Home Insurance Market Size, Share, Analysis, Trends, Growth, 2032

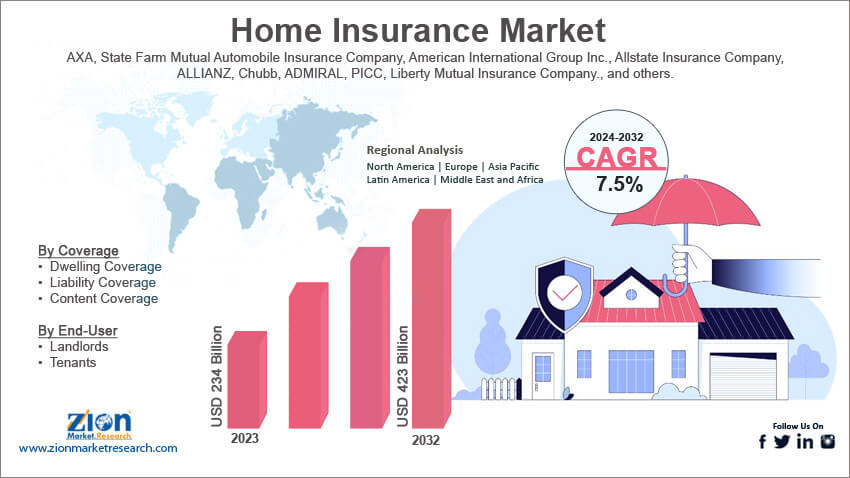

Home Insurance Market By Coverage (Dwelling Coverage, Liability Coverage, and Content Coverage), By End-User (Landlords and Tenants), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

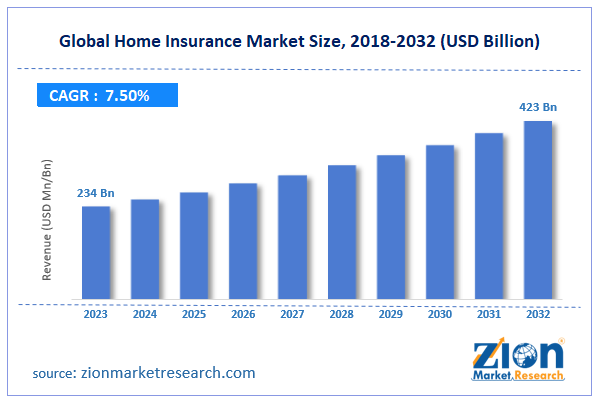

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 234 Billion | USD 423 Billion | 7.5% | 2023 |

Home Insurance Industry Prospective:

The global home insurance market size was evaluated at $234 billion in 2023 and is slated to hit $423 billion by the end of 2032 with a CAGR of nearly 7.5% between 2024 and 2032.

Home Insurance Market: Overview

Home insurance is a kind of property insurance that covers damages and losses of the homeowners against their households and private assets. Reportedly, it is an insurance policy that integrates a spectrum of personal insurance protection and includes damages occurring in one’s household as well as the loss of personal belongings of the house-owner. Apart from this, home insurance policy offers financial protection to homeowners against natural disasters such as earthquakes, landslides, and floods.

Key Insights

- As per the analysis shared by our research analyst, the global home insurance market is projected to expand annually at the annual growth rate of around 7.5% over the forecast timespan (2024-2032)

- In terms of revenue, the global home insurance market size was evaluated at nearly $234 billion in 2023 and is expected to reach $423 billion by 2032.

- The global home insurance market is anticipated to grow rapidly over the forecast timeline owing to an increase in the rate of homeownership.

- In terms of type, the dwelling coverage segment is slated to register the highest CAGR over the forecast period.

- Based on the end-user, the landlords segment is predicted to dominate the segmental space in the upcoming years.

- Region-wise, the Asia-Pacific home insurance industry is projected to register the fastest CAGR during the forecast timespan.

Request Free Sample

Request Free Sample

Home Insurance Market: Growth Factors

A surge in natural calamities and accidents boosts global market trends

An increase in the rate of homeownership is likely to translate into rapid expansion of the global home insurance market in the upcoming years. A prominent increase in the number of collisions and natural disasters owing to global warming has paved the way for the humungous growth of the global market. Favorable reimbursement policies and supportive government schemes can prop up the growth of the market globally. A growing number of thefts, fires, and vandalism witnessed across the globe will scale up the growth of the market globally. A surge in the number of private and public players across the globe can escalate the growth of the market globally.

Home Insurance Market: Restraints

Less know-how about benefits offered by home insurance policies can restrict the expansion of the global industry

Low awareness related to home insurance policies can retard the growth of the global home insurance industry. In some of the emerging economies and developed countries home insurance does not cover everything such as damage caused due to lightning, smoke, explosion, and rail or road constructions.

Home Insurance Market: Opportunities

Supportive government schemes for individuals in emerging economies can open new growth opportunities for the global market

The untapped growth potential of developing countries and the launching of favorable policies for middle-income groups can open new growth avenues for the global home insurance market. Furthermore, home insurance offers protection to the owner from lawsuits. For instance, if an individual is injured in the house of the house owner then the latter is not liable to pay the medical bill expenses to the individual in the countries such as India. Apart from this, low deductible costs of premium in comparison to home repairing costs can further offer new avenues for the growth of the global market.

Home Insurance Market: Challenges

Strict government guidelines associated with home insurance can challenge the global industry expansion by 2032

Many do’s and don’ts in home insurance coverage can pose a huge threat to the growth of the global home insurance industry. Apart from this, home insurance firms also take into consideration the location of residence, age of the resident, and replacement value of the household, thereby posing a huge challenge to the expansion of the industry globally.

Home Insurance Market: Segmentation

The global home insurance market is divided into coverage, end-user, and region.

In type terms, the home insurance market across the globe is bifurcated into dwelling coverage, liability coverage, and content coverage segments. Additionally, the dwelling coverage segment, which gathered nearly 72% of the global market proceeds in 2023, is anticipated to record the fastest annual growth rate in the forecast timeline. The expansion of the segment in the next couple of years can be a result of an increase in residential constructions in emerging economies along with high home values in these regions. Apart from this, dwelling coverage offers homeowners with financial coverage against damage from fire, theft, storms, and vandalism.

Based on the end-user, the global home insurance industry is divided into landlord and tenant segments. Moreover, the landlords segment, which accumulated approximately 57% of the global industry share in 2023, is projected to make lucrative contributions towards the segmental growth in the analysis timeline. The segmental growth in the ensuing years can be credited to a rise in the number of migrants in the cities from rural areas for jobs. Moreover, the rise in the home properties on rents has led to a surge in the purchase of home insurance policies by landlords. Reportedly, home insurance coverage offers liability claims encompassing property damage and body injury suffered by tenants. Moreover, landlords can reduce fiscal losses incurred due to loss or damage to the property.

Home Insurance Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Home Insurance Market |

| Market Size in 2023 | USD 234 Billion |

| Market Forecast in 2032 | USD 423 Billion |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 217 |

| Key Companies Covered | AXA, State Farm Mutual Automobile Insurance Company, American International Group Inc., Allstate Insurance Company, ALLIANZ, Chubb, ADMIRAL, PICC, Liberty Mutual Insurance Company., and others. |

| Segments Covered | By Coverage, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Home Insurance Market: Regional Insights

North America is expected to maintain its leadership quo in the global market in the forecasting years

North America, which contributed approximately 58.9% of the global home insurance market share in 2023, is expected to maintain dominance in the global market in the upcoming years. In addition to this, the regional market expansion in the forthcoming years can be owing to an increase in the incidences of floods, wildfires, hurricanes, and changing fluctuating climatic conditions. A surge in the risks associated with damage to homes along with growing insurance coverage provided by the governments of the U.S. and Canada offering protection to homeowners against property damage & loss of property of households to boost the regional market trends.

Asia-Pacific home insurance industry is anticipated to record the fastest growth rate annually in the forecast timeline. The swift progression of the industry in APAC can be a result of growing urbanization resulting in the demand for home insurance coverage policies by the people in countries such as China and India. A prominent rise in the allocation of funds in the real-estate sector and residential constructions will boost the growth of the industry in Asia-Pacific.

Key Developments

- In the second half of 2022, Amazon introduced a home insurance tool in the UK and signed three major insurers. For the record, the third-party services are likely to be provided by LV General Insurance and Ageas UK Co-operative.

Home Insurance Market: Competitive Space

The global home insurance market profiles key players such as:

- AXA

- State Farm Mutual Automobile Insurance Company

- American International Group Inc.

- Allstate Insurance Company

- ALLIANZ

- Chubb

- ADMIRAL

- PICC

- Liberty Mutual Insurance Company.

The global home insurance market is segmented as follows:

By Coverage

- Dwelling Coverage

- Liability Coverage

- Content Coverage

By End-User

- Landlords

- Tenants

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Home insurance is a kind of property insurance that covers damages and losses of the homeowners against their households and private assets.

The global home insurance market growth over the forecast period can be owing to a prominent increase in the number of collisions and natural disasters owing to global warming.

According to a study, the global home insurance industry size was $234 billion in 2023 and is projected to reach $423 billion by the end of 2032.

The global home insurance market is anticipated to record a CAGR of nearly 7.5% from 2024 to 2032.

Asia-Pacific home insurance industry is set to register the fastest CAGR over the forecasting timeline can be as a result of growing urbanization resulting in the demand for home insurance coverage policies by people in countries such as China and India. A prominent rise in the allocation of funds in the real-estate sector and residential constructions will boost the growth of the industry in Asia-Pacific.

The global home insurance market is led by players such as AXA, State Farm Mutual Automobile Insurance Company, American International Group, Inc., Allstate Insurance Company, ALLIANZ, Chubb, ADMIRAL, PICC, and Liberty Mutual Insurance Company.

The global home insurance market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed