India Honey Market Growth, Size, Share, Trends, and Forecast 2032

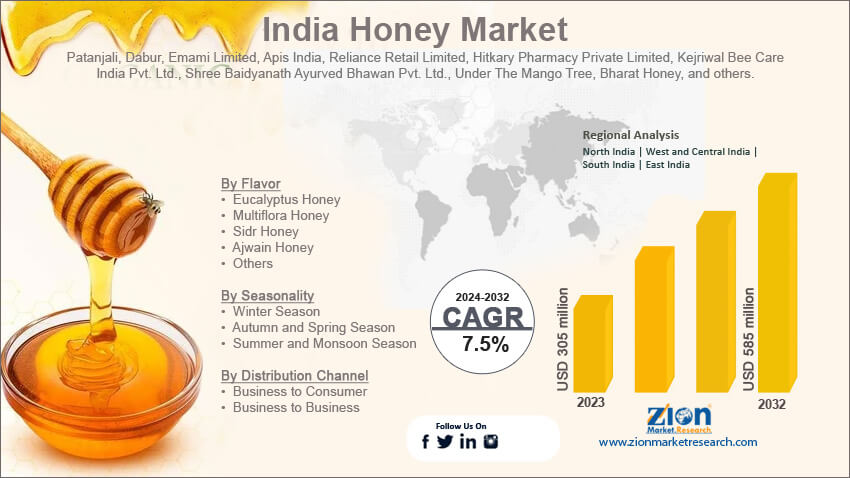

India Honey Market By Flavor (Eucalyptus Honey, Multiflora Honey, Sidr Honey, Ajwain Honey, and Others), By Seasonality (Winter Season, Autumn & Spring Season, and Summer & Monsoon Season), By Distribution Channel (Business to Consumer and Business to Business), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

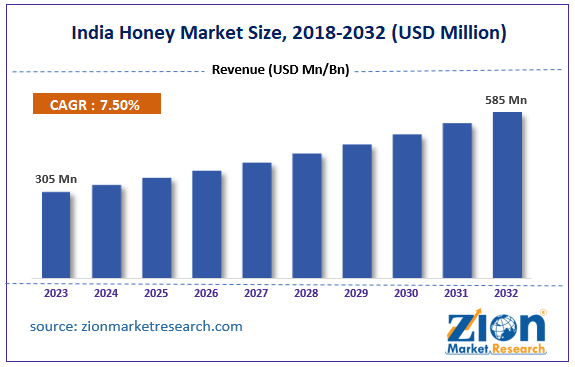

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 305 million | USD 585 million | 7.5% | 2023 |

India Honey Industry Prospective:

India honey market size was worth around USD 305 million in 2023 and is predicted to grow to around USD 585 million by 2032 with a compound annual growth rate (CAGR) of roughly 7.5% between 2024 and 2032.

India Honey Market: Overview

Honeybees employ naturally occurring sweet resources to manufacture honey, such as plant nectar, plant secretions, or the remains of plant-eating insects. Bees gather, break down, and combine these materials using specific enzymes before storing them in honeycombs to ripen. Trace enzymes, minerals, vitamins, and amino acids are all present in honey, which is mostly composed of carbs like fructose and glucose. It is employed in many conventional and contemporary medical applications and has therapeutic qualities in addition to being a common food and drink sweetener.

Key Insights

- As per the analysis shared by our research analyst, the India honey market is estimated to grow annually at a CAGR of around 7.5% over the forecast period (2024-2032).

- In terms of revenue, the India honey market size was valued at around USD 305 million in 2023 and is projected to reach USD 585 million, by 2032.

- The growing health and wellness trends are expected to propel the India honey market growth over the projected period.

- Based on the flavor, the multiflora honey segment is expected to dominate the market over the forecast period.

- Based on the seasonality, the autumn and spring season segment is expected to capture the largest market share over the forecast period.

- Based on the distribution channel, the business to consumer segment is expected to garner a significant revenue share over the forecast period.

- Based on the state, Maharashtra is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Honey Market: Growth Drivers

Increasing demand for healthier food options drives market growth

Chronic illnesses including diabetes, heart disease, and cancer are growing increasingly prevalent as a result of sedentary lifestyles, bad diets, and an aging community. Since many disorders can be prevented or managed, there is an increasing need for healthier food options. Because of its natural composition and potential health benefits, honey is also becoming a more and more popular healthier alternative to refined sugar and artificial sweeteners. Honey's low glycemic index and antioxidant properties, which promote the India honey market expansion, are also believed to have a range of benefits that can help various conditions.

India Honey Market: Restraints

Adulteration issues and high costs impede market growth

The India honey market is full of contaminated honey, which is honey blended with sugar syrups and other chemicals, undermining consumer confidence and preventing the market from expanding. A key concern is guaranteeing the quality and purity of the product. Beekeeping and the production of honey can entail high labor, equipment, and maintenance costs. These costs are frequently above the means of small-scale beekeepers, which hinders market expansion and supply overall.

India Honey Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity for India honey market growth over the projected period. For instance, in March 2023, the introduction of Bagrry's Organic Wild Honey was announced by Bagrry’s India, a morning cereal and health food company situated in New Delhi. The brand wants to improve the full experience of eating 100% natural organic honey by entering the luxury honey and preserves market by offering a healthy and nourishing alternative. The brand expands into new product categories with this launch. The product comes directly from organic farms that don't use any dangerous chemicals or pesticides, and it is supported by official organic certification from recognized regulatory organizations. Because of its multi-floral origin, it contains trace amounts of natural pollen grains, which have nutritious enzymes that aid in digestion and boost immunity. The product maintains its natural probiotic qualities, rich flavor, nutritional value, and dark color due to its lack of processing, filtering, or pasteurization.

India Honey Market: Challenges

The availability of substitutes poses a major challenge to market expansion

The market for honey may be restricted in its expansion by the availability of less expensive artificial sweeteners and sugar substitutes including molasses, corn syrup, raw sugar, brown sugar, and maple syrup. Instead of honey, consumers searching for cheaper options could choose these substitutes. Thus, these substitutes pose a major challenge for the India honey market expansion.

India Honey Market: Segmentation

India honey industry is segmented based on flavor, seasonality, distribution channel, and region.

Based on the flavor, the India honey market is bifurcated into eucalyptus honey, multiflora honey, sidr honey, ajwain honey, and others. The multiflora honey segment is expected to dominate the market over the forecast period. The nectar of different flowers and plants is used to make multiflora honey, which has a distinctive flavor and scent combination. Customers find it quite appealing because of its varied flavor profile and the idea that it is a more genuine and natural kind of honey. A variety of consumers find the multiflora variation appealing due to its unique and rich flavor. Additionally, the increasing inclination towards multiflora honey stems from its adaptability in the kitchen, as it can be used in a wide range of dishes, drinks, and traditional medicines, is a significant stimulus for growth. Moreover, successful marketing tactics used by honey firms are responsible for multiflora honey's domination. To draw customers, producers also emphasize the distinct flavor profile and the honey's natural origins.

Based on the seasonality, the India honey industry is segmented into winter season, autumn and spring season and summer and monsoon season. The autumn and spring season segment is expected to capture the largest market share over the forecast period. In India, the autumn season (September to November) is when honey production peaks. The abundance of nectar-rich blooms and the pleasant weather encourage bees to actively forage, which in turn increases demand. Sunflowers, eucalyptus, mustard, citrus trees, and mustard are just a few of the flowering plants that bees get nectar from. Fall's easy access to a wide range of nectar sources contributes to the production of a great deal of honey with distinct flavors and characteristics. Due to the higher honey production during this time of year, which raises the quantity accessible on the market, it is critical for both producers and suppliers of honey.

Based on the distribution channel, the India honey market is segmented into business to consumer and business to business. The business to consumer segment is expected to garner a significant revenue share over the forecast period. Direct sales of honey products to customers via a variety of retail channels are referred to as business-to-consumer (B2C) distribution. The B2C channel's expansion has also been greatly aided by the accessibility of supermarkets, hypermarkets, convenience stores, and general stores in India's metropolitan and semi-urban areas. Customers can buy honey products from these retail locations on an easy-to-access platform. Furthermore, a change in purchase patterns has resulted from the growing purchasing power of Indian consumers. The increased inclination among customers to buy honey for domestic and personal usage is driving up demand for the product through B2C channels.

India Honey Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Honey Market |

| Market Size in 2023 | USD 305 Million |

| Market Forecast in 2032 | USD 585 Million |

| Growth Rate | CAGR of 7.5% |

| Number of Pages | 216 |

| Key Companies Covered | Patanjali, Dabur, Emami Limited, Apis India, Reliance Retail Limited, Hitkary Pharmacy Private Limited, Kejriwal Bee Care India Pvt. Ltd., Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Under The Mango Tree, Bharat Honey, and others. |

| Segments Covered | By Flavor, By Seasonality, Distribution Channel, and By State |

| States Covered in India | Maharashtra, Tamil Nadu, Karnataka, Punjab, Rajasthan, and Uttar Pradesh |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Honey Market: State Analysis

Maharashtra is expected to dominate the market over the forecast period

Maharashtra is expected to dominate the India honey market over the forecast period. Maharashtra offers an abundant supply of nectar for the production of honey due to its wide variety of blooming plants. Beekeeping thrives in certain areas, such as the Western Ghats. Furthermore, the Maharashtra government's efforts to support beekeeping through financial aid, subsidies, and training programs have increased the state's output of honey. According to the NABARD report, the Maharashtra State Khadi and Village Industries Board and Gandhi Smruti Nilay Kendra are proposing to provide Rs. 70 crores for the development of a honey production center.

Also, the honey industry in Maharashtra has benefited greatly from the emergence of e-commerce platforms, which have made it possible for producers to access a wider consumer base outside of local marketplaces. Besides, Uttar Pradesh is expected to hold a prominent market share in the country. The UP's varied temperature and abundant floral diversity make for a great beekeeping setting that enables the production of honey all year round. In Saharanpur, for example, secondary sources state that the region produces an astounding 8,000–10,000 quintals of honey annually. In addition, there is a growing market for organic honey due to consumers who are concerned about their health and prefer natural, chemical-free products. In the UP, organic honey production is becoming more popular.

India Honey Market: Competitive Analysis

India honey market is dominated by players like:

- Patanjali

- Dabur

- Emami Limited

- Apis India

- Reliance Retail Limited

- Hitkary Pharmacy Private Limited

- Kejriwal Bee Care India Pvt. Ltd.

- Shree Baidyanath Ayurved Bhawan Pvt. Ltd.

- Under The Mango Tree

- Bharat Honey

India honey market is segmented as follows:

By Flavor

- Eucalyptus Honey

- Multiflora Honey

- Sidr Honey

- Ajwain Honey

- Others

By Seasonality

- Winter Season

- Autumn and Spring Season

- Summer and Monsoon Season

By Distribution Channel

- Business to Consumer

- Business to Business

By State

- Maharashtra

- Tamil Nadu

- Karnataka

- Punjab

- Rajasthan

- Uttar Pradesh

Table Of Content

Methodology

FrequentlyAsked Questions

Honeybees employ naturally occurring sweet resources to manufacture honey, such as plant nectar, plant secretions, or the remains of plant-eating insects. Bees gather, break down, and combine these materials using specific enzymes before storing them in honeycombs to ripen. Trace enzymes, minerals, vitamins, and amino acids are all present in honey, which is mostly composed of carbs like fructose and glucose. It is employed in many conventional and contemporary medical applications and has therapeutic qualities in addition to being a common food and drink sweetener.

The India honey market is being driven by several factors such as increasing demand for natural and organic products, growing health and wellness trends, increasing applications including food & beverages, pharmaceuticals, cosmetics and others, increasing government support, changing lifestyles and urbanization and the medicinal properties of honey.

According to the report, India honey market size was worth around USD 305 million in 2023 and is predicted to grow to around USD 585 million by 2032.

India's honey market is expected to grow at a CAGR of 7.5% during the forecast period.

India honey market growth is driven by Maharashtra. It is currently the nation's highest revenue-generating market due to the rising government initiatives.

India honey market is dominated by players like Patanjali, Dabur, Emami Limited, Apis India, Reliance Retail Limited, Hitkary Pharmacy Private Limited, Kejriwal Bee Care India Pvt. Ltd., Shree Baidyanath Ayurved Bhawan Pvt. Ltd., Under The Mango Tree and Bharat Honey among others.

India honey Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed