India Active Pharmaceutical Ingredient Market Size, Share, Industry Analysis, Trends, Growth, 2032

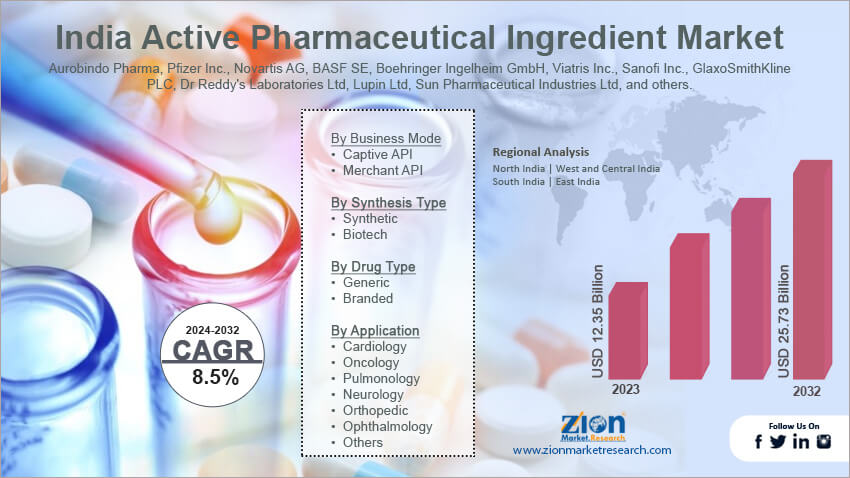

India Active Pharmaceutical Ingredient Market By Business Mode (Captive API and Merchant API), By Synthesis Type (Synthetic and Biotech), By Drug Type (Generic and Branded), By Application (Cardiology, Oncology, Pulmonology, Neurology, Orthopedic, Ophthalmology, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

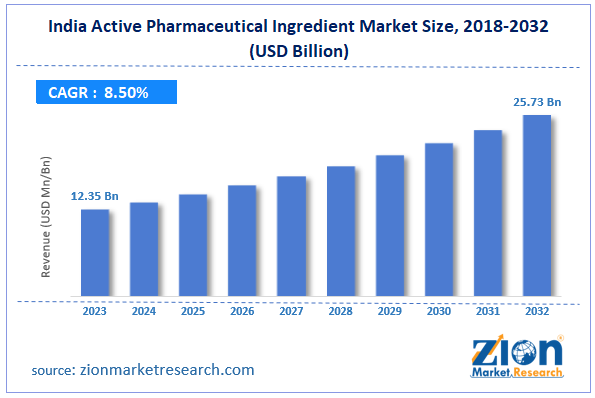

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 12.35 Billion | USD 25.73 Billion | 8.5% | 2023 |

India Active Pharmaceutical Ingredient Industry Prospective:

India's Active Pharmaceutical Ingredient market size was worth around USD 12.35 billion in 2023 and is predicted to grow to around USD 25.73 billion by 2032 with a compound annual growth rate (CAGR) of roughly 8.5% between 2024 and 2032.

India Active Pharmaceutical Ingredient Market: Overview

An over-the-counter (OTC) or prescription medicine's active pharmaceutical ingredient (API) is the part that gives the medication its intended health benefits. An API and its name are the same as a generic version of a prescription medication. Multiple active ingredients, each with the potential to operate differently or treat distinct symptoms, are used in combination therapy. The India API industry is driven by several factors such as the increasing prevalence of chronic disease, growing R&D investment, rising government expenditures, rising pharmaceutical sector, technological advancements, and increasing generic drug demand.

Key Insights

- As per the analysis shared by our research analyst, India's Active Pharmaceutical Ingredient market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2024-2032).

- In terms of revenue, the India Active Pharmaceutical Ingredient market size was valued at around USD 12.35 billion in 2023 and is projected to reach USD 25.73 billion, by 2032.

- The rising prevalence of chronic disease is expected to propel India Active Pharmaceutical Ingredient market growth over the projected period.

- Based on the synthesis type, the synthetic segment is expected to capture the largest market share over the forecast period.

- Based on the drug type, the branded segment is expected to dominate the market during the forecast period.

- Based on the application, the oncology segment is expected to grow at a rapid rate over the projected period.

- Based on the region, West and Central India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Active Pharmaceutical Ingredient Market: Growth Drivers

A change in perspective for the manufacturing process drives market growth

One of the main developments in the India Active Pharmaceutical Ingredient market is a paradigm change in the production process. India has long been recognized for manufacturing generic medications, but there is a noticeable shift toward the production of complex, high-value APIs. The need for complex novel therapies, strict regulatory requirements, and the growing demand for specialized pharmaceuticals worldwide are some of the factors propelling this shift. Additionally, the focus on R&D encourages innovation in green chemical techniques, process optimization, and API synthesis techniques. In addition, the industry's pursuit of higher-value goods is shown in the growing popularity of complex chiral API and peptide synthesis. The industry's tenacity and commitment to staying abreast of worldwide developments in pharmaceutical manufacturing are also demonstrated by this paradigm shift. Thus, during the projected period, it is expected that the market will benefit from the paradigm change from captive manufacturing to contract manufacturing.

India Active Pharmaceutical Ingredient Market: Restraints

A stringent regulatory environment impedes market growth

One major obstacle to India Active Pharmaceutical Ingredient industry expansion is the presence of strict regulations. India's low cost of living has accelerated and expanded the country's manufacturing sector. Although manufacturers are still subject to intense regulatory monitoring, especially in Asia, quality issues still exist, primarily as a result of the region's extensive manufacturing. Because there is a suitable regulatory framework governing the discovery, approval, production, and sale of pharmaceutical products, this country represents a rapidly growing, organized, highly controlled market for pharmaceutical products globally.

India Active Pharmaceutical Ingredient Market: Opportunities

Rising investment offers an attractive opportunity for market growth

The increasing investment by the key market players is expected to offer a lucrative opportunity for India Active Pharmaceutical Ingredient market growth over the projected period. For instance, in June 2022, With an investment of USD 30 million, Piramal Pharma Solutions expanded its operations in Telangana, India, to boost drug development and increase the manufacturing capacity of active pharmaceutical ingredients (APIs). Similarly, in November 2022, to ensure and support domestic API manufacture by raising the production capacity to 15,000 tons yearly, Aurobindo Pharma intended to finish the Penicillin G factory allowed under the PLI scheme by 2024, investing USD 2,000 million in the project.

India Active Pharmaceutical Ingredient Market: Challenges

Complicated production techniques pose a major challenge to market expansion

Numerous active compounds in pharmaceuticals have intricate molecular structures that necessitate multi-step manufacturing processes. It can take some time to thoroughly optimize and validate each phase. Production schedules can also be impacted by the sourcing and availability of raw materials, particularly in the event of supply chain interruptions or poor raw material quality. To guarantee consistent medication safety and efficacy, production processes for active pharmaceutical ingredients must be consistent. Prolonged testing and batch-to-batch modifications might cause output to lag. There could be production capacity constraints in the Indian active pharmaceutical ingredient manufacturing sector, which would mean longer lead times to satisfy market demand.

India Active Pharmaceutical Ingredient Market: Segmentation

India's active pharmaceutical ingredient industry is segmented based on business mode, synthesis type, drug type, application, and region.

Based on the business mode, India's active pharmaceutical ingredient market is bifurcated into Captive API and Merchant API.

Based on the synthesis type, India's active pharmaceutical ingredient industry is segmented into synthetic and biotech. The synthetic segment is expected to capture the largest market share over the forecast period. The strong need for generic medications is a major factor propelling the synthetic API market. Companies that manufacture synthetic and chemical APIs generate significant profits from the development of generic pharmaceuticals using these APIs. For CDMOs, this is opening up a lot of opportunities. There are new growth opportunities in the industry due to the growing trend of outsourcing, which lowers production costs and increases profitability.

Based on the drug type, India's active pharmaceutical ingredient market is segmented into generic and branded. The branded segment is expected to dominate the market during the forecast period. This market is expected to develop due in part to the high prevalence of chronic illness in the nation, rising consumer awareness of branded drugs, and expanding efforts from pharmaceutical companies. In 2021, the ICMR research estimated that the number of cancer patients in India will increase to 26.7 million, while in 2025, it was expected to reach 29.8 million. Given the anticipated increase in the number of cancer patients, it is therefore anticipated that the discovery of effective treatments will quicken. As a result, there will likely be a greater demand for APIs throughout the nation, driving market growth.

Based on the application, India's active pharmaceutical ingredient industry is segmented into cardiology, oncology, pulmonology, neurology, orthopedics, ophthalmology, and others. The oncology segment is expected to grow at a rapid rate over the projected period. Rising cancer caseloads, more knowledge of illnesses and treatments related to the early-onset cancer epidemic, and a rise in product introductions are the reasons driving the market's expansion. The 2020 GLOBOCAN factsheet states that 1,324,413 new cases of cancer were reported in India in 2020, with 678,383 females and 646,030 men. The Indian cancer patient population was predicted by the ICMR 2021 Report to increase from 26.7 million in 2021 to 29.8 million in 2025. Effective medication development is therefore more important given the anticipated rise in the number of cancer patients. Consequently, it is expected that the market will develop as a result of increased API demand.

India Active Pharmaceutical Ingredient Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Active Pharmaceutical Ingredient Market |

| Market Size in 2023 | 12.35 Bn |

| Market Forecast in 2032 | 25.73 Bn |

| Growth Rate | CAGR of 8.5% |

| Number of Pages | 209 |

| Key Companies Covered | Aurobindo Pharma, Pfizer Inc., Novartis AG, BASF SE, Boehringer Ingelheim GmbH, Viatris Inc., Sanofi Inc., GlaxoSmithKline PLC, Dr Reddy's Laboratories Ltd, Lupin Ltd, Sun Pharmaceutical Industries Ltd, and others. |

| Segments Covered | By Business Mode, By Synthesis Type, By Drug Type, By Application, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Active Pharmaceutical Ingredient Market: Region Analysis

West and Central India is expected to dominate the market over the forecast period

West and Central India is expected to dominate the India Active Pharmaceutical Ingredient market over the forecast period. Due to several factors, including its strategic position, highly skilled workforce, and strong infrastructure, the West India area dominates the Indian market for active pharmaceutical ingredients (APIs). Leading the charge are several API manufacturers and research institutions located in Maharashtra, which has well-established pharmaceutical industry clusters in Mumbai and Pune. An appealing location for API production is Gujarat, another important player in the West, which has a robust chemical industry base and a favorable business climate. In addition, the area's closeness to important ports makes import and export activities more efficient and allows for a smooth integration into international pharmaceutical supply chains. In addition, programs such as the Maharashtra Industrial Policy and Gujarat Pharma Vision 2020 have made the pharmaceutical industry more competitive and innovative by offering incentives and assistance for its expansion.

India Active Pharmaceutical Ingredient Market: Competitive Analysis

India's active pharmaceutical ingredient market is dominated by players like:

- Aurobindo Pharma

- Pfizer Inc.

- Novartis AG

- BASF SE

- Boehringer Ingelheim GmbH

- Viatris Inc.

- Sanofi Inc.

- GlaxoSmithKline PLC

- Dr Reddy's Laboratories Ltd

- Lupin Ltd

- Sun Pharmaceutical Industries Ltd

India's active pharmaceutical ingredient market is segmented as follows:

By Business Mode

- Captive API

- Merchant API

By Synthesis Type

- Synthetic

- Biotech

By Drug Type

- Generic

- Branded

By Application

- Cardiology

- Oncology

- Pulmonology

- Neurology

- Orthopedic

- Ophthalmology

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

An over-the-counter (OTC) or prescription medicine's active pharmaceutical ingredient (API) is the part that gives the medication its intended health benefits. An API and its name are the same as a generic version of a prescription medication. Multiple active ingredients, each with the potential to operate differently or treat distinct symptoms, are used in combination therapy.

The India API industry is driven by several factors such as the increasing prevalence of chronic disease, growing R&D investment, rising government expenditures, rising pharmaceutical sector, technological advancements, and increasing generic drug demand.

According to the report, India's active pharmaceutical ingredient market size was worth around USD 12.35 billion in 2023 and is predicted to grow to around USD 25.73 billion by 2032.

India's active pharmaceutical ingredient market is expected to grow at a CAGR of 8.5% during the forecast period.

India's active pharmaceutical ingredient market growth is driven by West and Central India. It is currently the nation's highest revenue-generating market due to the growing pharmaceutical sector.

India's active pharmaceutical ingredient market is dominated by players like Aurobindo Pharma, Pfizer Inc., Novartis AG, BASF SE, Boehringer Ingelheim GmbH, Viatris Inc., Sanofi Inc., GlaxoSmithKline PLC, Dr Reddy's Laboratories Ltd, Lupin Ltd and Sun Pharmaceutical Industries Ltd among others.

India's active pharmaceutical ingredient market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed