HDPE Pipe Market Size, Share, Analysis, Trends, Growth Report, 2030

HDPE Pipe Market By Application (Irrigation, Oil & Gas, and Water & Waste Management), By Type (PE 100, PE 80, and PE 63), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

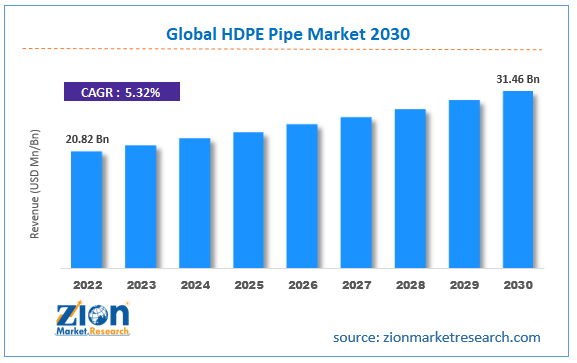

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 20.82 Billion | USD 31.46 Billion | 5.32% | 2022 |

HDPE Pipe Industry Prospective:

The global HDPE pipe market size was worth around USD 20.82 billion in 2022 and is predicted to grow to around USD 31.46 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.32% between 2023 and 2030.

HDPE Pipe Market: Overview

HDPE pipes are made of thermoplastic high-density polyethylene (HDPE). They are flexible pipes typically used for transferring gas and liquid. In recent times, demand for HDPE pipes has grown due to their application in the replacement of steel mains or aging concrete pipeline infrastructure. HDPE pipes exhibit strong molecular bonds due to their high impermeability level making them ideal for applications that require high-pressure pipelines. Across the globe, HDPE pipes have gained popularity due to extensive use in gas or water mains, slurry transfer lines, sewer mains, electrical and communications conduit, rural irrigation, stormwater & drainage pipes, and fire system supply lines. The production of HDPE pipes entails a process called extrusion. It involved heating HDPE material to a semi-molten form and forcing it through a size-determining die to form a tube which is later cooled and cut into desired pipe length. The extrusion process involved in the production is known to deliver superior-quality pipelines consistently.

Key Insights:

- As per the analysis shared by our research analyst, the global HDPE pipe market is estimated to grow annually at a CAGR of around 5.32% over the forecast period (2023-2030)

- In terms of revenue, the global HDPE pipe market size was valued at around USD 20.82 billion in 2022 and is projected to reach USD 31.46 billion, by 2030.

- The HDPE pipe market is projected to grow at a significant rate due to the increasing application in surface water removal systems

- Based on application segmentation, waste & water management was predicted to show maximum market share in the year 2022

- Based on type segmentation, PE 100 was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

HDPE Pipe Market: Growth Drivers

Increasing application in surface water removal systems to drive market growth

The global HDPE pipe market is expected to grow owing to the increasing application of these flexible and chemical-resistance pipes in surface water removal (SWR) drainage systems. It refers to the process of removing and managing stormwater. The ancillary infrastructure for SWR drainage helps in preventing waterlogging and handling extra precipitation during heavy rainfall. The increasing rate of industrialization and urbanization has resulted in severe climate changes and unpredictable weather conditions.

Global warming is one of the most pressing environmental issues affecting countries across the globe. One of the most significant impacts of global warming is on the amount and intensity of rainfall. Every year, the number of excess rainfall, flooring, and waterlogging is increasing at a rapid rate. For instance, as per multiple official records, 2022 was one of the most challenging years for US citizens in terms of climate conditions as the region was victim to frequent and intense storms and floods followed by heart waves and drought. The growing number of SWR drainage projects using HDPE pipes is expected to help the market players gain higher revenue.

Increasing expansion and construction of HDPE pipe-producing facilities to assist in further growth

The increasing rate of investments in the expansion of existing HDPE pipe manufacturing facilities and the construction of new units is expected to help the HDPE pipe market gain greater momentum during the forecast period. This also includes working with new and advanced production technologies for a quicker manufacturing rate without compromising product quality. For instance, in February 2022, Encoma Ltd., a HDPE pipe manufacturing startup with a 63,000 ft2 plant in Canada, invested in installing the first QuickSwitch line KraussMaffei in the North American region. The company has already placed orders for 2 more production lines. The production line consists of a three-layer QuickSwitch line covering the entire manufacturing process.

HDPE Pipe Market: Restraints

Growing demand for alternate materials for pipe may restrict market growth

The HDPE pipe industry growth is likely to be restricted due to the growing demand and application of alternate materials for small and large-scale pipeline structures. Some of the most common substitute materials used by end-user verticals include cross-linked polyethylene, polyvinyl chloride, ductile iron tapes, concrete pipes, chlorinated polyvinyl chloride (PVC), and steel pipes among others. The increasing demand for these materials driven by specific advantages offered by them may cause inhibited demand for HDPE pipe.

HDPE Pipe Market: Opportunities

Excellent performance in agricultural applications by HDPE pipes may create growth opportunities

The HDPE pipe industry will showcase excellent growth opportunities influenced by the increasing application of these pipelines in agricultural settings. The two main factors defining the pipe's performance are its versatility and durability. For instance, HDPE pipes can withstand extreme weather conditions that most agricultural tools are subject to including high temperature, ultraviolet radiation, and chemical exposure. As compared to other pipes such as the ones made with PVC, HDPE material has proven more durable with a longer lifespan. Furthermore, these pipes are resistant to corrosion and do not react harshly to chemical fertilizers or pesticides.

HDPE pipes are not expensive to install or maintain. They can be handled easily and transported across long distances without any loss of product. Downtime and repair prices further go down since HDPE pipes have leak-proof joints that are also resistant to corrosion. The interior surface of high-density polyethylene is extremely smooth allowing water and other liquids to flow smoothly thus reducing energy consumption by pipes and the risk of blockages or clogs. Studies have shown that HDPE pipes are seamlessly compatible with environmentally friendly farming methods due to their longer lifespan and recyclability. The increasing global agriculture industry and the need to develop efficient agriculture-supporting tools could create new expansion possibilities for HDPE pipes.

HDPE Pipe Market: Challenges

Disadvantages associated with HDPE to impact growth in the pipe industry

High-density polyethylene (HDPE) material has several disadvantages associated with it that are expected to cause challenges for the HDPE pipe industry during the forecast period. For instance, HDPE is known to be flammable. The US does not allow the use of HDPE pipes in public infrastructure projects. Moreover, it shows poor weathering along with being sensitive to cracking when applied to high pressure. HDPE does not have high-temperature capability and cannot be composted. It doesn't have biodegradable attributes. Companies operating in the pipe manufacturing industry are focusing on the development of high-performance and environmentally friendly materials that offer comprehensive advantages.

HDPE Pipe Market: Segmentation

The global HDPE pipe market is segmented based on application, type, and region.

Based on application, the global market segments are irrigation, oil & gas, water & waste management. In 2022, the highest growth was witnessed in the water & waste management segment. HDPE pipe durability, versatility, and flexibility have made them highly popular for applications that include the transport of water and other liquids along with managing slurry, sewage, and gas transportation. Furthermore, these pipes can be used on sub-surface, submerged, and ground-level conditions. Although most HDPE pipes are manufactured to last around 50 years, their life expectancy can sometimes reach 100 years if maintained properly.

Based on type, the global HDPE pipe market segments are PE 100, PE 80, and PE 63. The highest revenue-generating segment in 2022 was PE 100 since these variants are lightweight and easy to install. PE 100 is made of the highest grade of high-density polyethylene material and is widely used for gas or water transportation. The demand for the PE 80 segment was considerably high due to applications in the oil & gas industry along with the agricultural sector. HDPE pipes are known to work effortlessly in a temperature range of -2200 F to +1800 F.

HDPE Pipe Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | HDPE Pipe Market |

| Market Size in 2022 | USD 20.82 Billion |

| Market Forecast in 2030 | USD 31.46 Billion |

| Growth Rate | CAGR of 5.32% |

| Number of Pages | 228 |

| Key Companies Covered | ADS (Advanced Drainage Systems), WL Plastics, JM Eagle, Ferguson Waterworks, Dura-Line, Charlotte Pipe and Foundry, Polypipe Group, ISCO Industries, Plastika Kritis, Uponor Infra, Prinsco, IPEX, PEM KOREA, Vinidex, Lane Enterprises, and others. |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

HDPE Pipe Market: Regional Analysis

Asia-Pacific to drive the market growth during the forecast period

The global HDPE pipe market is expected to be dominated by Asia-Pacific during the forecast period driven by extensive production of pipes in countries such as China and India. The main influencing force for regional dominance is the presence of large-scale HDPE-producing facilities in these countries. China has one of the largest chemical and material sectors. Between 2019 and 2021, the country is estimated to have produced around 4 million metric tons of HDPE. China is the most significant exporter of HDPE to other countries.

In addition to this, it is further fueling more investments in the chemicals and materials sectors leading to higher HDPE production rate. The demand for HDPE is significantly high in emerging economies of Asian territory because these pipes offer high cost-efficiency while exhibiting excellent durability that can withstand harsh conditions. The rising applications in the agriculture sector allowing infrastructure development projects cannot be ignored. Europe is expected to grow at a significant pace. The high regional demand for HDPE pipes for infrastructure projects could be the driving factor.

HDPE Pipe Market: Competitive Analysis

The global HDPE pipe market is led by players like:

- ADS (Advanced Drainage Systems)

- WL Plastics

- JM Eagle

- Ferguson Waterworks

- Dura-Line

- Charlotte Pipe and Foundry

- Polypipe Group

- ISCO Industries

- Plastika Kritis

- Uponor Infra

- Prinsco

- IPEX

- PEM KOREA

- Vinidex

- Lane Enterprises

The global HDPE pipe market is segmented as follows:

By Application

- Irrigation

- Oil & Gas

- Water & Waste Management

By Type

- PE 100

- PE 80

- PE 63

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

HDPE pipes are made of thermoplastic high-density polyethylene (HDPE). They are flexible pipes typically used for transferring gas and liquid.

The HDPE pipe market is projected to grow at a significant rate due to the increasing application in surface water removal systems.

According to study, the global HDPE pipe market size was worth around USD 20.82 billion in 2022 and is predicted to grow to around USD 31.46 billion by 2030.

The CAGR value of the HDPE pipe market is expected to be around 5.32% during 2023-2030.

The global HDPE pipe market is expected to be dominated by Asia-Pacific.

The global HDPE pipe market is led by players like ADS (Advanced Drainage Systems), WL Plastics, JM Eagle, Ferguson Waterworks, Dura-Line, Charlotte Pipe and Foundry, Polypipe Group, ISCO Industries, Plastika Kritis, Uponor Infra, Prinsco, IPEX, PEM KOREA, Vinidex, and Lane Enterprises.

The report explores crucial aspects of the HDPE pipe market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed