Finish Foils Market Trend, Share, Growth, Size and Forecast 2030

Finish Foils Market By Technology (Coating and Impregnation), By Material Type (PET and PVC), By Format Type (Floor Films and Furniture Films), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

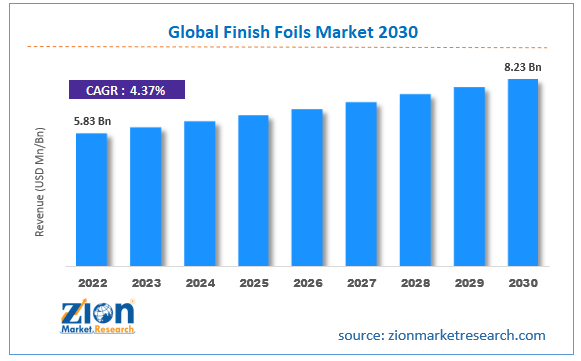

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 5.83 Billion | USD 8.23 Billion | 4.37% | 2022 |

Finish Foils Industry Prospective:

The global finish foils market size was worth around USD 5.83 billion in 2022 and is predicted to grow to around USD 8.23 billion by 2030 with a compound annual growth rate (CAGR) of roughly 4.37% between 2023 and 2030.

Finish Foils Market: Overview

Finish foils are used as coating materials and are mainly used to cover wood-based units or panels. They are paper layers consisting of lacquer-coated surfaces and may have additional printed designs or colors. They are used extensively in several end-user verticals including furniture making and construction as they are installed in almost all living settings including kitchens, living rooms, photo frames, and flooring to name a few. They have also found applications in the making of baseboards, wall panels, chipboards, inner doors, medium-density fiberboard (MDF), and many more items. Finish foil is an abbreviation of the longer name foil finish decorative paper which is generally made of superior-grade acrylic resins, and polyurethane (PU) lacquer with an addition of curing yellow which assists in yellow color adjustment. There are several advantages of using finish foil and some of them include vivid and clear texture to the finished product and eco-friendliness. During the forecast period, the finish foils market is expected to grow at a steady rate with a considerable increase in revenue by the end of 2030.

Key Insights:

- As per the analysis shared by our research analyst, the global finish foils market is estimated to grow annually at a CAGR of around 4.37% over the forecast period (2023-2030)

- In terms of revenue, the global finish foils market size was valued at around USD 5.83 billion in 2022 and is predicted to grow to around USD 8.23 billion, by 2030.

- The finish foils market is projected to grow at a significant rate due to the booming real estate business.

- Based on technology segmentation, the coating was predicted to show maximum market share in the year 2022

- Based on format type segmentation, the furniture films segment was the leading type in 2022

- On the basis of region, Europe was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Finish Foils Market: Growth Drivers

Booming real estate segment to drive market growth

The global finish foils market is expected to benefit from the growing revenue in the real estate segment worldwide. Factors influencing growth in the industry include a growing global economy and unprecedented demand for properties which is not restricted to urban areas anymore as consumers are willing to buy properties in remote locations as well. As of July 2023, official records showcased that emerging economies such as India were registering a rise in the demand for luxury homes driven by the need for larger living spaces equipped with better amenities. Coldwell Banker Richard Ellis (CBRE) reported a year-on-year (Y-o-Y) increase of 130% in India’s luxury housing segment. As real estate players focus on improving organizational structure in the industry, the housing unit is showing excellent signs of growth in the future and it will directly impact the demand for good quality finish foils as they play a crucial role in modern home settings starting with furniture manufacturing to final touchup on the structural units such as kitchen panels and doors.

Additionally, the finish foils industry will also benefit from the growing sales registered by international and larger furniture corporations such as IKEA and Lourdes. In fiscal year 2022, IKEA’s sales in the US alone reached approximately USD 6 billion which was a result of high sales made by the company’s e-commerce platform. Driven by its already-established brand name on a global scale, the company has now entered new and emerging markets. As of August 2023, the company operates in 62 regions with a total of 460 stores. In May 2023, IKEA announced its plans to open stores in a new format in Virginia by the summer of 2023 and in Maryland by the fall of the same year. Such large companies along with smaller and domestic players are registering high demand in urban areas as people are willing to spend on quality products. Leveraging the impact of e-commerce and online platforms has been one of the most effective strategies adopted by furniture providers to reach a broader group of audience and help the global market sales volume.

Finish Foils Market: Restraints

Lack of natural finish with these foils to restrict market growth

One of the key attributes lacking by finish foils is the lack of natural finish or the extreme difficulty in achieving an organic texture. This is mainly because the foil is a synthetic product and does not have the same texture that may appear on naturally occurring decorative options such as leather, stone, or wood. Moreover, it is challenging to achieve the same level of light reflection that occurs with organic options which further limits the overall visual appeal of finish foils.

Vulnerability to scratches caused by sharp objects further impedes market expansion

Finish foils are vulnerable to scratch marks caused by sharp objects such as blades, pens, or pencils. A simple and small scratch can destroy the entire aesthetics of the product. Moreover, it is difficult to repair finish foils and may require complete replacement of the outer coating or the product itself. Such attributes are likely to drive more consumers toward alternate solutions offering higher cost-efficiency.

Finish Foils Market: Opportunities

Rising demand for pre-used furniture to create growth opportunities

There is a growing consumer group that prefers buying and using pre-owned furniture items which can impact the global finish foils market expansion trajectory. This group can open new doors for higher growth as finish foils can be used to deliver pre-loved items with a fresh look depending on the requirements of the new consumer. A recent survey conducted by YouGov across 18 countries stated that nearly 36% of the respondents were willing to buy pre-owned furniture. Growing environmental awareness, personal choices of the buyers, and increasing value of antique items are the most likely causes of growth in this segment.

Growing innovation and launch of new finish foils to possibilities

The finish foils industry is witnessing a rise in innovation and the launch of novel finish foils. This trend is expected to create higher demand in the commercial market. In November 2019, LX Hausys announced the launch of a new series of finish foil called Solid Matt Series of DECO FOIL. The new launch consists of a large range of new colors providing consumers with customized solutions.

Finish Foils Market: Challenges

Varying cost perception around finish foils to challenge market growth

Consumer segments may find finish foil is less cost-efficient when compared to other coating or decorative materials. They may perceive products made of finish foils as low-cost in terms of quality. Additionally, these materials have low heat and water sensitivity which further adds to the non-appealing attributes of finish foils.

Finish Foils Market: Segmentation

The global finish foils market is segmented based on technology, material type, format type, and region.

Based on technology, the global market segments are coating and impregnation. In 2022, the highest growth was observed in the coating segment due to the extensive use of finish foils as decorative and coating agents. They are extremely versatile as manufacturers can achieve a range of patterns and designs using finish foils and while it is difficult to achieve natural finish using these foils, they can imitate the style effectively. Furthermore, the foils are easy to apply, and when compared to certain natural materials, they can be more environmentally friendly. The rise in the construction sector which is expected to grow at a CAGR of over 10% by 2030 is likely to push segmental growth.

Based on material type, the finish foils industry divisions are PET and PVC.

Based on format type, the global market is segmented into floor films and furniture films. The highest CAGR was observed in the furniture films segment in 2022 where the foils are used to coat or decorate furniture items including tables, cabinets, chairs, and other items. Rapid urbanization, increasing spending habits, and the rise of pre-owned furniture sellers along with the impact of online sales channels are some of the main reasons for higher demand in the furniture films segment. By 2030, the global furniture industry is likely to reach USD 782 billion in terms of value.

Finish Foils Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Finish Foils Market |

| Market Size in 2022 | USD 5.83 Billion |

| Market Forecast in 2030 | USD 8.23 Billion |

| Growth Rate | CAGR of 4.37% |

| Number of Pages | 202 |

| Key Companies Covered | Impress, Kronospan, Tocchio, Imawell, Mobelfolien, Schattdecor, Ahlstrom-Munksjo, Turkuaz Decor, Interprint, Chiyoda, Lamidecor., and others. |

| Segments Covered | By Technology, By Material Type, By Format Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Finish Foils Market: Regional Analysis

Europe to register the highest growth rate during the forecast period

The global finish foils market is expected to witness the highest growth in Europe as the region is home to some of the most beautifully curated residential and commercial spaces. Asia-Pacific is projected to emerge as the second-fastest growing regional market driven by the booming real estate market in India and China as both the countries along with other nations are emerging economies with growing populations and increase in middle-income groups. As the standard of living continues to rise in Asia, the demand for affordable yet aesthetically pleasing furniture and other units for living spaces will continue to grow. The trend is further pushed by the entry of international ready-to-assemble sellers. In 2022, IKEA India witnessed a jump of 73% in its total revenue. China, on the other hand, has a huge export rate in terms of readymade furniture with a consumer base spread on a global scale. China is currently the largest producer and supplier of furniture products and is currently valued at over USD 80 billion.

Finish Foils Market: Competitive Analysis

The global finish foils market is led by players like:

- Impress

- Kronospan

- Tocchio

- Imawell

- Mobelfolien

- Schattdecor

- Ahlstrom-Munksjo

- Turkuaz Decor

- Interprint

- Chiyoda

- Lamidecor.

The global finish foils market is segmented as follows:

By Technology

- Coating

- Impregnation

By Material Type

- PET

- PVC

By Format Type

- Floor Films

- Furniture Films

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Finish foils are used as coating materials and are mainly used to cover wood-based units or panels.

The global finish foils market is expected to benefit from the growing revenue in the real estate segment worldwide.

According to study, the global finish foils market size was worth around USD 5.83 billion in 2022 and is predicted to grow to around USD 8.23 billion by 2030.

The CAGR value of the finish foils market is expected to be around 4.31% during 2023-2030.

The global finish foils market is expected to witness the highest growth in Europe as the region is home to some of the most beautifully curated residential and commercial spaces.

The global finish foils market is led by players like Impress, Kronospan, Tocchio, Imawell, Mobelfolien, Schattdecor, Ahlstrom-Munksjo, Turkuaz Decor, Interprint, Chiyoda, and Lamidecor.

The report explores crucial aspects of the finish foils market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed