India Gelatin Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

India Gelatin Market By Source (Animal Source and Plant Source), By Function (Stabilizer, Thickener, Gelling Agent, and Others), By Type (Type A and Type B), By Application (Food & Beverages, Healthcare, Cosmetics, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

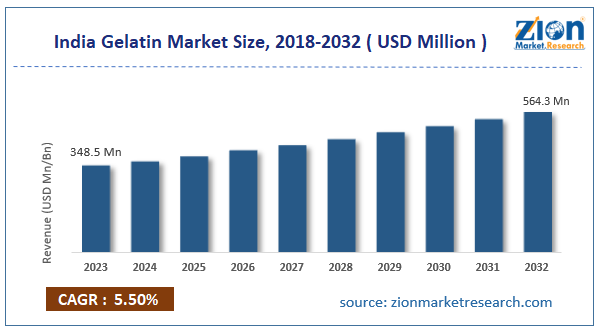

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 348.5 Million | USD 564.3 Million | 5.5% | 2023 |

India Gelatin Industry Prospective:

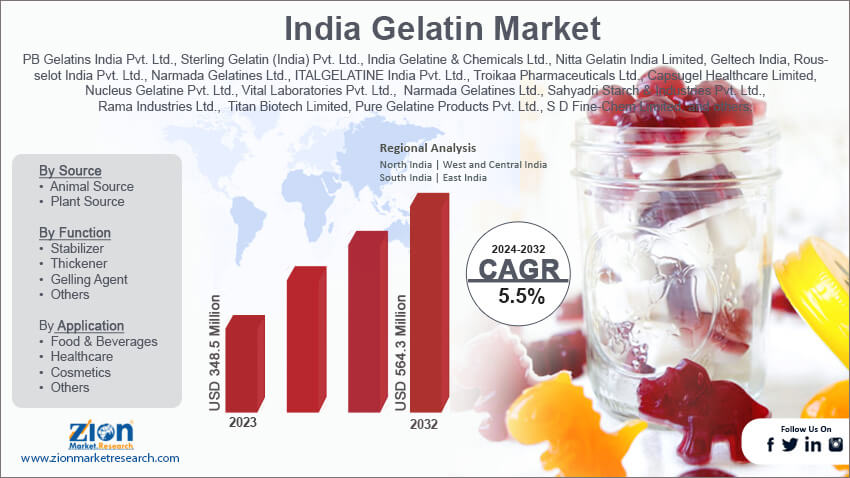

India gelatin market size was worth around USD 348.5 million in 2023 and is predicted to grow to around USD 564.3 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.5% between 2024 and 2032.

India Gelatin Market: Overview

Gelatin, or gelatine, is a transparent, flavorless food component that is commonly derived from the collagen of animal body parts. It is brittle while dry, but flexible when wet. It is also known as hydrolyzed collagen, collagen hydrolysate, hydrolyzed gelatine, and collagen peptides after hydrolysis. It is commonly used as a gelling agent in food, beverages, pharmaceuticals, papers, cosmetics, films, and vitamin or medication capsules. Anything that either contains gelatin or functions similarly is referred to as a gelatinous substance. Gelatin is an irreversibly hydrolyzed form of collagen that results from the hydrolysis of protein fibrils into smaller peptides; the range of molecular weights of these peptides is determined by the physical and chemical denaturation processes.

Key Insights

- As per the analysis shared by our research analyst, India's gelatin market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2024-2032).

- In terms of revenue, the India gelatin market size was valued at around USD 348.5 million in 2023 and is projected to reach USD 564.3 million, by 2032.

- The rising food & beverage industry is expected to propel India gelatin market growth over the projected period.

- Based on the function, the stabilizer segment is expected to hold the largest market share over the projected period.

- Based on the type, the Type A segment is expected to dominate the market over the forecast period.

- Based on the application, the food & beverages segment is expected to capture the largest market share over the projected period.

- Based on the region, West and Central India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Gelatin Market: Growth Drivers

Rising demand from the food & beverages industry drives market growth

Due to its thickening, stabilizing, and gelling qualities, gelatin finds many uses in food and beverages, supporting gelatin market developments in this industry. It is frequently used in meat items, dairy products, sweets, and confections. As a result, this is greatly boosting the gelatin market's revenue in India. Furthermore, the growing trend of consumers choosing products with pure and natural components has led to an advancement in the use of gelatin derived from natural sources such as animal bones and connective tissues. Additionally, the usage of gelatin is increasing because of the popularity of various functional meals, such as low-fat and protein-rich goods, and gelatin stead extract is showing signs of increased activity in the use of gelatin. Thus, the increasing demand from the food & beverages sector propel the Indian gelatin market growth during the forecast period.

India Gelatin Market: Restraints

Availability of gelatin alternatives impedes market growth

The fierce rivalry in the Indian gelatin industry presents major obstacles for businesses. Due to price wars and low profit margins caused by several competitors vying for market supremacy, it is difficult for businesses to stay successful. Moreover, in a highly competitive marketplace, it is often vital to continuously develop and differentiate to stand out due to severe competition. It can be resource-intensive and more challenging for smaller rivals to successfully compete with larger, more established organizations when they are expected to continuously deliver unique products and services. In addition, customers have a lot of options and can switch providers fast based on cost, convenience, or other factors, making it challenging to retain their loyalty in the face of fierce competition.

India Gelatin Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launches are expected to offer a potential opportunity for India gelatin market growth during the projected period. For instance, in April 2023, the industry leader in collagen peptides and customized gelatins, GELITA, introduced a fast-setting gelatin that promises to revolutionize the production of fortified gummies. Under the brand name CONFIXX®, this new gelatin makes it possible to produce gummies without starch while maintaining a sensory profile that was previously only possible with a starch-based manufacturing process. This allows producers of these popular supplements to experiment with different active ingredients, streamline their operations, and save a significant amount of money—all while knowing that crucial textures won't be compromised.

India Gelatin Market: Challenges

Raw material availability poses a major challenge to market expansion

Animal by-products like bones and skin from pigs, cattle, and fish are major sources of gelatin; fluctuations in these raw materials' availability owing to disease outbreaks, regulatory changes, or ethical concerns can impact production; India frequently depends on imports for high-quality raw materials, which can cause supply chain disruptions and higher costs. Thus, posing a major challenge to India gelatin market expansion.

India Gelatin Market: Segmentation

India's gelatin industry is segmented based on source, function, type, application, and region.

Based on the source, India's gelatin market is bifurcated into animal source and plant sources.

Based on function, India's gelatin industry is segmented into stabilizers, thickeners, gelling agents, and others. The stabilizer segment is expected to hold the largest market share over the projected period. Products that are popular in the Indian market, such as marshmallows, gummy candies, and jellies, frequently contain gelatin as a stabilizer. It improves the texture and consistency of goods like panna cotta, ice cream, and yogurt by stabilizing them. To add stability and extend shelf life, gelatin is used in mousses, whipped cream, and other baked goods. Gelatin's stabilizing qualities also make it an essential component in the manufacturing of tablet coatings and both soft and hard capsules. Vitamins and dietary supplements are stabilized, guaranteeing their efficacy and durability. Thus, driving the segment growth.

Based on type, India's gelatin market is segmented into Type A and Type B. The Type A segment is expected to dominate the market over the forecast period. The product's widespread use in the food and beverage industry is responsible for its high share. Type A collagen is obtained from acid-treated skin and has an isoionic point of 6 to 9. Type B collagen is typically derived from the skin of cattle and is obtained from an alkali-treated precursor with an isoionic point of 5.

Based on application, India's gelatin industry is segmented into food & beverages, healthcare, cosmetics, and others. The food & beverages segment is expected to capture the largest market share over the projected period. Its substantial share can be attributed to the global increase in demand for a variety of food and drink goods, including meat products, confectionary items, functional food products, and desserts.

India Gelatin Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Gelatin Market |

| Market Size in 2023 | 348.5 Mn |

| Market Forecast in 2032 | 564.3 Mn |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 210 |

| Key Companies Covered | PB Gelatins India Pvt. Ltd., Sterling Gelatin (India) Pvt. Ltd., India Gelatine & Chemicals Ltd., Nitta Gelatin India Limited, Geltech India, Rousselot India Pvt. Ltd., Narmada Gelatines Ltd., ITALGELATINE India Pvt. Ltd., Troikaa Pharmaceuticals Ltd., Capsugel Healthcare Limited, Nucleus Gelatine Pvt. Ltd., Vital Laboratories Pvt. Ltd., Nutra Healthcare, Narmada Gelatines Ltd., Sahyadri Starch & Industries Pvt. Ltd., Rama Industries Ltd., Sai Roadlines Pvt. Ltd., Titan Biotech Limited, Pure Gelatine Products Pvt. Ltd., S D Fine-Chem Limited, and others. |

| Segments Covered | By Source, By Function, By Type, By Application, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Gelatin Market: Region Analysis

West and Central India is expected to lead the market over the forecast period

West and Central India is expected to lead the India gelatin market over the forecast period. For several reasons, the West and Central India region is crucial to the growth of the Indian gelatin industry. Big cities like Mumbai, Pune, and Ahmedabad, located in West India, act as centers for a variety of industries including pharmaceuticals, food & beverage, and cosmetics—all of which make substantial use of gelatin. The need for gelatin, an essential ingredient in products like capsules, candies, and cosmetics, is fueled by these industries. West India has a robust infrastructure as well, which enables gelatin producers to use efficient distribution networks to reach a variety of consumers across the country. Additionally, the proximity of the area to important ports promotes global trade by permitting the export of completed gelatin products as well as raw materials, which fuels market expansion.

India Gelatin Market: Competitive Analysis

India's gelatin market is dominated by players like:

- PB Gelatins India Pvt. Ltd.

- Sterling Gelatin (India) Pvt. Ltd.

- India Gelatine & Chemicals Ltd.

- Nitta Gelatin India Limited

- Geltech India

- Rousselot India Pvt. Ltd.

- Narmada Gelatines Ltd.

- ITALGELATINE India Pvt. Ltd.

- Troikaa Pharmaceuticals Ltd.

- Capsugel Healthcare Limited

- Nucleus Gelatine Pvt. Ltd.

- Vital Laboratories Pvt. Ltd.

- Nutra Healthcare

- Narmada Gelatines Ltd.

- Sahyadri Starch & Industries Pvt. Ltd.

- Rama Industries Ltd.

- Sai Roadlines Pvt. Ltd.

- Titan Biotech Limited

- Pure Gelatine Products Pvt. Ltd.

- S D Fine-Chem Limited

India's gelatin market is segmented as follows:

By Source

- Animal Source

- Plant Source

By Function

- Stabilizer

- Thickener

- Gelling Agent

- Others

By Type

- Type A

- Type B

By Application

- Food & Beverages

- Healthcare

- Cosmetics

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Gelatin, or gelatine, is a transparent, flavorless food component that is commonly derived from the collagen of animal body parts. It is brittle while dry, but flexible when wet. It is also known as hydrolyzed collagen, collagen hydrolysate, hydrolyzed gelatine, and collagen peptides after hydrolysis. It is commonly used as a gelling agent in food, beverages, pharmaceuticals, papers, cosmetics, films, and vitamin or medication capsules. Anything that either contains gelatin or functions similarly is referred to as a gelatinous substance. Gelatin is an irreversibly hydrolyzed form of collagen that results from the hydrolysis of protein fibrils into smaller peptides; the range of molecular weights of these peptides is determined by the physical and chemical denaturation processes.

The growing need for gelatin in the food and beverage sector in India is primarily driven by the product's adaptable qualities as thickeners, stabilizers, and gelling agents, which support the growth of the pharmaceutical and nutraceutical industries as well as advancements in personal care and rehabilitation.

According to the report, India's gelatin market size was worth around USD 348.5 million in 2023 and is predicted to grow to around USD 564.3 million by 2032.

India's gelatin market is expected to grow at a CAGR of 5.5% during the forecast period.

India's gelatin market growth is driven by West and Central India. It is currently the nation's highest revenue-generating market due to the presence of several manufacturers.

India's gelatin market is dominated by players like PB Gelatins India Pvt. Ltd., Sterling Gelatin (India) Pvt. Ltd., India Gelatine & Chemicals Ltd., Nitta Gelatin India Limited, Geltech India, Rousselot India Pvt. Ltd., Narmada Gelatines Ltd., ITALGELATINE India Pvt. Ltd., Troikaa Pharmaceuticals Ltd., Capsugel Healthcare Limited, Nucleus Gelatine Pvt. Ltd., Vital Laboratories Pvt. Ltd., Nutra Healthcare, Narmada Gelatines Ltd., Sahyadri Starch & Industries Pvt. Ltd., Rama Industries Ltd., Sai Roadlines Pvt. Ltd., Titan Biotech Limited, Pure Gelatine Products Pvt. Ltd. and S D Fine-Chem Limited among others.

India's gelatin market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed