Green Mining Market Size, Share, Trends, Growth and Forecast 2032

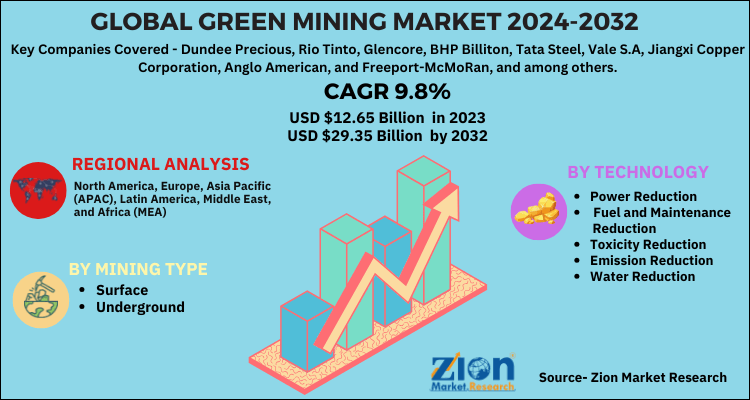

Green Mining Market - By Type (Surface and Underground), By Technology (Power Reduction, Fuel and Maintenance Reduction, Toxicity Reduction, Emission Reduction, and Water Reduction), and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2024 - 2032-

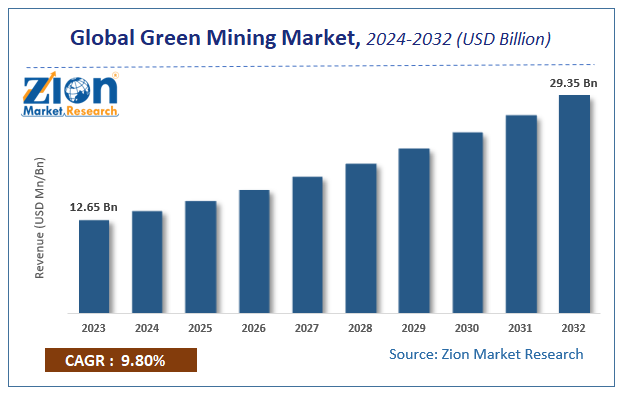

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.65 Billion | USD 29.35 Billion | 9.8% | 2023 |

Global Green Mining Market Insights

According to a report from Zion Market Research, the global Green Mining Market was valued at USD 12.65 Billion in 2023 and is projected to hit USD 29.35 Billion by 2032, with a compound annual growth rate (CAGR) of 9.8% during the forecast period 2024-2032. This report explores market strengths, weakness, opportunities, and threats. It also provides valuable insights into the market's growth drivers, challenges, and the future prospects that may emerge in the Green Mining industry over the next decade.

The report covers in-depth analysis of the strategies adopted by major competitors in the global Green Mining market. To understand the competitive landscape in the global Green Mining market, an analysis of Porter’s Five Forces model is also included. The research study comprises of market attractiveness analysis, wherein all the segments are benchmarked on the basis of their market size and growth rate.

The research study provides a decisive view on the global Green Mining market based on Type, Technology, and Region. All the segments of the market have been analyzed based on the past, present, and future trends. The market is estimated from 2024 to 2032.

Owing to the increasing requirement for stringent environmental regulations and other public concerns regarding the mining industry is expected to help augment the global Green Mining market during the forecast period. In addition, the growing pressure on mining industries to reduce the impact on the environment and pay more often for the arising local issues is likely to propel the Green Mining market. This might raise the companies’ capital and operating expenditure to comply with environmental norms and laws. Furthermore, the mounting demand for more productivity with less of expenditure is projected to expand this market in over a period of time.

During the mining process, the consumption of power is high and are could be performed using comminution process that helps reduce the size of the solid materials. The control over the use of energy in mining is rare and thus, it is the comminution process that helps reduce the use of energy. Thus, power reduction is projected to account for the largest market share in the technology segment of global Green Mining Technology. The green mining practices are largely followed across various regions owing to the demand for sustainable practices. The awareness of protecting the environment using various innovative technologies is anticipated to fuel the global Green Mining market during the forecast period.

Global Green Mining Market: Segmentation

The study provides a decisive view of the green mining market by segmenting the market based on by mining type, by technology and by region. All the segments have been analyzed based on present and future trends and the market is estimated from 2024 to 2032.

On the basis of type, the market for green mining is divided into Surface and Underground.

Based on technology, the global Green Mining Technology is segregated into Power Reduction, Fuel and Maintenance Reduction, Toxicity Reduction, Emission Reduction, and Water Reduction.

The regional segmentation comprises the past, present, and estimated demand for the Middle East & Africa, North America, Asia Pacific, Latin America, and Europe.

The regional segment is further split into the U.S., Canada, Mexico, UK, France, Germany, China, Japan, India, South Korea, Brazil, and Argentina among others.

Green Mining Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Green Mining Market |

| Market Size in 2023 | USD 12.65 Billion |

| Market Forecast in 2032 | USD 29.35 Billion |

| Growth Rate | CAGR of 9.8% |

| Number of Pages | 110 |

| Key Companies Covered | Dundee Precious, Rio Tinto, Glencore, BHP Billiton, Tata Steel, Vale S.A, Jiangxi Copper Corporation, Anglo American, and Freeport-McMoRan, and among others |

| Segments Covered | By Mining Type, By Technology And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Green Mining Market: Key Players

Some of the key players in the global Green Mining market include:

- Dundee Precious

- Rio Tinto

- Glencore

- BHP Billiton

- Tata Steel

- Vale S.A

- Jiangxi Copper Corporation

- Anglo American

- Freeport-McMoRan

The report on the global Green Mining market is segmented into:

Global Green Mining Market: By Mining Type Segmentation Analysis

- Surface

- Underground

Global Green Mining Market: By Technology Segmentation Analysis

- Power Reduction

- Comminution Efficiency

- Hydrometallurgical Processes

- Fuel and Maintenance Reduction

- Equipment route optimization

- Fuel additives

- Natural gas conversion

- Training Simulators

- Toxicity Reduction

- Bioleaching

- Bioremediation

- Emission Reduction

- Dust management

- Carbon Sequestration

- Interior Bleaching

- Water Reduction

- AMD/ARD Remediation

- Wastewater processing:

- Tailings Remediation

- Desalination

Global Green Mining Market: By Regional Segmentation Analysis

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The global Green Mining Market was valued at USD 12.65 Billion in 2023 and is projected to hit USD 29.35 Billion by 2032, with a compound annual growth rate (CAGR) of 9.8% during the forecast period 2024-2032.

The CAGR value of the green mining market is expected to be around 9.8% during 2024-2032.

Europe is projected to dominate the global Green Mining market during the forecast period. The green mining practices are largely followed in Europe owing to the demand for sustainable practices in regions such as Russia, Germany, Poland, and Turkey.

Some key players of the global green mining market are Dundee Precious, Rio Tinto, Glencore, BHP Billiton, Tata Steel, Vale S.A, Jiangxi Copper Corporation, Anglo American, and Freeport-McMoRan.

The Regional segment includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed