures by the prominent players drive the growth of the global financial wellness benefits market.

Some of the key players in the global financial wellness benefits market are Bank of America Merrill Lynch, Prudential Financial, Mercer, Fidelity Investments, Financial Finesse, Ayco, Aduro, Beacon Health Options, BrightDime, Best Money Moves, Brightside, Edukate, DHS Group, Enrich Financial Wellness, FlexWages, Even, Financial Fitness Group, HealthCheck360, Financial Knowledge, Holberg Financial, LearnLux, Health Advocate, Limeade, PayActiv, Money Starts Here, Purchasing Power, Transamerica, and Ramsey Solutions.

The North American market is estimated to hold a substantial share and expected to contribute significant revenue in the global financial wellness benefits market. This is mainly due to rising financial wellness incentives, and the democratization of financial wellness area for special groups.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed