India Instant Coffee Market Size, Share, Industry Analysis, Trends, Growth, 2032

India Instant Coffee Market By Packaging (Jar, Pouch, Sachet, and Others), By Product Type (Spray-Dried and Freeze-Dried), By Distribution Channel (Business-To-Business, Supermarkets and Hypermarkets, Convenience Stores, Online, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

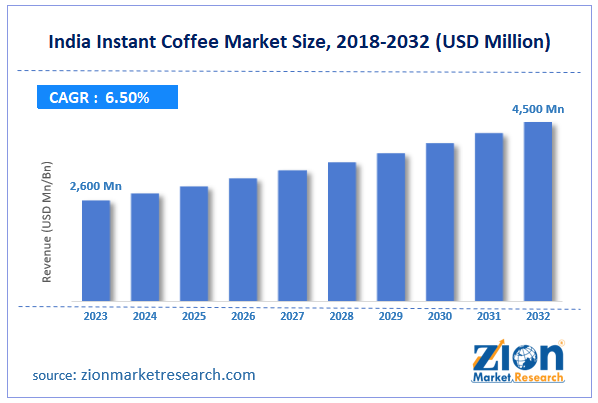

| USD 2,600 Million | USD 4,500 Million | 6.5% | 2023 |

India Instant Coffee Industry Prospective:

India's instant coffee market size was worth around USD 2,600 million in 2023 and is predicted to grow to around USD 4,500 million by 2032 with a compound annual growth rate (CAGR) of roughly 6.5% between 2024 and 2032.

India Instant Coffee Market: Overview

Consumers can easily prepare hot coffee by adding hot water or milk to instant coffee powder, which is a beverage made from brewed coffee beans. The same beans are ground and blended to make instant coffee as for normal coffee, but the finished result is often coarser. Currently, several factors are driving the demand for instant coffee in India. Owing to rising urbanization and shifting lifestyles, instant coffee offers consumers a quick and easy way to make hot coffee anyplace. It is also quite simple for anyone to cook. Since all the consumer needs to prepare is a cup, some boiling water, and a stirrer. The demand for instant coffee in India is also driven by other causes, such as changing eating habits, its health advantages, the growing café culture in India, rising incomes, and increased demand from the institutional sector.

Key Insights

- As per the analysis shared by our research analyst, India's instant coffee market is estimated to grow annually at a CAGR of around 6.5% over the forecast period (2024-2032).

- In terms of revenue, the India instant coffee market size was valued at around USD 2,600 million in 2023 and is projected to reach USD 4,500 million by 2032.

- The rising disposable income is expected to propel India instant coffee market growth over the projected period.

- Based on the packaging, the pouch segment is expected to dominate the market over the forecast period.

- Based on the product type, the spray-dried segment is expected to hold the largest market share over the projected period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Instant Coffee Market: Growth Drivers

Rising focus on health and wellness drives market growth

The growing customer concern about their health and increased focus on wellness and health is driving growth in the instant coffee market in India. Coffee products with functional ingredients like vitamins and minerals are in high demand since they provide extra health advantages. Because of their health advantages, there is an increased demand for coffee products that contain substances like guarana, ginseng, and green tea extract. In addition, because green coffee speeds up metabolism and helps with weight management, the number of obese and diabetic cases among Indians is on the rise, which is driving up demand for the beverage.

India Instant Coffee Market: Restraints

Preference for traditional brewed coffee and tea impedes market growth

Tea continues to be the most widely consumed hot beverage in India and has strong cultural significance. The country's fondness for tea, particularly in the north and east, can provide a serious obstacle to the expansion of India instant coffee industry. Furthermore, freshly made filter coffee is strongly preferred in South India, where coffee consumption is higher. The conventional brewing technique is preferred over instant coffee, which is frequently thought to be of lower quality and taste. Thus, this is expected to impede instant coffee market growth in India over the projected period.

India Instant Coffee Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launch is expected to offer a lucrative opportunity to the India Instant Coffee market over the projected period. For instance, in October 2022, this International Coffee Day, Bevzilla, a D2C beverage company and the creator of India's first instant coffee cubes, increased its product line with the introduction of Turkish Hazelnut, a flavor that is very delightful for coffee enthusiasts. Bevzilla remains committed to providing its customers with smooth, tasty, nutritious, and foamy coffee, even with this latest innovation. The new Turkish Hazelnut Coffee will surely be the individual favorite beverage on International Coffee Day, offering its patrons an exceptional coffee experience and the ideal balance of warm hazelnut and Turkish flavor. The instant coffee powder has no additional preservatives and is produced entirely from pure Arabica beans.

India Instant Coffee Market: Challenges

Price sensitivity poses a major challenge to market expansion

When compared to conventional tea or even brewed coffee, instant coffee can be more expensive per serving. Its appeal may be limited in a price-sensitive country like India, especially to lower-class consumers who value affordability over convenience. Furthermore, in rural areas where disposable income is smaller, and the emphasis is on more affordable beverages like tea, the relatively greater cost of instant coffee products may also limit their adoption. Therefore, price sensitivity is a major challenging factor for India instant coffee market during the analysis period.

India Instant Coffee Market: Segmentation

India's instant coffee industry is segmented based on packaging, product type, distribution channel, and region.

Based on the packaging, India instant coffee market is bifurcated into jar, pouch, sachet, and others. The pouch segment is expected to dominate the market over the forecast period. A pouch's flexible construction, such as that of plastic or foil, makes it lightweight and small. The tiny design of the bag also means that it takes up less room when being transported, contributing to the positive prognosis for the instant coffee business. Packaging in jars or cans is more expensive to produce and ship than a pouch. The resealable feature in pouches ensures the coffee's freshness and aroma. Furthermore, the development of durable and sustainable pouch materials is being facilitated by advancements in packaging technologies.

Based on product type, India instant coffee industry is segmented into spray-dried and freeze-dried. The spray-dried segment is expected to hold the largest market share over the projected period. Because of its natural processing, spray-dried instant coffee is becoming more and more popular among health-conscious consumers. Spray drying is a clean method because it is a physical process that doesn't include any chemicals. This is in line with consumer demand for natural and minimally processed foods. In addition, businesses are investing in cutting-edge spray-drying technologies that allow them to precisely regulate the size and shape of coffee particles, which is driving projected growth for the India instant coffee market.

Based on distribution channel, India's instant coffee market is segmented into business-to-business, supermarkets and hypermarkets, convenience stores, online, and others.

India Instant Coffee Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Instant Coffee Market |

| Market Size in 2023 | 2,600 Mn |

| Market Forecast in 2032 | 4,500 Mn |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 213 |

| Key Companies Covered | Tata Consumer Products Limited, Nestle India Limited, CCL Products (India) Limited, Hindustan Unilever Limited, The Coca-Cola Company (Georgia Coffee), AVT Natural Products Limited, BRU Coffee, Madhu Jayanti International Limited (M.J.IL), Leo Coffee, Fresh & Honest Coffee Limited (South Indian Beverages Pvt. Ltd.), TGL Co., Sunbean Beaten Caffe (ITC Limited), Sri Narasu’s Coffee Company Limited, ITC Limited, Wagh Bakri Tea Group, and others. |

| Segments Covered | By Packaging, By Product Type, By Distribution Channel, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Instant Coffee Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India instant coffee market over the forecast period. North India is home to several fast-urbanizing cities, including Noida, Gurgaon, and Delhi. The need for quick and easy beverage options, like instant coffee, is rising as more people move into cities. The desire for instant coffee, which provides a quick and simple caffeine dose without the need for complex preparation, is being driven by the fast-paced lifestyle in urban areas. Moreover, coffee consumption has increased as a result of exposure to Western culture and worldwide trends, especially in urban areas. This cultural shift is helping instant coffee, which is becoming more and more popular around the world. More individuals have been exposed to coffee as a result of the growth of coffee chains like Starbucks, Barista, and Café Coffee Day in North India. This has generally increased the consumption of coffee, including instant variants. Thus, this is expected to drive the India instant coffee market over the projected period.

India Instant Coffee Market: Competitive Analysis

India's instant coffee market is dominated by players like:

- Tata Consumer Products Limited

- Nestle India Limited

- CCL Products (India) Limited

- Hindustan Unilever Limited

- The Coca-Cola Company (Georgia Coffee)

- AVT Natural Products Limited

- BRU Coffee

- Madhu Jayanti International Limited (M.J.IL)

- Leo Coffee

- Fresh & Honest Coffee Limited (South Indian Beverages Pvt. Ltd.)

- TGL Co.

- Sunbean Beaten Caffe (ITC Limited)

- Sri Narasu’s Coffee Company Limited

- ITC Limited

- Wagh Bakri Tea Group

India's instant coffee market is segmented as follows:

By Packaging

- Jar

- Pouch

- Sachet

- Others

By Product Type

- Spray Dried

- Freeze Dried

By Distribution Channel

- Business-To-Business

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Consumers can easily prepare hot coffee by adding hot water or milk to instant coffee powder, which is a beverage made from brewed coffee beans. The same beans are ground and blended to make instant coffee as for normal coffee, but the finished result is often coarser.

Several factors are driving the demand for instant coffee in India. Owing to rising urbanization and shifting lifestyles, instant coffee offers consumers a quick and easy way to make hot coffee anyplace. It is also quite simple for anyone to cook. Since all the consumer needs to prepare is a cup, some boiling water, and a stirrer. The demand for instant coffee in India is also driven by other causes, such as changing eating habits, its health advantages, the growing café culture in India, rising incomes, and increased demand from the institutional sector.

According to the report, India's instant coffee market size was worth around USD 2,600 million in 2023 and is predicted to grow to around USD 4,500 million by 2032.

India's instant coffee market is expected to grow at a CAGR of 6.5% during the forecast period.

India's instant coffee market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising urbanization.

India's instant coffee market is dominated by players like Tata Consumer Products Limited, Nestle India Limited, CCL Products (India) Limited, Hindustan Unilever Limited, The Coca-Cola Company (Georgia Coffee), AVT Natural Products Limited, BRU Coffee, Madhu Jayanti International Limited (M.J.IL), Leo Coffee, Fresh & Honest Coffee Limited (South Indian Beverages Pvt. Ltd.), TGL Co., Sunbean Beaten Caffe (ITC Limited), Sri Narasu’s Coffee Company Limited, ITC Limited and Wagh Bakri Tea Group among others.

India's instant coffee market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed