Hydroprocessing Catalysts (HPC) Market Size, Share, Analysis, Trends, Growth, 2032

Hydroprocessing Catalysts (HPC) Market By Product Type (Hydrocracking Catalysts and Hydrotreating Catalysts), By Application (Diesel Hydrotreating, Kerosene/Jet Fuel Hydrotreating, Gasoline Hydrotreating, Residue Upgrading, and Lube Oil Hydrotreating), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

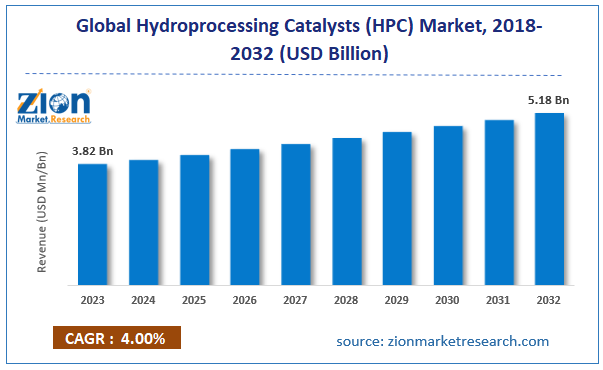

| USD 3.82 Billion | USD 5.18 Billion | 4.00% | 2023 |

Hydroprocessing Catalysts (HPC) Industry Prospective:

The global hydroprocessing catalysts (HPC) market size was worth around USD 3.82 billion in 2023 and is predicted to grow to around USD 5.18 billion by 2032, with a compound annual growth rate (CAGR) of roughly 4.00% between 2024 and 2032.

Hydroprocessing Catalysts (HPC) Market: Overview

Hydroprocessing catalysts (HPC) are specially designed chemicals that allow specific and highly targeted chemical reactions with hydrogen addition. The final goal of HPC is to improve the hydrogen-to-carbon ratio in crude oil and its derivatives. It works by removing excess impurities, such as nitrogen, sulfur, and oxygen, along with some metals from crude oil.

Hydroprocessing is generally divided into two main types: hydrotreating and hydrocracking. The latter is traditionally used for breaking down heavier elements into more usable products such as diesel fuel and gasoline. Hydrotreating catalysts are used for desulphurization and removal of metals or nitrogen. They are known to improve fuel performance and increase stability.

On the other hand, hydrocracking catalysts are widely used for the production of jet fuel and other lubricants. Some of the extended applications of hydroprocessing catalysts include producing renewable fuel and production of petrochemical products.

During the forecast period, the demand for HPCs is likely to grow at a steady rate driven by several factors. For instance, the growing demand for crude oil derivatives worldwide as well as increasing focus on production of renewable fuel will be critical to the industry’s final growth rate. However, global economic volatility and supply chain disruptions may impact the overall growth trajectory of the hydroprocessing catalysts industry.

Key Insights:

- As per the analysis shared by our research analyst, the global hydroprocessing catalysts (HPC) market is estimated to grow annually at a CAGR of around 4.00% over the forecast period (2024-2032)

- In terms of revenue, the global hydroprocessing catalysts (HPC) market size was valued at around USD 3.82 billion in 2023 and is projected to reach USD 5.18 billion by 2032.

- The hydroprocessing catalysts market is projected to grow at a significant rate due to the rising demand for transportation fuel across the globe.

- Based on the product type, the hydrotreating catalysts segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- Based on the application, the diesel hydrotreating segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Hydroprocessing Catalysts (HPC) Market: Growth Drivers

Rising demand for transportation fuel across the globe to drive market demand rate

The global hydroprocessing catalysts (HPC) market is expected to grow due to the rising demand for transportation fuels worldwide. Some of the most commonly used transportation fuels include diesel, petrol, and jet fuel. Although the global automotive industry is showing a steady shift toward electric vehicles, the majority of the operational automotive industry in the current transportation industry is dominated by internal combustion engine-powered vehicles.

For instance, according to official estimates, around 17.9% of India’s passenger vehicle market was dominated by diesel variants in 2023. Similarly, gasoline is one of the most consumed transportation vehicles powering passenger and public transport vehicles.

In addition to this, demand for jet fuel has escalated to newer heights in recent times. The increase in consumption of jet fuel is influenced by growing travel through air mediums along with increasing spending on space exploration projects.

According to the National Aeronautics and Space Administration (NASA), two solid rocket boosters can consume up to 11,000 pounds of fuel per second. In recent times, more investments have been directed toward scaling the production of sustainable aviation fuel (SAF) which can further promote the usage of hydroprocessing catalysts.

In November 2024 Bharat Petroleum Corporation Limited (BPCL) announced its plan to launch India’s first SAF facility by 2027 which is known to emit 80% less greenhouse gasses.

Government mandates to improve fuel quality and reduce environmentally harmful impurities to promote market expansion

The global hydroprocessing catalysts (HPC) market is projected to be positively influenced by the rising number of government initiatives and mandates focusing on improving fuel quality. Governments across the globe have launched new mandates or following international standards to reduce the consumption of impure fuels that are known to be environmentally harmful.

For instance, Europe’s Directive (EU) 2016/802 focuses on marine fuel in the region to have a sulfur content of not more than 3.5% by mass. In addition, the International Maritime Organization (IMO) announced new reductions in sulfur content in fuel in 2020. The changes induced around 70% reduction in sulfur oxide emissions from the shipping industry.

Hydroprocessing Catalysts (HPC) Market: Restraints

Global economic volatility and disruptions in the supply chain impact final growth in the industry

The global hydroprocessing catalysts (HPC) industry is projected to be restricted by the currently prevalent global economic volatility. The international trading relationships between world economies are witnessing a steady change, which can disrupt the supply chain of raw materials required for HPC production as well as final goods. In addition, stringent regulations governing the production and use of hydroprocessing catalysts may further discourage new players from entering the market.

Hydroprocessing Catalysts (HPC) Market: Opportunities

Increasing investments in improving catalyst performance will generate growth opportunities

The global hydroprocessing catalysts (HPC) market is expected to generate more growth opportunities due to the rising investments in research & development (R&D) focused on delivering high-performance catalysts.

For instance, in a recent event, Advanced Refining Technologies (ART) announced the launch of 545DX. It is a novel catalyst made of nickel-molybdenum (NiMo) and is designed to promote the production of ultra-low sulfur diesel (ULSD). According to official reports, the new offering delivers several advantages over currently available catalysts in the market.

In September 2024, Shell Catalysts & Technologies, one of the world’s leading producers of high-performance catalysts, announced a new partnership with Licella. The collaboration will aim to develop global low-carbon biomass-to-biofuel commercial solutions such as sustainable aviation fuel.

In July 2021, Haldor Topsoe, a Danish company specializing in catalysis and process technology, announced renewed investments in building a 5,000-ton-per-year hydroprocessing catalyst plant at the company’s existing facility in Pasadena. The new unit will facilitate meeting demand for renewable diesel and jet fuel production along with traditional refining. The industry for HPC is expected to garner more momentum as more powerful hydroprocessing catalysts get introduced in the market with extensive applications.

Hydroprocessing Catalysts (HPC) Market: Challenges

Emergence of alternative fuel and renewable energy to challenge market expansion

The global industry for Hydroprocessing catalysts (HPC) is expected to be challenged by the growing investment in the development of alternative fuels. In addition, the world is witnessing a shift toward renewable energy such as electric and solar power. Market players may face growth complexities as the demand for alternative and renewable energies continues to grow.

Hydroprocessing Catalysts (HPC) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Hydroprocessing Catalysts (HPC) Market |

| Market Size in 2023 | USD 3.82 Billion |

| Market Forecast in 2032 | USD 5.18 Billion |

| Growth Rate | CAGR of 4.00% |

| Number of Pages | 212 |

| Key Companies Covered | BASF, Shell Catalysts & Technologies, Kraton Polymers, Clariant, Chempure, Johnson Matthey, W.R. Grace & Co., ExxonMobil Catalysts, Albemarle Corporation, Worley, Honeywell UOP, SABIC, Haldor Topsoe, TechnipFMC, and others. |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Hydroprocessing Catalysts (HPC) Market: Segmentation

The global hydroprocessing catalysts (HPC) market is segmented based on product type, application, and region.

Based on the product type, the global market segments are hydrocracking catalysts and hydrotreating catalysts. In 2023, the highest growth was witnessed in the hydrotreating catalysts segment which dominated nearly 77.21% of the final revenue. The process deals with a reduction in the quantity of impurities with the addition of hydrogen in the presence of HPC. One of the main goals of the process is to meet regulatory mandates by reducing harmful chemicals that impact environmental quality. Hydrotreating is used across several applications such as gasoline hydrotreating and jet fuel hydrotreating.

Based on the application, the hydroprocessing catalyst industry segments are diesel hydrotreating, kerosene/jet fuel hydrotreating, gasoline hydrotreating, residue upgrading, and lube oil hydrotreating. In 2023, the highest demand was listed in the diesel hydrotreating segment which held control over 27.5% of the total revenue. The growing consumption of diesel across major industries is promoting the segmental demand rate. During the forecast period, the kerosene/jet fuel hydrotreating industry is expected to create higher revenue due to changing government mandates governing the quality of jet fuel.

Hydroprocessing Catalysts (HPC) Market: Regional Analysis

Asia-Pacific to lead the industry growth rate during the forecast period

The global hydroprocessing catalysts (HPC) market will be led by Asia-Pacific during the forecast period. Countries such as China, India, and Japan will register the highest growth rate according to market research. Asian countries are home to some of the world’s largest number of oil refineries.

In November 2024, official reports emerged suggesting that India was investing in developing the country’s first greenfield refinery in the last 10 years. The new facility is expected to deliver a capacity of 9 MMT in partnership with HPCL Rajasthan Refinery Ltd. (HRRL).

In February 2024, Chevron Lummus Global LLC (CLG), a US-based company providing services in process technologies and catalysts, announced the commencement of the world’s largest white oil hydroprocessing unit built in Shandong Province of China.

North America is another prominent market with the US leading the regional revenue. The US is home to a large number of prominent companies operating in the oil refining industries.

Furthermore, the North American region is influenced by increasing demand for environmentally friendly fuel with low sulfur content. Increasing regional investments in large-scale production of SAF and renewable fuel will further promote North America’s growth rate in the coming years.

Hydroprocessing Catalysts (HPC) Market: Competitive Analysis

The global hydroprocessing catalysts (HPC) market is led by players like:

- BASF

- Shell Catalysts & Technologies

- Kraton Polymers

- Clariant

- Chempure

- Johnson Matthey

- W.R. Grace & Co.

- ExxonMobil Catalysts

- Albemarle Corporation

- Worley

- Honeywell UOP

- SABIC

- Haldor Topsoe

- TechnipFMC

The global hydroprocessing catalysts (HPC) market is segmented as follows:

By Product Type

- Hydrocracking Catalysts

- Hydrotreating Catalysts

By Application

- Diesel Hydrotreating

- Kerosene/Jet Fuel Hydrotreating

- Gasoline Hydrotreating

- Residue Upgrading

- Lube Oil Hydrotreating

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Hydroprocessing catalysts (HPC) are specially designed chemicals that allow specific and highly targeted chemical reactions with hydrogen addition.

The global hydroprocessing catalysts (HPC) market is expected to grow due to the rising demand for transportation fuels worldwide.

According to study, the global hydroprocessing catalysts (HPC) market size was worth around USD 3.82 billion in 2023 and is predicted to grow to around USD 5.18 billion by 2032.

The CAGR value of the hydroprocessing catalysts (HPC) market is expected to be around 4.00% during 2024-2032.

The global hydroprocessing catalysts (HPC) market will be led by Asia-Pacific during the forecast period.

The global hydroprocessing catalysts (HPC) market is led by players like BASF, Shell Catalysts & Technologies, Kraton Polymers, Clariant, Chempure, Johnson Matthey, W.R. Grace & Co., ExxonMobil Catalysts, Albemarle Corporation, Worley, Honeywell UOP, SABIC, Haldor Topsoe and TechnipFMC.

The report explores crucial aspects of the hydroprocessing catalysts (HPC) market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed