Healthcare Insurance Market Trend, Share, Growth, Size, and Forecast 2032

Healthcare Insurance Market - by Provider (Private Providers and Public Providers), by Product (Disease Insurance, Medical Insurance, and Income Protection Insurance), by Provider Network (Preferred Provider Organizations (PPOs), Point Of Service (POS), Health Maintenance Organizations (HMOs), and Exclusive Provider Organizations (EPOs)), by Type (Lifetime Coverage and Term Coverage), and by Demographics (Minors, Adults, and Senior Citizens): Global Industry Perspective, Comprehensive Analysis, and Forecast 2024-2032

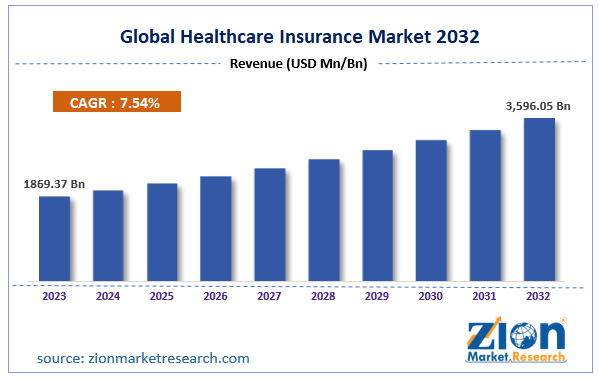

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1869.37 Billion | USD 3,596.05 Billion | 7.54% | 2023 |

Global Healthcare Insurance Market Overview

The global Healthcare Insurance market size accrued earnings worth approximately USD 1869.37 Billion in 2023 and is predicted to gain revenue of about USD 3,596.05 Billion by 2032, is set to record a CAGR of nearly 7.54% over the period from 2024 to 2032.

The report offers a valuation and analysis of the Healthcare Insurance Market on a global as well as regional level. The study offers a comprehensive assessment of the industry competition, limitations, sales estimates, avenues, current & emerging trends, and industry-validated market data.

Health insurance is an insurance policy that provides expense reimbursement for medical treatment. Health insurance reimburses surgical and medical expenses that have aroused from injury or illness and has resulted in hospitalization. Healthcare investments are a significant priority for the growth of the human race. Investments made in healthcare along with designing healthcare insurance policies are directly linked with the interaction between the economy and the healthcare industry. Interaction factor is dependent on the quality of an economic system, the function of the performance, social capital, regulatory frameworks, performance of the healthcare system, and people’s standards of living. Thus, the growing disposable income and GDP of developing nations are likely to propel the healthcare insurance market over the forecast time period.

Healthcare insurance is a kind of insurance coverage that is paid for medical, surgical, prescribed medicine, and dental expenditure incurred by the insurer. Moreover, enforcement of Patient Protection and Affordable Act – a largest healthcare initiative by the U.S. government – in March 2010 has brought a change in healthcare system in the country. The move made by the government was aimed at easing accessibility to healthcare insurance in the U.S. These favorable initiatives taken by the U.S. government is likely to embellish the expansion of healthcare insurance industry across the globe in the near future.

To know more about this report, Request a FREE sample copy

Key Insights Healthcare Insurance Market

Key Market Drivers and Trends:

- Rising Healthcare Costs:

- The escalating cost of medical treatments, hospital stays, and pharmaceuticals is a major driver of health insurance demand.

- Growing Prevalence of Chronic Diseases:

- An increase in chronic conditions like diabetes, cancer, and heart disease is leading to a greater need for comprehensive healthcare coverage.

- Technological Advancements:

- The integration of technology, including telemedicine, AI, and digital platforms, is transforming the insurance industry, improving efficiency and accessibility.

- Increased Awareness of Health and Wellness:

- People are becoming more proactive about their health, leading to a higher demand for preventive care and comprehensive insurance plans.

- Government Initiatives:

- Government policies and regulations aimed at expanding healthcare access and affordability are influencing market growth.

- Aging Population:

- As the world population ages, the demand for health services, and therefore health insurance, increases.

- Increased digital adoption:

- The use of online platforms to purchase, manage, and claim health insurance is increasing.

Market Growth Dynamics

Rise in the aging population prone to chronic ailments and a surge in the per capita income of the consumers will prompt the healthcare insurance market size over the assessment timeframe. Apart from this, prominent inflation in the gross domestic product of emerging economies and unmet medical requirements of the population will steer the market trends. Additionally, huge medical expenditure associated with the hospitalization of patients with chronic is likely to pave a way for the growth of the healthcare insurance industry over the forecast timespan. In addition to this, favorable government healthcare reimbursement policies pertaining to surgeries will open new growth dimensions for the healthcare industry over the assessment timeline from 2024 to 2032.

With inception of new pandemics like COVID-19, Swine Flu, and Bird Flu, it is more likely that the healthcare insurance market will gain traction over the forthcoming years. Apart from this, escalating awareness among the people about the benefits of the healthcare insurance policy will further accelerate the pace of the growth of the healthcare insurance industry over the upcoming years. Nevertheless, inflating costs of healthcare insurance products and strict laws pertaining to claim reimbursement procedure will put brakes on the business growth.

Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Healthcare Insurance Market |

| Market Size in 2023 | USD 1869.37 Billion |

| Market Forecast by 2032 | USD 3,596.05 Billion |

| Compound Annual Growth Rate | CAGR of 7.54% |

| Number of Pages | 210 |

| Forecast Units | Value (USD Trillion), and Volume (Units) |

| Key Companies Covered | AXA, Prudential Financial Inc, Kaiser Foundation Health Plan Inc, Apollo Munich Health Insurance Company Ltd, Allianz, ASSICURAZIONI GENERALI S.P.A, UnitedHealth Group, Berkshire Hathaway Inc, Aetna Inc, China Life Insurance (Group) Company, International Medical Group Inc, AIA Group Limited, Anthem Inc, Japan Post Holding Co Ltd, Aviva, Cigna, Munich Re Group, Express Scripts Holding Company, and Zurich Insurance Group Ltd |

| Segments Covered | By Provider, By Product, By Type, By Provider Network, By Demographics, By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East and Africa (MEA) |

| Countries Covered | North America: U.S and Canada Europe: Germany, Italy, Russia, U.K, Spain, France, Rest of Europe APAC: China, Australia, Japan, India, South Korea, South East Asia, Rest of Asia Pacific Latin America: Brazil, Argentina, Chile The Middle East And Africa: South Africa, GCC, Rest of MEA |

| Base Year | 2023 |

| Historical Year | 2018 - 2023 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, market attractiveness analysis by segments and region, company market share analysis, and COVID-19 impact analysis. |

Healthcare Insurance Market Opportunity

Benefits of Health Insurance Plans Health insurance policies provide policyholders with reimbursement for various medical expenses, including hospitalization, surgeries, and treatments resulting from injuries. A health insurance policy represents an agreement between the policyholder and the insurance company, wherein the insurer commits to covering the costs of future medical issues, and the policyholder agrees to pay the specified premium according to the insurance plan.

Access to top-notch healthcare is a key feature of health insurance policies. A comprehensive insurance policy should offer extensive coverage tailored to the needs of individuals, families, and senior citizens. The increasing benefits and advantages offered by health insurance policies contribute to a growing demand for health insurance among the public.

Healthcare Insurance Market: Challenges

Rising Healthcare Costs:

Premium Increases:

The rising cost of medical care, drugs, and technology gets directly passed on to higher insurance premiums, rendering coverage less accessible to individuals and families.

Cost Containment:

Health insurers find it difficult to keep costs down while offering sufficient coverage, resulting in intricate negotiations with providers and pharmaceutical firms.

Coverage Gaps:

Much as it has been sought to increase coverage, most people, especially in populations that are underprivileged, do not have access to affordable health coverage.

Out-of-Pocket Expenses:

Despite insurance, high copayments, deductibles, and coinsurance place important financial burdens on individuals, discouraging them from obtaining care.

Changing Regulations:

The healthcare sector is exposed to ongoing regulation changes, and insurers need to modify their policies and business, which can be expensive and time-consuming.

Compliance:

Keeping up with numerous regulations, such as data protection and security, contributes to insurance companies' operational burden.

Digital Divide:

Though technology provides the promise of increased efficiency and accessibility, differences in access and digital literacy can pose challenges for some consumers.

Data Security and Privacy:

The growing deployment of digital health records and data creates concerns for security breaches and privacy infringement.

Complexity of Policies:

Health insurance policies may be overly complex and opaque, causing consumers to become confused and distrustful.

Customer Experience:

Enhancing the customer experience, such as streamlining claims processing and delivering clear communication, is key to developing trust and loyalty.

Workforce shortages/burnout:

Particularly in the healthcare provider industry, but also in the insurance industry, workforce shortages and burnout cause issues with delivering proper care, and claims processing.

The global healthcare insurance market is segmented by provider, product, provider network, type, and demographics.

Based on the provider, the market is segmented into private providers and public providers. The private provider segment is likely to grow significantly, owing to less waiting time in hospitals and claim money back on non-medicare health services.

By product, the market is segmented into disease insurance, medical insurance, and income protection insurance.

By provider network, the market is classified into preferred provider organizations (PPOs), point of service (POS), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs). The EPOs segment is expected to grow significantly in the global healthcare insurance market.

By type, the market is segmented into lifetime coverage and term coverage. The demographic segment is classified into minors, adults, and senior citizens. The adult segment holds the largest share in the health insurance market. Rising disease awareness and health concerns is a vital factor responsible for the augmentation of the global healthcare insurance market globally.

Regional Analysis

By geography, the global healthcare insurance market is segmented into Latin America, North America, Asia Pacific, Europe, and the Middle East and Africa. North America held a major share in the healthcare insurance market in 2023 and is projected to continue its regional superiority in the forthcoming years. The growth of this regional market can be attributed to the favorable government regulations and policies for healthcare insurance. Asia Pacific is anticipated to grow at a significant CAGR by 2032, due to favorable government initiatives, increasing disposable incomes, and growing interest displayed by the regional population toward health insurance policies.

North America To Contribute Sizably Towards Market Value By 2032

The expansion of the industry in North America during the assessment period can be credited to value proposition created by the giant players in the countries like the U.S. Additionally, there are behemoth firms in the region and this will account majorly towards the regional market size in the years ahead. Easy access to Medicare in the countries like the U.S. will proliferate the rate of growth of the industry in North America over the upcoming years.

Competitive Landscape

Key players profiled in the study include

- AXA

- Prudential Financial Inc

- Kaiser Foundation Health Plan Inc

- Apollo Munich Health Insurance Company Ltd

- Allianz

- ASSICURAZIONI GENERALI S.P.A

- UnitedHealth Group

- Berkshire Hathaway Inc

- Aetna Inc

- China Life Insurance (Group) Company

- International Medical Group Inc

- AIA Group Limited

- Anthem Inc

- Japan Post Holding Co Ltd

- Aviva

- Cigna

- Munich Re Group

- Express Scripts Holding Company

- and Zurich Insurance Group Ltd

The report segments the global healthcare insurance market as follows:

By Provider Segment Analysis

- Private Providers

- Public Providers

By Product Segment Analysis

- Disease Insurance

- Medical Insurance

- Income Protection Insurance

By Type Segment Analysis

- Lifetime Coverage

- Term Coverage

By Provider Network Segment Analysis

- Preferred Provider Organizations (PPOs)

- Point Of Service (POS)

- Health Maintenance Organizations (HMOs)

- Exclusive Provider Organizations (EPOs)

By Demographics Segment Analysis

- Minors

- Adults

- Senior Citizens

By Region

-

North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Rise in the aging population prone to chronic ailments and surge in the per capita income of the consumers will prompt the healthcare insurance market size over the assessment timeframe. Apart from this, a prominent inflation in the gross domestic product of the emerging economies and unmet medical requirements of the population will steer the market trends. Additionally, huge medical expenditure associated with hospitalization of patients with chronic is likely to pave a way for the growth of healthcare insurance industry over the forecast timespan. In addition to this, favorable government reimbursement policies pertaining to surgeries will open new growth dimensions for healthcare industry over the assessment timeline ranging from 2024 to 2032. With inception of new pandemics like COVID-19, Swine Flu, and Bird Flu, it is more likely that the healthcare insurance market will gain traction over the forthcoming years.

According to Zion market research report, the global Healthcare Insurance market size accrued earnings worth approximately USD 1869.37 Billion in 2023 and is predicted to gain revenue of about USD 3,596.05 Billion by 2032, is set to record a CAGR of nearly 7.54% over the period from 2024 to 2032.

North America is likely to make noteworthy contributions towards overall market revenue. The regional market growth over 2024-2032 can be attributed to value proposition created by the giant players in the countries like the U.S. Additionally, there are behemoth firms in the region and this will account majorly towards the regional market size in the years ahead. Easy access to Medicare in the countries like the U.S. will proliferate the rate of growth of the industry in North America over the upcoming years.

The key players profiled in the report include AXA, Prudential Financial, Inc., Kaiser Foundation Health Plan, Inc., Apollo Munich Health Insurance Company Ltd., Allianz, ASSICURAZIONI GENERALI S.P.A., UnitedHealth Group, Berkshire Hathaway Inc., Aetna Inc., China Life Insurance (Group) Company, International Medical Group Inc., AIA Group Limited, Anthem, Inc., Japan Post Holding Co., Ltd., Aviva, Cigna, Munich Re Group, Express Scripts Holding Company, and Zurich Insurance Group Ltd.

By Provider (Private Providers And Public Providers), By Product (Disease Insurance, Medical Insurance, And Income Protection Insurance), By Provider Network (Preferred Provider Organizations (PPOs), Point Of Service (POS), Health Maintenance Organizations (HMOs), And Exclusive Provider Organizations (EPOs)), By Type (Lifetime Coverage And Term Coverage), And By Demographics (Minors, Adults, And Senior Citizens)

Healthcare Insurance Market will set to record a CAGR of nearly 7.9% over 2024 - 2032

Choose License Type

List of Contents

Global Market OverviewTo know more about this report, Request a FREE sample copyKey Insights MarketMarket Growth DynamicsReport ScopeMarket OpportunityChallengesRegional AnalysisCompetitive LandscapeThe report segments the global healthcare insurance market as follows:By RegionNorth AmericaRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed