India Organic Fertilizer Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

India Organic Fertilizer Market By Source (Plant, Animal, and Mineral), By Form (Dry and Liquid), By Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables, and Others), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

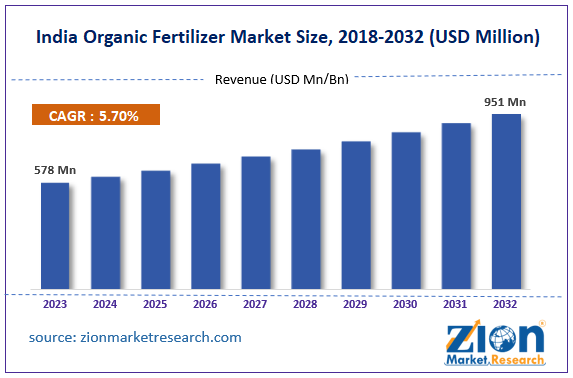

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 578 Million | USD 951 Million | 5.7% | 2023 |

India Organic Fertilizer Industry Prospective:

India organic fertilizer market size was worth around USD 578 million in 2023 and is predicted to grow to around USD 951 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.7% between 2024 and 2032

India Organic Fertilizer Market: Overview

Natural resources, including cow dung, earthworm castings, animal waste, and agricultural waste, are used to make organic fertilizer. These chemicals help improve soil fertility and plant growth because of their high concentrations of organic matter and minerals. One of the main advantages of organic fertilizers is their capacity to improve soil water retention. Consequently, they guarantee that plants receive water even during dry spells and help retain soil moisture. In addition to improving soil structure and increasing soil aeration for plant roots, organic fertilizers loosen the soil and convert it into gaseous forms. Because of the better soil structure, toxic salts can't build up and degrade the soil's quality.

Key Insights

- As per the analysis shared by our research analyst, India's organic fertilizer market is estimated to grow annually at a CAGR of around 5.7% over the forecast period (2024-2032).

- In terms of revenue, the India organic fertilizer market size was valued at around USD 578 million in 2023 and is projected to reach USD 951 million by 2032.

- The rising awareness associated with the benefits of organic fertilizer is expected to propel India organic fertilizer market growth over the projected period.

- Based on the source, the animal segment is expected to dominate the market during the forecast period.

- Based on its form, the dry segment is expected to hold a significant market share over the forecast period.

- Based on the crop type, the fruits & vegetables segment is expected to hold the largest market share during the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Organic Fertilizer Market: Growth Drivers

Rising demand from the agriculture sector drives market growth

Natural materials are combined to create organic fertilizers, which are applied or sprayed on crops to boost yield. These are the organic fertilizers that come from living things like plants and animals. Organic fertilizers are excellent because they feed the soil with carbonic molecules, which are necessary for plant growth. If organic fertilizers are applied, the amount of organic matter in plants increases as well. This encourages the growth of microorganisms and modifies the chemical and physical composition of the soil. The need for organic fertilizers is being driven by the limited amount of arable land available and the need for high-quality yield production on farms. In both home gardening and modern agriculture, organic fertilizers are essential. For instance, India shipped 455 cargoes of organic fertilizer between March 2023 and February 2024 (TTM), according to Volza's data on exports from India. Thus, the aforementioned statistics are expected to propel the growth of India organic fertilizer market over the forecast period.

India Organic Fertilizer Market: Restraints

Availability of substitutes impedes market growth

India's organic fertilizer industry will grow more slowly if there are potential replacement products, such as chemical or synthetic fertilizers, available in a particular market sector. Buyers will attempt to negotiate cheaper costs for better quality and service, and the cost of organic fertilizer equipment will be open to public scrutiny. The specifications and rivalry from rivals will all result in the organic fertilizer equipment seller losing money. Potential buyers and suppliers will gradually grow less interested in organic fertilizer equipment as the cost becomes clearer. Consequently, organic fertilizer growth is greatly aided. The high expense of this fertilizer has prevented large-scale agricultural production, like the production of commodity crops.

India Organic Fertilizer Market: Opportunities

Rising collaboration among the key players offers an attractive opportunity for market growth

The rising collaboration among the key players is expected to offer a lucrative opportunity to India organic fertilizer industry over the projected period. For instance, in June 2022, Leading international specialty minerals supplier ICL said it had extended its supply of polysulphate to India Potash Limited (IPL) through 2026, with an option to renew. One million metric tons is the total amount for the five-year duration, with amounts rising each year of the deal. Every shipment shall have a minimum of 25,000 tons and be evenly spaced throughout the year. IPL and ICL will periodically agree on rates and terms of payment. It is anticipated that the availability of Polysulphate will support the Government of India's organic agriculture initiative. Unlike blended or compound fertilizers, polysulphate is available in its natural state and is mined, crushed, screened, and bagged without the need for extra chemical separation or other industrial processes. It also has the lowest carbon footprint on the market worldwide. Due to its four essential plant nutrients—sulfur, potassium, magnesium, and calcium—which are continuously available to plants throughout the crop cycle, polysulphate provides an affordable solution to crop nutrition.

India Organic Fertilizer Market: Challenges

The high cost of organic fertilizer poses a major challenge to market expansion

The methods required to source, compost, and process organic materials result in the higher production costs of organic fertilizers compared to chemical fertilizers. Since organic fertilizers are more expensive to produce, especially for small and marginal farms, the expense of production is passed on to the farmers. As compared to chemical fertilizers that are mass-produced, the cost per unit of organic fertilizer in India is greater because many producers are small-scale operators in a still-developing industry. Therefore, the high cost of organic fertilizer might be posing a major challenge to India organic fertilizer market.

India Organic Fertilizer Market: Segmentation

India organic fertilizer industry is segmented based on source, form, crop type, and region.

Based on the source, India organic fertilizer market is bifurcated into plant, animal, and mineral. The animal segment is expected to dominate the market during the forecast period. The use of organic fertilizers is encouraged by the Indian government's support of organic farming through several programs and incentives. These programs promote animal-based organic fertilizers by increasing their market share and revenue. As farmers look for alternatives to chemical fertilizers, policies and initiatives supporting organic farming directly contribute to the expansion of the organic fertilizer market, including the animal-sourced component. In addition, India is exporting a growing amount of organic goods, such as fertilizers. Revenue growth is influenced by the demand for premium organic fertilizers made from animal sources in global markets, especially in areas where organic farming is expanding rapidly.

Based on form, India organic fertilizer industry is segmented into dry and liquid. The dry segment is expected to hold a significant market share over the forecast period. Dry organic fertilizers are solid fertilizers made up of a combination of different nutrients and a single substance, like rock phosphate. Examples of dry organic fertilizers are granular and powdered organic fertilizers. The key factor driving this segment's market expansion is the increasing use of dry fertilizers in agricultural applications as well as garden and lawn applications.

Based on crop type, India organic fertilizer market is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others. The fruits & vegetables segment is expected to hold the largest market share during the forecast period. In India, the use of organic produce is growing in popularity as people become more conscious of its health benefits and concern about the harmful effects of chemical residues. The need for organic fertilizers is rising as a result of farmers adopting organic farming methods. Other continents, especially North America and Europe, have a substantial market for Indian organic fruits and vegetables. Organic fertilizers are in high demand because this firm must meet export standards for organic certification.

India Organic Fertilizer Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Organic Fertilizer Market |

| Market Size in 2023 | 578 Mn |

| Market Forecast in 2032 | 951 Mn |

| Growth Rate | CAGR of 5.7% |

| Number of Pages | 212 |

| Key Companies Covered | Deepak Fertilisers & Petrochemicals Corp. Ltd, Amruth Organic Fertilizers, Coromandel International Ltd, Chaitanya Agrochemicals, Eastern Organic Fertilizer Pvt. Limited, Madras Fertilizers Limited, Krishna Agro Bio Products, GrowTech Agri Science Private Limited, Gujarat State Fertilizers & Chemicals Ltd, Gujarat Narmada Valley Fertilizers & Chemicals Ltd, Swaroop Agrochemical Industries, NM India Biotech, Southern Petrochemical Industries Corp. Ltd, Simbhaoli Sugars Inc., Prabhat Agri Mangalore Chemicals and Fertilizers Limited, Rallis India Ltd., and others. |

| Segments Covered | By Source, By Form, By Crop Type, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Organic Fertilizer Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India organic fertilizer market over the forecast period. North India, especially the states of Punjab, Haryana, Uttar Pradesh, and Uttarakhand, is well-known for its rich soil and intensive farming methods. Fertilizers, especially organic ones, are desperately needed in this area because so many fruits, vegetables, and food grains are grown there. Many different types of crops are grown in the area, including high-value commodities like sugarcane, fruits, and vegetables, as well as staples like wheat and rice. Organic fertilizers can be widely used due to the variable cropping pattern, particularly to improve crop quality and soil health. Furthermore, organic farming provides farmers in North India with long-term advantages like increased soil fertility, less reliance on chemical inputs, and enhanced crop resilience. These advantages are beginning to be recognized by more people. The demand for organic fertilizers is rising.

India Organic Fertilizer Market: Competitive Analysis

India's organic fertilizer market is dominated by players like:

- Deepak Fertilisers & Petrochemicals Corp. Ltd

- Amruth Organic Fertilizers

- Coromandel International Ltd

- Chaitanya Agrochemicals

- Eastern Organic Fertilizer Pvt. Limited

- Madras Fertilizers Limited

- Krishna Agro Bio Products

- GrowTech Agri Science Private Limited

- Gujarat State Fertilizers & Chemicals Ltd

- Gujarat Narmada Valley Fertilizers & Chemicals Ltd

- Swaroop Agrochemical Industries

- NM India Biotech

- Southern Petrochemical Industries Corp. Ltd

- Simbhaoli Sugars Inc.

- Prabhat Agri Mangalore Chemicals and Fertilizers Limited

- Rallis India Ltd.

India's organic fertilizer market is segmented as follows:

By Source

- Plant

- Animal

- Mineral

By Form

- Dry

- Liquid

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Natural resources including cow dung, earthworm castings, animal waste, and agricultural waste are used to make organic fertilizer. These chemicals help improve soil fertility and plant growth because of their high concentrations of organic matter and minerals. One of the main advantages of organic fertilizers is their capacity to improve soil water retention. Consequently, they guarantee that plants receive water even during dry spells and help retain soil moisture. In addition to improving soil structure and increasing soil aeration for plant roots, organic fertilizers loosen the soil and convert it into gaseous forms. Because of the better soil structure, toxic salts can't build up and degrade the soil's quality.

The growing public awareness of the harmful effects of synthetic chemicals on both individuals and the environment is the driving force behind India organic fertilizer industry. Additionally, as more people turn to organic food, there is a growing demand for the product, which will increase the need for organic agriculture methods in India.

According to the report, India's organic fertilizer market size was worth around USD 578 million in 2023 and is predicted to grow to around USD 951 million by 2032.

India's organic fertilizer market is expected to grow at a CAGR of 5.7% during the forecast period.

India's organic fertilizer market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising area of organic farming.

India's organic fertilizer market is dominated by players like Deepak Fertilisers & Petrochemicals Corp. Ltd, Amruth Organic Fertilizers, Coromandel International Ltd, Chaitanya Agrochemicals, Eastern Organic Fertilizer Pvt. Limited, Madras Fertilizers Limited, Krishna Agro Bio Products, GrowTech Agri Science Private Limited, Gujarat State Fertilizers & Chemicals Ltd, Gujarat Narmada Valley Fertilizers & Chemicals Ltd, Swaroop Agrochemical Industries, NM India Biotech, Southern Petrochemical Industries Corp. Ltd, Simbhaoli Sugars Inc., Prabhat Agri Mangalore Chemicals and Fertilizers Limited and Rallis India Ltd. among others.

India's organic fertilizer market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed