India Cosmetic Market Size, Share, Trends, Growth and Forecast 2032

India Cosmetic Market By Distribution Channel (Specialty Stores, Hypermarkets/Supermarkets, Online Sales, Pharmacies, and Others), By Type (Lip Products, Face Products, Body Cosmetics, Eye Products, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

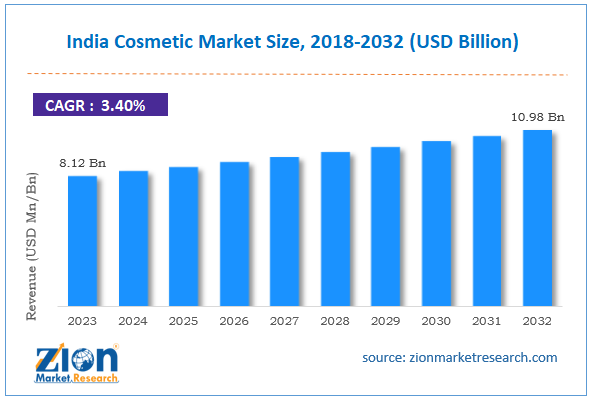

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.12 Billion | USD 10.98 Billion | 3.40% | 2023 |

India Cosmetic Industry Prospective:

The India cosmetic market size was worth around USD 8.12 billion in 2023 and is predicted to grow to around USD 10.98 billion by 2032 with a compound annual growth rate (CAGR) of roughly 3.40% between 2024 and 2032.

India Cosmetic Market: Overview

The Indian cosmetic industry deals with domestic and international companies that produce, store, and distribute cosmetic items. As per the official definition, cosmetic items are produced as a mixture of several chemical compounds that are either produced synthetically or from natural resources. Cosmetic items are used for skin care and personal care purposes. The Indian cosmetic industry is witnessing a surge in demand due to the presence of an impressive and growing consumer group. The regional market is currently mainly dominated by the affordable segment group while luxury cosmetic brands are steadily generating consumer loyalty. The main items produced in the Indian cosmetic industry include products such as foundation, lipsticks, and mascara. The industry also deals with supply chains of other wellness items such as conditioners, shampoos, soap, and bubble baths. According to the generalized definition, cosmetic items are applied to the human body to achieve more attractiveness, beautification, cleansing, and altering the overall physical appearance. However, they do not impact body functions or structure. The online cosmetic infrastructure is projected to generate massive growth opportunities while the regional market runs the risk of being oversaturated with the number of players.

Key Insights:

- As per the analysis shared by our research analyst, the India cosmetic market is estimated to grow annually at a CAGR of around 3.40% over the forecast period (2024-2032)

- In terms of revenue, the India cosmetic market size was valued at around USD 8.12 billion in 2023 and is projected to reach USD 10.98 billion, by 2032.

- The India cosmetic market is projected to grow at a significant rate due to the rising number of buyers.

- Based on the distribution channel, the online sales segment is growing at a high rate and will continue to dominate the regional market as per industry projections.

- Based on the type, the eye products segment is anticipated to command the largest market share.

- Based on region, all parts of India are projected to dominate the regional market during the forecast period.

Request Free Sample

Request Free Sample

India Cosmetic Market: Growth Drivers

Rising number of buyers fuels the market demand rate

The India cosmetic market is expected to be driven by the growing number of buyers in the country. India has huge growth potential since it is home to a large consumer segment. The regional population currently stands at 1.4 billion. In addition to this, the general population is also witnessing a shift in lifestyle and buying preferences driven by increased disposable income and higher job opportunities. The sector of cosmetic products in India is mainly dominated by the female population. As per official findings, between April and September 2023, more than INR 4500 crore was spent on over 100.5 million cosmetic products in India. The male segment of the consumer group is also registering higher demand with changing lifestyles. This is especially observed in urban and metropolitan areas.

Surging entry of international brands in the Indian market may impact the market revenue

International brands are increasingly entering the Indian economy as the consumer adoption rate has been positive in recent times. The expansion rate of world-famous brands among the highly-aware consumer group has been comprehensive. In April 2024, the famous American brand Kylie Cosmetics announced the launch of their products in the Indian market. In July 2024, another company Max Factor, Coty Inc.’s cosmetic line, entered the Indian market. The company will launch its global bestsellers such as lipsticks, mascara, and foundation in the Indian market. On the other hand, the rise of domestic and regional companies especially celebrity-owned cosmetic brands is also influencing the India cosmetic market. Recently, Kay Beauty, a company jointly owned by Indian actor Katrina Kaif and Nykaa, announced the expansion of the product portfolio with the addition of new products such as brow liners, kajals, and microblading brow pens.

India Cosmetic Market: Restraints

Risk of oversaturation in the industry will restrict the growth trend

The India cosmetic industry runs the risk of oversaturation. Currently, there are several domestic and international companies operating in India providing a vast range of personal care and cosmetic items. Recent studies indicate that customers are becoming overwhelmed with the constant addition of new products in the commercial market. Oversaturation also leads to a long-term impact on market revenue in the form of difficulties in achieving brand differentiation and customer loyalty.

India Cosmetic Market: Opportunities

The e-commerce cosmetic space holds tremendous expansion possibilities

The India cosmetic market is projected to come across several novel growth opportunities during the forecast period. Higher revenue can be expected from the e-commerce companies that have strengthened their supply chain in recent times. Additionally, online companies selling cosmetic products in the Indian market are currently the primary choices for launching new products since they help reduce the overall cost of business development. For instance, in April 2023, India witnessed the launch of Reliance Industries-backed Tira. As of June 2024, along with providing a platform for other companies, Tira launched private-label brands in the form of Tira Tools and Nails Our Way. In February 2024, Nykaa, a leading beauty and wellness e-commerce company originating from India, announced the approval of an investment worth USD 2.5 million made by the United Arab Emirates (UAE)-based firm called Nessa International Holdings.

Innovations in product packaging and marketing solutions will improve returns on investment (ROI)

Product packaging and innovative marketing solutions are key aspects of enhancing customer reach. Incorporating sustainable packaging that is user-friendly and attractive will help the regional market flourish. Additionally, the use of organic ingredients that also aid improvements in product quality can prove beneficial for the industry players.

India Cosmetic Market: Challenges

Changing regulatory requirements for business operations could prove challenging for the industry

The India cosmetic industry is expected to be challenged by the presence of a complex and highly dynamic regulatory environment. These policies govern factors such as permissible product ingredients, ethical marketing tactics, and labeling guidelines among others. Constant changes to these laws will discourage the entry of new players into the existing industry.

India Cosmetic Market: Segmentation

The India cosmetic market is segmented based on distribution channel, type, and region.

Based on the distribution channel, the India cosmetic market divisions are specialty stores, hypermarkets/supermarkets, online sales, pharmacies, and others. In 2023, the highest growth was observed in the online sales segment. The online beauty community in India is extremely strong since almost all high-end to affordable cosmetic products are available on online portals. In the fiscal year 2023, Nykaa generated more than INR 6,300 crore in revenue.

Based on the type, the India cosmetic industry divisions are lip products, face products, body cosmetics, eye products, and others. In 2023, the most dominant segment was eye products. India has a strong consumer base for eye cosmetic items including mascara, kohl, and eye shadows. The demand for organic eye kajals that are smudge-proof and long-lasting has been growing leading to higher segmental demand. As per official statistics, more than 25% of the overall color cosmetics market is led by the Kohl sector.

India Cosmetic Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Cosmetic Market |

| Market Size in 2023 | 8.12 Bn |

| Market Forecast in 2032 | 10.98 Bn |

| Growth Rate | CAGR of 3.40% |

| Number of Pages | 219 |

| Key Companies Covered | Mamaearth, Patanjali Ayurved, VLCC, Hindustan Unilever Limited, Forest Essentials, Lotus Herbals, Lakmé, Kaya Limited, Himalaya Herbals, Sugar Cosmetics, L'Oréal India, Colorbar Cosmetics, Biotique, Revlon India, Shahnaz Husain, and others. |

| Segments Covered | By Distribution Channel, By Type, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Cosmetic Market: Regional Analysis

India is to witness high demand across all major cities during the forecast period

The India cosmetic market is expected to witness high demand for products from almost all parts of the country. Higher demand for colored cosmetics and personal care products can be expected from major metropolitan cities and urban regions such as Delhi, Mumbai, Bangalore, and others. The increase in the working population in India is a major contributor to the regional cosmetic industry. Working professionals are actively seeking work-appropriate cosmetic products that can be used every day. However, they are also opting for products that are less damaging to the skin and body parts such as the eyes. The rise in per capita income and greater availability of affordable variants of cosmetic items is helping the industry thrive in remote parts of the country. Market players have been paying special focus to the dynamic consumer demand in the Indian region. They are offering a wide range of products in the same category differentiated by colors and shades. The growing investments in e-commerce portals and toward strengthening supply chains for online beauty companies are expected to help improve revenue in the Indian industry for cosmetics.

India Cosmetic Market: Competitive Analysis

The India cosmetic market is led by players like:

- Mamaearth

- Patanjali Ayurved

- VLCC

- Hindustan Unilever Limited

- Forest Essentials

- Lotus Herbals

- Lakmé

- Kaya Limited

- Himalaya Herbals

- Sugar Cosmetics

- L'Oréal India

- Colorbar Cosmetics

- Biotique

- Revlon India

- Shahnaz Husain

The India cosmetic market is segmented as follows:

By Distribution Channel

- Specialty Stores

- Hypermarkets/Supermarkets

- Online Sales

- Pharmacies

- Others

By Type

- Lip Products

- Face Products

- Body Cosmetics

- Eye Products

- Others

By Region

India

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

The Indian cosmetic industry deals with domestic and international companies that produce, store, and distribute cosmetic items.

The India cosmetic market is expected to be driven by the growing number of buyers in the country.

According to study, the India cosmetic market size was worth around USD 8.12 billion in 2023 and is predicted to grow to around USD 10.98 billion by 2032.

The CAGR value of India cosmetic market is expected to be around 3.40% during 2024-2032.

The India cosmetic market is expected to witness high demand for products from almost all parts of the country.

The India cosmetic market is led by players like Mamaearth, Patanjali Ayurved, VLCC, Hindustan Unilever Limited, Forest Essentials, Lotus Herbals, Lakmé, Kaya Limited, Himalaya Herbals, Sugar Cosmetics, L'Oréal India, Colorbar Cosmetics, Biotique, Revlon India and Shahnaz Husain

The report explores crucial aspects of the India cosmetic market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed