Home Elevator Market Size, Share, Trends, Growth 2030

Home Elevator Market By Door Systems (Manual and Automatic), By Application (Freight and Passengers), By Type (Pneumatic, Hydraulic, Traction, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

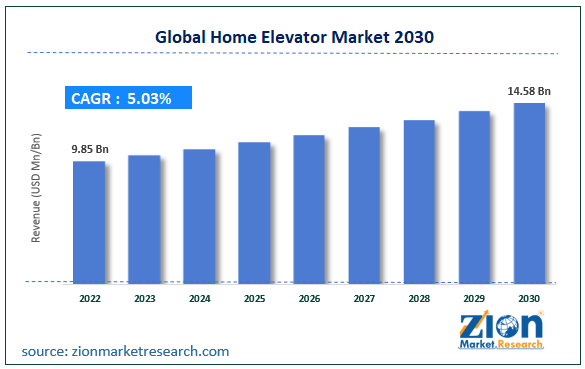

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 9.85 Billion | USD 14.58 Billion | 5.03% | 2022 |

Home Elevator Industry Prospective:

The global home elevator market size was worth around USD 9.85 billion in 2022 and is predicted to grow to around USD 14.58 billion by 2030 with a compound annual growth rate (CAGR) of roughly 5.03% between 2023 and 2030.

Home Elevator Market: Overview

Home elevators are vertically transporting machines designed to be used in a residential or home setting. Home elevators should not be confused with home lifts. Although both the machines perform the same function, there is a significant difference between the two in terms of several factors including size and weight carrying capacity. Home elevators are larger than home lifts and can carry more weight. Furthermore, they are designed keeping in view multiple factors. For instance, while the primary goal is to transport people or objects from one floor to another, home elevators have to be aesthetically pleasing as well. They are available in various types such as hydraulic, pneumatic, traction, and others. Several companies are currently operating in the market delivering results as per client expectations by designing home elevators that not only serve the purpose but also fit in the overall residential structure. The rising research and innovation in terms of home elevator technology and the growing integration of advanced systems may help in delivering promising results during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global home elevator market is estimated to grow annually at a CAGR of around 5.03% over the forecast period (2023-2030)

- In terms of revenue, the global home elevator market size was valued at around USD 9.85 billion in 2022 and is projected to reach USD 14.58 billion, by 2030.

- The home elevator market is projected to grow at a significant rate due to the rising number of 2 or more storey residential houses

- Based on door systems segmentation, automatic was predicted to show maximum market share in the year 2022

- Based on type segmentation, traction was the leading segment in 2022

- On the basis of region, North America was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Home Elevator Market: Growth Drivers

Rising number of 2 or more storey residential houses to create high demand

The global home elevator market is expected to grow due to the rising number of 2 or more storey homes across the globe. The increasing disposable income and changing preference for the normal population to live in separate homes away from main cities or urban areas has triggered a high construction rate of personally-owned residential homes housing all family members. Factors that are pushing the trend forward include a rising number of earning members in the family along with an increasing rate of home loans, migration of people from city areas to quiet and peaceful living areas, and a surge in home loan or financial assistance sanctions. For instance, India’s home loan market was valued at INR 22 lakh crore in 2022 and is expected to double in the coming 5 years. In homes with more than one floor, people tend to invest in home elevators especially if there is significant movement of people or objects from one floor to another. Home elevators ease the process of movement while improving the overall residential aesthetics.

Increasing geriatric population and people with medical conditions may contribute to higher consumption

The growing number of elderly population and people with medical conditions that restrict mobility are expected to fuel the demand and consumption of home elevators to new heights. As per an October 2022 report by the World Health Organization (WHO), the number of people over 60 years old was higher than children below 5 years in 2020. As per official statistics, WHO predicts between 2015 and 2050, the number of people over 60 years will double from 12% to 22%. In addition to this, there are millions of people affected by serious medical conditions such as cancer, diabetes, musculoskeletal disorders, genetic conditions, and cardiovascular diseases. These conditions are known to reduce or negatively impact mobility among patients requiring them to use external assistance for movement especially vertically. In such situations, home elevators can be highly beneficial since these machines can hold heavy weight including the weight of the patient and wheelchair if needed.

Home Elevator Market: Restraints

High machinery costs may restrict market growth

Home elevators are complex machines. Their production and installation cost is extremely high, which restricts global home elevator market growth. For instance, basic home elevators may cost around 1 million in initial placement. The expense increases gradually as additional maintenance cost burden piles up. These factors make home elevators a luxury product catering to the needs of a niche group of consumers. People with limited income in emerging or economically struggling nations may not have access to such high amounts for investing in home elevators. Furthermore, a large part of the potential consumers prefer using stairs for moving between floors. There are other alternate methods to assist in such transportation such as the installation of slopes for transporting goods or using stair chairs.

Home Elevator Market: Opportunities

New product launches and increased research & development may create expansion possibilities

The home elevator industry size may witness further expansion due to the ongoing research and development activities facilitating the launch of more advanced and premium home elevators as consumer preference continues to evolve. In May 2019, Thyssenkrupp Access, a leading manufacturer of lifts and other accessibility products, announced its plans to launch an affordable range of home elevators in the emerging Indian market thus expanding its presence in the global commercial world. Furthermore, developments such as connecting home elevators with renewable energy sources, employing better technical features, integration with smart home systems, voice-controlled attributes, and remote diagnostics are expected to help the market generate higher growth momentum during the projection period. Companies manufacturing home elevators are working on improving space efficiency by developing elevators that can be accommodated in smaller spaces as the world struggles with reducing land accessibility. For instance, shaft-less elevators, also known as through-floor elevators, are ideal for two-floor homes. They can be retrofitted into existing homes and do not require large areas as compared to traditional home elevators. Companies provide variations in mechanical designs, cab styles, and other installation requirements.

Home Elevator Market: Challenges

Machine safety and competition from home lifts to challenge market growth

The home elevator industry players face challenges owing to the confusion between home lifts and home elevators. While technically, both machines perform the role, there are significant differences between the two vertical transportation machines. More awareness about distinguishing factors will help companies operate without confusion from the consumer's end. Furthermore, the safety of the machines remains a critical point of concern for manufacturers and users. Only high-grade must be used along with advanced machine operating technology to ensure user safety. Any compromise on these aspects can lead to severe accidents.

Home Elevator Market: Segmentation

The global home elevator market is segmented based on door systems, application, type, and region.

Based on door systems, the global market segments are manual and automatic. In 2022, the highest growth was registered in the automatic segment. These machines exhibit automated operations as they work on photoelectric and infrared sensors. These elevators are an essential part of luxury homes. Manufacturers can ensure higher demand by experimenting and offering new features such as advanced control mechanics, automated predictive maintenance, excellent customer service, energy efficiency, and higher security. In 2023, Mumbai, India registered the sale of luxury homes worth more than INR 11,000 crore.

Based on application, the home elevator industry divisions are freight and passengers.

Based on type, the global home elevator market divisions are pneumatics, hydraulic, traction, and others. In 2022, the highest demand was witnessed in the pneumatics segment due to the higher cost and performance efficiency offered by these variants. They are known to consume less energy and make use of ropes & pulleys for vertical movement. Cab traction home elevators perform by counterweighting the weight of the occupants. During the forecast period, the demand for hydraulic systems is expected to rise at a steady pace. Most hydraulic home elevators can carry weight up to 750 lbs reaching up to 1000 lbs.

Home Elevator Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Elevator Market |

| Market Size in 2022 | USD 9.85 Billion |

| Market Forecast in 2030 | USD 14.58 Billion |

| Growth Rate | CAGR of 5.03% |

| Number of Pages | 228 |

| Key Companies Covered | Thyssenkrupp Elevator, Otis Elevator Company, PVE (Pneumatic Vacuum Elevators), Schindler Elevator Corporation, Waupaca Elevator Company, Savaria Corporation, RAM Manufacturing Ltd., KONE Corporation, Garaventa Lift, Stannah Stairlifts, Inclinator Company of America, Bruno Independent Living Aids Inc., Access Elevator and Lifts, Federal Elevator, Cambridge Elevating Inc., and others. |

| Segments Covered | By Door Systems, By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Elevator Market: Regional Analysis

North America to register the highest growth rate during the projected timeline

The global home elevator market is expected to witness the highest growth in North America with the US leading region. One of the primary reasons for higher regional growth is the presence of an extensive luxury home segment in the US. The standard of living in the US is higher with a large part of the population living in standalone homes with multiple storey. As per multiple official reports, New York is home to some of the most luxurious, rarest, and expensive penthouses. The average cost of a Manhattan penthouse is around USD 2621 per square foot. The country is also home to some of the most important manufacturers of home elevators working on deploying advanced systems for improved experience. Other factors such as a rising rate of geriatric population and high per capita income may further drive regional growth. Asia-Pacific is one of the most crucial emerging markets and has gained attention from several home elevator manufacturers and suppliers in recent times. Countries such as Singapore, India, China, South Korea, and Japan are the most essential regional markets.

Home Elevator Market: Competitive Analysis

The global home elevator market is led by players like:

- Thyssenkrupp Elevator

- Otis Elevator Company

- PVE (Pneumatic Vacuum Elevators)

- Schindler Elevator Corporation

- Waupaca Elevator Company

- Savaria Corporation

- RAM Manufacturing Ltd.

- KONE Corporation

- Garaventa Lift

- Stannah Stairlifts

- Inclinator Company of America

- Bruno Independent Living Aids Inc.

- Access Elevator and Lifts

- Federal Elevator

- Cambridge Elevating Inc.

The global home elevator market is segmented as follows:

By Door Systems

- Manual

- Automatic

By Application

- Freight

- Passengers

By Type

- Pneumatic

- Hydraulic

- Traction

- Others

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Home elevators are vertically transporting machines designed to be used in a residential or home setting.

The global home elevator market is expected to grow due to the rising number of 2 or more storey homes across the globe.

According to study, the global home elevator market size was worth around USD 9.85 billion in 2022 and is predicted to grow to around USD 14.58 billion by 2030.

The CAGR value of the home elevator market is expected to be around 5.03% during 2023-2030.

The global home elevator market is expected to witness the highest growth in North America with the US leading region.

The global home elevator market is led by players like Thyssenkrupp Elevator, Otis Elevator Company, PVE (Pneumatic Vacuum Elevators), Schindler Elevator Corporation, Waupaca Elevator Company, Savaria Corporation, RAM Manufacturing Ltd., KONE Corporation, Garaventa Lift, Stannah Stairlifts, Inclinator Company of America, Bruno Independent Living Aids, Inc., Access Elevator and Lifts, Federal Elevator, and Cambridge Elevating, Inc.

The report explores crucial aspects of the home elevator market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed