India Chocolate Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

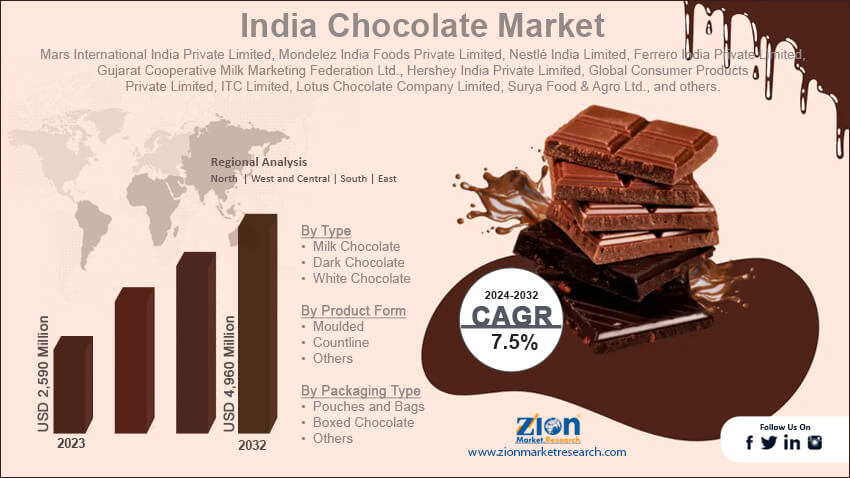

India Chocolate Market By Type (Milk Chocolate, Dark Chocolate, and White Chocolate), By Product Form (Moulded, Countline, and Others), By Packaging Type (Pouches and Bags, Boxed Chocolate, and Others), By Distribution Channel (Retail Sales and Institutional Sales), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2,590 Million | USD 4,960 Million | 7.5% | 2023 |

India Chocolate Industry Prospective:

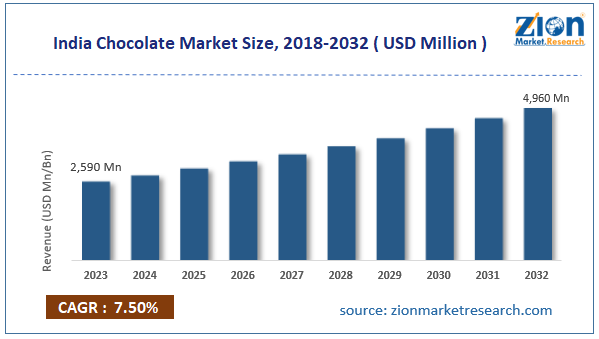

India chocolate market size was worth around USD 2,590 million in 2023 and is predicted to grow to around USD 4,960 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.5% between 2024 and 2032.

India Chocolate Market: Overview

The confectionery and pastry industries use chocolate extensively, which is made from roasted cacao beans. Health officials claim that eating chocolate in moderation raises serotonin levels, which have antidepressant and calming effects on the brain. Furthermore, it triggers the body to release endorphins, which immediately improve mood. Cortisol, the stress hormone, is likewise decreased by chocolate ingestion. Customers would want to incorporate health-promoting foods into their normal diet rather than relying solely on medication. Sales of chocolate are predicted to increase in the upcoming years because it promotes happiness and mental relaxation.

Key Insights

- As per the analysis shared by our research analyst, India's chocolate market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2024-2032).

- In terms of revenue, the India chocolate market size was valued at around USD 2,590 million in 2023 and is projected to reach USD 4,960 million by 2032.

- The rising disposable income is expected to propel India chocolate market growth over the projected period.

- Based on the type, the milk chocolate segment is expected to dominate the market during the forecast period.

- Based on its product form, the moulded segment is expected to hold a significant market share over the forecast period.

- Based on its packaging type, the boxed chocolate segment is expected to grow at the highest CAGR during the projected period.

- Based on its distribution channel, the retail sales segment is expected to hold the largest market share over the projected period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Chocolate Market: Growth Drivers

Rising gifting culture and festive celebrations drive market growth

Due to the Indian custom of giving gifts, chocolates are a common option for a variety of festive occasions and gifts. The introduction of unique, holiday-themed, gift-wrapped chocolates and chocolate gift sets available during the festive season also helps to boost the market. In addition, many well-known companies are creating effective marketing campaigns to market chocolates as a great present. In various parts of the nation, the market is significantly impacted by each of these elements. The growing corporate gifting industry also helps fuel the expansion of the chocolate market in India. During special occasions or seasons, many businesses customarily offer chocolates to their partners, clients, and staff as a token of appreciation. Therefore, the rising gifting culture and festive celebrations are expected to drive the India chocolate market over the projected period.

India Chocolate Market: Restraints

Concern regarding high sugar content impedes market growth

India chocolate industry expansion is severely restricted by growing health concerns about the excessive sugar and fat content of chocolates. Customers are choosing healthier foods as they grow more conscious of the effects of diabetes, obesity, and other health problems. The chocolate industry isn't growing because consumers are becoming less tolerant of products they consider to be extravagant or harmful. As consumer demands for healthier products change, manufacturers must either modify their product formulas or offer healthier alternatives. To continue being marketable, they must carefully balance the nutritional and flavor components.

India Chocolate Market: Opportunities

The growing partnership offers an attractive opportunity for market growth

A growing partnership is expected to offer a potential opportunity to India's chocolate industry over the projected period. For instance, in February 2023, leading FMCG conglomerate Dharampal Satyapal Group (DS Group), a multi-business organization, established a partnership with premium Swiss chocolate brand Läderach for the brand's first launch in India. In addition to marking DS Group's entry into the largest confectionary market—the chocolate segment—this cooperation is a calculated move to strengthen the company's position in the confectionary sector. With brands including Pulse, Chingles, Rajnigandha Silver Pearls, and Maze under its umbrella, the Group is already a well-known participant in the confectionery industry. Along with cultivating brands like Le Marche, L'Opera, Uncafe, and Les Petits, the Group has experience in luxury retail. Internationally recognized companies, including YSL, Tom Ford, Berluti, and others, have been managed by it.

India Chocolate Market: Challenges

Competition from traditional sweets poses a major challenge to market expansion

Traditional Indian sweets, known as mithai, continue to have great cultural value despite the increased popularity of chocolates, particularly during festivals and special occasions. This ingrained predilection, especially in rural areas, may restrict the market share of chocolate products. Thus, competition from traditional sweets is expected to pose a major challenge to India's chocolate industry.

India Chocolate Market: Segmentation

India's chocolate industry is segmented based on type, product form, packaging type, distribution channel, and region.

Based on the type, India chocolate market is bifurcated into milk chocolate, dark chocolate, and white chocolate. The milk chocolate segment is expected to dominate the market during the forecast period. In the Indian chocolate market, milk chocolate is the most widely consumed product category, drawing in consumers of all ages and socioeconomic backgrounds. Its creamy flavor and pleasant, sweet flavor, together with the fact that this type may be used in a multitude of goods, are the reasons for its profitable performance. This market can and frequently is used by candy bars, flavored drinks, truffles, and baking ingredients. The widespread availability of milk chocolate in neighborhood stores also helps to support its performance in the market. It is motivating producers to play around with cocoa solids, add nuts and raisins, and experiment with packaging to provide consumers with a variety of options.

Based on product form, India chocolate industry is segmented into moulded, countline, and others. The moulded segment is expected to hold a significant market share over the forecast period. Due to their broad consumer appeal and variety of options, moulded chocolates have the biggest market share of any product type in the Indian chocolate industry. These chocolates are made by pouring liquid chocolate into molds that come in a variety of forms and sizes. These molds might be straightforward slabs or intricately designed figurines. Furthermore, because of their versatility, moulded chocolates are ideal for both informal and formal situations, as well as being quite portable and great for giving. Their regular shapes and packaging facilitate stacking in retail settings, which increases their appeal to customers seeking both convenience and quality.

Based on packaging type, India chocolate market is segmented into pouches and bags, boxed chocolate, and others. The boxed chocolate segment is expected to grow at the highest CAGR during the projected period. As a high-end present choice, boxed chocolates have grown in popularity, particularly for weddings, birthdays, and business gatherings, as well as during significant Indian holidays like Diwali, Raksha Bandhan, and Christmas. The demand for elegantly presented, premium chocolates as presents has fueled this segment's revenue development.

Based on distribution channels, India chocolate industry is segmented into retail sales and institutional sales. The retail sales segment is expected to hold the largest market share over the projected period. The retail sales of chocolate have been greatly impacted by the explosive expansion of e-commerce in India. A large assortment of chocolates, including specialty and foreign brands, are available from online retailers like Amazon and Flipkart as well as specialty grocery delivery services like BigBasket and Grofers. Online chocolate sales have increased dramatically as a result of regular discounts and specials, as well as the ease of home delivery.

India Chocolate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Chocolate Market |

| Market Size in 2023 | 2,590 Mn |

| Market Forecast in 2032 | 4,960 Mn |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 216 |

| Key Companies Covered | Mars International India Private Limited, Mondelez India Foods Private Limited, Nestlé India Limited, Ferrero India Private Limited, Gujarat Cooperative Milk Marketing Federation Ltd., Hershey India Private Limited, Global Consumer Products Private Limited, ITC Limited, Lotus Chocolate Company Limited, Surya Food & Agro Ltd., and others. |

| Segments Covered | By Type, By Product Form, By Packaging Type, By Distribution Channel, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Chocolate Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead India chocolate market over the forecast period. This trend is a result of the area's dense population, accelerating rate of urbanization, and comparatively greater quality of life. Plus, big towns in North India like Delhi, Chandigarh, and Lucknow have a thriving retail scene that offers chocolate goods to consumers in the form of supermarkets and other local stores. Additionally, the area's traditional love of chocolate and giving gifts has increased consumption of the confection, as people there frequently indulge in chocolate during holidays and special occasions like weddings and Diwali. Further driving demand for new and luxury chocolate kinds is the preference for global lifestyle trends among North India's sizable young populace and the advent of digital interaction.

India Chocolate Market: Competitive Analysis

India's chocolate market is dominated by players like:

- Mars International India Private Limited

- Mondelez India Foods Private Limited

- Nestlé India Limited

- Ferrero India Private Limited

- Gujarat Cooperative Milk Marketing Federation Ltd.

- Hershey India Private Limited

- Global Consumer Products Private Limited

- ITC Limited

- Lotus Chocolate Company Limited

- Surya Food & Agro Ltd.

India's chocolate market is segmented as follows:

By Type

- Milk Chocolate

- Dark Chocolate

- White Chocolate

By Product Form

- Moulded

- Countline

- Others

By Packaging Type

- Pouches and Bags

- Boxed Chocolate

- Others

By Distribution Channel

- Retail Sales

- Institutional Sales

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

The confectionery and pastry industries use chocolate extensively, which is made from roasted cacao beans. Health officials claim that eating chocolate in moderation raises serotonin levels, which have antidepressant and calming effects on the brain. Furthermore, it triggers the body to release endorphins, which immediately improve mood. Cortisol, the stress hormone, is likewise decreased by chocolate ingestion. Customers would want to incorporate health-promoting foods into their normal diet rather than relying solely on medication. Sales of chocolate are predicted to increase in the upcoming years because it promotes happiness and mental relaxation.

The introduction of new flavors and packaging styles, the expansion of e-commerce platforms throughout the nation, and the ease of access to a vast array of chocolate products, both domestic and foreign, are some of the major drivers propelling the India chocolate market growth.

According to the report, India's chocolate market size was worth around USD 2,590 million in 2023 and is predicted to grow to around USD 4,960 million by 2032.

India's Chocolate market is expected to grow at a CAGR of 7.5% during the forecast period.

India's chocolate market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising disposable income.

India's chocolate market is dominated by players like Mars International India Private Limited, Mondelez India Foods Private Limited, Nestlé India Limited, Ferrero India Private Limited, Gujarat Cooperative Milk Marketing Federation Ltd., Hershey India Private Limited, Global Consumer Products Private Limited, ITC Limited, Lotus Chocolate Company Limited and Surya Food & Agro Ltd. among others.

India's chocolate market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed