India Butter Market Size, Share, Trends, Growth and Forecast 2032

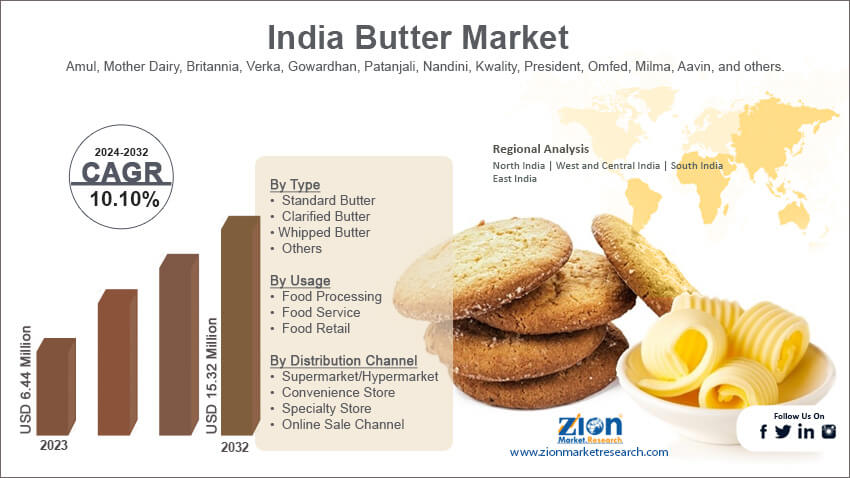

India Butter Market By Type (Standard Butter, Clarified Butter, Whipped Butter, and Others), By Usage (Food Processing, Food Service, and Food Retail), By Distribution Channel (Supermarket/Hypermarket, Convenience Store, Specialty Store, and Online Sale Channel) and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

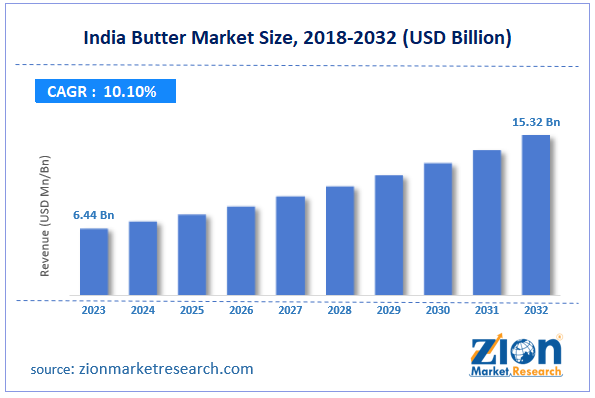

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.44 Million | USD 15.32 Million | 10.10% | 2023 |

India Butter Industry Prospective:

India butter market size was worth around USD 6.44 billion in 2023 and is predicted to grow to around USD 15.32 billion by 2032 with a compound annual growth rate (CAGR) of roughly 10.10% between 2024 and 2032.

India Butter Market: Overview

Butter is a dairy product made from the fat and protein in churned cream. It is an emulsion that is semi-solid and contains about 80% butterfat at room temperature. It can be melted & used as a condiment, spread at room temperature, and used as a culinary fat for pan frying, baking, and other methods. Although cow's milk is used to make butter the most frequently, milk from sheep, goats, buffalo, and yaks can also be used to make butter. Milk or cream needs to be churned to extract the fat globules from the buttermilk. Salt has been used to preserve butter since ancient times, particularly while it is being transported. Even while salt can be preserved to some extent today, its whole supply chain is often refrigerated.

Key Insights

- As per the analysis shared by our research analyst, the India butter market is estimated to grow annually at a CAGR of around 10.10% over the forecast period (2024-2032).

- In terms of revenue, the India butter market size was valued at around USD 6.44 billion in 2023 and is projected to reach USD 15.32 billion, by 2032.

- The rising disposable income is expected to propel the India butter market growth over the projected period.

- Based on the type, the standard butter segment is expected to dominate the market over the forecast period.

- Based on the usage, the food processing segment is expected to capture the largest market share over the forecast period.

- Based on the distribution channel, the online sales channel segment is expected to grow at the fastest rate over the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Butter Market: Growth Drivers

Escalating customer demand for processed foods drives market growth

Dairy fats have become more popular in India as a substitute for their vegetable oil-based counterparts in dairy products. A change in taste preferences and a more positive understanding of the health advantages of dairy fat may be responsible for this tendency. As consumers' discretionary expenditures rise and diets become more globally integrated, it is predicted that emerging countries will consume more dairy products due to an increase in processed food consumption. The rising demand for baked products including cakes, bread, cookies, and biscuits is largely responsible for the increased butter use in the bakery business. Without the use of this ingredient, confectionery production cannot continue. With a wider range of confectionery foods becoming more and more popular, it is expected that butter demand will rise. It is widely used in ready-to-eat and ready-to-cook meals, which are becoming more and more popular due to the surge in convenience food demand. It is projected that the number of innovations and advancements involving the usage of butter will continue to rise in the dairy beverage business in the upcoming years.

India Butter Market: Restraints

Growing popularity of lactose-free and plant-based foods impedes market growth

The rising awareness among customers regarding animal welfare practices is one factor driving up demand for plant-based foods. Furthermore, foods and drinks that are solely plant-based are quickly entering the mainstream retail goods market. The growing perception that plant-based products are safer and healthier is driving up demand for natural butter alternatives like butter made from soymilk and nut milk. Similarly, there is a growing market for butter made with nut milk. The need for dairy alternatives is increasing due to the growing number of people who are lactose intolerant. Due to their involvement in the development of obesity and other diseases linked to lifestyle choices, products containing lactose are considered unhealthy. The fast-growing dairy alternatives market is expected to hamper the growth of the India butter market with its new product developments, which include non-dairy ice creams, vegetable oil-based bakery, and confectionary goods.

India Butter Market: Opportunities

Growing innovative product launches offer an attractive opportunity for market growth

The growing innovative product launches offer an attractive opportunity for the India butter industry growth during the projected period. For instance, in October 2023, the largest and most creative fresh food company in India, iD Fresh Food, recently announced the release of the iD Twist and Spread Butterstick, a handy tool that makes spreading butter easier and less messy, easy to store, and convenient to use when traveling. Every major market has seen the launch of the product. The iD Twist and Spread Butterstick, which takes its cue from the glue stick design, comes with 50 grams of fresh, preservative-free butter packaged in a way that allows it to soften fast at room temperature. Toast spreading doesn't have to be a painful, time-consuming chore any longer! After that, the individual can restock the pack.

India Butter Market: Challenges

The volatile nature of butter poses a major challenge to market expansion

The price of butter is subject to swings as a result of variations in milk output, which is impacted by various factors including animal health, feed costs, and climate conditions. Price volatility can have an impact on consumer purchase decisions as well as production. Thus, the volatile nature of butter might be a major challenging factor for India butter market expansion.

India Butter Market: Segmentation

India butter industry is segmented based on type, usage, distribution channel, and region.

Based on the type, the India butter market is bifurcated into standard butter, clarified butter, whipped butter and others. The standard butter segment is expected to dominate the market over the forecast period. Butter consumption has increased as a result of the growing middle class and rising disposable incomes. Butter is becoming more and more commonplace in households' food shopping routines. Furthermore, the need for butter has grown dramatically as a result of the foodservice sector's explosive expansion, which includes fast-food franchises, cafes, and restaurants. In these industries, butter is widely used for spreading, baking, and cooking. In addition, home baking has become increasingly popular, particularly after the pandemic. Butter is a necessary component for consumers experimenting with baking at home, which increases retail sales. Thus, driving the segment growth.

Based on the usage, the India butter industry is segmented into food processing, food service, and food retail. The food processing segment is expected to capture the largest market share over the forecast period. The rising need for butter in the food processing sector is the main factor behind the segment's expansion. Butter is frequently used as the main ingredient in confections. The need for butter in this market has increased due to manufacturers' growing investments in the creation of novel confectionary products. A popular ingredient in many baked items, particularly bread and cakes, is butter. It is anticipated that the quickly growing bakery sector will drive market expansion in the near future.

Based on the distribution channel, the India butter market is segmented into supermarkets/hypermarkets, convenience stores, specialty stores, and online sales channels. The online sales channel segment is expected to grow at the fastest rate over the forecast period. Manufacturers of these products are increasingly offering products via their websites and/or on e-commerce platforms; for instance, India-based Amul delivers milk and dairy products via its mobile application, which in turn will drive the segment demand. The growing rate of smartphone penetration and improved internet connectivity worldwide have contributed to the significant growth of the e-commerce sector in India, which is driving the growth of this segment.

India Butter Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Butter Market |

| Market Size in 2023 | 6.44 Bn |

| Market Forecast in 2032 | 15.32 Bn |

| Growth Rate | CAGR of 10.10% |

| Number of Pages | 218 |

| Key Companies Covered | Amul, Mother Dairy, Britannia, Verka, Gowardhan, Patanjali, Nandini, Kwality, President, Omfed, Milma, Aavin, and others. |

| Segments Covered | By Type, By Usage, By Distribution Channel, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Butter Market: Region Analysis

North India is expected to dominate the market over the forecast period

North India is expected to dominate the India butter market over the forecast period. Butter is a staple in North Indian cooking, especially in curries, sweets, and parathas. One reason for the steady need for butter is the persistence of traditional recipes and culinary techniques. Furthermore, they have a long history of consuming dairy products; butter, yogurt, and milk are commonplace in many homes. Sales of butter are increased by this societal preference for dairy products. For instance, Across the seven cities of Ahmedabad, Bengaluru, Chennai, Delhi, Hyderabad, Kolkata, and Mumbai, the Indian Council of Medical Research (ICMR) report also showed that men consume more fat than women, with men consuming 34.1 grams per person daily instead of 31.1 grams. Furthermore, the growing need for butter for baking, frying, and spreading is fueled by the plethora of fast-food chains, cafes, and restaurants in North India's foodservice sector.

India Butter Market: Competitive Analysis

India butter market is dominated by players like:

- Amul

- Mother Dairy

- Britannia

- Verka

- Gowardhan

- Patanjali

- Nandini

- Kwality

- President

- Omfed

- Milma

- Aavin

India butter market is segmented as follows:

By Type

- Standard Butter

- Clarified Butter

- Whipped Butter

- Others

By Usage

- Food Processing

- Food Service

- Food Retail

By Distribution Channel

- Supermarket/Hypermarket

- Convenience Store

- Specialty Store

- Online Sale Channel

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Butter is a dairy product made from the fat and protein in churned cream. It is an emulsion that is semi-solid and contains about 80% butterfat at room temperature. It can be melted and used as a condiment, spread at room temperature, and used as a culinary fat for pan frying, baking, and other methods. Although cow's milk is used to make butter the most frequently, milk from sheep, goats, buffalo, and yaks can also be used to make butter. Milk or cream needs to be churned to extract the fat globules from the buttermilk. Salt has been used to preserve butter since ancient times, particularly while it is being transported. Even while salt can be preserved to some extent today, its whole supply chain is often refrigerated.

The India butter market is being driven by several factors such as rising disposable income, e-commerce growth, increased consumer demand, growing urbanization and lifestyle changes, rising health & nutrition awareness, and others.

According to the report, India butter market size was worth around USD 6.44 billion in 2023 and is predicted to grow to around USD 15.32 billion by 2032.

India's butter market is expected to grow at a CAGR of 10.10% during the forecast period.

India butter market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the growing health awareness.

India butter market is dominated by players like Amul, Mother Dairy, Britannia, Verka, Gowardhan, Patanjali, Nandini, Kwality, President, Omfed, Milma and Aavin? among others.

India butter Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed