Fresh Berries Market Size, Share, Trends, Growth and Forecast 2034

Fresh Berries Market By Type (Strawberries, Blueberries, Raspberries, Blackberries, and Others), By Category (Conventional and Organic), By Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

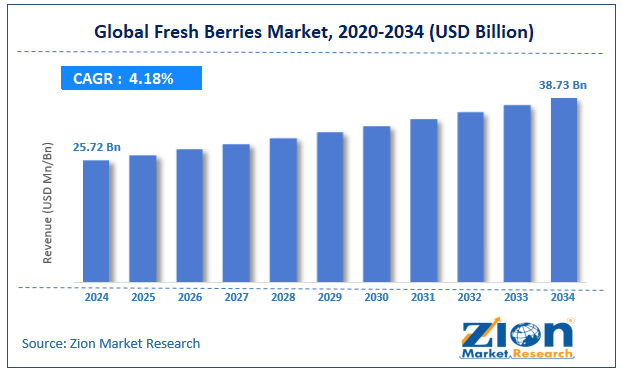

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.72 Billion | USD 38.73 Billion | 4.18% | 2024 |

Fresh Berries Industry Prospective:

The global fresh berries market size was valued at approximately USD 25.72 billion in 2024 and is expected to reach around USD 38.73 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 4.18% between 2025 and 2034.

Fresh Berries Market: Overview

Fresh berries are a bunch of small, pulpy, and often edible fruits with great colors, unique flavors, and nutritional profiles. Fresh berries stand out with great colors, tastes, and nutritional value. These fruits impact health-conscious buyers globally as they have many antioxidants, vitamins, and fiber.

Buyers are aware that berries boost heart health, help the immune system, and might reduce cancer risks. That's why berries are a top health food. And berries can be eaten alone or in desserts, smoothies, salads, and jams. That's broadened the appeal of berries beyond health-conscious buyers and made them more accessible to the masses through retail channels.

Berries, being superfoods, are growing disposable income and shifting consumer preference towards natural and nutritious food, which is expected to drive significant growth over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global fresh berries market is estimated to grow annually at a CAGR of around 4.18% over the forecast period (2025-2034)

- In terms of revenue, the global fresh berries market size was valued at around USD 25.72 billion in 2024 and is projected to reach USD 38.73 billion by 2034.

- The fresh berries market is projected to grow significantly due to rising health consciousness, increasing demand for natural superfoods, and expanding retail distribution networks.

- Based on type, strawberries lead the segment and will continue to dominate the global market per industry projections.

- Based on category, conventional berries are anticipated to command the largest market share.

- Based on distribution channels, supermarkets/hypermarkets are expected to lead the market during the forecast period.

- Based on region, North America is projected to dominate the global market during the forecast period.

Fresh Berries Market: Growth Drivers

Increasing health consciousness and nutritional awareness

With the focus on preventive healthcare and wellness, the fresh berries market is seeing a surge in demand. Packed with antioxidants, vitamins, fiber, and phytochemicals, berries are increasingly recognized for reducing chronic diseases and improving cognitive function and overall health. Scientific studies on berries' anti-inflammatory and anti-cancer properties have included them in health diets.

For example, a study published in the Journal of Agricultural and Food Chemistry found that regular blueberry consumption can improve memory and delay cognitive aging, thus contributing to their growing popularity as a brain-boosting superfood.

Expanding retail infrastructure and cold chain logistics

Advanced cold chain logistics and preservation technologies have extended the shelf life of fresh berries, enabling them to be distributed across more expansive geographic areas. Modern packaging innovations like modified atmosphere packaging (MAP) and controlled atmosphere packaging (CAP) reduce spoilage and maintain berry quality during transportation.

Major retailers are investing in dedicated berry sections with specialized refrigeration units, increasing visibility and accessibility. For example, Walmart has expanded its produce sections to feature premium berry displays, growing sales, and market penetration in areas previously constrained by logistics.

Fresh Berries Market: Restraints

Price volatility and seasonal availability

The fresh berries industry is highly seasonal and weather-dependent, which impacts price fluctuations throughout the year. Extreme weather events such as frosts, excessive rainfall, or droughts impact harvest volume and quality, which results in supply shortages and price surges.

The seasonal berry production in many areas also creates availability gaps during off seasons, requiring expensive imports to meet year-round demand. These factors affect consumer buying behavior and create challenges for food manufacturers and retailers to maintain pricing and supply chain consistency.

Fresh Berries Market: Opportunities

Year-round production and greenhouse cultivation

In the fresh berries market, advances in controlled environment agriculture (CEA), including greenhouse and vertical farming technologies, create opportunities for year-round berry production regardless of climate. These systems offer precise control over growing parameters such as temperature, humidity, light, and nutrient delivery to ensure consistent quality and an extended growing season.

Companies like Driscoll's have invested in protected growing environments across multiple regions to ensure a consistent berry supply throughout the year. Moreover, substrate cultivation and hydroponic system innovations enable berry production in non-traditional growing areas, reducing import dependency and transportation costs while providing fresher products to local markets.

Fresh Berries Market: Challenges

Increasing labor costs and workforce shortages

The fresh berries market faces a labor-intensive nature for production and harvesting, as labor costs are increasing globally. Most berries require hand-picking to maintain quality and prevent damage, making mechanization hard without compromising product integrity.

In major producing countries like the US and Europe, stricter immigration policies have reduced the availability of seasonal workers, while local labor markets are struggling to fill harvesting positions even with wage increases. These workforce shortages can result in unharvested crops, reduced quality control, and higher production costs, impacting market pricing and profitability across the supply chain.

Fresh Berries Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Fresh Berries Market |

| Market Size in 2024 | USD 25.72 Billion |

| Market Forecast in 2034 | USD 38.73 Billion |

| Growth Rate | CAGR of 4.18% |

| Number of Pages | 226 |

| Key Companies Covered | Driscoll's Inc., Naturipe Farms LLC, Hortifrut S.A., Berry Fresh Group, Wish Farms, SunOpta Inc., Berryworld Ltd., Agrana Beteiligungs AG, Costa Group Holdings Limited, Del Monte Fresh Produce N.A. Inc., Dole Food Company Inc., T&G Global Limited, The Kraft Heinz Company, Berry Gardens Ltd., Milarex, MBG Marketing, Giddings Fruit, Planasa, North Bay Produce, Red Jewel Berry, Alpine Fresh, Haygrove Ltd., Sakuma Brothers, New Wave Berries, Sweet Darling Berries, and others. |

| Segments Covered | By Type, By Category, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Fresh Berries Market: Segmentation

The global fresh berries market is segmented based on type, category, distribution channel, and region.

Based on type, the fresh berries industry is segregated into strawberries, blueberries, raspberries, blackberries, and others. Strawberries dominate the market as they remain the most widely consumed berry variety globally, accounting for approximately 40% of the market share. Their versatility in culinary applications, recognizable appearance, and year-round availability through advanced growing techniques contribute to their dominant position. Additionally, their relatively larger size and higher yield per plant make them economically attractive for commercial cultivation.

Based on category, the fresh berries market is divided into conventional and organic. Conventional berries dominate the market, accounting for over 75% of sales, as they remain more affordable and widely available across diverse retail channels.

However, organic berries are experiencing faster growth at approximately 9% annually, driven by increasing consumer concerns regarding pesticide residues and environmental sustainability.

Based on distribution channels, the fresh berries industry is categorized into supermarkets/hypermarkets, specialty stores, online retail, and others. Supermarkets/hypermarkets are expected to lead during the forecast period since they benefit from their extensive cold chain infrastructure, broad consumer reach, and ability to offer multiple berry varieties under one roof. Their dedicated produce sections with temperature-controlled displays maintain berry freshness while allowing consumers to assess quality visually before purchase.

Fresh Berries Market: Regional Analysis

North America to Lead the Market

North America will lead the fresh berries market due to high per capita consumption, established distribution networks, and consumer awareness of berries' health benefits. The US alone accounts for over 30% of global berry consumption, with blueberry and strawberry being the top segments.

Imports from Mexico and South America supplement domestic production to ensure year-round supply. The region invests significantly in berry breeding programs that have developed varieties with improved flavor profiles, shelf life, and disease resistance.

Also, the presence of significant berry producers like Driscoll's, California Giant, and Naturipe Farms drives innovation and marketing initiatives to expand the consumer base.

Health-focused dietary trends like keto, paleo, and plant-based eating have further boosted berry consumption, as berries are typically approved in these diets. The growth of direct-to-consumer models, such as farm-to-table and subscription-based berry deliveries, further increases accessibility and demand.

Europe to Grow Significantly

Europe is growing strongly in the fresh berries market, with key contributors being Spain, Poland, the UK, and the Netherlands. The region has increasing consumer demand for locally grown produce and premium berry varieties. European berry consumption has grown by 30% over the last 10 years, with blueberry being the fastest-growing segment, which has moved from niche to mainstream.

Improvements in farming techniques have extended the growing season in traditional areas while greenhouse production is expanding in northern regions.

Major European retailers have prominent fresh berries in their premium produce strategies with prominent shelf space and private-label berry lines. The rise of organic and pesticide-free berry options also attracts more health-conscious consumers, reinforcing strong market growth.

Recent Market Developments:

- In February 2024, Driscoll's introduced a patented raspberry variety that offers a 30% longer shelf life while maintaining flavor integrity.

- In July 2024, Naturipe Farms launched a proprietary packaging technology that reduces plastic usage by 40% while extending berry freshness.

- In September 2024, Hortifrut deployed AI-powered sorting technology across its facilities, improving quality consistency by 25%.

- In November 2024, Sunshine Berry Farms secured certification for its carbon-neutral production methods, targeting eco-conscious consumer segments.

Fresh Berries Market: Competitive Analysis

The global fresh berries market is led by players like:

- Driscoll's Inc.

- Naturipe Farms LLC

- Hortifrut S.A.

- Berry Fresh Group

- Wish Farms

- SunOpta Inc.

- Berryworld Ltd.

- Agrana Beteiligungs AG

- Costa Group Holdings Limited

- Del Monte Fresh Produce N.A. Inc.

- Dole Food Company Inc.

- T&G Global Limited

- The Kraft Heinz Company

- Berry Gardens Ltd.

- Milarex

- MBG Marketing

- Giddings Fruit

- Planasa

- North Bay Produce

- Red Jewel Berry

- Alpine Fresh

- Haygrove Ltd.

- Sakuma Brothers

- New Wave Berries

- Sweet Darling Berries

The global fresh berries market is segmented as follows:

By Type

- Strawberries

- Blueberries

- Raspberries

- Blackberries

- Others

By Category

- Conventional

- Organic

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Fresh berries are a diverse group of small, pulpy, and often edible fruits characterized by their vibrant colors, distinctive flavors, and exceptional nutritional profiles.

The fresh berries market is expected to be driven by increasing health consciousness, growing demand for natural superfoods, expanding retail infrastructure, and advancements in cold chain logistics.

According to a study, the global fresh berries market was worth around USD 25.72 billion in 2024 and is predicted to grow to around USD 38.73 billion by 2034.

The CAGR value of the fresh berries market is expected to be around 4.18% during 2025-2034.

The global smart parking market will register the highest growth in North America during the forecast period.

Key players in the fresh berries market include Driscoll's Inc., Naturipe Farms LLC, Hortifrut S.A., Berry Fresh Group, Wish Farms, SunOpta Inc., Berryworld Ltd., Agrana Beteiligungs AG, Costa Group Holdings Limited, Del Monte Fresh Produce N.A., Inc., Dole Food Company, Inc., T&G Global Limited, The Kraft Heinz Company, Berry Gardens Ltd., Milarex, MBG Marketing, Giddings Fruit, Planasa, North Bay Produce, Red Jewel Berry, Alpine Fresh, Haygrove Ltd., Sakuma Brothers, New Wave Berries, and Sweet Darling Berries.

The report provides a comprehensive analysis of the fresh berries market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, consumer preferences, and technological innovations reshaping berry cultivation, distribution, and marketing strategies.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed