Calcium Aluminate Cement Market Size, Share, Trends, Growth 2030

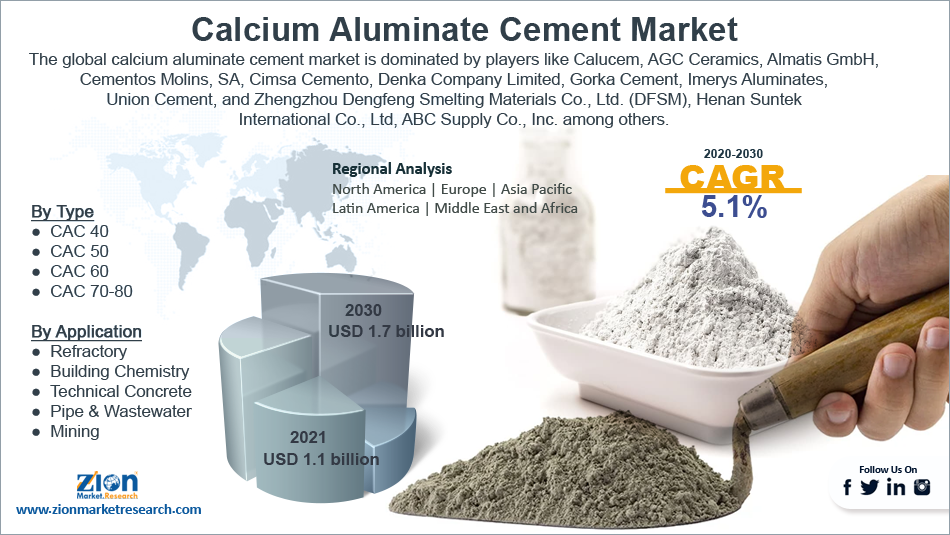

Calcium Aluminate Cement Market By Type (CAC 40, CAC 50, CAC 60, and CAC 70-80), By Application (Refractory, Building Chemistry, Technical Concrete, Pipe & Wastewater, and Mining) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2030

| Market Size in 2021 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1.1 Billion | USD 1.7 Billion | 5.1% | 2021 |

Calcium Aluminate Cement Market Size:

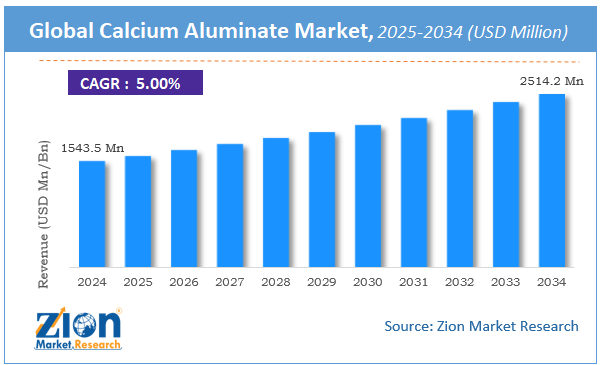

The global calcium aluminate cement market size was worth around USD 1.1 Billion in 2021 and is predicted to grow to around USD 1.7 Billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.1% between 2022 and 2030.

The report analyzes the global calcium aluminate cement market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the calcium aluminate cement market.

Get more information about this report - Request Free Sample PDF

Calcium Aluminate Cement Market: Overview

Hydraulic calcium aluminate cement, also known as calcium-aluminate cement, is made by grinding a solidified melt or clinker that is mostly composed of proportional hydraulic calcium aluminates. Generally, they are separated into three groups based on the amounts of alumina and iron oxide (Low Purity, Intermediate Purity, and High Purity). Higher alumina concentration cement is appropriate for applications involving higher temperatures. Typically, calcium-aluminate cement is employed in high-heat refractory applications.

As part of the expanding component in various shrinkage-compensating types of cement, somewhat acid-resistant applications, high-early strength, and quick-setting combinations are a few more uses. These cement are primarily made of calcium aluminate, which may generate a lot of heat within the first 24 hours, and are designed to build strength much more quickly than regular Portland cement. According to the intended application performance parameters, the cement phase ratios (CA or CA2) are proportioned.

Key Insights

- As per the analysis shared by our research analyst, the global calcium aluminate cement market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2022-2030).

- In terms of revenue, the global calcium aluminate cement market size was valued at around USD 1.1 billion in 2021 and is projected to reach USD 1.7 billion, by 2030.

- The growing demand for calcium aluminate cement from the construction industry is expected to drive the growth of the market during the forecast period.

- Based on the type, the CAC 40 segment accounted for the largest revenue share in 2021.

- Based on the application, the pipe & wastewater segment is projected to hold the largest market share over the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

To know more about this report, request a sample copy.

Calcium Aluminate Cement Market: Growth Drivers

Growing demand from the construction industries to drive the market growth

The expansion of the global building industry will surely have a favorable impact on product usage. It is mostly used in the construction industry in a variety of products, such as sealers, self-leveling toppings, repair mortars, non-shrink grouts, and bedding mortars. The forecast period will see a surge in building attraction usage due to supportive government regulations, urbanization, public and private investment, and a growing population. For instance, according to World Bank Data, approximately 4.4 billion people, or 56% of the world's population, now reside in cities. By 2050, approximately 7 out of 10 people will live in cities, with the urban population predicted to more than double its current level. Thus, these components are key growth catalysts for the calcium aluminate cement industry globally.

Calcium Aluminate Cement Market: Restraints

The high cost of calcium aluminate limits the market growth

The mining and building industries both employ calcium aluminate cement. However, several factors can act as global calcium aluminate cement market restraints, such as high costs that restrict consumers from purchasing such products. Due to the expense, installation costs, and maintenance costs, contractors are discouraged from purchasing it. Such factors can lead customers to opt against buying, which is projected to lower market demand.

Calcium Aluminate Cement Market: Opportunities

Growing demand for technologically advanced procedures provides a lucrative opportunity

The majority of uses for calcium aluminate cement involve high-temperature headstrong materials. Major applications include quick-setting mixes with high early strength, applications with sufficient acid resistance, and adhesives with expanding elements that compensate for shrinkage. This cement is made by pounding a solidified dissolve that is mostly composed of hydraulic calcium aluminates that are created from carefully balanced ratios of aluminous and calcareous components.

They mostly contain calcium aluminate, which may generate a lot of heat, and are generally thought to build strength much faster than regular cement. To accommodate the intended application features, the cement phase ratios are adjusted.

Calcium Aluminate Cement Market: Challenges

Chloride chemical attack, resulting in surface softening act as a major challenge

In the parts of the building where it was warm and humid, such as the roof areas, bathrooms, and kitchens. Numerous instances of chemical deterioration were detected in roof sections. Each time, wood wool slabs were used to cover the units, and there was condensation or leakage. It was discovered that calcium chloride was frequently used to stabilize the wood fiber in wood wool slabs (to inhibit organic development).

Condensate effluent or leakage caused chloride attack on concrete, which increased permeability and rendered the concrete more vulnerable to attack. The surface had softened to a depth of about 10 mm due to the attack, which was primarily caused by the development of calcium alumino-chloride. Thus, acting as a major challenge for the market growth over the forecast period.

Calcium Aluminate Cement Market: Segmentation

The global calcium aluminate cement market is segmented based on type, application, and region

Based on the type, the global market is bifurcated into CAC 40, CAC 50, CAC 60, and CAC 70-80. The CAC 40 segment accounted for the largest revenue share in 2021 and is expected to continue the same pattern during the forecast period. The growth in the segment is attributable to its versatility and inexpensive cost in the refractory and building industries. In the refractory industry, CAC 40 is used to make low-duty refractory concretes; however, in the construction industry, it is combined with other reactive minerals to create a binder that can be used to make a variety of products, such as self-leveling floor products, non-shrink grouts, and fast-setting patch materials.

On the other hand, the CAC 50 type segment holds a significant market share during the forecast period. It is produced on a typical rotary kiln utilizing high-purity bauxite and limestone and has a minimum alumina concentration of 50%. Due to its light color and excellent reactivity, CAC 50 is employed not only in refractory but also in the building chemistry industry.

Based on the application, the global calcium aluminate cement market is categorized into refractory, building chemistry, technical concrete, pipe & wastewater, and mining. The pipe & wastewater segment is projected to hold the largest market share over the forecast period.

The growth in the segment is owing to the use of calcium aluminate cement in the water treatment procedure due to its exceptional characteristics. On the other hand, the building chemistry segment is expected to grow at the highest CAGR over the forecast period. Different building chemistry items include floor leveling compounds, sealers, quick floor screeds, tile adhesives, bedding mortars, tile grouts, and repair mortars.

This extensive line of goods has Portland cement and CAC as their mineral base. Slag, admixtures, gypsum, polymers, lime, and fine calcareous material may also be included in the blend. Thus, driving the segmental growth over the forecast period.

Recent Developments:

- In August 2022, Calucem, a manufacturer of specialty cement, will increase its market position in the United States by investing US$35 million in the construction of a manufacturing facility in New Orleans. The second-largest manufacturer of calcium aluminate cement, a high-performance material used in a variety of commercial and industrial uses, is Calucem, a division of Cementos Molins. The project will generate about 228 new jobs for Louisiana's Southeast Region, including 70 direct jobs and, according to Louisiana Economic Development, 158 indirect jobs.

- In June 2021, Imerys, a French manufacturer of industrial minerals, invested USD 44 million in India to build a 30,000-tonne calcium aluminate factory in Vizag, Andhra Pradesh. Calcium aluminate is a crucial raw ingredient for producing refractories. This new plant, in which the Group invested USD 44 million, increases the Group's footprint in the nation and enables it to provide domestic customers with solutions tailored to their regional needs.

Calcium Aluminate Cement Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Calcium Aluminate Cement Market Research Report |

| Market Size in 2021 | USD 1.1 Billion |

| Market Forecast in 2030 | USD 1.7 Billion |

| Compound Annual Growth Rate | CAGR of 5.1% |

| Number of Pages | 194 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Calucem, AGC Ceramics, Almatis GmbH, Cementos Molins, SA, Cimsa Cemento, Denka Company Limited, Gorka Cement, Imerys Aluminates, Union Cement, and Zhengzhou Dengfeng Smelting Materials Co., Ltd. (DFSM), Henan Suntek International Co., Ltd, ABC Supply Co., Inc. among others. |

| Segments Covered | By Type, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2021 |

| Historical Year | 2016 to 2020 |

| Forecast Year | 2022 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Calcium Aluminate Cement Market: Regional Analysis

North America is expected to dominate the market during the forecast period

North America is expected to hold the largest global calcium aluminate cement market share during the forecast period owing to the rising cement production, expanding demand for refractory, and robust iron and steel growth. Major CAC players that serve the domestic CAC market, including Curimbaba Group, Kerneos, Inc., Calucem, and RWC Cement, are well-represented in the area. With a significant amount of cement output of about 89 million tons in 2019, the U.S. is one of the top cement producers.

Major multinational corporations control the thriving cement sector, which further expands the use of calcium aluminate cement in monolithic refractories for the production of cement. Additionally, the region shows a significant increase in building in the commercial, residential, road, and home remodeling sectors.

One of the greatest construction markets in the world, the U.S. spent an amazing approximately USD 1.3 trillion on building in 2019. Some of the main elements influencing the demand for CAC in tile adhesives, quick floor screeds, CAC-based concrete, protective coatings, mortars, etc. are positive developments in building and infrastructure.

Besides, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. The growth in the region is primarily attributed to the increasing construction sector and growing government initiatives to develop strong infrastructural growth in the region, especially in India and China. For instance, according to the India Brand Equity Foundation, through its "National Infrastructure Pipeline," India intends to invest US$ 1.4 trillion in infrastructure over the next five years. Infrastructure-related operations made about 13% of the US$81.72 billion in total FDI inflows in FY21. To realize the goal of housing for everybody by 2022, India will need to build 43,000 homes per day till that time.

The Pradhan Mantri Awas Yojna scheme has sanctioned 122.69 lakh homes, grounded 103.01 lakh homes, and completed 62.21 lakh homes as of August 22, 2022. (PMAY-Urban). Therefore, the increasing government initiatives in these countries drive the growth of the market during the forecast period.

Calcium Aluminate Cement Market: Competitive Analysis

The global calcium aluminate cement market is dominated by players like:

- Calucem

- AGC Ceramics

- Almatis GmbH

- Cementos Molins

- SA

- Cimsa Cemento

- Denka Company Limited

- Gorka Cement

- Imerys Aluminates

- Union Cement

- Zhengzhou Dengfeng Smelting Materials Co. Ltd. (DFSM)

- Henan Suntek International Co. Ltd

- ABC Supply Co. Inc.

The global calcium aluminate cement market is segmented as follows:

By Type

- CAC 40

- CAC 50

- CAC 60

- CAC 70-80

By Application

- Refractory

- Building Chemistry

- Technical Concrete

- Pipe & Wastewater

- Mining

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The consumption of CAC will increase as monolithic refractories are used more frequently to replace traditional refractories. In monolithic refractory materials with improved qualities and a variety of installation methods, such as high-density, low-moisture, pumpable, self-flowing, and shotcrete (formless) castables, CAC is primarily used.

According to the report, the global market size was worth around USD 1.1 billion in 2021 and is predicted to grow to around USD 1.7 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.1% between 2022 and 2030.

The global calcium aluminate cement market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market owing to rising cement production, expanding demand for refractory, and robust iron and steel growth.

The global calcium aluminate cement market is dominated by players like Calucem, AGC Ceramics, Almatis GmbH, Cementos Molins, SA, Cimsa Cemento, Denka Company Limited, Gorka Cement, Imerys Aluminates, Union Cement, and Zhengzhou Dengfeng Smelting Materials Co., Ltd. (DFSM), Henan Suntek International Co., Ltd, ABC Supply Co., Inc. among others.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed