HCS Software and Services Market Size, Share, Trend, Growth 2028

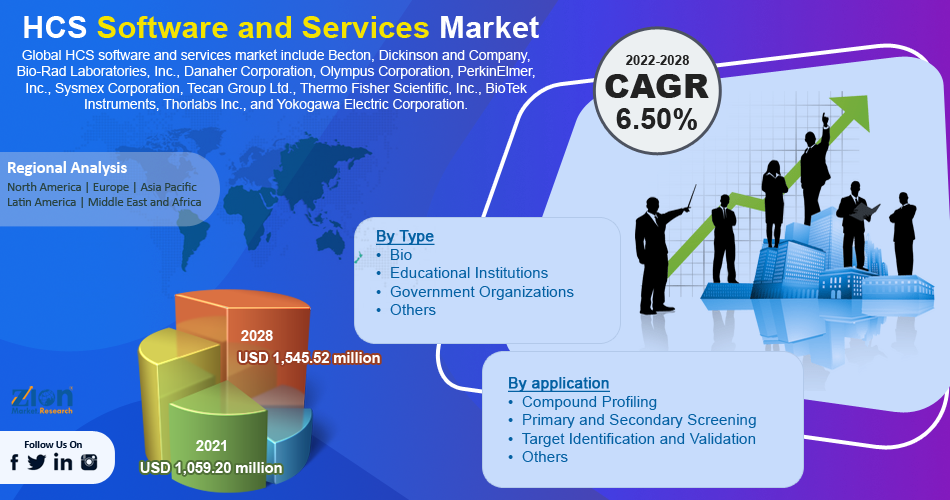

HCS Software and Services Market By Type (Bio, Educational Institutions, Government Organizations, and Other), By Application (Compound Profiling, Primary & Secondary Screening, Target Identification & Validation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028-

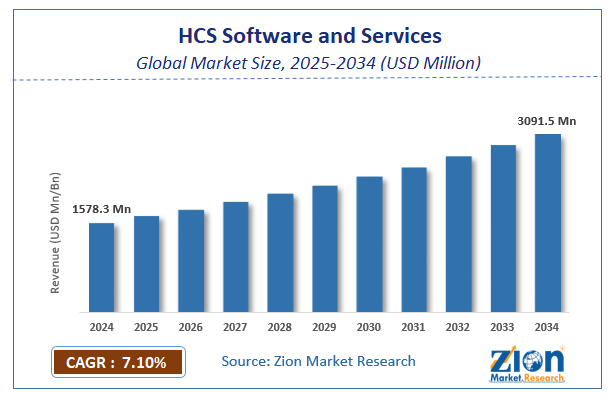

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,059.20 Million | USD 1,545.52 Million | 6.50% | 2021 |

HCS Software and Services Industry Perspective:

The global HCS software and services market size was worth USD 1,059.20 Million in 2021 and is estimated to grow to USD 1,545.52 Million by 2028, with a compound annual growth rate (CAGR) of approximately 6.50 percent over the forecast period.

The report analyzes the HCS software and services market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the HCS software and services market.

HCS Software and Services Market: Overview

High-content screening (HCS) is used in biological and drug research to identify substances such as small molecules, peptides, and RNAi that change the phenotype of cells in the desired way. The HCS system is used at almost every stage of pharmaceutical research. These include cell sorting, selectivity, absorption, permeability, and metabolism. HCS is comprehensive healthcare I.T. platform that includes electronic medical records (EHR), revenue cycle management, financial management, mobility, and business intelligence. Increasing demand for HCS software and services from bioinformatics research institutes, educational institutions, government agencies, and other end users is Kiley to drive its demand over coming period.

HCS software and services help researchers identify biomarkers for drug discovery and development. It also provides support for target identification, validation, and compound profiling. This software and services are used to improve the efficiency of the pharmaceutical research process. HCS software manages and analyses data from high content screening (HCS) experiments. Vendor-provided services include assay design, data interpretation, target identification, and compound profiling

Covid-19 impact:

The COVID-19 pandemic negatively impacted the research and drug development process in the HCS software and services industry. Ongoing research activities are hampered by government blockades and closures worldwide. Prior to the COVID-19 pandemic, high-content screening equipment was well-received in emerging markets for cell imaging and toxicity research. However, the pandemic has hit the high-content screening market due to product launch delays and a significant decline in sales of key products.

Key Insights

- The global HCS software and services market was estimated approximately USD 1,059.20 million in 2021 and is projected to grow to about USD 1545.52 million by 2028, with a compound annual growth rate (CAGR) of around 6.50 % over the forecast period.

- The development of a new HCS approach is expected to drive the growth of the global high content screening (HCS) market during the forecast period.

- Growth in the primary & secondary screening segments can also be attributed to numerous potential drug candidates for targeted delivery.

- North America is expected to grow fastest due to high research & development costs and the presence of key pharmaceutical market players.

HCS Software and Services Market: Growth Drivers

Increasing focus on secondary screening is projected to boost the market growth during the forecast period.

The focus on drug toxicity research, and the focus on secondary cell screening by major market players has increased the demand for high content screening in recent years. In addition, the growing number of pharmaceutical and biotechnology companies with a continuous focus on new drug development also creates opportunities for developing technologically advanced high-content screening systems, thereby fueling the global HCS software and services market.

HCS Software and Services Market: Restraints

Low adoption of HCS products due to their high prices

HCS equipment is offered at a high price due to its advanced cell imaging and analysis capabilities. Confocal microscopes can cost more than $ 200,000. The cell 2000 analyzer system (manufactured by G.E. Healthcare) used in HCS costs approximately U.S. $ 240,000. Flow cytometers range in price from $ 35,000 for a simple cell analyzer to over $ 300,000 for more complex and high-throughput systems. For example, Sysmex-Partec's CyFlow Cube 6 costs about $ 35,000. The Bio-Rad Laboratories S3 cell sorter costs $ 150,000, while the BD FACS Jazz costs about $ 240,000. Academic laboratories find it difficult to buy such equipment due to their limited budget.

On the other hand, pharmaceutical companies need many such systems, which significantly increases the cost of capital. In addition, maintenance costs and some other indirect costs increase the total cost of ownership of this equipment. Therefore, high costs prevent the widespread adoption of HCS equipment in both clinical and research applications, especially in emerging markets.

HCS Software and Services Market: Opportunities

Increasing number of CROs providing HCS services

HCS is used in multiple phases of the drug discovery process, including primary & secondary screening, target identification & validation, and toxicity studies. HCS equipment is expensive and adds to the overall drug development costs of pharmaceutical and bio pharmacy companies. In addition, academic institution budget restrictions limit the acquisition of these devices. The handling of these devices also requires qualified professionals. As a result, many companies and academic institutions prefer to outsource HCS services to CROs. With the growing demand for HCS outsourcing service providers, more and more CROs are offering HCS services. This serves as an opportunity for growth in the global HCS software and services market.

HCS Software and Services Market: Challenges

Lack of knowledgeable and experienced HCS equipment handling personnel to bring up challenges for market growth

Operators of HCS equipment such as flow cytometers and multi-mode readers have relatively complex technologies. Optimal use requires a specialist with extensive knowledge of cell-based assays and handling software & equipment. However, there is a significant shortage of skilled workers in this market. A study by the British Pharmaceutical Industry Association (ABPI) in the United Kingdom reveals a shortage of skilled workers in pharmaceutical companies. Approximately 93 employees from 59 pharmaceutical companies participated in the survey. More than 50% of respondents expressed an urgent need to improve staff availability in 10 departments. Due to the lack of qualified and knowledgeable professionals, companies tend to prefer traditional screening methods to cell-based assays. This poses significant challenges to the growth of the global market.

HCS Software and Services: Segmentation

The global HCS software and services market is segregated on the basis of type, application, and region.

By type the market is divided into the bio, educational institutions, government organizations, and others. Among these, the bio segment dominates the market during the forecast period due to this software is commonly used by pharmaceutical companies, biotechnology companies, academic institutions, and government agencies. Moreover, bio software is typically used for primary & secondary screening, target identification & validation, image analysis, compound profiling, data management, and more, which is anticipated to spur market expansion in the coming years.

The market, by application, is divided by compound profiling, primary & secondary screening, target identification and validation. Over the forecast period, the primary & secondary screening market is expected to develop at the fastest rate owing to recent advances in this area that have significantly enhanced the capabilities of these technologies by increasing the accessibility of imaging tools at an affordable price. Over the forecast period, the compound profiling segment is expected to develop at the fastest rate owing to the increasing demand for efficient drug discovery and development processes. Furthermore, the capabilities of the HCS platform for processing high content data make the HCS platform the preferred choice for researchers considering complex profiling. In addition, these platforms can be used to reduce test costs and increase throughput.

Recent Developments

- In October 2020, CytoSMART Technologies announced the launch of a new advanced automated live cell imaging system designed for long-term experiments, large-scale laboratory studies, and comparative studies.

- In June 2020, Olympus launched a new cell imaging system, the SciLog SciPure FD system, which enables rapid and more quantitative results to be obtained with high-quality multi-color images.

Global HCS Software and Services Market Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | HCS Software and Services Market |

| Market Size in 2021 | USD 1,059.20 Million |

| Market Forecast in 2028 | USD 1,545.52 Million |

| Compound Annual Growth Rate | CAGR of 6.50% |

| Number of Pages | 255 |

| Forecast Units | Value (USD Million), and Volume (Units) |

| Key Companies Covered | Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, Olympus Corporation, PerkinElmer, Inc., Sysmex Corporation, Tecan Group Ltd., Thermo Fisher Scientific, Inc., BioTek Instruments, Thorlabs Inc., and Yokogawa Electric Corporation. |

| Segments Covered | By Source, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latian America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2020 |

| Historical Year | 2016 to 2021 |

| Forecast Year | 2022 - 2028 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

HCS Software and Services Market: Regional Landscape

Increasing advancement in technology and growing focus of key market players are likely to help North America dominate the global market

The presence of key market players in the region and the increasing adoption of advanced imaging technology are key factors that create growth opportunities in the U.S.. One of the key drivers of growth is the surge in U.S. health care costs. CMS Actuary Office predicts that overall healthcare costs in 2019 will be about 4.6% faster than the U.S.'s overall economic growth rate of 4.0% when measured in terms of gross domestic product (GDP) in 2019. In addition, high per capita healthcare costs and favorable health policies have created a favorable environment for introducing advanced cell imaging tools in the United States. The presence of key players such as Becton, Dickinson and Company, Thermo Fisher Scientific and G.E. Healthcare also support this growth in the United States.

HCS Software and Services Market: Competitive Landscape

Some of the main competitors dominating the global HCS software and services market include

- Becton

- Dickinson and Company

- Bio-Rad Laboratories, Inc

- Danaher Corporation

- Olympus Corporation

- PerkinElmer, Inc

- Sysmex Corporation

- Tecan Group Ltd.

- Thermo Fisher Scientific, Inc.

- BioTek Instruments

- Thorlabs Inc

- Yokogawa Electric Corporation

Global HCS software and services market is segmented as follows:

By Type

- Bio

- Educational Institutions

- Government Organizations

- Others

By application

- Compound Profiling

- Primary and Secondary Screening

- Target Identification and Validation

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

The main factors expected to drive the high-content screening market are the need for cost control in drug R & D, increased funding for cell research, and technological advances in HCS solutions that drive the growth of the HCS market. It is expected to be supported during the period.

According to the report, the global s market was worth 1,059.20 (USD million) in 2021 and is predicted to grow to 1,545.52 (USD million) by 2028, with a compound annual growth rate (CAGR) of around 6.50 percent.

North America dominates the HCS software and services market and accounts for the largest market share. High R & D costs, the presence of key pharmaceutical market players, and increased government support are some of the factors that contribute significantly to North America's market share. However, the Asia-Pacific market is expected to achieve the highest growth during the forecast period due to increased drug discovery research, government initiatives, increased concentration of multinational companies in emerging markets, and the development of R & D infrastructure.

Some of the main competitors dominating the global s market include - Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., Danaher Corporation, Olympus Corporation, PerkinElmer, Inc., Sysmex Corporation, Tecan Group Ltd., Thermo Fisher Scientific, Inc., BioTek Instruments, Thorlabs Inc., and Yokogawa Electric Corporation.

Choose License Type

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed