India Semiconductor Market Size, Share, Industry Analysis, Trends, Growth, 2032

India Semiconductor Market By Application (Industrial, Telecommunication, Automotive, Defense, Consumer Electronics, and Others), By Component (MCU, Memory Devices, MPU, Analog IC, Discrete Power Devices, and Others), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

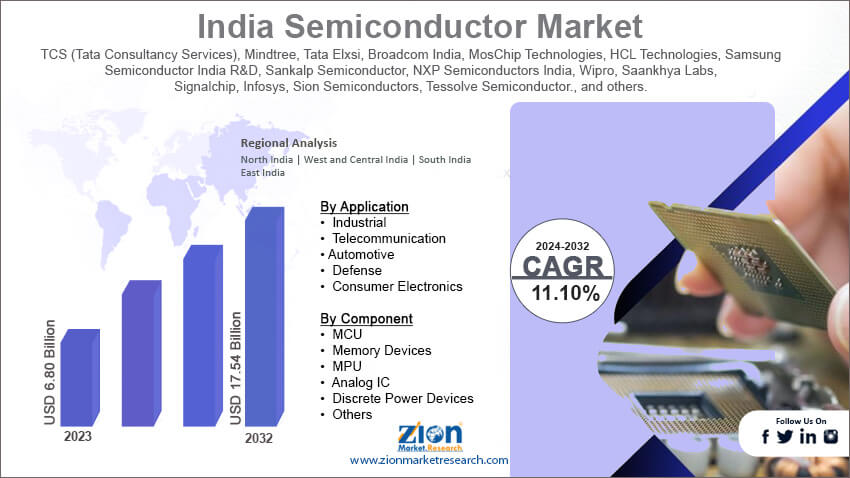

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 6.80 Billion | USD 17.54 Billion | 11.10% | 2023 |

India Semiconductor Industry Prospective:

The India semiconductor market size was worth around USD 6.80 billion in 2023 and is predicted to grow to around USD 17.54 billion by 2032 with a compound annual growth rate (CAGR) of roughly 11.10% between 2024 and 2032.

India Semiconductor Market: Overview

The India semiconductor industry is an evolving sector within the Indian economy. It deals with investments, business strategies, and comprehensive roles of involved stakeholders in the procurement and sale of conventional or advanced semiconductors. It is a rising sector as the regional government is focusing on improving infrastructure supporting mass domestic production of semiconductors used in end-user industries. A semiconductor is defined as a material product consisting of properties displayed by conductors and insulators. Semiconductors are the basis of modern electronics. They facilitate advanced computing, communications, transportation, health care, military operations, and several other novel applications. Semiconductors are generally placed between insulators and conductors in electronic equipment. The structure helps in managing and controlling the flow of electric current necessary for the electronic equipment to perform assigned functions. One of the key advantages of highly sophisticated semiconductors is the miniaturization of electronic items. However, semiconductor production requires intensive investments and expertise. India’s semiconductor sector is expected to generate higher growth during the projection period.

Key Insights:

- As per the analysis shared by our research analyst, the India semiconductor market is estimated to grow annually at a CAGR of around 11.10% over the forecast period (2024-2032)

- In terms of revenue, the India semiconductor market size was valued at around USD 6.80 billion in 2023 and is projected to reach USD 17.54 billion, by 2032.

- The India semiconductor market is projected to grow at a significant rate due to the increasing demand for consumer electronics.

- Based on the application, the consumer electronics segment is growing at a high rate and will continue to dominate the market as per industry projections.

- Based on the component, the MCU segment is anticipated to command the largest market share.

- Based on region, South India is projected to dominate the market during the forecast period.

Request Free Sample

Request Free Sample

India Semiconductor Market: Growth Drivers

Increasing demand for consumer electronics will facilitate higher revenue generation

The India semiconductor market is expected to grow due to the rising demand for advanced consumer electronics. India has a large consumer market. Additionally, it is also registering a substantial growth in per capita income. The rise in income has allowed growth in spending capacity. The regional consumer base is diverse. It is further proven by the growing demand for affordable as well as expensive electronic gadgets. In 2023, India was ranked at the fifth position as over 10 million units of iPhone were sold in the country. The regional e-commerce industry has a pivotal role to play in reaching remote buyers. Indian internet-based products selling apps such as Flipkart, Myntra, and Amazon India have developed a robust supply chain. The dense distribution network brings product sellers and buyers closer thus enhancing revenue streams.

Rising support from the Indian government to promote the regional semiconductor industry will prove beneficial

In recent times, the Indian government has undertaken several ambitious projects and initiatives to improve the country’s semiconductor industry. In 2021, the government launched the Semicon India program. Through the novel initiative, the government has allotted INR 76,000 crore as the project will provide necessary support and incentives to companies involved in display fabrication, silicon semiconductor fabrication, semiconductor design & packaging, and compound semiconductors/sensors fabrication. In March 2024, the Indian officials approved an investment of USD 15.2 billion for setting up 3 semiconductor plants. A significant part of the fund will be used for constructing the country’s first fabrication unit. The Tata Group along with Taiwanese firm Powerchip Semiconductor Manufacturing Corp (PSMC) will be responsible for building the unit thus promoting the India semiconductor market.

India Semiconductor Market: Restraints

Extensive investment associated with the industry will limit the market’s growth rate

The India semiconductor industry is projected to register growth limitations during the projection period. The semiconductor sector is highly resource-intensive. It demands large investments in bulk quantities. For instance, the estimated cost of India’s first commercial fab unit will reach around INR 91,000 crore. Apart from the direct costs, several additional charges are involved in successfully running a fabrication plant. Limited companies in India currently have the bandwidth to participate in investment-rich undertakings.

India Semiconductor Market: Opportunities

Growth in the regional military sector will generate excellent expansion possibilities for the market players

The India semiconductor market can garner more growth opportunities due to staggering growth in the regional military industry. India is observing rapid technological growth in the regional military sector. In a recent event, the Indian Defense Ministry signed a deal with Hindustan Aeronautics Limited (HAL). The contract deals with HAL supplying 97 made-in-India LCA Mark 1A fighter jets. The modernization of the regional defense units will result in higher demand for supporting infrastructure including cutting-edge semiconductor solutions.

Surging adoption of electric vehicles (EVs) will be essential for driving market demand

The Indian industry for semiconductors will be fueled by the growing adoption of electric vehicles. India has huge growth potential for two-wheeler and three-wheeler electric vehicles. Additionally, public transport systems are rapidly incorporating EVs to reduce carbon emissions. Moreover, the regional players are focusing on reducing EV production costs. For instance, Tata-owned Tiago EV is currently the most inexpensive electric vehicle in the country. It is currently priced at INR 6.9 lakh. India’s EV market is expected to grow at a CAGR of more than 25% during the projection period. The promising efforts of the local government to boost EV adoption will create more demand for semiconductors in the regional economy.

India Semiconductor Market: Challenges

Hesitant in sharing knowledge related to semiconductor development will challenge the market expansion rate

The India semiconductor market is expected to be challenged due to businesses refraining from sharing intellectual expertise in semiconductor fabrication. Intellectual Property (IP) theft is a major cause of concern among countries and businesses operating in the industry. Moreover, semiconductors are also considered strategic assets thus limiting knowledge sharing.

India Semiconductor Market: Segmentation

The India semiconductor market is segmented based on application, component, and region.

Based on the application, the India semiconductor industry is divided into industrial, telecommunication, automotive, defense, consumer electronics, and others. In 2023, the highest growth was observed in the consumer electronics segment. The changes in consumer lifestyle shifting toward higher reliance on electronic products such as laptops, smartphones, and other items is expected to fuel the demand for semiconductors. According to official reports, more than 650 million people in India own smartphones.

Based on the components, the India semiconductor industry divisions are MCU, memory devices, MPU, analog IC, discrete power devices, and others. The demand was highest for microcontroller units (MCUs) in 2023 in the Indian economy. The growth rate is driven by the higher use of MCUs in the production of essential consumer electronics. Analog integrated circuits (ICs) are also widely adopted across industries in the country. In 2022, India imported more than USD 4.56 billion worth of semiconductor devices.

India Semiconductor Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Semiconductor Market |

| Market Size in 2023 | 6.80 Bn |

| Market Forecast in 2032 | 17.54 Bn |

| Growth Rate | CAGR of 11.10% |

| Number of Pages | 221 |

| Key Companies Covered | TCS (Tata Consultancy Services), Mindtree, Tata Elxsi, Broadcom India, MosChip Technologies, HCL Technologies, Samsung Semiconductor India R&D, Sankalp Semiconductor, NXP Semiconductors India, Wipro, Saankhya Labs, Signalchip, Infosys, Sion Semiconductors, Tessolve Semiconductor., and others. |

| Segments Covered | By Application,By Component, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Semiconductor Market: Regional Analysis

India’s semiconductor sector is expected to deliver the most optimal results during the forecast period

The India semiconductor market is projected to witness massive growth during the forecast period. India is currently seeking more opportunities and industries for expansion. The regional government has shown interest in investing in advanced technologies such as semiconductor design and production. Moreover, India’s ‘Make-in-India’ program has been running for a decade. The general consensus has shown an inclination toward further investments in modern systems that are driving the global economy. Semiconductor fabrication is at the forefront of such systems. Currently, India is a large importer of semiconductors. However, during the forecast period, it is expected to emerge as a rapidly growing semiconductor producer and designer. The Assam Government in India has laid emphasis on the rapid development of a new semiconductor unit in the region. The state government has partnered with Tata Group after signing a 60-year lease agreement allowing the company to use over 170 acres of land. In July 2025, Advanced Micro Devices (AMD), a global giant in the semiconductor sector, signed an agreement with the Society for Innovation and Entrepreneurship (SINE) at the Indian Institute of Technology (IIT), Mumbai. The agreement is expected to encourage startups to develop energy-efficient Spiking Neural Network (SNN) chips.

India Semiconductor Market: Competitive Analysis

The India semiconductor market is led by players like:

- TCS (Tata Consultancy Services)

- Mindtree

- Tata Elxsi

- Broadcom India

- MosChip Technologies

- HCL Technologies

- Samsung Semiconductor India R&D

- Sankalp Semiconductor

- NXP Semiconductors India

- Wipro

- Saankhya Labs

- Signalchip

- Infosys

- Sion Semiconductors

- Tessolve Semiconductor.

The India semiconductor market is segmented as follows:

By Application

- Industrial

- Telecommunication

- Automotive

- Defense

- Consumer Electronics

By Component

- MCU

- Memory Devices

- MPU

- Analog IC

- Discrete Power Devices

- Others

By Region

- India

Table Of Content

Methodology

FrequentlyAsked Questions

The India semiconductor industry is an evolving sector within the Indian economy. It deals with investments, business strategies, and comprehensive roles of involved stakeholders in the procurement and sale of conventional or advanced semiconductors.

The India semiconductor market is expected to grow due to the rising demand for advanced consumer electronics.

According to study, the India semiconductor market size was worth around USD 6.80 billion in 2023 and is predicted to grow to around USD 17.54 billion by 2032.

The CAGR value of India semiconductor market is expected to be around 11.10% during 2024-2032.

The India Semiconductor Market will be led by the South of India during the forecast period.

The India semiconductor market is led by players like TCS (Tata Consultancy Services), Mindtree, Tata Elxsi, Broadcom India, MosChip Technologies, HCL Technologies, Samsung Semiconductor India R&D, Sankalp Semiconductor, NXP Semiconductors India, Wipro, Saankhya Labs, Signalchip, Infosys, Sion Semiconductors, and Tessolve Semiconductor.

The report explores crucial aspects of the India semiconductor market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

India SemiconductorIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesGrowth in the regional military sector will generate excellent expansion possibilities for the market playersChallengesSegmentationReport ScopeRegional AnalysisCompetitive AnalysisThe India semiconductor market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed