India Pharmaceutical Market Size, Share, Trends, Growth and Forecast 2032

India Pharmaceutical Market By Type (Pharmaceutical Drugs and Biologics), By Nature (Organic and Conventional), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

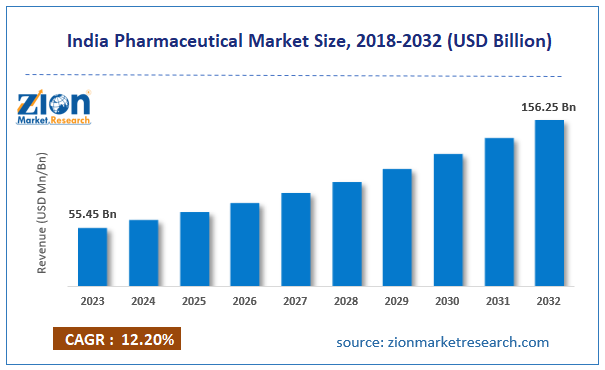

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 55.45 Billion | USD 156.25 Billion | 12.2% | 2023 |

India Pharmaceutical Industry Perspective:

India pharmaceutical market size was worth around USD 55.45 billion in 2023 and is predicted to grow to around USD 156.25 billion by 2032 with a compound annual growth rate (CAGR) of roughly 12.2% between 2024 and 2032.

India Pharmaceutical Market: Overview

Pharmaceuticals are goods that are discovered, developed, produced, and marketed for use as drugs. These drugs work by being administered to patients or self-administered by them, with the intention of curing and/or preventing disease (as well as possibly alleviating symptoms of illness and/or injury). Pharmaceutical firms can deal with "generic" drugs and medical equipment that don't include intellectual property, "brand" materials that are primarily associated with the history of a specific company, or both in different situations. Entire financial processes, including the patenting, efficacy testing, safety review, and marketing of these products, are governed by a range of rules and regulations that apply to the industry's subdivisions (which include different areas such as producing biologics).

Key Insights

- As per the analysis shared by our research analyst, India's pharmaceutical market is estimated to grow annually at a CAGR of around 12.2% over the forecast period (2024-2032).

- In terms of revenue, the India pharmaceutical market size was valued at around USD 55.45 billion in 2023 and is projected to reach USD 156.25 billion by 2032.

- The rising government initiative is expected to propel India pharmaceutical market growth over the projected period.

- Based on the type, the pharmaceutical drugs segment is expected to dominate the market during the forecast period.

- Based on its nature, the conventional segment is expected to hold a significant market share over the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Pharmaceutical Market: Growth Drivers

Rising government initiatives and support drive market growth

Government-driven programs and assistance greatly boost the Indian pharmaceutical business. A climate that is conducive to the expansion of pharmaceutical businesses in the nation is created by several policies intended to improve regulatory frameworks, increase medical infrastructure, and promote medical affordability. Programs like the "Make in India" program promote domestic pharmaceutical production, which lowers reliance on imports. Pharmacies continue to be affordable for a larger portion of the population when price limitations are imposed on vital medications. Additionally, research and development (R&D) incentives are supported by the government and encourage pharmaceutical businesses to invest in new ideas and therapeutic discoveries. By promoting a mutually beneficial partnership between the government and the pharmaceutical sector, these strategic moves not only accelerate business growth but also enhance the standard and accessibility of healthcare in India.

India Pharmaceutical Market: Restraints

Regulatory and pricing pressure impedes market growth

The complicated and lengthy regulatory system in India, combined with the rigorous approval procedures, can take longer for new medications to be released onto the market. Many small and medium-sized businesses (SMEs) find it challenging to ensure compliance with international quality standards, particularly those that are enforced by the FDA and EMA. Export limitations and additional regulatory concerns could result from this. Another instrument the Indian government employs to limit the cost of necessary medications is the National Pharmaceutical Pricing Authority (NPPA). While affordability is guaranteed, the profit margins of pharmaceutical companies are strained. The fierce competition in the generic medication industry forces corporations to keep their pricing low, which may have a detrimental effect on their bottom line. Thus, this is expected to impede India's pharmaceutical sector growth over the projected period.

India Pharmaceutical Market: Opportunities

The rising prevalence of several chronic diseases offers an attractive opportunity for market growth

The increasing prevalence of several chronic diseases, including cancer, cardiovascular disease, and others, is expected to offer a potential opportunity to India pharmaceutical industry over the projected period. The Indian Council of Medical Research developed a paper estimating that 1,461,427 new cases of cancer will be diagnosed in India in 2022, with a crude incidence rate of 100.4 cases per 100,000 people. Cancer is predicted to be diagnosed in India at some point in the lives of one in nine persons. Men were most likely to have lung cancer, whereas women were more likely to have breast cancer. Lymphoid leukemia stood out as the most common location among pediatric malignancies (0–14 years), accounting for 24.2% of cases in girls and 29.2% in boys. Forecasts indicate that the incidence of cancer will rise by an estimated 12.8% between 2020 and 2025.

India Pharmaceutical Market: Challenges

Lack of skilled workforce poses a major challenge to market expansion

The pharmaceutical industry has grown significantly, yet there is a dearth of highly qualified individuals working in research and development (R&D). This restricts the industry's ability to innovate and create novel medications. The capabilities needed for modern pharmaceutical manufacture and research are lacking in India due to disparities in the quality of pharmaceutical education and training. Thus, the lack of a skilled workforce is expected to pose a major challenge to India's pharmaceutical industry.

India Pharmaceutical Market: Segmentation

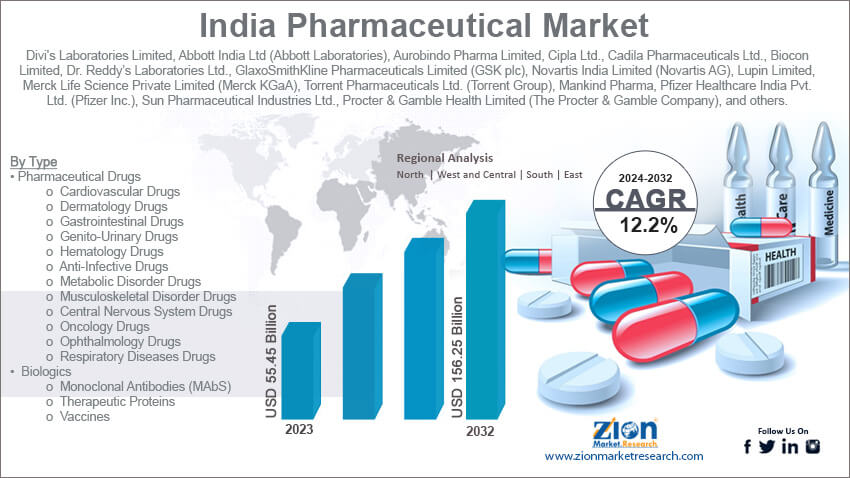

India pharmaceutical industry is segmented based on type, nature, and region.

Based on the type, India pharmaceutical market is bifurcated into pharmaceutical drugs and biologics. The pharmaceutical drugs segment is expected to dominate the market during the forecast period. India is a significant global supplier due to the wide range of pharmaceutical products it produces, which meet both domestic and international demand. India produces an extensive range of pharmaceutical products that cater to different medical ailments due to its advanced production facilities and large pool of experienced workers. The industry's resilience and competitiveness are bolstered by this wide range of pharmaceuticals, including novel therapies and generic versions. India has established itself as a reliable supplier of pharmaceuticals globally due to its dedication to quality control, legal compliance, and cost-effectiveness.

Based on nature, India pharmaceutical industry is segmented into organic and conventional. The conventional segment is expected to hold a significant market share over the forecast period. Conventional sources cover a variety of elements that support the expansion of the sector. The pharmaceutical industry is built on a foundation of established supply chain networks, research methodology, and production techniques. Pharmaceutical businesses in India manufacture a broad range of pharmaceuticals that address various medical needs by utilizing established procedures. These traditional methods support the nation's status as a major supplier of pharmaceuticals to the world market and guarantee the availability of reasonably priced drugs.

India Pharmaceutical Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Pharmaceutical Market |

| Market Size in 2023 | 55.45 Bn |

| Market Forecast in 2032 | 156.25 Bn |

| Growth Rate | CAGR of 12.2% |

| Number of Pages | 211 |

| Key Companies Covered | Divi's Laboratories Limited, Abbott India Ltd (Abbott Laboratories), Aurobindo Pharma Limited, Cipla Ltd., Cadila Pharmaceuticals Ltd., Biocon Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline Pharmaceuticals Limited (GSK plc), Novartis India Limited (Novartis AG), Lupin Limited, Merck Life Science Private Limited (Merck KGaA), Torrent Pharmaceuticals Ltd. (Torrent Group), Mankind Pharma, Pfizer Healthcare India Pvt. Ltd. (Pfizer Inc.), Sun Pharmaceutical Industries Ltd., Procter & Gamble Health Limited (The Procter & Gamble Company), and others. |

| Segments Covered | By Type, By Nature, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Pharmaceutical Market: Region Analysis

North India is expected to lead the market over the forecast period

North India is expected to lead the India pharmaceutical market over the forecast period. North India is influential in the pharmaceutical business due to its strategic position, advanced industrial infrastructure, and convenient access to a large consumer base. States such as Punjab, Haryana, and Himachal Pradesh host a large number of pharmaceutical manufacturing facilities, significantly contributing to the nation's overall output. The concentration of educational institutions, pharmaceutical centers, and research facilities in North India drives the development of novel medications and improvements in medical research. Moreover, the region's proximity to important distribution and transportation networks helps to ensure a seamless national flow of pharmaceutical products. North India's position as a key player in determining the expansion of the Indian pharmaceutical industry is further strengthened by the robust government backing and advantageous policies intended to encourage pharmaceutical investment. This impact is expected to last as long as the area draws in capital, encourages creativity, and adds to the country's healthcare system.

India Pharmaceutical Market: Competitive Analysis

India's pharmaceutical market is dominated by players like:

- Divi's Laboratories Limited

- Abbott India Ltd (Abbott Laboratories)

- Aurobindo Pharma Limited

- Cipla Ltd.

- Cadila Pharmaceuticals Ltd.

- Biocon Limited

- Dr. Reddy’s Laboratories Ltd.

- GlaxoSmithKline Pharmaceuticals Limited (GSK plc)

- Novartis India Limited (Novartis AG)

- Lupin Limited

- Merck Life Science Private Limited (Merck KGaA)

- Torrent Pharmaceuticals Ltd. (Torrent Group)

- Mankind Pharma

- Pfizer Healthcare India Pvt. Ltd. (Pfizer Inc.)

- Sun Pharmaceutical Industries Ltd.

- Procter & Gamble Health Limited (The Procter & Gamble Company)

India's pharmaceutical market is segmented as follows:

By Type

- Pharmaceutical Drugs

- Cardiovascular Drugs

- Dermatology Drugs

- Gastrointestinal Drugs

- Genito-Urinary Drugs

- Hematology Drugs

- Anti-Infective Drugs

- Metabolic Disorder Drugs

- Musculoskeletal Disorder Drugs

- Central Nervous System Drugs

- Oncology Drugs

- Ophthalmology Drugs

- Respiratory Diseases Drugs

- Biologics

- Monoclonal Antibodies (MAbS)

- Therapeutic Proteins

- Vaccines

By Nature

- Organic

- Conventional

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Pharmaceuticals are goods that are discovered, developed, produced, and marketed for use as drugs. These drugs work by being administered to patients or self-administered by them, with the intention of curing and/or preventing disease (as well as possibly alleviating symptoms of illness and/or injury). Pharmaceutical firms can deal with "generic" drugs and medical equipment that don't include intellectual property, "brand" materials that are especially associated with the history of a certain company, or both in different situations. Entire financial processes, including the patenting, efficacy testing, safety review, and marketing of these products, are governed by a range of rules and regulations that apply to the industry's subdivisions (which include different areas such as producing biologics).

The India pharmaceutical industry is expanding steadily as a result of the recent introduction of a wave of innovative strategies by several major firms. Working together with startups and research institutes to investigate novel treatments such as gene therapies and precision medicine has become more popular, demonstrating an optimistic outlook. Furthermore, complicated generic medications and biosimilars are receiving more attention, opening up more affordable options to pricey therapies.

According to the report, India's pharmaceutical market size was worth around USD 55.45 billion in 2023 and is predicted to grow to around USD 156.25 billion by 2032.

India's pharmaceutical market is expected to grow at a CAGR of 12.2% during the forecast period.

India's pharmaceutical market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rising investment in pharmaceutical.

India's pharmaceutical market is dominated by players like Divi's Laboratories Limited, Abbott India Ltd (Abbott Laboratories), Aurobindo Pharma Limited, Cipla Ltd., Cadila Pharmaceuticals Ltd., Biocon Limited, Dr. Reddy’s Laboratories Ltd., GlaxoSmithKline Pharmaceuticals Limited (GSK plc), Novartis India Limited (Novartis AG), Lupin Limited, Merck Life Science Private Limited (Merck KGaA), Torrent Pharmaceuticals Ltd. (Torrent Group), Mankind Pharma, Pfizer Healthcare India Pvt. Ltd. (Pfizer Inc.), Sun Pharmaceutical Industries Ltd. and Procter & Gamble Health Limited (The Procter & Gamble Company) among others.

India's pharmaceutical market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed