India FMCG Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

India FMCG Market By Distribution Channel (Offline and Online), By Demographics (Rural and Urban), By Product Type (Pharmaceuticals, Home & Household Care, Food & Beverages, Pet Care, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

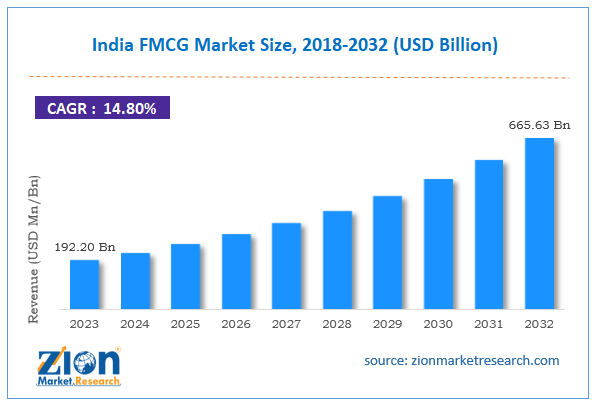

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

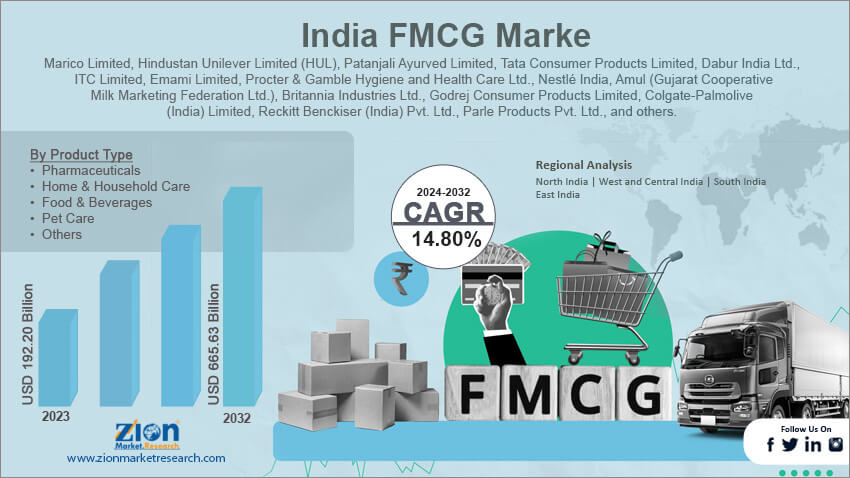

| USD 192.20 Billion | USD 665.63 Billion | 14.80% | 2023 |

India FMCG Industry Prospective:

The India FMCG market size was worth around USD 192.20 billion in 2023 and is predicted to grow to around USD 665.63 billion by 2032 with a compound annual growth rate (CAGR) of roughly 14.80% between 2024 and 2032.

India FMCG Market: Overview

The fast-moving consumer goods (FMCG) sector is one of the key contributors to the thriving Indian economy. The FMCG industry deals with the production and sale of products that are readily available at reasonable prices and enjoy high demand. The fast-moving consumer goods are used frequently by customers and hence have limited display life in stores and supermarkets. Some of the key characteristics of FMCG items include exceptional usability and low prices. The most commonly used items categorized as FMCG include products such as prepared meals, toothpaste, cookies, soap, chocolate, notepads, and others. The fast-moving consumer goods are divided into 4 main types including personal care, food & beverages, home care commodities, and healthcare goods. The Indian FMCG industry has been growing at a rapid pace in recent times. Some of the crucial regional market growth drivers are rising consumerism and disposable income. Additionally, the organic FMCG segment is projected to register a rapid growth rate in the coming years. However, the Indian industry for fast-moving consumer goods may face risks associated with the industry reaching a point of oversaturation.

Key Insights:

- As per the analysis shared by our research analyst, the India FMCG market is estimated to grow annually at a CAGR of around 14.80% over the forecast period (2024-2032)

- In terms of revenue, the India FMCG market size was valued at around USD 192.20 billion in 2023 and is projected to reach USD 665.63 billion, by 2032.

- The India FMCG market is projected to grow at a significant rate due to the increasing per capita income and consumerism rate.

- Based on the distribution channel, the offline segment is growing at a high rate and will continue to dominate the regional market as per industry projections.

- Based on the product type, the home & household care segment is anticipated to command the largest market share

- Based on region, Northern states are projected to dominate the regional market during the forecast period.

Request Free Sample

Request Free Sample

India FMCG Market: Growth Drivers

Increasing per capita income and consumerism rate in India will drive the market growth rate

The India FMCG market is expected to grow during the projection period owing to the rising disposable income of the general population. In the last decade, the country has witnessed a steady rise in job opportunities. The per capita income of the regional economy has grown consistently. In 2023, official records suggest that the country’s per capita net national income (NNI) was over INR 170 thousand with an annual growth rate of 13.75% as compared to 2022. The changes in Indian official policies facilitating Make-in-India campaigns as well as a higher influx of foreign investments have been crucial to the region’s economic growth over the years.

For instance, in June 2024, the Department of Telecommunications (DoT) announced the launch of a survey program. The agency is focusing on identifying and addressing challenges faced by micro, small, & medium enterprises (MSMEs) while changing their technological resources. The surge in innovation and manufacturing in Indian commercial states will increase the earning capacity of the general population thus allowing them to spend more on regular necessities such as FMCG items.

Surge in investments in manufacturing facilities will fuel the industry's revenue rate

India is witnessing a surge in investments toward the construction and development of sophisticated manufacturing facilities. The novel production units have the capacity to deliver exceptional volumes thus meeting the growing regional demand. In April 2023, PepsiCo India announced plans to invest INR 1266 crore for the construction of a new manufacturing facility in Madhya Pradesh state. The facility will be equipped with cutting-edge solutions to produce flavors. Similarly, in September 2023, ITC, a diversified group in the commercial space, announced an investment of INR 1500 crore for setting up a food-producing and logistics facility. Additionally, the investment will also be used for developing a novel production unit for sustainable packaging solutions. In January 2024, Dabur, a leading player in the India FMCG market, announced its plan to launch a new manufacturing facility to be built on an investment of INR 135 crore in south India.

India FMCG Market: Restraints

Oversupply of products and market saturation will limit the industry’s growth rate

The Indian industry for FMCG is expected to be restricted due to the market players facing the risk of over-saturation. The regional sector is filled with a large number of companies targeting the consumer group. The everyday consumer may find the extensive range of products overwhelming. Additionally, it also raises concerns over product innovation which may impact the overall quality of the final items.

India FMCG Market: Opportunities

Changing consumer inclination toward organic products holds massive expansion opportunities

The India FMCG market players can expect several new growth opportunities during the projection period. The consumption of organic fast-moving consumer goods has escalated over the years with growing consumer awareness. Organic personal care, hygiene, toiletries, and cosmetic products are the most popular items. In September 2023, Siddhayu International, an Indian Ayurvedic remedy provider, announced the launch of EO Naturals. It is a luxury skincare brand made of ingredients that are safe for the skin and the environment. Additionally, companies are investing in integrating cutting-edge technology in the production cycle. Investments in exploring and developing new raw materials for producing food & beverage items will help the regional industry’s expansion trend.

India FMCG Market: Challenges

Managing pollution caused by FMCG items will challenge the market expansion rate

The Indian FMCG industry is plagued with challenges that emerge due to pollution caused by excessive use of FMCG items. The basic trait of a fast-moving consumer good is related to frequent replacement, FMCG items are considered among some of the largest polluters across the globe. Over 25% of global greenhouse gas emissions are caused by the FMCG sector. The regional companies must implement policies that reduce the environmental impact of FMCG production and consumption.

India FMCG Market: Segmentation

The India FMCG market is segmented based on distribution channel, demographics, product type, and region.

Based on the distribution channel, the regional market is divided into offline and online. In 2023, the highest growth was witnessed in the offline segment. Across India, most buyers prefer to shop from retail stores since supermarkets or hypermarkets offer a vast range of options at reasonable prices. However, the online segment is rapidly flourishing especially in urban areas. Several FMCG product delivery applications and portals have emerged in recent times. As per official reports, quick commerce contributed to over 15% of the total revenue in India's FMCG sector.

Based on demographics, the India FMCG industry is segmented into rural and urban.

Based on the product type, the regional market divisions are pharmaceuticals, home & household care, food & beverages, pet care, and others. In 2023, the home & household care segment was the leading revenue generator. The prominent reasons for higher segmental demand were the rising rate of urbanization, increasing population, and change in consumer lifestyle. The Indian food & beverages industry, in 2023, was valued at over USD 330 billion.

India FMCG Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India FMCG Market |

| Market Size in 2023 | 192.20 Bn |

| Market Forecast in 2032 | 665.63 Bn |

| Growth Rate | CAGR of 14.80% |

| Number of Pages | 224 |

| Key Companies Covered | Marico Limited, Hindustan Unilever Limited (HUL), Patanjali Ayurved Limited, Tata Consumer Products Limited, Dabur India Ltd., ITC Limited, Emami Limited, Procter & Gamble Hygiene and Health Care Ltd., Nestlé India, Amul (Gujarat Cooperative Milk Marketing Federation Ltd.), Britannia Industries Ltd., Godrej Consumer Products Limited, Colgate-Palmolive (India) Limited, Reckitt Benckiser (India) Pvt. Ltd., Parle Products Pvt. Ltd., and others. |

| Segments Covered | By Distribution Channel, By Demographics, By Product Type, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India FMCG Market: Regional Analysis

Northern states in India to deliver exceptional results during the projection period

The India FMCG market is projected to be led by the Northern states of the country. Regions such as Maharashtra, Bihar, and Uttar Pradesh are ranked as the most populated states in the country. Additionally, the state consumers have recorded a growth in income and spending capacity. Indian state governments are increasingly spending on developing regional infrastructure to support the development of new production facilities. In October 2022, iD Fresh Food, a Bengaluru-based food firm, announced the construction of a new production facility in Haryana state of India. The company expects to meet the growing consumer demand in Northern states through the facility. In September 2023, ITC, a leading player in the regional FMCG sector, announced an investment of INR 1500 crore. The company will build food packaging and manufacturing plants in the Madhya Pradesh region. South Indian states are significant revenue generators. Factors such as favorable government policies for businesses and the presence of skilled labor reinforce revenue rates originating from southern regions. In January 2024, Akshayakalpa Organic, a dominant company operating in the organic dairy space, launched a new production facility in the Chennai region at the Pooriyampakkam farm. The unit is equipped with state-of-the-art technologies with a capacity to process around 40,000 liters of exceptional-grade organic dairy products every day.

India FMCG Market: Competitive Analysis

The India FMCG market is led by players like:

- Marico Limited

- Hindustan Unilever Limited (HUL)

- Patanjali Ayurved Limited

- Tata Consumer Products Limited

- Dabur India Ltd.

- ITC Limited

- Emami Limited

- Procter & Gamble Hygiene and Health Care Ltd.

- Nestlé India

- Amul (Gujarat Cooperative Milk Marketing Federation Ltd.)

- Britannia Industries Ltd.

- Godrej Consumer Products Limited

- Colgate-Palmolive (India) Limited

- Reckitt Benckiser (India) Pvt. Ltd.

- Parle Products Pvt. Ltd.

The India FMCG market is segmented as follows:

By Distribution Channel

- Offline

- Online

By Demographics

- Rural

- Urban

By Product Type

- Pharmaceuticals

- Home & Household Care

- Food & Beverages

- Pet Care

- Others

By Region

- India

Table Of Content

Methodology

FrequentlyAsked Questions

The fast-moving consumer goods (FMCG) sector is one of the key contributors to the thriving Indian economy.

The India FMCG market is expected to grow during the projection period owing to the rising disposable income of the general population.

According to study, the India FMCG market size was worth around USD 192.20 billion in 2023 and is predicted to grow to around USD 665.63 billion by 2032.

The CAGR value of India FMCG market is expected to be around 14.80% during 2024-2032.

The India FMCG market is projected to be led by the Northern states of the country.

The India FMCG market is led by players like Marico Limited, Hindustan Unilever Limited (HUL), Patanjali Ayurved Limited, Tata Consumer Products Limited, Dabur India Ltd., ITC Limited, Emami Limited, Procter & Gamble Hygiene and Health Care Ltd., Nestlé India, Amul (Gujarat Cooperative Milk Marketing Federation Ltd.), Britannia Industries Ltd., Godrej Consumer Products Limited, Colgate-Palmolive (India) Limited, Reckitt Benckiser (India) Pvt. Ltd. and Parle Products Pvt. Ltd.

The report explores crucial aspects of the FMCG market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed