High Fructose Corn Syrup Market Size, Share, Trends, Growth 2034

High fructose corn syrup (HFCS) Market By Type (HFCS 42, HFCS 55, Others), By Distribution channel (Offline, Online), By Application (Food and Beverages, Pharmaceuticals, Animal Feed, Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

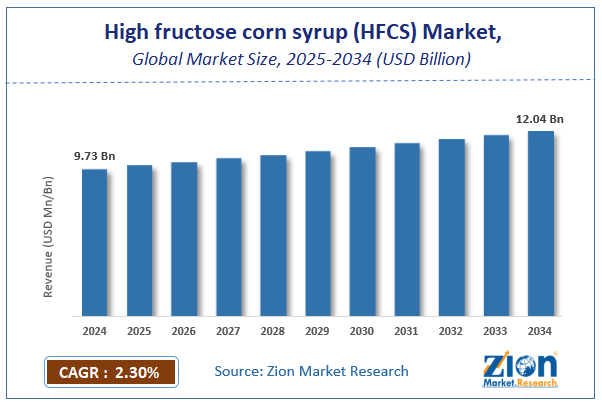

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.73 Billion | USD 12.04 Billion | 2.3% | 2024 |

High fructose corn syrup (HFCS) Industry Prospective:

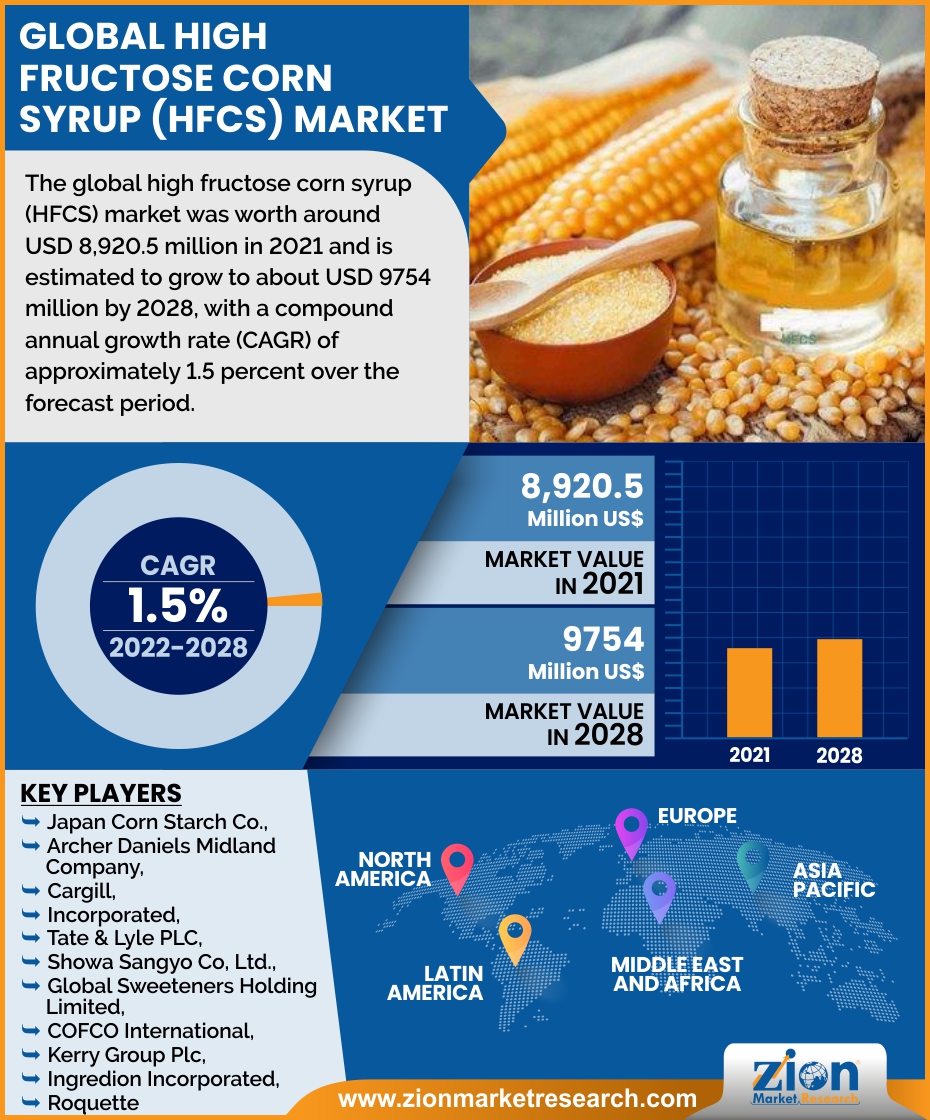

The global high fructose corn syrup (HFCS) market Size was worth around USD 9.73 Billion in 2024 and is estimated to grow to about USD 12.04 Billion by 2034, with a compound annual growth rate 2.3% between 2025 and 2034. The report analyzes the high fructose corn syrup (HFCS) market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the high fructose corn syrup (HFCS) market.

High fructose corn syrup (HFCS) Market: Overview

High fructose corn syrup (HFCS) is made by using a process called wet milling of corn. It is regarded as a natural sweetener and is used across the world in multiple food and beverage applications. It contains around 40 to 55 percent of fructose and is similar to many sweeteners.

High fructose corn syrup (HFCS) is majorly used in acidic beverages, as it holds composition very well in these mediums. The competitive pricing of high fructose corn syrup (HFCS) as compared to other sweeteners in this category is what majorly drives the high fructose corn syrup (HFCS) market potential over the forecast period.

However, increasing health and fitness trends are expected to majorly restrain the use of high fructose corn syrup (HFCS) in the long run.

Key Insights

- As per the analysis shared by our research analyst, the global high fructose corn syrup (HFCS) market is estimated to grow annually at a CAGR of around 2.3% over the forecast period (2025-2034).

- Regarding revenue, the global high fructose corn syrup (HFCS) market size was valued at around USD 9.73 Billion in 2024 and is projected to reach USD 12.04 Billion by 2034.

- The high fructose corn syrup (HFCS) market is projected to grow at a significant rate due to increasing demand for convenience and processed foods, coupled with HFCS's cost-effectiveness and functional benefits in those products.

- Based on Type, the HFCS 42 segment is expected to lead the global market.

- On the basis of Distribution channel, the Offline segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Food and Beverages segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

High fructose corn syrup (HFCS) Market: Growth Drivers

Competitive Pricing to Boost Demand for High fructose corn syrup (HFCS)

High fructose corn syrup (HFCS) is priced competitively and this is what majorly boosts its adoption despite other drawbacks. Food and beverage manufacturers adopt the use of high fructose corn syrup (HFCS) in order to cut costs and boost profitability while still being able to claim they used a natural sweetener is what will drive the high fructose corn syrup (HFCS) market potential over the forecast period.

High fructose corn syrup (HFCS) Market: Restraints

Increasing health and fitness awareness to restrain the market growth

High fructose corn syrup (HFCS) is sweet and is not exactly a healthy sweetener in the eyes of multiple consumers and since the focus on health and calorie intake has increased substantially over the past few years this will restrain the high fructose corn syrup (HFCS) market growth over the forecast period.

High fructose corn syrup (HFCS) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | High fructose corn syrup (HFCS) Market |

| Market Size in 2024 | USD 9.73 Billion |

| Market Forecast in 2034 | USD 12.04 Billion |

| Growth Rate | CAGR of 2.3% |

| Number of Pages | 155 |

| Key Companies Covered | Japan Corn Starch Co., Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Showa Sangyo Co, Ltd., Global Sweeteners Holding Limited, COFCO International, Kerry Group Plc, Ingredion Incorporated, Roquette, and others. |

| Segments Covered | By Type, By Distribution channel, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global High fructose corn syrup (HFCS) Market: Segmentation

The global high fructose corn syrup (HFCS) market is segregated based on type, distribution channel, application, and region.

By Distribution channel, the market is divided into online and offline. The offline sales of high fructose corn syrup (HFCS) are expected to have a dominant outlook over the forecast period owing to the rising preference for these channels among end users.

By Application, the high fructose corn syrup (HFCS) market is segmented into Food and Beverages, Pharmaceuticals, Animal Feed, and Others. The food & beverages segment will account for a major market share but is expected to lose some share over the forecast period as the popularity of functional and healthy alternatives increases across the world.

High fructose corn syrup (HFCS) Market: Regional Landscape

North America region leads the global high fructose corn syrup (HFCS) market in terms of revenue and volume share. High use of high fructose corn syrup (HFCS) in packaged foods and assorted foods is expected to be the major trend driving growth in the North American region over the forecast period. High fructose corn syrup (HFCS) manufacturers are also expected to see lucrative opportunities from the nation of Japan owing to the rising use of high fructose corn syrup (HFCS) in food and beverages manufactured in these regions. High usage of high fructose corn syrup (HFCS) in confectionery, bakery and soft drink manufacturing is also anticipated to boost market potential in the coming years. Increasing use in the production of processed foods and cereals is also expected to boost demand through 2028.

High fructose corn syrup (HFCS) Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the high fructose corn syrup (HFCS) market on a global and regional basis.

Some of the main competitors dominating the global high fructose corn syrup (HFCS) market include -

- Japan Corn Starch Co.

- Archer Daniels Midland Company

- Cargill

- Incorporated

- Tate & Lyle PLC

- Showa Sangyo Co. Ltd.

- Global Sweeteners Holding Limited

- COFCO International

- Kerry Group Plc

- Ingredion Incorporated

- Roquette

The global high fructose corn syrup (HFCS) market is segmented as follows:

By Type

- HFCS 42

- HFCS 55

- Others

By Distribution channel

- Offline

- Online

By Application

- Food and Beverages

- Pharmaceuticals

- Animal Feed

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

High Fructose Corn Syrup (HFCS) is a sweetener made from corn starch that has been processed to convert some of its glucose into fructose, resulting in a sweeter product. It is commonly used in processed foods and beverages as a cheaper alternative to sugar (sucrose).

The global high fructose corn syrup (HFCS) market is expected to grow due to growing processed food consumption, increasing demand for sweeteners in the food and beverage industry, cost-effectiveness compared to sugar, and expanding applications in bakery, dairy, and soft drinks.

According to a study, the global high fructose corn syrup (HFCS) market size was worth around USD 9.73 Billion in 2024 and is expected to reach USD 12.04 Billion by 2034.

The global high fructose corn syrup (HFCS) market is expected to grow at a CAGR of 2.3% during the forecast period.

North America is expected to dominate the high fructose corn syrup (HFCS) market over the forecast period.

Leading players in the global high fructose corn syrup (HFCS) market include Japan Corn Starch Co., Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, Showa Sangyo Co, Ltd., Global Sweeteners Holding Limited, COFCO International, Kerry Group Plc, Ingredion Incorporated, Roquette, among others.

The report explores crucial aspects of the high fructose corn syrup (HFCS) market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed