India Hospital Furniture Market Size, Share, Trends, Growth 2032

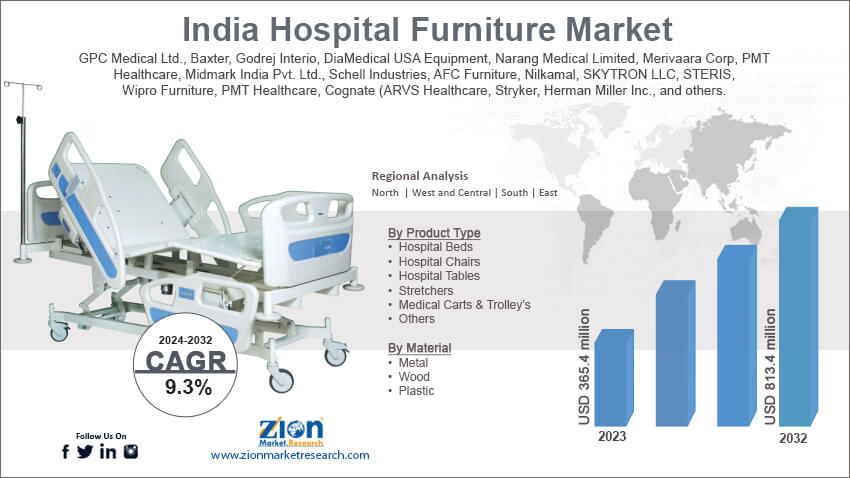

India Hospital Furniture Market By Product Type (Hospital Beds, Hospital Chairs, Hospital Tables, Stretchers, Medical Carts & Trolleys, and Others), By Material (Metal, Wood, and Plastic), By End-User (Government Hospital, Private Hospital, and Others), By Sales Channel (Online and Offline), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

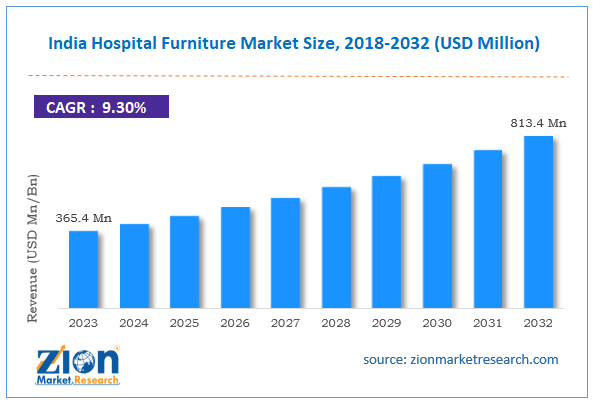

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 365.4 million | USD 813.4 million | 9.3% | 2023 |

India Hospital Furniture Industry Prospective:

India's hospital furniture market size was worth around USD 365.4 million in 2023 and is predicted to grow to around USD 813.4 million by 2032 with a compound annual growth rate (CAGR) of roughly 9.3% between 2024 and 2032.

India Hospital Furniture Market: Overview

Hospital furniture plays a vital role in providing medical care. To mention a few, it has beds, side screens, and carts. Since the beginning of time, modern furniture and medical devices have been integral parts of health care. One item that every hospital has to have is hospital furniture. The hospitals use cutting-edge furniture technology in all of their clinical environments since they are dedicated to ensuring patients feel safe and comfortable during their treatments. A patient's medical examination is an essential component of their diagnosis, and ICU hospital furnishings contribute to the critical care unit's safety. Thus, clinical furnishings are versatile and can be utilized in any medical facility. A vital component of any healthcare system is hospital furniture. Its design is crucial because it can make all the difference in the level of treatment patients receive while they are in the hospital.

Key Insights

- As per the analysis shared by our research analyst, India's hospital furniture market is estimated to grow annually at a CAGR of around 9.3% over the forecast period (2024-2032).

- In terms of revenue, the India hospital furniture market size was valued at around USD 365.4 million in 2023 and is projected to reach USD 813.4 million by 2032.

- The rising investment in healthcare infrastructure is expected to propel India hospital furniture market growth over the projected period.

- Based on product type, the hospital beds segment is expected to dominate the market over the forecast period.

- Based on the material, the metal segment is expected to hold the largest market share over the projected period.

- Based on the end-user, the private hospital segment is expected to capture a significant market share over the projected period.

- Based on the sales channel, the offline segment is expected to dominate the market over the analysis period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Hospital Furniture Market: Growth Drivers

The rising number of medical emergencies drives market growth

The main trend in the hospital furniture market in India is the increase in medical emergencies. Medical facilities are modernizing their emergency, critical care, acute care, and surgical facilities to offer improved services and cutting-edge equipment, such as motorized and modern hospital beds. For the treatment of medical emergencies, these facilities are necessary. To handle medical emergencies, hospitals and other emergency medical facilities are adopting preventative measures and stocking up on essential supplies. In addition, manual hospital beds are necessary for long-term care in hospitals and home care facilities, whereas semi-automatic beds are utilized in acute care facilities. To handle the growing number of medical emergencies, emergency departments are opening more frequently, which is driving up demand for hospital beds. The market participants and producers of these goods are raising their production levels in response to this demand, which is fueling the market's expansion in India for hospital furniture throughout the forecast period.

India Hospital Furniture Market: Restraints

High cost and lack of standardization impede market growth

Although there is a market for technologically sophisticated hospital furniture, the exorbitant price of these items can be a major deterrent, particularly for hospitals in remote locations and smaller healthcare facilities. Adoption may be discouraged by the upfront costs and ongoing maintenance. Furthermore, the lack of uniform standards for hospital furniture may result in variations in both quality and safety among various medical facilities. Because of this absence of standardization, inferior products that might not adhere to the essential safety and comfort criteria may be purchased. Thus, this is expected to hamper the India hospital furniture sector over the projected period.

India Hospital Furniture Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity to the India hospital furniture market over the projected period. For instance, in February 2023, one of the top producers of medical technology globally, Stryker, announced the release of the SmartMedic platform. Hospital ICU bed capacities are improved with the patient care platform SmartMedic. The goal of this solution is to assist medical staff in performing X-rays on patients inside the intensive care unit (ICU) without having to relocate them, monitor patient turns from nursing stations, and control changes in patient weight. The goal of SmartMedic is to minimize a patient's discomfort and offer superior care to them during their hospital stay, regardless of their level of acuity. The innovative platform can establish a wireless connection with nurse call systems, which can boost the efficiency and productivity of nursing personnel in providing care and perhaps lower hospital costs. Because SmartMedic is installable and works with any ICU bed, it is a useful solution for any facility. Reducing the discomfort that critically ill ICU patients can feel during weight measurement procedures or prolonged bedrest is one of the technology's main advantages.

India Hospital Furniture Market: Challenges

Limited healthcare budget poses a major challenge to market expansion

Many government hospitals and smaller private facilities have tight finances, even in the face of rising healthcare costs. This limits their capacity to spend money on long-lasting, high-quality hospital furniture, which frequently forces them to settle for less expensive but less sturdy alternatives. Therefore, the limited healthcare budget negatively impacts India hospital furniture market during the analysis period.

India Hospital Furniture Market: Segmentation

India's hospital furniture industry is segmented based on product type, material, end user, sales channel, and region.

Based on the product type, India's hospital furniture market is bifurcated into hospital beds, hospital chairs, hospital tables, stretchers, medical carts & trolleys, and others. The hospital beds segment is expected to dominate the market over the forecast period. The increased need for hospital beds as a result of the rising incidence of chronic diseases is what is driving the segment expansion. ICU beds, fowler beds, regular hospital beds, pediatric beds, maternity beds, and other types of beds are the different categories of hospital beds. The market expansion of this sector is also anticipated to be driven by the increased need for motorized and electrical beds from large private and public hospitals as a result of the growing number of patients in need of bariatric care and the aging population.

Based on material, India hospital furniture industry is segmented into metal, wood, and plastic. The metal segment is expected to hold the largest market share over the projected period. Excellent strength, comfort, and durability are offered by metal furniture. Over the projected period, rising usage of hospital furniture made of metal is anticipated to propel market expansion in this sector. Furthermore, certain metal-based beds, such as stainless steel, have antimicrobial qualities that are useful for operating rooms and medical equipment.

Based on end-user, India's hospital furniture market is segmented into government hospitals, private hospitals, and others. The private hospital segment is expected to capture a significant market share over the projected period. The country's growing number of private hospitals and the healthcare industry's growing privatization are to blame for the segment's expansion. There are 43,486 private hospitals, 1.18 million beds, 59,264 intensive care units, and 29,631 ventilators in India. The share of private infrastructure in India's overall health infrastructure is close to 62%.

Based on sales channels, India's hospital furniture industry is segmented into online and offline. The offline segment is expected to dominate the market over the analysis period. Hypermarkets and supermarkets, as well as specialty shops and furniture malls, are instances of offline sales channels. Because offline mode offers customized possibilities, quick delivery, sales staff support, and comprehensive installation assistance, consumers prefer it. Over the projected period, an internet sales channel is anticipated to increase at a considerable growth rate.

India Hospital Furniture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Hospital Furniture Market |

| Market Size in 2023 | 365.4 Mn |

| Market Forecast in 2032 | 813.4 Mn |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 214 |

| Key Companies Covered | GPC Medical Ltd., Baxter, Godrej Interio, DiaMedical USA Equipment, Narang Medical Limited, Merivaara Corp, PMT Healthcare, Midmark India Pvt. Ltd., Schell Industries, AFC Furniture, Nilkamal, SKYTRON LLC, STERIS, Wipro Furniture, PMT Healthcare, Cognate (ARVS Healthcare, Stryker, Herman Miller Inc., and others. |

| Segments Covered | By Product Type, By Material, By End User, By Sales Channel, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Hospital Furniture Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India hospital furniture market over the forecast period. In North India, there has been a significant investment in healthcare facilities, particularly in states like Delhi, Haryana, Punjab, and Uttar Pradesh. Due to the expansion and modernization of hospitals and clinics, there is a great demand for high-quality hospital furniture in this region. Delhi and other North Indian towns are major medical tourism hubs that attract tourists from both domestic and foreign travel destinations. The need for luxurious hospital furniture that meets international standards is rising and serves a wide spectrum of patient needs. The implementation of government healthcare schemes such as Ayushman Bharat has led to an increase in the number of public healthcare facilities in North India. This is driving up demand for hospital furniture, especially in public hospitals and healthcare centers.

India Hospital Furniture Market: Competitive Analysis

India's hospital furniture market is dominated by players like

- GPC Medical Ltd.

- Baxter

- Godrej Interio

- DiaMedical USA Equipment

- Narang Medical Limited

- Merivaara Corp

- PMT Healthcare

- Midmark India Pvt. Ltd.

- Schell Industries

- AFC Furniture

- Nilkamal

- SKYTRON LLC

- STERIS

- Wipro Furniture

- PMT Healthcare

- Cognate (ARVS Healthcare

- Stryker and Herman Miller Inc.

- among others.

India's hospital furniture market is segmented as follows:

By Product Type

- Hospital Beds

- Hospital Chairs

- Hospital Tables

- Stretchers

- Medical Carts & Trolley’s

- Others

By Material

- Metal

- Wood

- Plastic

By End User

- Government Hospital

- Private Hospital

- Others

By Sales Channel

- Online

- Offline

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Hospital furniture plays a vital role in providing medical care. To mention a few, it has beds, side screens, and carts. Since the beginning of time, modern furniture and medical devices have been integral parts of health care. One item that every hospital has to have is hospital furniture. The hospitals use cutting-edge furniture technology in all of their clinical environments since they are dedicated to making sure that patients feel safe and comfortable during their treatments.

The aging population, technological developments in the hospital furniture sector, regulatory compliance, and shifts in the healthcare delivery landscape are the main factors driving the growth of the hospital furniture market in India. The industry has been driven to continuously innovate due to these motivations, which have produced a wide range of specialized and patient-centric hospital furniture alternatives that are intended to fulfill the changing needs of patients and healthcare providers.

According to the report, India's hospital furniture market size was worth around USD 365.4 million in 2023 and is predicted to grow to around USD 813.4 million by 2032.

India's hospital furniture market is expected to grow at a CAGR of 9.3% during the forecast period.

India's hospital furniture market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising government initiatives.

India's hospital furniture market is dominated by players like GPC Medical Ltd., Baxter, Godrej Interio, DiaMedical USA Equipment, Narang Medical Limited, Merivaara Corp, PMT Healthcare, Midmark India Pvt. Ltd., Schell Industries, AFC Furniture, Nilkamal, SKYTRON LLC, STERIS, Wipro Furniture, PMT Healthcare, Cognate (ARVS Healthcare, Stryker and Herman Miller Inc. among others.

India's hospital furniture market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed