Grinding Machinery Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

Grinding Machinery Market By Type (Surface Grinder, Cylindrical Grinder, Gear Grinder, Tool & Cutter Grinder, Bench Grinder, Jig Grinder, Belt Grinder, and Others), By Application (Automotive, Aerospace & Defense, Electrical & Electronics, Shipbuilding, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

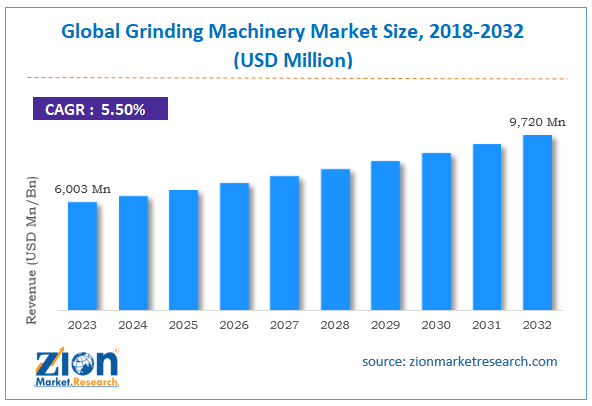

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6,003 Million | USD 9,720 Million | 5.5% | 2023 |

Grinding Machinery Industry Prospective:

The global grinding machinery market size was worth around USD 6,003 million in 2023 and is predicted to grow to around USD 9,720 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.5% between 2024 and 2032.

Grinding Machinery Market: Overview

A grinding machine is a type of machine tool that usually uses an abrasive wheel for grinding. The machine is used to polish a variety of workpieces, including parts and components for aircraft as well as household products. Because of this, grinding machines can be used for a wide variety of tasks. A grinding machine is typically used to precisely shape and finish materials or semi-finished items that have a low surface roughness and a high surface quality requirement. This is usually utilized to produce highly accurate items by smoothing relatively small amounts of metal. Due to the strict requirements for precise finishing in a variety of applications, grinding machines have become extremely popular worldwide across a wide range of industry verticals.

Key Insights

- As per the analysis shared by our research analyst, the global grinding machinery market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2024-2032).

- In terms of revenue, the global grinding machinery market size was valued at around USD 6,003 million in 2023 and is projected to reach USD 9,720 million by 2032.

- The growing automotive industry is expected to drive the grinding machinery market growth over the forecast period.

- Based on the type, the cylindrical grinder segment is expected to dominate the market during the forecast period.

- Based on the application, the aerospace & defense segment is expected to hold a prominent market share over the projected period.

- Based on region, the Asia Pacific is expected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

Grinding Machinery Market: Growth Drivers

The rising automotive industry drives market growth.

An increasing amount of accurate and effective machinery is required for vital applications including engine components, gearboxes, and brakes due to the automobile industry's ongoing innovation and expansion. Automobiles without precise parts cannot be certain to be reliable, secure, or functional. To manufacture high-precision automotive parts that must adhere to strict specifications for surface quality and dimensional accuracy, like crankshafts, camshafts, and gearbox components, machines are required. Automotive manufacturers are increasingly utilizing lightweight metals and composites to reduce vehicle weight and increase fuel efficiency. The use of equipment designed to process these materials effectively without compromising the vehicle's decreased weight and structural integrity is encouraged by this tendency. Thus, all these aspects are likely to boost the global grinding machinery market growth during the coming period.

Grinding Machinery Market: Restraints

Fluctuations in raw material prices hinder market growth

The fluctuation in raw material prices, encompassing steel and components, may exert an influence on the total expense of grinding machines. In addition, a substantial portion of the total cost of manufacturing grinding machines is incurred by raw materials. Moreover, rising costs for these components may result in increased production costs overall, which could raise the cost of machines for final consumers. Furthermore, changes in the price of raw materials can cause supply chain interruptions since producers may find it difficult to obtain a reliable and affordable supply of necessary parts. Further, companies in the industrial, aerospace, and automotive sectors are among the end-users of grinding machines that may be vulnerable to these changes in the cost of raw materials, thereby hampering the expansion of the grinding machinery industry.

Grinding Machinery Market: Opportunities

Increasing product launches offers a lucrative opportunity for market growth

Increasing product launches are expected to offer a lucrative opportunity for grinding machinery market growth during the forecast period. For instance, in February 2024, Nidec Machine Tool Corporation, a group subsidiary of Nidec Corporation, declared that it had created the first high-accuracy polishing (grinding) technique in the world for mass-producing internal gears, which are used for robot joints and drive units in cars. For mass production, high-accuracy polish-machining techniques are currently available for external gears; however, no equivalent techniques have been made accessible for internal gears. The Company has successfully secured the level of accuracy and production that traditional grinding, honing, or skiving processes could not after doing a study on this topic.

Grinding Machinery Market: Challenges

The high cost of advanced machinery poses a major challenge to market expansion

Modern grinding machines can be expensive, especially if automation and Industry 4.0 technologies are included. This can be a major deterrent for small and medium-sized businesses (SMEs) who want to improve or grow. Also, expensive machinery has an extended return on investment, which might discourage grinding machinery businesses from making large capital investments, particularly during uncertain economic times.

Grinding Machinery Market: Segmentation

The global grinding machinery industry is segmented based on type, application, and region.

Based on the type, the global grinding machinery market is bifurcated into surface grinder, cylindrical grinder, gear grinder, tool & cutter grinder, bench grinder, jig grinder, belt grinder, and others. The cylindrical grinder segment is expected to dominate the market during the forecast period. The industrial demand, global expansion, technical improvements, and sustainability focus are driving the robust revenue growth of the cylindrical grinder market. This increase is mostly being driven by the integration of Industry 4.0 technologies and the growing demand from important industries including the manufacturing of medical devices, aerospace, and automobiles. Despite certain obstacles, the market for cylindrical grinders is expected to grow and offer prospects for innovation and expansion.

Based on the application, the global grinding machinery industry is bifurcated into automotive, aerospace & defense, electrical & electronics, shipbuilding, and others. The aerospace & defense segment is expected to hold a prominent market share over the projected period. Turbine components composed of superalloys and other cutting-edge materials are needed for aerospace applications. The use of cylindrical and surface grinding equipment is essential to getting the exact measurements and surface finishes needed for maximum efficiency. Crucial pieces including engine mounts, landing gear parts, and structural elements that have to adhere to strict quality and safety requirements are produced using grinding machinery. In addition, the aerospace and defense industries are adopting more and more cutting-edge materials including carbon composites, ceramics, and titanium alloys. High-performance grinding wheels and sophisticated control systems enable grinding machinery to handle these materials with efficiency. Continuous improvements in robotic automation, machine learning, and CNC technology improve the accuracy and productivity of grinding operations while satisfying the exacting tolerances needed for aerospace and defense applications.

Grinding Machinery Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Grinding Machinery Market |

| Market Size in 2023 | USD 6,003 Million |

| Market Forecast in 2032 | USD 9,720 Million |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 217 |

| Key Companies Covered | Master Abrasives Ltd., FIVES SAS, Hardinge Inc., Amada Co. Ltd., ANCA Pty Ltd., DMG MORI Co. Ltd., Erwin Junker Maschinenfabrik GmbH, FALCON MACHINE TOOLS Co. Ltd., JTEKT Machinery Americas Corp., Makino Inc., Mitsubishi Heavy Industries Ltd., MONDRAGON Corp., MTI Technology, Okuma Corp., Phillips Machine Tools India Pvt. Ltd., FFG European and American Holdings GmbH, Geo Kingsbury Machine Tools Ltd, KEHREN GmbH, Lecn Anhui Co. Ltd., UNITED GRINDING North America Inc., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Grinding Machinery Market: Regional Analysis

Asia Pacific is expected to dominate the market during the forecast period

The Asia Pacific is expected to dominate the grinding machinery market during the forecast period. Rapid industrialization is occurring in nations like China, India, Japan, and South Korea, which is driving up demand for machinery in several industries, including construction, automotive, aerospace, and electronics. The need for grinding machinery is increasing due to the expansion of the industrial sector in Asia Pacific economies. This is especially true for industries like precision machining, tool & die production, and metalworking. Furthermore, the manufacturing of infrastructure-related components, such as pipes, building materials, and transportation infrastructure components, which demand precision grinding, is mandated by the fast urbanization of Asia Pacific countries. Moreover, joint ventures and alliances between Asian producers and multinational suppliers of grinding equipment promote information sharing, creativity, and the creation of locally-specific products.

Grinding Machinery Market: Competitive Analysis

The global grinding machinery market is dominated by players like:

- Master Abrasives Ltd.

- FIVES SAS

- Hardinge Inc.

- Amada Co. Ltd.

- ANCA Pty Ltd.

- DMG MORI Co. Ltd.

- Erwin Junker Maschinenfabrik GmbH

- FALCON MACHINE TOOLS Co. Ltd.

- JTEKT Machinery Americas Corp.

- Makino Inc.

- Mitsubishi Heavy Industries Ltd.

- MONDRAGON Corp.

- MTI Technology

- Okuma Corp.

- Phillips Machine Tools India Pvt. Ltd.

- FFG European and American Holdings GmbH

- Geo Kingsbury Machine Tools Ltd

- KEHREN GmbH

- Lecn Anhui Co. Ltd.

- UNITED GRINDING North America Inc.

The global grinding machinery market is segmented as follows:

By Type

- Surface Grinder

- Cylindrical Grinder

- Gear Grinder

- Tool & Cutter Grinder

- Bench Grinder

- Jig Grinder

- Belt Grinder

- Others

By Application

- Automotive

- Aerospace & Defense

- Electrical & Electronics

- Shipbuilding

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

A grinding machine is a type of machine tool that usually uses an abrasive wheel for grinding. The machine is used to polish a variety of workpieces, including parts and components for aircraft as well as household products. Because of this, grinding machines can be used for a wide variety of tasks. A grinding machine is typically used to precisely shape and finish materials or semi-finished items that have a low surface roughness and a high surface quality requirement.

The grinding machinery market is being driven by several factors including the growing automotive industry, rising product launches, increasing collaboration, the advent of Industry 4.0, and many others.

According to the report, the global grinding machinery market size was worth around USD 6,003 million in 2023 and is predicted to grow to around USD 9,720 million by 2032.

The global grinding machinery market is expected to grow at a CAGR of 5.5% during the forecast period.

The global grinding machinery market growth is expected to be driven by the Asia Pacific. It is currently the world’s highest revenue-generating market due to the increasing automotive sector.

The global grinding machinery market is dominated by players like Master Abrasives Ltd., FIVES SAS, Hardinge Inc., Amada Co. Ltd., ANCA Pty Ltd., DMG MORI Co. Ltd., Erwin Junker Maschinenfabrik GmbH, FALCON MACHINE TOOLS Co. Ltd., JTEKT Machinery Americas Corp., Makino Inc., Mitsubishi Heavy Industries Ltd., MONDRAGON Corp., MTI Technology, Okuma Corp., Phillips Machine Tools India Pvt. Ltd., FFG European and American Holdings GmbH, Geo Kingsbury Machine Tools Ltd, KEHREN GmbH, Lecn Anhui Co., Ltd., and UNITED GRINDING North America, Inc. among others.

The grinding machinery market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed