India Sodium Silicate Market Size, Share, Growth Report, Forecasts, 2032

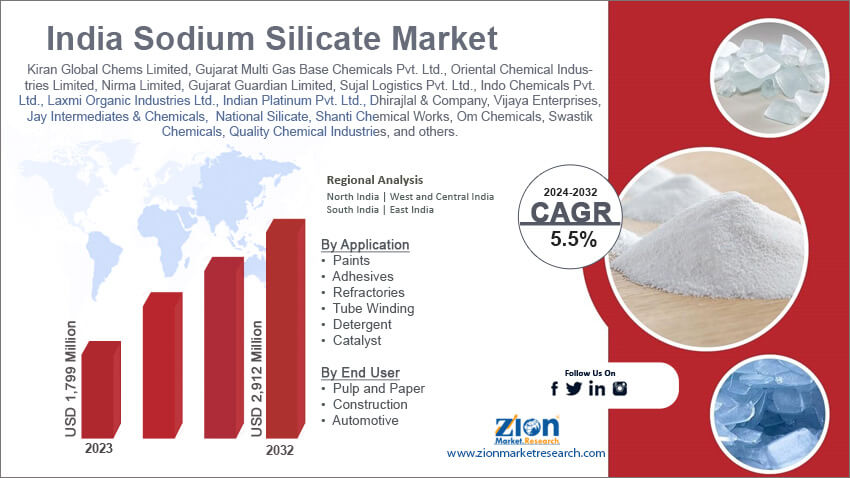

India Sodium Silicate Market By Form (Crystalline and Anhydrous), By Type (Liquid and Solid), By Grade (Neutral and Alkaline), By Application (Paints, Adhesives, Refractories, Tube Winding, Detergent, and Catalyst), By End-User (Pulp and Paper, Construction, and Automotive), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

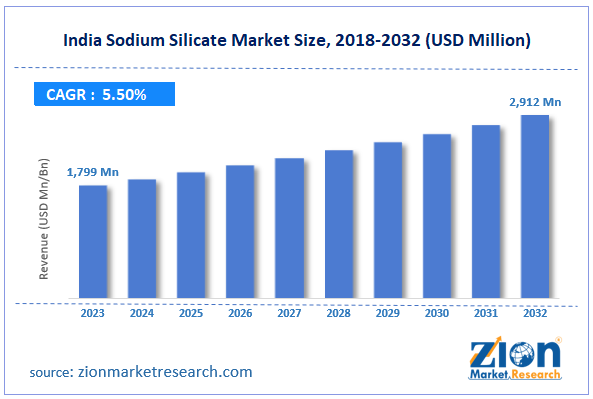

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 1,799 Million | USD 2,912 Million | 5.5% | 2023 |

India Sodium Silicate Industry Prospective:

India Sodium Silicate market size was worth around USD 1,799 million in 2023 and is predicted to grow to around USD 2,912 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.5% between 2024 and 2032.

India Sodium Silicate Market: Overview

A colorless mixture of silicon dioxide and sodium oxides, sodium silicate has several different chemical formulas that differ in the amounts or ratios of silicon dioxide (SiO2). When silica sand and sodium carbonate are reacted at high temperatures—between 1200°C and 1400°C—it becomes soluble in water. Correct reactant proportioning results in a range of compounds, including Na2 O.4SiO2 and 2Na2 O.SiO2, which are sodium silicates. Colloidal silicates, which range in ratio from Na2 O.1.6SiO2 to Na2 O.4SiO2, are sodium silicates that are marketed as 20% to 50% aqueous solutions, or water glass.

Key Insights

- As per the analysis shared by our research analyst, India Sodium Silicate market is estimated to grow annually at a CAGR of around 5.5% over the forecast period (2024-2032).

- In terms of revenue, the India Sodium Silicate market size was valued at around USD 1,799 million in 2023 and is projected to reach USD 2,912 million, by 2032.

- The rising construction sector is expected to propel India Sodium Silicate market growth over the projected period.

- Based on the form, the crystalline segment is expected to hold a prominent market share during the forecast period.

- Based on the grade, the alkaline segment is expected to dominate the market during the forecast period.

- Based on the end-user, the construction segment is expected to dominate the market growth over the projected period.

- Based on the region, West and Central India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Sodium Silicate Market: Growth Drivers

Rapid industrialization drives market growth

One of the main factors driving the India Sodium Silicate market's expansion is quick industrialization, especially in industries like construction, textiles, and detergent businesses. Accordingly, the special qualities of sodium silicate—such as its high alkalinity and adhesiveness—make it a crucial component in many industrial processes. Moreover, it is widely employed as a builder in the detergent industry, improving surfactant cleaning efficiency and offering both practical and financial advantages. The product's increasing use in the textile industry's bleaching and dyeing procedures, where it serves as a stabilizer for hydrogen peroxide, is also driving the market's expansion. Moreover, the growing product application in the construction industry as a binding agent in cement and concrete to enhance material strength and durability is positively influencing the market expansion.

India Sodium Silicate Market: Restraints

Dangerous side effect impedes market growth

Sodium silicate is something that people ought to make every effort to avoid. When it comes into close touch with the body's surface, it may irritate the skin. If exposed for a long period, it can result in serious and permanent eye damage. Additionally, it may irritate the respiratory tract, which may cause discomfort in the respiratory and gastrointestinal systems. Skin irritation can result from symptoms including nausea, vomiting, diarrhea, and lip burns. The India Sodium Silicate industry will not be able to grow to its full potential because of these product qualities.

India Sodium Silicate Market: Opportunities

Rising urbanization and infrastructure development offer an attractive opportunity for market growth

A major factor driving the India sodium silicate market's expansion has been the speed at which infrastructure is being developed and urbanized, especially in emerging markets. As a result, the market is expanding due to the rising need for durable yet affordable building materials. Building projects benefit greatly from the use of sodium silicate, which is widely used in cement and concrete as a setting and strengthening agent. Furthermore, the application of this material in soil stabilization is driving up market growth as it helps prepare the ground for building and lowers the likelihood of structural failures. Furthermore, the need for sodium silicate is being aided by the rise in large-scale construction projects including urban housing, bridges, and roads, which demand materials resistant to normal wear and tear.

India Sodium Silicate Market: Challenges

Volatility in raw material prices and environmental regulation pose a major challenge to market expansion

The production of sodium silicate requires raw materials such as soda ash and silica sand. Because price changes of different raw materials can affect overall manufacturing costs, it can be difficult for manufacturers to maintain consistent pricing and profitability. Strict environmental regulations controlling the production and disposal of chemical goods may also pose challenges for the sodium silicate industry. Follow-through with these criteria often means further investments in pollution control and environmentally friendly production methods.

India Sodium Silicate Market: Segmentation

India's sodium silicate industry is segmented based on form, type, grade, application, end-user, and region.

Based on the form, India's sodium silicate market is bifurcated into crystalline and anhydrous. The crystalline segment is expected to hold a prominent market share during the forecast period. The composition of the crystallized water determines the melting points of crystalline sodium silicates, which are different. The water of crystallization is used to produce sodium metasilicate in its penta- or nonahydrate form. Sodium metasilicates make up the majority of crystalline sodium silicates. They are used in floor cleaning, metal, dairy, fireproofing, and washing. They are also used in antibacterial agents, paper drinks, fungicides, and cleaning solutions for carbonated beverage bottles. An anhydrous material is miscible with water indefinitely and dissolves relatively slowly at ambient temperature. The unique composition of silicate solutions is determined by the density, viscosity, and silica metal-oxide ratio.

Based on the type, India's sodium silicate industry is segmented into liquid and solid.

Based on the grade, India's sodium silicate market is segmented into neutral and alkaline. The alkaline segment is expected to dominate the market during the forecast period. Alkaline sodium silicate is a liquid that has no smell and is transparent to opaque. Both normal temperature and pressure are non-reactive. It finds application in mineral processing, zeolites, drilling fluids, refractory cement, paper, adhesives, deinking, detergents/soaps, textiles, and catalysts. It produces drilling mud, precipitated silica, and silicate gel. When treating wastewater, neutral sodium silicate is mainly employed as an aqueous solution and white solid. It is also a water gas. It coagulates or deflocculates in the treatment plant. Water is cleaned by the reaction of negatively charged water particles with sodium silicate.

Based on the application, India's sodium silicate industry is segmented into paints, adhesives, refractories, tube winding, detergent, and catalysts.

Based on the end-user, India's sodium silicate market is segmented into pulp & paper, construction, and automotive. The construction segment is expected to dominate the market growth over the projected period. Sodium silicate is already widely used in cementitious materials. It is sprayed as silicate mineral paint to increase durability and waterproofing, and it is used as an alkali-activator and setting accelerator in alkali-activated cement.

India Sodium Silicate Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Sodium Silicate Market |

| Market Size in 2023 | 1,799 Mn |

| Market Forecast in 2032 | 2,912 Mn |

| Growth Rate | CAGR of 5.5% |

| Number of Pages | 208 |

| Key Companies Covered | Kiran Global Chems Limited, Gujarat Multi Gas Base Chemicals Pvt. Ltd., Oriental Chemical Industries Limited, Nirma Limited, Gujarat Guardian Limited, Sujal Logistics Pvt. Ltd., Indo Chemicals Pvt. Ltd., Laxmi Organic Industries Ltd., Indian Platinum Pvt. Ltd., Dhirajlal & Company, Vijaya Enterprises, Jay Intermediates & Chemicals, The Andhra Petrochemicals Limited, Shri Shyam Enterprises, National Silicate, Shanti Chemical Works, Om Chemicals, Swastik Chemicals, Quality Chemical Industries, and others. |

| Segments Covered | By Form, By Type, By Grade, By Application, By End User, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Sodium Silicate Market: Region Analysis

West and Central India is expected to dominate the market over the forecast period

West and Central India is expected to dominate the India Sodium Silicate market over the forecast period. Because of several important variables, the sodium silicate market in India is largely driven by the West India area. First off, West India—particularly the states of Gujarat and Maharashtra—is the hub of India's manufacturing and industrial activity. The chemical, textile, construction, and automotive industries are among those that utilize a lot of sodium silicate for various purposes such as detergents, adhesives, coatings, and foundry operations. The robust industrial foundation and manufacturing base of West India contribute to the significant demand for products containing sodium silicate. Large ports like Mumbai and Kandla are strategically positioned to facilitate the import and export of completed sodium silicate commodities, contributing to the region's market dominance.

India Sodium Silicate Market: Competitive Analysis

India's sodium silicate market is dominated by players like:

- Kiran Global Chems Limited

- Gujarat Multi Gas Base Chemicals Pvt. Ltd.

- Oriental Chemical Industries Limited

- Nirma Limited

- Gujarat Guardian Limited

- Sujal Logistics Pvt. Ltd.

- Indo Chemicals Pvt. Ltd.

- Laxmi Organic Industries Ltd.

- Indian Platinum Pvt. Ltd.

- Dhirajlal & Company

- Vijaya Enterprises

- Jay Intermediates & Chemicals

- The Andhra Petrochemicals Limited

- Shri Shyam Enterprises

- National Silicate

- Shanti Chemical Works

- Om Chemicals

- Swastik Chemicals

- Quality Chemical Industries

India's sodium silicate market is segmented as follows:

By Form

- Crystalline

- Anhydrous

By Type

- Liquid

- Solid

By Grade

- Neutral

- Alkaline

By Application

- Paints

- Adhesives

- Refractories

- Tube Winding

- Detergent

- Catalyst

By End User

- Pulp and Paper

- Construction

- Automotive

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

A colorless mixture of silicon dioxide and sodium oxides, sodium silicate has several different chemical formulas that differ in the amounts or ratios of silicon dioxide (SiO2). When silica sand and sodium carbonate are reacted at high temperatures—between 1200°C and 1400°C—it becomes soluble in water. Correct reactant proportioning results in a range of compounds, including Na2 O.4SiO2 and 2Na2 O.SiO2, which are sodium silicates. Colloidal silicates, which range in ratio from Na2 O.1.6SiO2 to Na2 O.4SiO2, are sodium silicates that are marketed as 20% to 50% aqueous solutions, or water glass.

The India sodium silicate industry is being driven by several factors such as the increasing construction industry, growing urbanization, rising government expenditures, technological advancements, and increasing collaboration among the market players.

According to the report, India's sodium silicate market size was worth around USD 1,799 million in 2023 and is predicted to grow to around USD 2,912 million by 2032.

India's sodium silicate market is expected to grow at a CAGR of 5.5% during the forecast period.

India's sodium silicate market growth is driven by West and Central India. It is currently the nation's highest revenue-generating market due to the presence of major manufacturers.

India's sodium silicate market is dominated by players like Kiran Global Chems Limited, Gujarat Multi Gas Base Chemicals Pvt. Ltd., Oriental Chemical Industries Limited, Nirma Limited, Gujarat Guardian Limited, Sujal Logistics Pvt. Ltd., Indo Chemicals Pvt. Ltd., Laxmi Organic Industries Ltd., Indian Platinum Pvt. Ltd., Dhirajlal & Company, Vijaya Enterprises, Jay Intermediates & Chemicals, The Andhra Petrochemicals Limited, Shri Shyam Enterprises, National Silicate, Shanti Chemical Works, Om Chemicals, Swastik Chemicals and Quality Chemical Industries among others.

India's sodium silicate market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed