Hospital Outsourcing Market Size, Share, Growth Report 2032

Hospital Outsourcing Market By Hospital Size (Small & Medium Hospitals and Large Hospitals), By Service Type (Information Technology Services, Facility Management & Security Services, Clinical Services, Revenue Management Services, Insurance Verification Services, Marketing Services, Transportation Services, Recruitment Services, Catering & Cafeteria Services, Business & Administration Services, Others), By Hospital Type (Public Hospitals and Private Hospitals), By End-User (Clinics, Nursing Homes & Assisted Living, General Medical & Surgical Hospitals, Specialty Hospitals, Emergency & Other Outpatient Care Centers, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

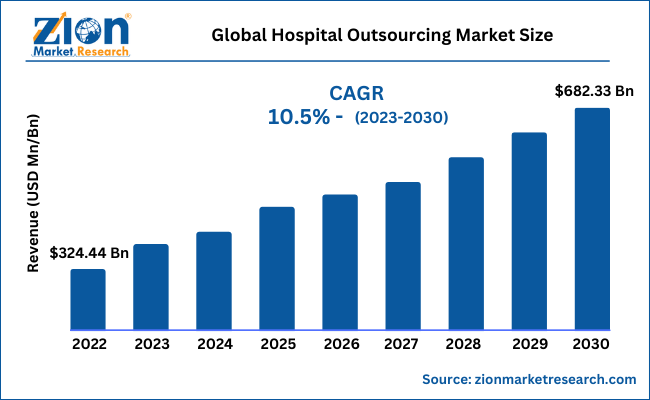

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 324.44 Billion | USD 682.33 Billion | 10.5% | 2022 |

Industry Perspective:

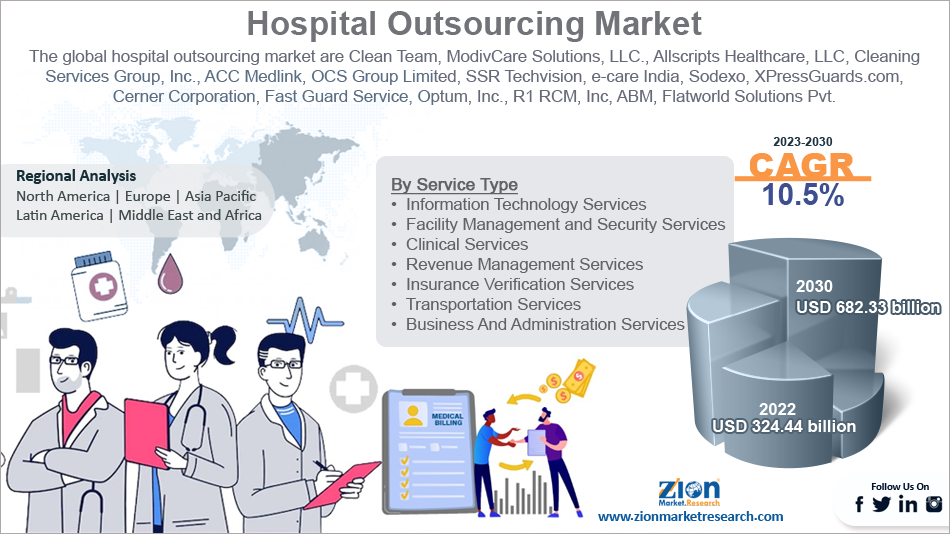

The global hospital outsourcing market size is set for rapid growth over the forecast period. In terms of revenue, the global hospital outsourcing market accounted for USD 324.44 Billion in 2022 and is expected to reach USD 682.33 Billion by 2030, growing at a CAGR of 10.5% during the forecast period.

The market report offers quantitative and qualitative insights into the key drivers, opportunities, constraints, and challenges impacting the global hospital outsourcing market industry.

Hospital Outsourcing Market: Overview

Hospital outsourcing is a business practice where the medical organization hires any third-party providers outside the company to perform the tasks and services of the hospitals. Such outsourcing practices help in cost savings and efficiency gains to get greater competitive advantage. The third-party providers are specialized in specific operations and may provide service more efficiently and less expensively than the healthcare organization. It also helps the staff in focusing on their main tasks and future strategy. Outsourcing hospitals tend to make the enterprise more resilient & versatile and can respond to evolving business demands and challenges while delivering cost savings and changes in the quality of service.

Key Insights

- As per the analysis shared by our research analyst, the global hospital outsourcing market is expected to grow annually at a promising CAGR of around 10.5% during the forecast period 2023-2030.

- In terms of revenue, the global hospital outsourcing market size was valued at around USD 324.44 billion in 2022 and is expected to reach USD 682.33 billion by 2030.

- The global hospital outsourcing market is projected to boost during the coming period owing to the increasing demand for cost-effective healthcare services.

- Based on hospital size, small and medium size hospitals held the largest market share in 2022.

- Based on service type, the clinical services segment held the largest market share in 2022.

- Based on hospital type, the private hospital segment held the dominating market share in 2022.

- Based on region, the North American region held the largest market share in 2022.

Hospital Outsourcing Market: Growth Factors

Rise in geriatric population and surge in demand for affordable healthcare services drive the growth of the industry

One of the major drivers of the global hospital outsourcing market is the increasing demand for cost-effective healthcare services. Outsourcing services such as revenue cycle management, healthcare IT, and patient care services help healthcare providers reduce costs and focus on core functions. Another driver is the growing aging population in developed countries, which is increasing the demand for healthcare services. Furthermore, technological advancements, such as telemedicine and artificial intelligence, are expected to drive growth in the hospital outsourcing market during the forecast period.

Hospital Outsourcing Market: Restraints

Growing concerns over data privacy and security may hinder the growth of the market

One of the significant restraints is the lack of skilled professionals in developing countries, which limits the outsourcing capabilities of healthcare providers. Additionally, concerns over data privacy and security may limit the adoption of outsourcing services in the healthcare industry. Another restraint is the reluctance of healthcare providers to outsource critical functions due to the potential for negative impacts on patient care. These factors impede the growth of the hospital outsourcing market to an extent.

Hospital Outsourcing Market: Opportunities

Surge in demand for revenue cycle management outsourcing services to create ample opportunities for the industry

There are several opportunities in the hospital outsourcing industry such as the increasing demand for healthcare IT outsourcing services. The market for healthcare IT outsourcing services is expected to grow due to the need for healthcare providers to manage and analyze large amounts of patient data. Another opportunity is the increasing demand for revenue cycle management outsourcing services. The revenue cycle management outsourcing market is expected to grow due to the complexity of the billing and reimbursement process, which is difficult for healthcare providers to manage in-house. Moreover, the COVID-19 pandemic has created an opportunity for the hospital outsourcing market, as healthcare providers have increased their outsourcing of non-core functions to focus on patient care.

Hospital Outsourcing Market: Challenges

Presence of a complicated regulatory environment in the healthcare act as a challenge for the market

One of the major challenges is the highly fragmented nature of the hospital outsourcing industry, which makes it difficult for new entrants to gain a foothold. Another challenge is the complex regulatory environment in the healthcare industry, which may vary from state to state and limit the adoption of outsourcing services. Finally, the COVID-19 pandemic has created challenges for the hospital outsourcing market, as disruptions to global supply chains and increased demand for certain services have created logistical and operational challenges for market players.

Hospital Outsourcing Market: Segmentation

The global hospital outsourcing market is segmented based on hospital size, hospital type, service type, end-user, and region.

Based on hospital size, the market is segmented into small & medium hospitals and large hospitals. The small & medium hospital segment held the dominating market share in 2022 and is further predicted to grow rapidly at a significant CAGR during the forecast period. These hospitals typically have limited resources and expertise, making outsourcing an attractive option to improve operational efficiency and reduce costs. Moreover, outsourcing can enable small and medium-sized hospitals to access specialized expertise and advanced technologies that they may not have the resources to develop in-house.

Additionally, the COVID-19 pandemic has increased the demand for outsourcing services among small and medium-sized hospitals, as they seek to focus on patient care and reduce the burden of administrative functions. Overall, the small and medium hospital segment of the hospital outsourcing market presents significant growth opportunities for service providers, particularly in revenue cycle management and healthcare IT outsourcing.

Based on service type, the market is bifurcated into information technology services, facility management & security services, clinical services, revenue management services, insurance verification services, marketing services, transportation services, recruitment services, catering & cafeteria services, business & administration services, and others. The clinical services segment held the largest market share in 2022 and is further predicted to grow at a remarkable CAGR during the forecast period. The clinical services segment of the hospital outsourcing market is expected to experience significant growth due to increasing demand for specialized medical expertise and advancements in medical technology. Clinical services outsourcing includes diagnostic testing, imaging services, and medical treatment services, among others.

Outsourcing these services can provide healthcare providers with access to specialized expertise and technologies, reducing the need for expensive equipment and personnel. Additionally, outsourcing can enable healthcare providers to offer a wider range of clinical services to patients, improving the quality of patient care. The COVID-19 pandemic has also increased the demand for clinical services outsourcing, particularly in telemedicine and remote patient monitoring. Overall, the clinical services segment of the hospital outsourcing market presents significant growth opportunities for service providers with specialized clinical expertise and advanced technologies.

Based on hospital type, the market is segmented into public hospitals and private hospitals. The private hospital segment held the largest market share in 2022 and is further predicted to grow at a notable CAGR during the forecast period. The private hospital segment of the hospital outsourcing market is expected to experience significant growth due to the increasing trend towards the privatization of healthcare services globally. Private hospitals typically have greater financial resources and are more open to outsourcing non-core functions to specialized service providers. Moreover, private hospitals have a greater focus on delivering high-quality medical care to their patients, which outsourcing can help achieve by reducing costs and improving operational efficiency. Additionally, the COVID-19 pandemic has increased the demand for outsourcing services among private hospitals, as they seek to reduce the burden of administrative functions and focus on patient care.

Based on end-user, the market is bifurcated into clinics, nursing homes and assisted living, general medical and surgical hospitals, specialty hospitals, emergency, and other outpatient care centers. The general medical and surgical hospitals segment held the largest market share in 2022 and is further predicted to grow at an exponential CAGR during the forecast period.

Recent Developments

- In March 2021, Accenture announced the launch of its Intelligent Patient Service Exchange (IPSE), a cloud-based platform that enables healthcare providers to securely share patient data and collaborate on patient care. The platform uses advanced analytics and artificial intelligence to enable real-time communication and data sharing among healthcare providers, improving the quality of patient care and reducing costs.

- In January 2021, Cognizant announced that it had acquired Linium, a healthcare consulting firm that specializes in clinical data management and regulatory compliance. The acquisition will enable Cognizant to expand its healthcare consulting services and offer a wider range of solutions to healthcare providers. Additionally, Linium's expertise in clinical data management will enable Cognizant to develop more advanced analytics and AI solutions for the healthcare industry.

Hospital Outsourcing Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hospital Outsourcing Market Research Report |

| Market Size in 2022 | USD 324.44 Billion |

| Market Forecast in 2030 | USD 682.33 Billion |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 200 |

| Key Companies Covered | Clean Team, ModivCare Solutions, LLC., Allscripts Healthcare, LLC, Cleaning Services Group, Inc., ACC Medlink, OCS Group Limited, SSR Techvision, e-care India, Sodexo, XPressGuards.com, Cerner Corporation, Fast Guard Service, Optum, Inc., First Class Valet, R1 RCM, Inc, ABM, Flatworld Solutions Pvt. Ltd., Red Bean Hospitality, Grupa Impel, Apollo Sindoori, Stathakis, Aramark, Healthcare Resource Group, Inc., The Budd Group, 3M, Integrated Medical Transport, AdvantEdge Healthcare Solutions., TRIMEDX, Maxicus, and CIRFOOD, among others. |

| Segments Covered | By Hospital Size, By Service Type, By Hospital Type, By End-User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hospital Outsourcing Market: Regional Analysis

North America region is predicted to dominate the global market during the forecast period

Based on region, the North American region held the largest hospital outsourcing market share in 2022 and is further projected to grow rapidly at a significant CAGR during the forecast period. North America is home to some of the world's largest healthcare markets, with high healthcare spending and increasing demand for cost-effective healthcare solutions. Additionally, the region has a well-established healthcare infrastructure and a large number of hospitals and healthcare providers, making it an attractive market for outsourcing services.

Furthermore, the COVID-19 pandemic has increased the demand for outsourcing services among healthcare providers in North America, as they seek to focus on patient care and reduce the burden of administrative functions. Overall, the hospital outsourcing market in North America presents significant growth opportunities for service providers, particularly in revenue cycle management, healthcare IT outsourcing, and clinical services outsourcing. The increasing adoption of digital technologies and the growing trend toward value-based care models are also expected to drive growth in the market.

Hospital Outsourcing Market: Competitive Players

Some of the key players in the global hospital outsourcing market are:

- Clean Team

- ModivCare Solutions LLC.

- Allscripts Healthcare LLC

- Cleaning Services Group Inc.

- ACC Medlink

- OCS Group Limited

- SSR Techvision

- e-care India

- Sodexo

- XPressGuards.com

- Cerner Corporation

- Fast Guard Service

- Optum Inc.

- First Class Valet

- R1 RCM Inc

- ABM

- Flatworld Solutions Pvt. Ltd.

- Red Bean Hospitality

- Grupa Impel

- Apollo Sindoori

- Stathakis

- Aramark

- Healthcare Resource Group Inc.

- The Budd Group

- 3M

- Integrated Medical Transport

- AdvantEdge Healthcare Solutions.

- TRIMEDX

- Maxicus

- CIRFOOD

- Among Others.

The global hospital outsourcing market is segmented based on:

By Hospital Size

- Small & Medium Hospitals

- Large Hospitals

By Service Type

- Information Technology Services

- Facility Management and Security Services

- Clinical Services

- Revenue Management Services

- Insurance Verification Services

- Marketing Services

- Transportation Services

- Recruitment Services

- Catering And Cafeteria Services

- Business And Administration Services

By Hospital Type

- Public Hospitals

- Private Hospitals

By End-User

- Clinics

- Nursing Homes and Assisted Living

- General Medical and Surgical Hospitals

- Specialty Hospitals

- Emergency and Other Outpatient Care Centers

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Hospital outsourcing is a business practice where the medical organization hires any third-party providers outside the company to perform the tasks and services of the hospitals. Such outsourcing practices help in cost savings and efficiency gains to get a greater competitive advantage. The third-party providers are specialized in specific operations and may provide service more efficiently and less expensively than the healthcare organization. It also helps the staff in focusing on their main tasks and future strategy. Outsourcing hospitals tend to make the enterprise more resilient and versatile and can respond to evolving business demands and challenges while delivering cost savings and changes in the quality of service.

The global hospital outsourcing market is predicted to increase at a CAGR of 10.5% during the forecast period.

The global hospital outsourcing market was worth around USD 324.44 billion in 2022 and is expected to reach USD 682.33 billion by 2030.

The global hospital outsourcing market is being driven by several factors, including rising healthcare costs, increasing demand for quality healthcare services, and the need for cost-effective solutions. Additionally, technological advancements, such as telemedicine and artificial intelligence, are expected to drive growth in the hospital outsourcing market in the coming years.

North America held a notable share in the global hospital outsourcing market in 2022 and is likely to grow the fastest during the forecast period. The growth of the hospital outsourcing market in North America is being driven by factors such as increasing demand for healthcare services, the rising cost of healthcare, and the need for cost-effective solutions. Technological advancements and government initiatives to improve healthcare delivery are also expected to drive growth in the North American hospital outsourcing market.

Some of the major companies operating in the hospital outsourcing market include Clean Team, ModivCare Solutions, LLC., Allscripts Healthcare, LLC, Cleaning Services Group, Inc., ACC Medlink, OCS Group Limited, SSR Techvision, e-care India, Sodexo, XPressGuards.com, Cerner Corporation, Fast Guard Service, Optum, Inc., First Class Valet, R1 RCM, Inc, ABM, Flatworld Solutions Pvt. Ltd., Red Bean Hospitality, Grupa Impel, Apollo Sindoori, Stathakis, Aramark, Healthcare Resource Group, Inc., The Budd Group, 3M, Integrated Medical Transport, AdvantEdge Healthcare Solutions., TRIMEDX, Maxicus, and CIRFOOD, among others.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed