Global High Barrier Packaging Films Market Size, Share, Analysis, Trends, Growth, 2032

High Barrier Packaging Films Market By Material (Polyethylene, BOPET, Polypropylene, and Polyvinyl Chloride), By Product (Bags & Pouches, Trays Lidding Films, Wrapping Films, Blister Packs, and Others), By Application (Food & Beverages, Pharmaceuticals, Personal Care & Cosmetics, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

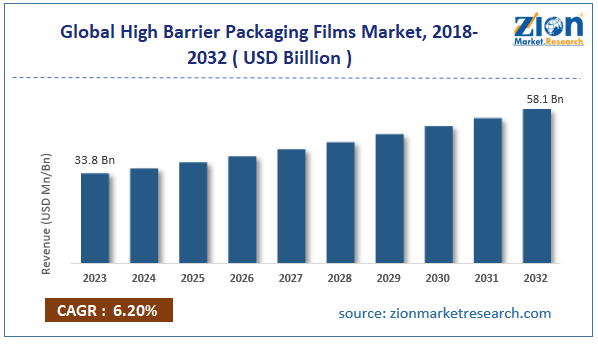

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 33.8 Billion | USD 58.1 Billion | 6.2% | 2023 |

High Barrier Packaging Films Industry Perspective:

The global high barrier packaging films market size was worth around USD 33.8 billion in 2023 and is predicted to grow to around USD 58.1 billion by 2032 with a compound annual growth rate (CAGR) of roughly 6.2% between 2024 and 2032.

High Barrier Packaging Films Market: Overview

High-barrier packaging films are made of specialized polymers that offer outstanding protection against environmental variables such as light, air, and moisture. These variables weaken the integrity of products. These films are used in several industries, such as pharmaceuticals, electronics, and others. These films are broadly utilized to increase safety, preserve product integrity, and prolong shelf life. They are usually made of materials like laminated, co-extruded, or metalized films that effectively block environmental contaminants.

The high barrier packaging market is influenced by several variables, including the growing pharmaceutical industry, increasing utilization to increase the shelf life of products, increasing consumer electronics industry, and others. However, the presence of alternatives might hamper the market over the analysis period.

Key Insights

- As per the analysis shared by our research analyst, the global high barrier packaging films market is estimated to grow annually at a CAGR of around 6.2% over the forecast period (2024-2032).

- In terms of revenue, the global high barrier packaging films market size was valued at around USD 33.8 billion in 2023 and is projected to reach USD 58.1 billion by 2032.

- The growing demand from the e-commerce industry is expected to drive the high barrier packaging films market over the forecast period.

- Based on the material, the polyethylene segment is expected to hold the largest market share over the forecast period.

- Based on the product, the bags & pouches segment is expected to dominate the market over the forecast period.

- Based on the application, the pharmaceuticals segment is expected to capture the largest market share during the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

High Barrier Packaging Films Market: Growth Drivers

Technological advancement drives market growth

Technological developments have greatly expanded the market for high barrier packaging films. The mechanical strength and barrier qualities of these films have been greatly enhanced by material innovations, including the development of multilayer films and the use of nanotechnology. They are thus working in a variety of industries, including food packaging and industrial and packaging technologies.

Growing environmental issues have also spurred the creation of recyclable and biodegradable barrier films, which are more popular among customers and companies who care about the surroundings. Thus, the growing technical advancements and product innovation drive the high barrier packaging films market over the forecast period.

High Barrier Packaging Films Market: Restraints

The presence of alternatives hinders market growth

Numerous alternative packaging options compete with the high barrier packaging films industry, which could affect its expansion and market share. Because they are recyclable and have excellent barrier qualities, glass and metal packaging—such as aluminum cans and glass jars—continue to be utilized in food, beverage, and pharmaceutical packaging. Glass and metal are substitutes in some situations, particularly when it comes to long-term storage, although they are not always a straight equivalent.

The usage of laminated pouches with specific high-barrier coatings (such as aluminum foils) in some alternative flexible packaging options may also provide competitive cost and customization. These might offer comparable protection with better choices for recycling, particularly when monomaterial laminates are used. Therefore, the presence of alternatives hinders the high barrier packaging films market over the forecast period.

High Barrier Packaging Films Market: Opportunities

Rising product launch by key market players offers a lucrative opportunity for market growth

The rising innovative product launch by the key market player is expected to offer a lucrative opportunity for high barrier packaging film market growth. For instance, in March 2024, India-based TOPPAN Speciality Films Private Limited (TSF) and TOPPAN Inc., a TOPPAN Group firm and a fully owned subsidiary of TOPPAN Holdings Inc., have created GL-SP, a barrier film that uses biaxially oriented polypropylene (BOPP) as the substrate.

Production and sales of the film are about to begin. The TOPPAN Group's GL BARRIER1 series of transparent vapor-deposited barrier films, which hold a dominant market share worldwide, now includes GL-SP as a new product in its line of sustainable packaging. With an emphasis on markets in the Americas, Europe, India, and the ASEAN area, TOPPAN and TSF will begin selling GL-SP for the packaging of dry products.

High Barrier Packaging Films Market: Challenges

Fluctuation in raw material prices poses a major challenge to market expansion

Petroleum-based products are the source of polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), which are frequently utilized in high-barrier films. The cost of making these films may go up if the price of crude oil changes. The cost of producing barrier films increases along with the price of petrochemical goods, which could result in higher package costs overall as a result of increased crude oil prices.

Additionally, the specialist polymers needed for their barrier qualities, EVOH (Ethylene Vinyl Alcohol) and PVDC (Polyvinylidene Chloride), are more expensive to produce and have a limited supply. Price hikes for barrier film may be a direct consequence of changes in the cost of these specialist materials brought on by increases in demand or shortages of raw materials. Thus, the fluctuation in raw material prices poses a major challenge for the high barrier packaging films market over the projected period.

Request Free Sample

Request Free Sample

High Barrier Packaging Films Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High Barrier Packaging Films Market |

| Market Size in 2023 | USD 33.8 Billion |

| Market Forecast in 2032 | USD 58.1 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 218 |

| Key Companies Covered | Amcor plc, Sealed Air, Huhtamaki, Klockner Pentaplast, Mondi, Constantia Flexibles, Berry Global Inc, Coveris, Sonoco Product Company, Wipak, Uflex Limited, Printpack, Jindal Poly Films, Cosmo Films Ltd., and others. |

| Segments Covered | By Material, By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

High Barrier Packaging Films Market: Segmentation

The global high barrier packaging films industry is segmented based on material, product, application, and region.

Based on the material, the global high barrier packaging films market is bifurcated into polyethylene, BOPET, polypropylene, and polyvinyl chloride. The polyethylene segment is expected to hold the largest market share over the forecast period. Polyethylene's superior moisture barrier qualities, cost-effectiveness, and flexibility make it a popular material. It is frequently used in applications like food packaging requiring moisture resistance.

Based on the product, the global high barrier packaging films industry is segmented into bags & pouches, trays, lidding films, wrapping films, blister packs, and others. The bags & pouches segment is expected to dominate the market over the forecast period. Flexible packaging, such as bags and pouches, is becoming more and more popular since it is affordable, lightweight, and space-efficient. Laminated bags and stand-up pouches are instances of high barrier films that are becoming more and more popular for preserving consumer items, food, beverages, and medications. These packaging options are more appealing to a range of businesses since they are adaptable, manageable, and customized.

Based on the application, the global high barrier packaging films market is segmented into food & beverages, pharmaceuticals, personal care & cosmetics, and others. The pharmaceuticals segment is expected to capture the largest market share during the forecast period. The pharmaceutical industry's shift to unit dose packaging is driving up demand for high-barrier films. Unit dose packaging provides simplicity, dosage management, and safety to end users. High-barrier films are suitable for storing tablets, capsules, and powders, ensuring that each dose is effective until used.

High Barrier Packaging Films Market: Regional Analysis

North America dominates the market over the projected period

North America is expected to dominate the global high barrier packaging films market during the forecast period. The regional market is fueled by increased demand for packaged food and beverages, pharmaceuticals, and personal care items. The region's excellent manufacturing skills and technological advances help to drive the development and adoption of high-performance packaging solutions.

Furthermore, strict rules governing food safety and pharmaceutical packaging standards increase the demand for high-barrier films. Environmental concerns and the demand for sustainable packaging solutions also affect market dynamics, resulting in increased investment in recyclable and biodegradable films.

High Barrier Packaging Films Market: Competitive Analysis

The global high barrier packaging films market is dominated by players like:

- Amcor plc

- Sealed Air

- Huhtamaki

- Klockner Pentaplast

- Mondi

- Constantia Flexibles

- Berry Global Inc

- Coveris

- Sonoco Product Company

- Wipak

- Uflex Limited

- Printpack

- Jindal Poly Films

- Cosmo Films Ltd.

The global high barrier packaging films market is segmented as follows:

By Material

- Polyethylene

- BOPET

- Polypropylene

- Polyvinyl Chloride

By Product

- Bags & Pouches

- Trays Lidding Films

- Wrapping Films

- Blister Packs

- Others

By Application

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

High barrier packaging films are made of specialized polymers that offer outstanding protection against environmental variables such as light, air, and moisture. These variables weaken the integrity of products.

The high barrier packaging films market is driven by increasing demand for extended shelf life, rising demand for sustainable packaging, growth in pharmaceutical & healthcare sectors, technological advancements in packaging materials, and others.

According to the report, the global high barrier packaging films market size was worth around USD 33.8 billion in 2023 and is predicted to grow to around USD 58.1 billion by 2032.

The global high barrier packaging films market is expected to grow at a CAGR of 6.2% during the forecast period.

The global high barrier packaging films market growth is expected to be driven by North America. It is currently the world’s highest revenue-generating market due to the rising investment in advanced technology and the expanding e-commerce sector.

The global high barrier packaging films market is dominated by players like Amcor plc, Sealed Air, Huhtamaki, Klockner Pentaplast, Mondi, Constantia Flexibles, Berry Global inc, Coveris, Sonoco product company, Wipak, Uflex limited, Printpack, Jindal poly films and Cosmo films ltd. among others.

The market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed