Garbage bags and trash bags in KSA Market Size, Share, Industry Analysis, Trends, Growth Report, 2030

Garbage bags and trash bags in KSA Market By Material (Low-Density Polyethylene, High-Density Polyethylene, Biodegradable Polyethylene, Linear Low-Density Polyethylene, and Others), By Type (Star Sealed Bags, Drawstring Bags, Zipper Bags, Flat Star Sealed Bags, and Others), By Distribution Channel (Convenience Stores, Supermarkets/Hypermarkets, Specialty Stores, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

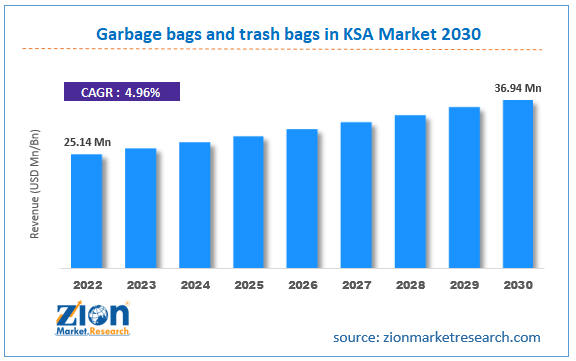

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 25.14 Million | USD 36.94 Million | 4.96% | 2022 |

Garbage Bags And Trash Bags In KSA Industry Prospective:

The garbage bags and trash bags in KSA market size was worth around USD 25.14 million in 2022 and is predicted to grow to around USD 36.94 million by 2030 with a compound annual growth rate (CAGR) of roughly 4.96% between 2023 and 2030.

Garbage Bags And Trash Bags In KSA Market: Overview

The Kingdom of Saudi Arabia (KSA) is an important country from the Middle Eastern region. Garbage bags and trash bags in the KSA industry refer to the production, distribution, and consumption of waste bags in Saudi Arabia. KSA is surrounded by other critical Arab countries. Among them, the most popular and economically strong nations are Qatar, Kuwait, the United Arab Emirates, Iraq, and Jordan to name a few. KSA has a total population of 3.6 crore people and they are driving the demand for regional garbage and trash bags.

These are disposable containers and are an essential part of the country’s waste management systems. In recent times, Saudi Arabia has been eyeing branching out from oil production and other forms of international trade to improve economic growth which has ultimately resulted in greater numbers of foreign nationals entering the country for growth opportunities further creating an excellent consumer base of garbage and trash bags in the Kingdom of Saudi Arabia. However, the regional industry has specific growth constraints and limitations that could impact regional revenue during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the garbage bags and trash bags in KSA market is estimated to grow annually at a CAGR of around 4.96% over the forecast period (2023-2030)

- In terms of revenue, the garbage bags and trash bags in KSA market size was valued at around USD 25.14 million in 2022 and is projected to reach USD 36.94 million, by 2030.

- The garbage bags and trash bags in KSA market is projected to grow at a significant rate due to the increasing investments in smart city projects

- Based on material segmentation, high-density polyethylene was predicted to show maximum market share in the year 2022

- Based on distribution channel segmentation, supermarkets/hypermarkets was the leading segment in 2022

- On the basis of region, Riyadh was the leading revenue generator in 2022

Garbage Bags And Trash Bags In KSA Market: Growth Drivers

Increasing investments in smart city projects to drive market growth

The regional garbage bags and trash bags in KSA market is expected to grow owing to the increasing investments by Saudi authorities in the development of smart cities equipped with excellent energy and waste management systems. For instance, the country has invested in a 170-km-long city development project in the deserts of Saudi Arabia. The project has already commenced and is being designed by Morphosis, a US-based studio. As per projections, the city is expected to house around 9 million citizens and is being constructed on an estimated budget ranging from USD 100 billion to USD 1 trillion. On the other hand, the country is also witnessing the development of a high-technology smart city project called NEOM with urban facilities.

Growing focus on effective waste management to push the regional industry further

With the growing regional population and increasing disposable income, consumerism in Saudi Arabia is rising at a rapid rate. This trend is in association with surging industrialization and commercialization observed in the economy. These factors are adding to the waste generated in KSA and regional officials have been promoted in managing all types of waste including medical waste, asbestos waste, hazardous waste, and others. Reports indicate that the region generates nearly 130 million tons of waste per year out of which only 1% is recycled. However, Saudi Arabia has signed up for the Vision 2030 reform project to promote a circular economy. The formation of the Saudi Investment Recycling Company (SIRC) is a step forward toward this vision. The country is also focusing on deploying smart waste management systems which could lead to higher demand for garbage bags and trash bags.

Garbage Bags And Trash Bags In KSA Market: Restraints

High competition in the regional industry could restrict market growth

The garbage bags and trash bags in KSA industry growth is likely to be restricted owing to the extreme competitiveness in KSA for the production and distribution of garbage bags and trash bags. The region is home to several branded waste bag sellers and multiple domestic or local producers. This leads to intense price competition to survive in the long run. Additionally, plastic or non-biodegradable waste bags lead to severe pollution rates and the growing concerns over excessive use of environmentally polluting garbage or trash bags could further limit revenue in the KSA region.

Garbage Bags And Trash Bags In KSA Market: Opportunities

Growing efforts to promote the use of recyclable or biodegradable bags could create growth opportunities

The garbage bags and trash bags in KSA industry is likely to witness higher growth owing to the increased focus of the regional authorities to promote the use of biodegradable or environmentally friendly waste bags. In September 2019, the Saudi Standards, Metrology and Quality Organization (SASO) announced new regulations surrounding the use and sale of plastic packaging in the country. For instance, plastics have to be OXO-biodegradable and all plastic products entering from other countries must be registered with SASO.

Surging industrialization rate to create higher growth possibilities

The KSA region is expanding its offerings to the industrial world leading to an increase in investments toward new production facilities and corporate houses. As reported by the Ministry of Industry and Mineral Resources (MIM) more than 80 new production facilities started production in February 2023 functioning at an invested amount of Saudi Riyal 4.3 billion.

Garbage Bags And Trash Bags In KSA Market: Challenges

Disruption in supply chain of final products to challenge market growth

The garbage bags and trash bags in KSA market players may face challenges owing to disruptions in the supply chain of garbage bags and trash bags especially for the products from the international market due to several environmental and political factors. Additionally, the strict regulatory conditions in Saudi Arabia related to the use of plastic materials may lead to added costs in bringing the products to market.

Garbage Bags And Trash Bags In KSA Market: Segmentation

The garbage bags and trash bags in KSA market is segmented based on material, type, distribution channel, and region.

Based on material, the regional market segments are low-density polyethylene, high-density polyethylene, biodegradable polyethylene, linear-low-density polyethylene. In 2022, the highest growth was observed in the high-density polyethylene segment since these bags are known for their superior performance. Additionally, they are also more affordable. However, influenced by the growing environment-oriented policies in KSA and the changing regulations regarding the use of non-biodegradable plastics, the demand for sustainable solutions is growing rapidly. As per reports, the Kingdom of Saudi Arabia produces nearly 54 million metric tons of garbage per year.

Based on type, the garbage bags and trash bags in KSA industry divisions are star sealed bags, drawstrings bags, zipper bags, flat star sealed bags, and others

Based on distribution channel, the regional market is divided into convenience stores, supermarkets/hypermarkets, specialty stores, and others. In 2022, the highest growth was marked in the supermarkets/hypermarkets due to the widespread presence of several supermarkets in KSA. In 2016, the country had around 1255 supermarkets or hypermarkets that accounted for nearly 37% of the total grocery-related sales.

Garbage bags and trash bags in KSA Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Garbage bags and trash bags in KSA Market |

| Market Size in 2022 | USD 25.14 Million |

| Market Forecast in 2030 | USD 36.94 Million |

| Growth Rate | CAGR of 4.96% |

| Number of Pages | 229 |

| Key Companies Covered | Berry Global, Hefty, Reynolds Consumer Products, Glad, Extrapack, Poly-America, Heritage Bag Company, The Clorox Company, Polykar, Inteplast Group, Xtex Polythene Ltd., Novolex, Luban Pack, Four Star Plastics, PackItHub, and others. |

| Segments Covered | By Material, By Type, By Distribution Channel, and By Region |

| Regions Covered | Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Garbage Bags And Trash Bags In KSA Market: Regional Analysis

Riyadh to witness the highest revenue during the projected timeline

The garbage bags and trash bags in KSA market will witness the highest growth in Riyadh since it is the capital city of the Kingdom. As of 2023, the city is home to around 7,68, 000 citizens and is also home to the King Abdullah Financial District. In addition to this, being the financial and regional capital, waste management protocols in Riyadh are stricter than in other cities or regions. The presence of several supermarkets and retail stores further assists in higher demand in the city. On the other hand, Jeddah is the commercial center of Saudi Arabia and is home to a diverse set of population. Mecca is an important religious site in Saudi Arabia as millions of Muslim worshipers visit the holy site every year. During the month of Ramadan, more than 2 million people are known to visit Mecca every year. This leads to higher use of waste disposable bags in hotels and other places providing shelter to the worshippers. Saudi Arabia is working on building friendly political relations with other nations and the increasing international collaborations are expected to drive higher growth in the KSA.

Garbage Bags And Trash Bags In KSA Market: Competitive Analysis

The garbage bags and trash bags in KSA market is led by players like:

- Berry Global

- Hefty

- Reynolds Consumer Products

- Glad

- Extrapack

- Poly-America

- Heritage Bag Company

- The Clorox Company

- Polykar

- Inteplast Group

- Xtex Polythene Ltd.

- Novolex

- Luban Pack

- Four Star Plastics

- PackItHub

The garbage bags and trash bags in KSA market is segmented as follows:

By Material

- Low-Density Polyethylene

- High-Density Polyethylene

- Biodegradable Polyethylene

- Linear Low-Density Polyethylene

- Others

By Type

- Star Sealed Bags

- Drawstring Bags

- Zipper Bags

- Flat Star Sealed Bags

- Others

By Distribution Channel

- Convenience Stores

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

By Region

- The Middle East & Africa

- Saudi Arabia

Table Of Content

Methodology

FrequentlyAsked Questions

Garbage bags and trash bags in the KSA industry refer to the production, distribution, and consumption of waste bags in Saudi Arabia.

The regional garbage bags and trash bags in KSA market is expected to grow owing to the increasing investments by Saudi authorities in the development of smart cities equipped with excellent energy and waste management systems.

According to study, the garbage bags and trash bags in KSA market size was worth around USD 25.14 million in 2022 and is predicted to grow to around USD 36.94 million by 2030.

The CAGR value of garbage bags and trash bags in KSA market is expected to be around 4.96% during 2023-2030.

The garbage bags and trash bags in KSA market will witness the highest growth in Riyadh since it is the capital city of the Kingdom.

The garbage bags and trash bags in KSA market is led by players like Berry Global, Hefty, Reynolds Consumer Products, Glad, Extrapack, Poly-America, Heritage Bag Company, The Clorox Company, Polykar, Inteplast Group, Xtex Polythene Ltd., Novolex, Luban Pack, Four Star Plastics, and PackItHub among many others.

The report explores crucial aspects of the garbage bags and trash bags in KSA market including detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Garbage Bags And Trash Bags In KSAIndustry Prospective:Garbage Bags And Trash Bags In KSA OverviewKey Insights:Garbage Bags And Trash Bags In KSA Growth DriversGarbage Bags And Trash Bags In KSA RestraintsGarbage Bags And Trash Bags In KSA OpportunitiesSurging industrialization rate to create higher growth possibilitiesGarbage Bags And Trash Bags In KSA ChallengesGarbage Bags And Trash Bags In KSA SegmentationReport ScopeGarbage Bags And Trash Bags In KSA Regional AnalysisGarbage Bags And Trash Bags In KSA Competitive AnalysisThe garbage bags and trash bags in KSA market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed