India Pan Masala Market Trend, Share, Growth, Size, Analysis and Forecast 2032

India Pan Masala Market By Type (Plain Pan Masala, Pan Masala with Tobacco, Flavored Pan Masala and Others), By Price (Premium and Non-Premium), By Packaging (Cans, Pouch and Others), and By State - Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

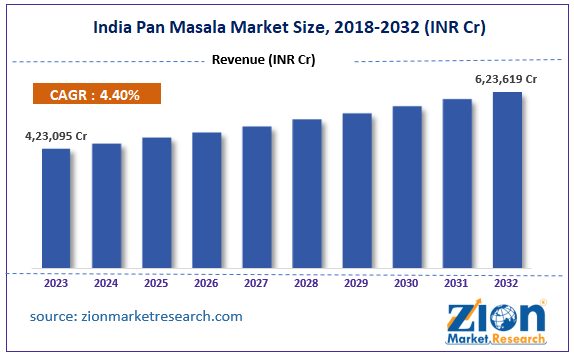

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| INR 4,23,095 crore | INR 6,23,619 crore | 4.4% | 2023 |

India Pan Masala Industry Prospective:

India pan masala market size was worth around INR 4,23,095 crore in 2023 and is predicted to grow to around INR 6,23,619 crore by 2032 with a compound annual growth rate (CAGR) of roughly 4.4% between 2024 and 2032.

India Pan Masala Market: Overview

A classic chewable tobacco product from India, pan masala is made with areca nut, catechu, slaked lime, sweet or savory flavorings, and a variety of fragrant spices. A tiny amount is usually placed in the mouth, where it can be chewed or sucked on to release tastes and induce salivation. After meals or on social occasions, pan masala is frequently served as a cool and fragrant mouth refresher. It is important to acknowledge that the ingestion of pan masala, particularly those that contain tobacco or areca nut, has been related to several health hazards and is advised against by health authorities owing to its possible associations with addiction and dental health complications.

India Pan Masala market is being driven by several factors including rising disposable income, growing product launches, changing lifestyles, Investment by manufacturers in marketing, product innovation and others.

Key Insights

- As per the analysis shared by our research analyst, the India Pan Masala market is estimated to grow annually at a CAGR of around 4.4% over the forecast period (2024-2032).

- In terms of revenue, India Pan Masala market size was valued at around INR 423095 crore in 2023 and is projected to reach INR 623619 crore, by 2032.

- The growing disposable income of the population is expected to propel the market growth over the projected period.

- Based on the type, the Plain Pan Masala segment is expected to dominate the market over the forecast period.

- Based on the price, the non-premium segment is expected to capture the largest market share over the forecast period.

- Based on the packaging, the pouch segment is expected to capture a significant market share during the forecast period.

- Based on the state, Madhya Pradesh is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Pan Masala Market: Growth Drivers

Changing lifestyles and rising disposable income drive market growth

Convenience and indulgence have become more and more popular among Indian consumers as their lives change. People are more interested in quick-fix and fun things as disposable income grows. With its abundance of flavour and convenient availability, pan masala perfectly suits these shifting consumer trends. For people who need a fast pick-me-up amid their hectic schedules or social events, it offers a handy and refreshing solution.

Furthermore, as customers' wealth has grown, so too has their purchasing power, giving them the freedom to try out new goods, like different kinds of pan masala. The pan masala market in India has been steadily growing due in significant measure to the confluence of evolving consumer spending patterns and growing spending power.

India Pan Masala Market: Restraints

Health issues on consuming pan masala impeding the market growth

The high risk of various health issues is expected to be a major restraining factor for the market growth during the forecast period. According to the surgeons, the risk of cancer increases if it is used with other harmful habits like smoking and drinking. Animal studies have shown that pan masala leads to tumors of the lungs, stomach, liver, testes and skin. It damages the liver and disturbs the metabolism of fats and carbohydrates. It damages kidneys, testes and even causes abnormalities in sperm. The appearance of withdrawal symptoms after 2-3 hours of abstinence in regular users shows the highly addictive nature of pan masala.

India Pan Masala Market: Opportunities

The growing cultural significance of pan masala offers an attractive opportunity for market growth

In India, pan masala has rich cultural importance steeped in long-standing traditions and rituals. It is more than simply a commodity; it is a necessary component of celebrations, religious rituals, and social interactions. As a show of respect and hospitality, serving pan masala to visitors strengthens cultural values and promotes social ties.

Pan masala usage has been down through the centuries and has grown to be an integral aspect of many communities' cultures and ways of life. Because people continue to identify pan masala with special memories, communal experiences, and customs, its cultural significance fuels the product's demand and makes it a highly sought-after commodity in the nation.

India Pan Masala Market: Challenges

Competition from alternatives poses a major challenge to market expansion

Alternative mouth fresheners and digestion aids, such as chewing gum, mints, and natural mouth fresheners like fennel seeds, compete with the pan masala business. The market share of pan masala products is being challenged by these substitutes, which customers view as healthier options.

India Pan Masala Market: Segmentation

India Pan Masala industry is segmented based on Type, Price, Packaging and region.

Based on the type, India Pan Masala market is bifurcated into Plain Pan Masala, Pan Masala with Tobacco, Flavored Pan Masala and Others. The Plain Pan Masala segment is expected to dominate the market over the forecast period. Plain pan masala is frequently chosen by users who want the refreshing and digestive characteristics of pan masala without the possibly negative consequences of tobacco use. Plain pan masala is commonly consumed after meals as a mouthwash and digestive help. It is popular with a diverse spectrum of people, including those of different ages and ethnic backgrounds. Thereby, driving the segment expansion.

Based on the price, the India Pan Masala industry is segmented into Premium and Non-Premium. The non-premium segment is expected to capture the largest market share over the forecast period. Non-premium pan masala products appeal to a diverse range of consumers, including those on a tight budget. They are typically supplied in smaller sachets or packages at reduced prices, making them more affordable to a wider range of people, including rural customers and urban migrants. Thus, propelling the segment growth.

Based on the packaging, the India Pan Masala market is segmented into Cans, Pouches and Others. The pouch segment is expected to capture a significant market share during the forecast period. Pouches are lightweight and portable, making them ideal for customers who want to enjoy pan masala on the move. Pouches are perfect for fitting into pockets or bags due to their tiny size. Furthermore, pouch packaging is generally inexpensive, allowing manufacturers to sell pan masala goods at competitive prices. This makes products available to a diverse spectrum of customers, including those with minimal disposable means.

India Pan Masala Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Pan Masala Market |

| Market Size in 2023 | INR 4,23,095 Cr |

| Market Forecast in 2032 | INR 6,23,619 Cr |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 221 |

| Key Companies Covered | DS Group, Vimal Pan Masala, Pan Parag, Pan Bahar Products Private Limited, Red Rose Group of Companies, Dharampal Satyapal Limited, Shikhar Group, and others. |

| Segments Covered | By Type, By Price, By Packaging, and By State |

| Regions/States Covered in India | Maharashtra, Uttar Pradesh, Rajasthan, Madhya Pradesh, and Delhi |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

State Analysis

Madhya Pradesh is expected to dominate the market over the forecast period

Madhya Pradesh is expected to dominate the market over the forecast period. The GATS-2 India Report shows that 28.1% of individuals in the state use smokeless tobacco. The majority of pan masala consumers are from lower and middle-income socioeconomic groups, primarily daily wage earners. The MGNREGA Act's budgetary allocation to the state has grown, resulting in a large increase in the number of working days for men and women. This increased people's discretionary income and created novel opportunities for the pan masala sector. Besides, Uttar Pradesh is expected to capture a prominent market share during the projected period. Uttar Pradesh's big and diversified population provides a significant market base for pan masala goods.

Pan masala consumption is widespread across demographics, encompassing urban and rural locations, as well as among individuals of all ages and socioeconomic situations. For instance, according to the data published by the National Institutes of Health, in a survey in Uttar Pradesh, 10.6% of urban and 7.9% of rural men (>10 years) reported using gutkha or tobacco pan masala (80% of users <40 years), whereas less than 4% used pan masala without tobacco. Thus, the aforementioned stats are driving the market growth in the state.

India Pan Masala Market: Competitive Analysis

India Pan Masala market is dominated by players like:

- DS Group

- Vimal Pan Masala

- Pan Parag

- Pan Bahar Products Private Limited

- Red Rose Group of Companies

- Dharampal Satyapal Limited

- Shikhar Group

India Pan Masala market is segmented as follows:

By Type

- Plain Pan Masala

- Pan Masala with Tobacco

- Flavored Pan Masala

- Others

By Price

- Premium

- Non-Premium

By Packaging

- Cans

- Pouch

- Others

By State

- Maharashtra

- Uttar Pradesh

- Rajasthan

- Madhya Pradesh

- Delhi

- Others

Table Of Content

Methodology

FrequentlyAsked Questions

A classic chewable tobacco product from India, pan masala is made with areca nut, catechu, slaked lime, sweet or savory flavorings, and a variety of fragrant spices. A tiny amount is usually placed in the mouth, where it can be chewed or sucked on to release tastes and induce salivation. After meals or on social occasions, pan masala is frequently served as a cool and fragrant mouth refresher.

India Pan Masala market is being driven by several factors including rising disposable income, growing product launches, changing lifestyles, Investment by manufacturers in marketing, product innovation and others.

According to the report, India's Pan Masala market size was worth around INR 423095 crore in 2023 and is predicted to grow to around INR 623619 crore by 2032.

India's Pan Masala market is expected to grow at a CAGR of 4.4% during the forecast period.

India Pan Masala market growth is driven by Madhya Pradesh. It is currently the nation's highest revenue-generating market due to the growing disposable income.

India Pan Masala market is dominated by players like DS Group, Vimal Pan Masala, Pan Parag, Pan Bahar Products Private Limited, Red Rose Group of Companies, Dharampal Satyapal Limited and Shikhar Group among others.

India Pan Masala Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed