India Dietary Supplements Market Size Report, Industry Share, Analysis, Growth, 2032

India Dietary Supplements Market By Product Type (Vitamin & Mineral Dietary Supplements, Herbal Dietary Supplements, Protein Dietary Supplements, and Others), By Form (Tablets, Capsules, Powders, Liquids, Soft Gels, and Gel Caps), By Distribution Channel (Pharmacies & Drug Stores, Supermarkets & Hypermarkets, Online Channels, and Others), By Application (Additional Supplements, Medicinal Supplement, and Sports Nutrition), By End-Use (Infant, Children, Adults, Pregnant Women, and Old-Aged), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

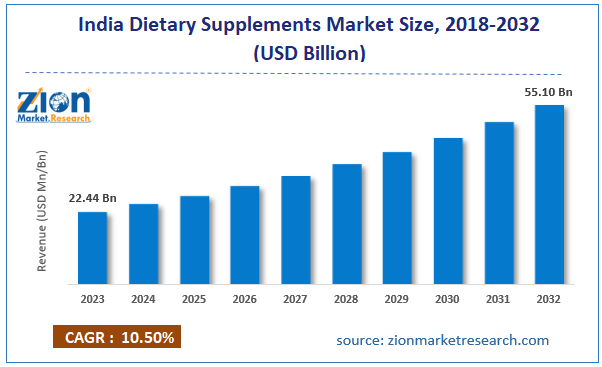

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 22.44 Billion | USD 55.10 Billion | 10.5% | 2023 |

India Dietary Supplements Industry Prospective:

India dietary supplements market size was worth around USD 22.44 billion in 2023 and is predicted to grow to around USD 55.10 billion by 2032 with a compound annual growth rate (CAGR) of roughly 10.5% between 2024 and 2032.

India Dietary Supplements Market: Overview

Food supplements, also known as dietary supplements, are products designed to augment a typical diet that includes concentrated sources of nutrients or other substances with physiological or nutritional effects in a simple or combined form. These products are sold in dosed formulas, powder bags, liquid vials, pills, capsules, tablets, and other similar forms that are meant to be taken in small, quantifiable amounts. The increasing consciousness of health and wellness among Indians is the main factor propelling the dietary supplement industry in India. More people are spending extra cash on nutritional supplements and other health-related products. The necessity for these dietary supplements is further supported by the urban population's strong desire to preserve a balanced diet and avoid lifestyle-related illnesses.

Key Insights

- As per the analysis shared by our research analyst, India's dietary supplements market is estimated to grow annually at a CAGR of around 10.5% over the forecast period (2024-2032).

- In terms of revenue, the India dietary supplements market size was valued at around USD 22.44 billion in 2023 and is projected to reach USD 55.10 billion, by 2032.

- The rising disposable income is expected to propel India dietary supplements market growth over the projected period.

- Based on the product type, vitamin and mineral dietary supplements are expected to dominate the market over the forecast period.

- Based on the form, the tablet segment is expected to hold the largest market share over the projected period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Dietary Supplements Market: Growth Drivers

Transition to plant-based and vegan diets drives market growth

Plant-based dietary supplements and veganism are becoming more popular in India, mirroring worldwide nutritional trends. Due to moral, health, and environmental concerns, consumers are choosing more and more supplements devoid of substances originating from animals. An analysis by Truly Experiences states that 24% of Indians follow a strict vegetarian diet, while 9% of Indians overall are vegans. More businesses are creating plant-based formulations to cater to this expanding market, primarily composed of urban and health-conscious consumers. This trend is having an impact on product offers and thus helps boost the growth of India dietary supplements.

India Dietary Supplements Market: Restraints

Counterfeit products and regulatory challenges impede market growth

The India dietary supplement market's propensity for contaminated and counterfeit dietary supplements endangers consumer safety and erodes confidence in reliable brands. The credibility and reputation of legitimate supplement companies are at risk due to the entry of counterfeit products into the market due to lax enforcement and oversight measures. Furthermore, a major danger to the Indian market for dietary supplements is the implementation of strict rules and shifting regulatory frameworks. Supplement companies may face operational difficulties and market entrance obstacles as a result of complicated and expensive compliance with changing regulatory guidelines, such as those about labeling, safety, and quality standards.

India Dietary Supplements Market: Opportunities

Rising online sale offers an attractive opportunity for market growth

Online sales have significantly increased as a result of the digital transformation, which has had a significant impact on the growth of the dietary supplement industry in India. A major channel of distribution that offers a large selection of goods at affordable rates along with the ease of home delivery is e-commerce platforms and help focus apps. The Indian Brand Equity Foundation reported that in the last three years, there has been a 125 million increase in online shopping in India, and by 2025, an additional 80 million are anticipated. India is anticipated to have a 200 billion USD e-commerce market by 2026, up from 111 billion USD in 2024.

India Dietary Supplements Market: Challenges

Health misinformation poses a major challenge to market expansion

Consumer confidence and industry expansion are threatened by false health claims and disinformation regarding dietary supplements that are spreading through different media outlets. Fraudulent or overstated statements on the effectiveness and safety of products have the potential to damage the industry's reputation and discourage customers from buying real supplements, which can affect demand and revenues.

India Dietary Supplements Market: Segmentation

India's dietary supplements industry is segmented based on product type, form, distribution channel, application, end-use, and region.

Based on the product type, India dietary supplement market is bifurcated into vitamin and mineral dietary supplements, herbal dietary supplements, protein dietary supplements, and others. The vitamin and mineral dietary supplements are expected to dominate the market over the forecast period. Dietary supplements containing vitamins and minerals account for a substantial portion of the Indian dietary supplement market. The primary driver for this dominance is the growing consumer knowledge about wellness and health, particularly about the role that micronutrients play in reducing lifestyle illnesses and enhancing immunity. A major factor in the rising number of Indians using supplements as a preventive approach is the increased incidence of vitamin deficiencies in the population. For instance, a consensus by Bayer's Consumer Health Division states that roughly half of the world's population—more than two billion people—suffers from micronutrient deficiencies or MiNDs. Over 80% of Indians experience shortages in micronutrients, which weaken their immune systems.

Based on form, India dietary supplements industry is segmented into tablets, capsules, powders, liquids, soft gels, and gel caps. The tablets segment is expected to hold the largest market share over the projected period. Tablets are the most widely used form factor and account for the largest portion of the sector in the India dietary supplement market. The simplicity and accuracy of dosage that tablets provide are the primary reasons for this preference. Tablets are a highly sought-after technology by manufacturers and consumers alike since they are simpler to pack, store, and travel. When weighed against alternative forms such as capsules and powders, tablets are a more affordable option, which appeals to the price-conscious Indian market. Tablets' ability to deliver nutrients gradually is another feature that helps with the absorption of several supplements, which contributes to their market domination.

Based on distribution channels, India dietary supplement market is segmented into pharmacies and drug stores, supermarkets and hypermarkets, online channels, and others.

Based on application, India's dietary supplements industry is segmented into additional supplements, medicinal supplements, and sports nutrition.

Based on end-use, India's dietary supplements market is segmented into infants, children, adults, pregnant women, and old-aged.

India Dietary Supplements Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Dietary Supplements Market |

| Market Size in 2023 | 22.44 Bn |

| Market Forecast in 2032 | 55.10 Bn |

| Growth Rate | CAGR of 10.5% |

| Number of Pages | 211 |

| Key Companies Covered | Amway India Enterprises Private Limited, Herbalife International India Private Limited, Dabur India Limited, Abbott India Limited, Kraft Heinz India Private Limited, Himalaya Drug Company, Sun Pharmaceutical Industries Limited, GlaxoSmithKline Consumer Healthcare Limited, Danone Nutricia International Private Limited, Patanjali Ayurved Limited, and others. |

| Segments Covered | By Product Type, By Form, By Distribution Channel, By Application, By End-Use, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Dietary Supplements Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India dietary supplements market over the forecast period. Increased customer awareness and a burgeoning fitness culture, particularly in cities like Chandigarh and Delhi, are credited with the development. Well-liked goods for the health-conscious market include multivitamins and protein supplements. Besides, considering the long history of natural medicine in the area, traditional and herbal supplements are preferred in the East Indian market, which has Kolkata as a major hub. In this domain, there's a special need for vitamins that boost immunity and energy. This area, which includes big cities like Mumbai and Pune, shows a strong demand for lifestyle-focused supplements, such as goods for sports nutrition and weight control.

India Dietary Supplements Market: Competitive Analysis

India dietary supplements market is dominated by players like:

- Amway India Enterprises Private Limited

- Herbalife International India Private Limited

- Dabur India Limited

- Abbott India Limited

- Kraft Heinz India Private Limited

- Himalaya Drug Company

- Sun Pharmaceutical Industries Limited

- GlaxoSmithKline Consumer Healthcare Limited

- Danone Nutricia International Private Limited

- Patanjali Ayurved Limited

India's dietary supplements market is segmented as follows:

By Product Type

- Vitamin and Mineral Dietary Supplements

- Herbal Dietary Supplements

- Protein Dietary Supplements

- Others

By Form

- Tablets

- Capsules

- Powders

- Liquids

- Soft Gels

- Gel Caps

By Distribution Channel

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Channels

- Others

By Application

- Additional Supplements

- Medicinal Supplement

- Sports Nutrition

By End-Use

- Infant

- Children

- Adults

- Pregnant Women

- Old-Age

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Food supplements, also known as dietary supplements, are products designed to augment a typical diet that includes concentrated sources of nutrients or other substances with physiological or nutritional effects in a simple or combined form. These products are sold in dosed formulas, powder bags, liquid vials, pills, capsules, tablets, and other similar forms that are meant to be taken in small, quantifiable amounts.

The increasing consciousness of health and wellness among Indians is the main factor propelling the dietary supplement industry in India. More people are spending extra cash on nutritional supplements and other health-related products. The necessity for these dietary supplements is further supported by the urban population's strong desire to preserve a balanced diet and avoid lifestyle-related illnesses.

According to the report, India's dietary supplements market size was worth around USD 22.44 billion in 2023 and is predicted to grow to around USD 55.10 billion by 2032.

India's dietary supplements market is expected to grow at a CAGR of 10.5% during the forecast period.

India's dietary supplements market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the presence of several manufacturers.

India's dietary supplements market is dominated by players like Amway India Enterprises Private Limited, Herbalife International India Private Limited, Dabur India Limited, Abbott India Limited, Kraft Heinz India Private Limited, Himalaya Drug Company, Sun Pharmaceutical Industries Limited, GlaxoSmithKline Consumer Healthcare Limited, Danone Nutricia International Private Limited, and Patanjali Ayurved Limited among others.

India's dietary supplements market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed