Gig Economy Insurance Products Market Size, Share, Analysis, Trends, Growth, 2032

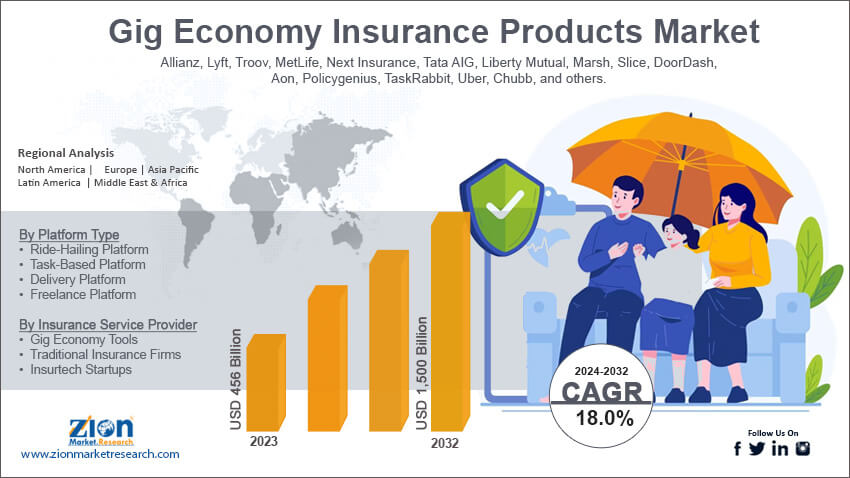

Gig Economy Insurance Products Market By Product Type (General Liability Insurance, Workers’ Compensation Insurance, Professional Liability Insurance, Cyber Liability Insurance, Commercial Auto Insurance, and Equipment Insurance), By Platform Type (Ride-Hailing Platform, Task-Based Platform, Delivery Platform, and Freelance Platform), By Insurance Provider Type (Gig Economy Tools, Traditional Insurance Firms, and Insurtech Startups), By End-User (Gig Economy Businesses and Individual Gig Employees), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

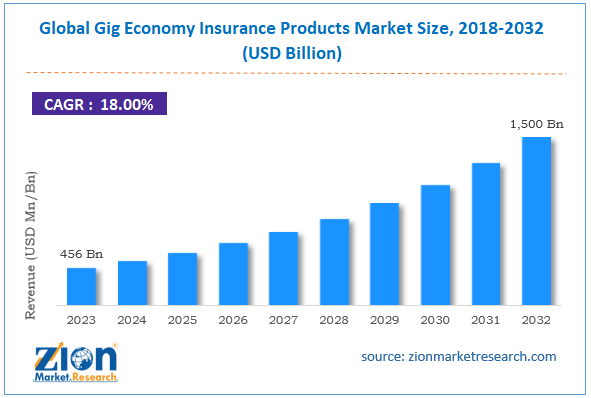

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 456 Billion | USD 1,500 Billion | 18% | 2023 |

Gig Economy Insurance Products Industry Prospective:

The global gig economy insurance products market size was evaluated at $456 billion in 2023 and is slated to hit $1,500 billion by the end of 2032 with a CAGR of nearly 18% between 2024 and 2032.

Gig Economy Insurance Products Market: Overview

The gig economy has witnessed a massive expansion in recent years, with individuals preferring a flexible work culture. Furthermore, this trend has culminated in a huge demand for special insurance products customized to fulfill the unique requirements of gig employees. There are a few gig economy insurance products, including commercial auto insurance, general liability insurance, equipment insurance, professional liability insurance, workers’ compensation insurance, and cyber liability insurance.

Key Insights

- As per the analysis shared by our research analyst, the global gig economy insurance products market is projected to expand annually at the annual growth rate of around 18% over the forecast timespan (2024-2032)

- In terms of revenue, the global gig economy insurance products market size was evaluated at nearly $456 billion in 2023 and is expected to reach $1,500 billion by 2032.

- The global gig economy insurance products market is anticipated to grow rapidly over the forecast timespan owing to an increase in the gig economy owing to a surge in freelancers as well as contractors.

- In terms of product type, the general liability insurance segment is slated to register the highest CAGR over the forecast period.

- Based on platform type, the ride-hailing platform segment is predicted to contribute majorly towards the global industry growth in the upcoming years.

- On the basis of insurance provider, the traditional insurance firms segment is predicted to contribute majorly toward the segmental growth in the ensuing years.

- Based on end-user, the gig economy businesses segment is predicted to lead the segmental landscape in the forecasting timeline.

- Region-wise, the European gig economy insurance products industry is projected to register the fastest CAGR during the projected timespan.

Request Free Sample

Request Free Sample

Gig Economy Insurance Products Market: Growth Factors

Escalating popularity of online platforms to spearhead the global market expansion over forecast period

An increase in the gig economy owing to a surge in freelancers as well as contractors has expedited the growth of the global gig economy insurance products market. Apart from this, the surging popularity of digital tools linking employees with customers has produced a new segment of gig workers needing insurance protection. Moreover, growing awareness about media focus on the gig economy along with awareness of firms about the significance of insurance for gig employees can pave the way for huge growth of the market globally. New product development has contributed majorly towards the global market expansion over the coming eight years.

Gig Economy Insurance Products Market: Restraints

Less knowledge about the product benefits can hinder the global industry expansion by 2032

Lack of awareness among gig employees about the benefits of insurance products along with rising costs of insurance can hinder the growth of the global gig economy insurance products industry. Moreover, changing consumer needs and the necessity of the latter for purchasing many insurance policies for covering potential risks can reduce the demand for gig economy insurance products.

Gig Economy Insurance Products Market: Opportunities

Tech innovations can open new growth opportunities for the global market over forecast timeline

Technological breakthroughs and large-scale use of data analytics along with favorable laws governing the gig economy can open new avenues of growth for the global gig economy insurance products market. Furthermore, supportive government policies and a rise in private-public partnerships for developing effective insurance programs for gig employees will boost global market trends.

Gig Economy Insurance Products Market: Challenges

Less access to historical data can challenge the global industry expansion over 2024-2032

Lack of availability of historical data, data privacy concerns, and strict legislation can challenge the expansion of the global gig economy insurance products industry in the coming years. Economic oscillations such as downturns and recessions along with job insecurity are few of the major factors hindering the growth of the global industry.

Gig Economy Insurance Products Market: Segmentation

The global gig economy insurance products market is divided into product type, platform type, insurance provider type, end-user, and region.

In terms of product type, the gig economy insurance products market across the globe is segmented into general liability insurance, workers’ compensation insurance, professional liability insurance, cyber liability insurance, commercial auto insurance, and equipment insurance segments. Apparently, the general liability insurance segment, which accumulated nearly half of the global market share in 2023, is projected to register the fastest CAGR during the coming years as a result of large-scale coverage offered by service providers for providing gig employees against a spectrum of potential liabilities, thereby making it a key insurance product for a large number of firms as well as people functioning in the gig economy.

Based on the platform type, the global gig economy insurance products industry is segmented into ride-hailing platform, task-based platform, delivery platform, and freelance platform segments. Apparently, the ride-hailing platform segment, which dominated the global industry share in 2023, is predicted to account remarkably toward the expansion of the industry globally in the upcoming years with an increase in the active customers of ride-hailing tools and commuters required to carry particular insurance coverage.

On the basis of insurance provider type, the global gig economy insurance products market is bifurcated into gig economy tools, traditional insurance firms, and insurtech startups segments. Moreover, the traditional insurance firms segment, which led to segmental growth in 2023, is projected to contribute notably towards the segmental space in the coming years. The growth can be credited to the setting up of strong healthcare infrastructure facilities globally along with the financial stability of gig workers opting for insurance coverage.

Based on the end-user, the gig economy insurance products industry across the globe is sectored into gig economy businesses and individual gig employees segments. Moreover, the gig economy businesses segment, which dominated the segmental space in 2023, is expected to continue the domination of the segment in the ensuing years, subject to demand for purchasing insurance owing to exposure to personal risks.

Gig Economy Insurance Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Gig Economy Insurance Products Market |

| Market Size in 2023 | USD 456 Billion |

| Market Forecast in 2032 | USD 1,500 Billion |

| Growth Rate | CAGR of 18% |

| Number of Pages | 231 |

| Key Companies Covered | Allianz, Lyft, Troov, MetLife, Next Insurance, Tata AIG, Liberty Mutual, Marsh, Slice, DoorDash, Aon, Policygenius, TaskRabbit, Uber, Chubb, and others. |

| Segments Covered | By Product Type, By Platform Type, By Insurance Service Provider, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Gig Economy Insurance Products Market: Regional Insights

Asia-Pacific is forecast to maintain leadership status in the global market over the stipulated timeline

Asia-Pacific, which contributed about half of the global gig economy insurance products market share in 2023, is expected to establish a number one position in the global market in the upcoming years. In addition, the regional market expansion in the coming eight years can be credited to swift economic development in the emerging economies of Asia. Moreover, surging acceptance of new technologies, leading to the expansion of gig economy tools, along with surging consciousness of the benefits of insurance products, is likely to augment the expansion of the market in the region.

The European gig economy insurance products industry is slated to register the highest annual gains in the coming eight years. The expansion of the industry in the European zone can be subject to the large-scale acceptance of online tools and data analytics, along with huge demand for insurance products in a slew of end-use sectors in European countries.

Key Developments

- In September 2024, Bharatsure introduced Gig Worker Insurance, which offers health and personal injury coverage for a low monthly price of INR 69/—.

Gig Economy Insurance Products Market: Competitive Space

The global gig economy insurance products market profiles key players such as:

- Allianz

- Lyft

- Troov

- MetLife

- Next Insurance

- Tata AIG

- Liberty Mutual

- Marsh

- Slice

- DoorDash

- Aon

- Policygenius

- TaskRabbit

- Uber

- Chubb

The global gig economy insurance products market is segmented as follows:

By Product Type

- General Liability Insurance

- Workers’ Compensation Insurance

- Professional Liability Insurance

- Cyber Liability Insurance

- Commercial Auto Insurance

- Equipment Insurance

By Platform Type

- Ride-Hailing Platform

- Task-Based Platform

- Delivery Platform

- Freelance Platform

By Insurance Service Provider

- Gig Economy Tools

- Traditional Insurance Firms

- Insurtech Startups

By End-User

- Gig Economy Businesses

- Individual Gig Employees

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The gig economy has witnessed a massive expansion in recent years, with individuals preferring a flexible work culture. Furthermore, this trend has culminated in a huge demand for special insurance products customized to fulfill the unique requirements of gig employees.

Which key factors will influence global gig economy insurance products market growth over 2024-2032?

The global gig economy insurance products market will grow over the forecast period due to the surging popularity of digital tools linking employees with customers, which has produced a new segment of gig workers needing insurance protection.

According to a study, the global gig economy insurance products industry size was $456 billion in 2023 and is projected to reach $1,500 billion by the end of 2032.

The global gig economy insurance products market is anticipated to record a CAGR of nearly 18% from 2024 to 2032.

The European gig economy insurance products industry is set to register the fastest CAGR over the forecasting timeline owing to the large-scale acceptance of online tools and data analytics and huge demand for insurance products in a slew of end-use sectors in European countries.

The global gig economy insurance products market is led by players such as Allianz, Lyft, Troov, MetLife, Next Insurance, Tata AIG, Liberty Mutual, Marsh, Slice, DoorDash, Aon, Policygenius, TaskRabbit, Uber, and Chubb.

The global gig economy insurance products market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed