India Smart Meter Market Growth, Size, Share, Trends, and Forecast 2032

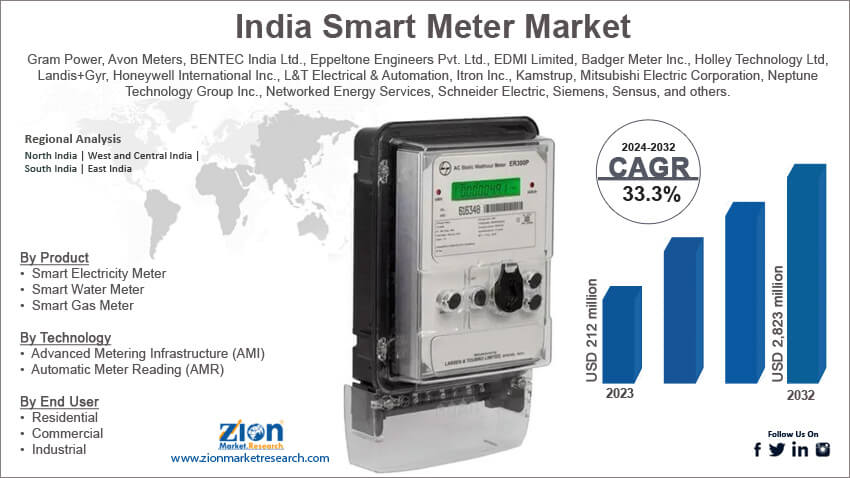

India Smart Meter Market By Product (Smart Electricity Meter, Smart Water Meter, and Smart Gas Meter), By Technology (Advanced Metering Infrastructure (AMI) and Automatic Meter Reading (AMR)), By End User (Residential, Commercial, and Industrial), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

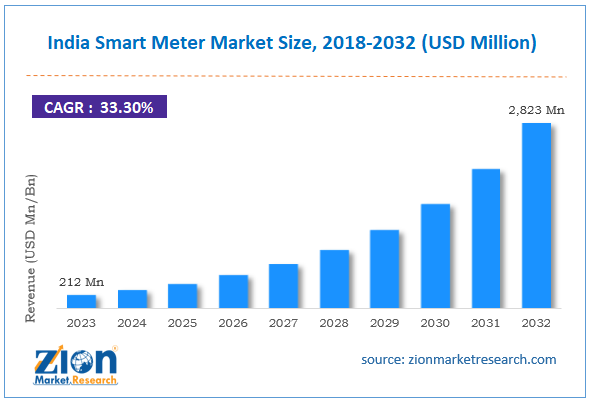

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 212 million | USD 2,823 million | 33.3% | 2023 |

India Smart Meter Industry Prospective:

India smart meter market size was worth around USD 212 million in 2023 and is predicted to grow to around USD 2,823 million by 2032 with a compound annual growth rate (CAGR) of roughly 33.3% between 2024 and 2032.

India Smart Meter Market: Overview

Smart meters are electronic devices that precisely track how much gas, water, and electricity is used. By transmitting usage data via cellular, power lines, and radiofrequency electromagnetic radiation (RF) transmission, these smart meters assist the utility business in efficiently controlling energy consumption. Numerous advantages are provided by smart meters, including lower meter reading costs, prevention of disconnection, elimination of billing inefficiencies, and lower reconnection prices for both businesses and consumers. During the projected period, the market for smart meters will develop as a result of increased consumer awareness and the need for transparency. The need for real-time insight tools is increasing as individuals become more aware of their consumption habits. This need is provided by smart meters, which provide a thorough analysis of utility usage straight to consumers' cell phones or computers.

Key Insights

- As per the analysis shared by our research analyst, the India smart meter market is estimated to grow annually at a CAGR of around 33.3% over the forecast period (2024-2032).

- In terms of revenue, the India smart meter market size was valued at around USD 212 million in 2023 and is projected to reach USD 2,823 million, by 2032.

- The rising government initiative in terms of energy efficiency is expected to propel the India smart meter market growth over the projected period.

- Based on the product, the smart electricity meter segment is expected to dominate the market over the forecast period.

- Based on the technology, the Advanced Metering Infrastructure (AMI) segment is expected to capture the largest market share over the forecast period.

- Based on the end user, the residential segment is expected to garner a significant revenue share over the forecast period.

- Based on the region, North India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Smart Meter Market: Growth Drivers

Rising emphasis on energy efficiency drives market growth

One of the primary reasons driving the growth of the smart meter market in India is the increased emphasis on energy efficiency. This is because conventional metering systems sometimes struggle to offer thorough insights into energy consumption, making it challenging to pinpoint inefficient or wasteful locations. This issue is resolved by smart meters, which offer real-time utility usage statistics. Because of this transparency, utility companies and customers may make data-driven decisions that lead to optimal energy use. Organizations and governments are becoming more and more aware of the value of energy-efficient operations since they save money and are essential to sustainability programs. Consequently, programs and regulations are being put in place to promote the use of smart meters.

India Smart Meter Market: Restraints

Lack of standardization impedes market growth

Even though smart electricity meters are being installed widely, end customers' financial and security worries are anticipated to operate as a barrier to the India smart meter industry's expansion. Because of their ignorance of smart power meters and uncertainties, end customers are hesitant to use this technology. Additionally, the novelty stage of smart energy meters needs funding from governments and regulatory organizations for the initial stages of research and development, which adds to the cost that will be borne by the administrative authorities of the respective countries. Thus, this is expected to hamper the market growth over the projected period.

India Smart Meter Market: Opportunities

Rising government initiatives offer an attractive opportunity for market growth

The government's incentives and regulations are a major factor driving the smart meter business in India. Numerous governments around the nation are enacting laws that either require or promote the installation of smart meters, frequently establishing deadlines for their widespread adoption. To hasten adoption rates, these measures can also be supported by monetary incentives like grants or tax breaks. Regulations have two goals: they encourage energy-efficient measures to improve environmental sustainability and standardize utility management for maximum performance. The adoption of smart meters across the nation is significantly accelerated by the existence of robust regulatory backing. For instance, the government of India has approved an outlay of Rs 3,000 billion under the Revamped Distribution Sector Scheme (RDSS), with total budgetary support of Rs 976 billion spread over five years, from 2021 to 26. In the following three years, it seeks to eliminate average supply-average revenue and cut pan-India AT&C losses by 12–15%.

India Smart Meter Market: Challenges

High cost and technical complexity pose a major challenge to market expansion

The use of smart meters necessitates substantial initial expenditures for the acquisition, setup, and modernization of existing infrastructure. Utilities and customers may have to pay more as a result, particularly in rural and economically weak regions. Furthermore, it can be difficult to integrate smart meters with the current grid infrastructure and make sure they work with various communication methods. Technological problems can arise from issues like device interoperability, network coverage, and data transfer reliability.

India Smart Meter Market: Segmentation

India smart meter industry is segmented based on product, technology, end-user, and region.

Based on the product, the India smart meter market is bifurcated into smart electricity meter, smart water meter, and smart gas meter. The smart electricity meter segment is expected to dominate the market over the forecast period. Since power is required for a wide range of uses in the residential, commercial, and industrial sectors, smart electricity meters are the most extensively utilized device. Modern life is powered by electricity, which runs everything from offices and houses to factories and data centers. Due to their widespread use, smart electricity meters are essential as they meet the growing need for precise and effective monitoring systems. Their features, which optimize energy usage and enable accurate invoicing, include real-time tracking and consumption analytics. Smart electricity meters are also required to handle intricate system interactions as a result of the shift to renewable energy sources.

Based on the technology, the India smart meter industry is segmented into Advanced Metering Infrastructure (AMI), and Automatic Meter Reading (AMR). The Advanced Metering Infrastructure (AMI) segment is expected to capture the largest market share over the forecast period. Advanced metering infrastructure (AMI) provides a wide range of features, such as two-way communication, real-time data monitoring, and remote control functions, that go beyond simple meter readings. The extensive features of AMI provide both utility companies and customers substantial benefits. AMI systems help utility providers run more efficiently and save money by enabling improved billing accuracy, streamlined operations, and the implementation of demand response programs. AMI provides comprehensive consumption information to consumers, facilitating more effective energy management and conservation. Thereby, driving the market growth.

Based on the end user, the India smart meter market is segmented into residential, commercial, and industrial. The residential segment is expected to garner a significant revenue share over the forecast period. When it comes to volume, the residential segment is among the most important. Smart meters are mostly used by homes in this industry to help with more accurate billing and to give customers access to real-time data. By assisting homeowners in better managing their utility consumption, this technology supports efforts to conserve energy. The usage of smart meters in residential settings is anticipated to increase steadily as awareness increases and costs decrease.

India Smart Meter Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Smart Meter Market |

| Market Size in 2023 | USD 212 Million |

| Market Forecast in 2032 | USD 2,823 Million |

| Growth Rate | CAGR of 33.3% |

| Number of Pages | 215 |

| Key Companies Covered | Gram Power, Avon Meters, BENTEC India Ltd., Eppeltone Engineers Pvt. Ltd., EDMI Limited, Badger Meter Inc., Holley Technology Ltd, Landis+Gyr, Honeywell International Inc., L&T Electrical & Automation, Itron Inc., Kamstrup, Mitsubishi Electric Corporation, Neptune Technology Group Inc., Networked Energy Services, Schneider Electric, Siemens, Sensus, and others. |

| Segments Covered | By Product, By Technology, By End User, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Smart Meter Market: Region Analysis

North India is expected to dominate the market over the forecast period

North India is expected to dominate the India smart meter market over the forecast period. This region is strongly committed to smart metering technology, as evidenced by states like Uttar Pradesh, which has over a million installations, and Delhi, which plans to install 2.5 million smart meters by 2025. With plans to install 2.5 lakh smart meters in the first phase and a total of 16 lakh functioning meters by 2025, Tata Power Delhi Distribution Ltd (TPDDL) is actively assisting in this transformation. The region's standing in the smart meter space is being further cemented by other North Indian states like Madhya Pradesh, which plans to install 270,000 smart meters, and Rajasthan, which has 1 million installed. In North India, the advantages of smart meters are starting to show beyond simple installations. According to a CEEW poll, 60% of smart meter users in six states, including Uttar Pradesh, expressed satisfaction, demonstrating a positive attitude among consumers. Users of prepaid smart meters are making good use of the technology; of these, 30% recharge their meters more than once a month, with Uttar Pradesh having the highest percentage (38%). Customers in every state included in the poll mention benefits including better power supply quality and more control over electricity costs. Thereby, driving the market growth in the region.

India Smart Meter Market: Competitive Analysis

India smart meter market is dominated by players like:

- Gram Power

- Avon Meters

- BENTEC India Ltd.

- Eppeltone Engineers Pvt. Ltd.

- EDMI Limited

- Badger Meter Inc.

- Holley Technology Ltd

- Landis+Gyr

- Honeywell International Inc.

- L&T Electrical & Automation

- Itron Inc.

- Kamstrup

- Mitsubishi Electric Corporation

- Neptune Technology Group Inc.

- Networked Energy Services

- Schneider Electric

- Siemens

- Sensus

India smart meter market is segmented as follows:

By Product

- Smart Electricity Meter

- Smart Water Meter

- Smart Gas Meter

By Technology

- Advanced Metering Infrastructure (AMI)

- Automatic Meter Reading (AMR)

By End User

- Residential

- Commercial

- Industrial

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Smart meters are electronic devices that precisely track how much is used for gas, water, and electricity. By transmitting usage data via cellular, power lines, and radiofrequency electromagnetic radiation (RF) transmission, these smart meters assist the utility business in efficiently controlling energy consumption. Numerous advantages are provided by smart meters, including lower meter reading costs, prevention of disconnection, elimination of billing inefficiencies, and lower reconnection prices for both businesses and consumers.

During the projected period, the market for smart meters in India will develop as a result of increased consumer awareness and the need for transparency. The need for real-time insight tools is increasing as individuals become more aware of their consumption habits. This need is provided by smart meters, which provide a thorough analysis of utility usage straight to consumers' cell phones or computers.

According to the report, India smart meter market size was worth around USD 212 million in 2023 and is predicted to grow to around USD 2,823 million by 2032.

India's smart meter market is expected to grow at a CAGR of 33.3% during the forecast period.

India smart meter market growth is driven by North India. It is currently the nation's highest revenue-generating market due to the rapid infrastructural and technological advancements.

India smart meter market is dominated by players like Gram Power, Avon Meters, BENTEC India Ltd., Eppeltone Engineers Pvt. Ltd., EDMI Limited, Badger Meter, Inc., Holley Technology Ltd, Landis+Gyr, Honeywell International Inc., L&T Electrical & Automation, Itron Inc., Kamstrup, Mitsubishi Electric Corporation, Neptune Technology Group Inc., Networked Energy Services, Schneider Electric, Siemens, and Sensus among others.

India smart meter Market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed