India Used Car Market Size, Share, Analysis, Trends, Growth, Forecasts, 2032

India Used Car Market By Type of Vehicle (Sports Utility Vehicle (SUV), Passenger Vehicle, Electric Vehicle (EV), Luxury Vehicle, and Others), By Mode of Service (Offline and Online), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

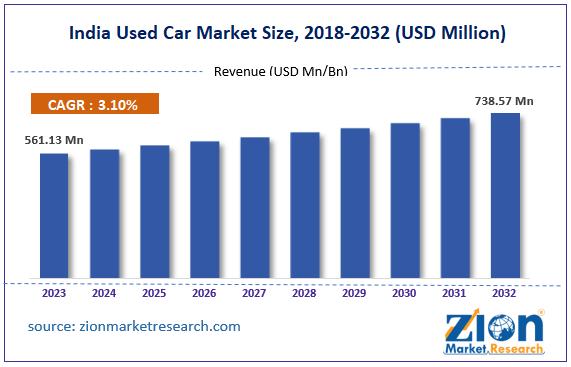

| USD 561.13 Million | USD 738.57 Million | 3.10% | 2023 |

India Used Car Industry Prospective:

The India used car market size was worth around USD 561.13 million in 2023 and is predicted to grow to around USD 738.57 million by 2032 with a compound annual growth rate (CAGR) of roughly 3.10% between 2024 and 2032.

India Used Car Market: Overview

Used cars in India have high demand. Vehicles that have been previously used by separate sets of owners are known as used cars. They are available in the Indian commercial market across models and variants. In the last decade, India’s used car sector has registered an exceptional growth trajectory as the industry has steadily evolved to become more organized. Additionally, more companies are entering the market leading to higher scope of further growth during the projection period. The introduction of technology and digital solutions in the used car segment has been crucial to changing the landscape of second-hand or pre-owned vehicles. However, the regional market is yet to achieve extensive growth since there are several growth barriers opposing the market’s expansion rate. For instance, companies selling brand-new cars have begun offering reduced initial deposits to attract buyers to buy new vehicles. During the forecast period, factors such as changing consumer buying patterns, mentality, or innovative solutions offered by market players will help the industry thrive. The much-anticipated opportunities for further growth will be registered in the electric or hybrid vehicle segment as well as greater incorporation of advanced technologies to streamline processes.

Key Insights:

- As per the analysis shared by our research analyst, the India used car market is estimated to grow annually at a CAGR of around 3.10% over the forecast period (2024-2032)

- In terms of revenue, the India used car market size was valued at around USD 561.13 million in 2023 and is projected to reach USD 738.57 million, by 2032.

- The India used car market is projected to grow at a significant rate due to the changing consumer preferences and buying patterns to positively impact the market growth rate.

- Based on the type of vehicle, the passenger vehicle segment is growing at a high rate and will continue to dominate the regional market as per industry projections.

- Based on the mode of service, the offline segment is anticipated to command the largest market share.

- Based on region, Maharashtra is projected to dominate the regional market during the forecast period.

Request Free Sample

Request Free Sample

India Used Car Market: Growth Drivers

Changing consumer preferences and buying patterns to positively impact the market growth rate

The India used car market is expected to grow due to the changing consumer preferences and buying patterns. The regional population is witnessing a rise in disposable income. India hosts a growing rate of per capita income which has led to a steady shift in buying strength of the ordinary buyers. In addition to this, another change in buying patterns involves frequently shifting from one product to another after a few months or years of use. For such buyers, used cars offer excellent buying options as pre-owned vehicles are less priced than brand-new versions. Additionally, buyers can choose to change their vehicles more frequently since they do not have to worry about losing large sums of money when changing vehicles. As per market research, the new-to-used car-vehicle ratio has changed from 1:1.21 to 1:2.12 in a few years. In addition to this, the current average holding time for a vehicle is around 3.1 years. These numbers are indicative of the growing user car popularity rate.

Growing organization of the regional industry will generate more confidence among new used car buyers

Until a few years ago, the industry for used cars in India was highly unorganized. Policies around buying, selling, and use of used vehicles were unclear along with a lack of consumer awareness. However, since the demand for used vehicles has grown over the years, the regional official bodies have made efforts to draft and implement clear guidelines regarding transactions of used vehicles. In September 2022, the Indian Ministry of Road Transport and Highways notified the Central Motor Vehicle Rules, 2022. The new regulation aims to bring more accountability and transparency in the transactions related to used cars. As per the amended regulation, dealers working in the India used car market must seek authorization from the respective State Transportation Department before becoming active in the commercial industry. The dealers will be considered as the owners of the used vehicle until bought by a consumer.

India Used Car Market: Restraints

Measures taken by new car sellers to promote vehicle sales will limit the industry’s growth rate

The used car industry in India is expected to face growth limitations over the forecast period. Companies and dealers selling new cars have launched several initiatives and facilities to promote the sale of fresh automotives. For instance, one of the most common strategies adopted by new car-selling brands is offering a low down payment rate which allows a buyer to purchase a product at minimal cost and pay the rest through Equated Monthly Installment (EMI). Additionally, the demand for new vehicles has grown significantly due to the launch of several affordable vehicles in all variants.

India Used Car Market: Opportunities

Expansion through online modes of sale and lucrative services to generate massive returns on investment

The India used car market is expected to generate several new expansion opportunities by incorporating advanced digital technologies in the transaction process. The emergence of several businesses operating in the online space through web-based applications and online portals can prove as a turning point for the India used car space. The market players must leverage the trend of increased adoption and consumption of mobile technologies such as smartphones and laptops. An ordinary Indian buyer at present time is more comfortable using online applications to buy and sell items worth higher amounts. Some of the major companies such as Mahindra First Choice Wheels, Cars 24, and OLX provide attractive and engaging services including digital documentation processes. Moreover, sellers of used cars offer extended warranties on automotive parts along with cleaning or maintenance services.

India Used Car Market: Challenges

Cost and hassle of maintaining used cars over an extended timeframe may challenge the market expansion rate

Consumers show hesitancy in buying used cars since in several cases the cost of repairing, maintaining, and using a pre-owned vehicle can exceed the cost of purchase. This is especially applicable to vehicles that have been already used for multiple years. The quality of used vehicles is sometimes excessively compromised thus delivering a reduced return on value. Moreover, when buying used cars from unauthorized dealers, buyers at put at risk of buying a vehicle with incomplete or fraud documents. Such unfavorable factors are expected to reduce the demand in the India used car industry.

India Used Car Market: Segmentation

The India used car market is segmented based on type of vehicle, mode of service, and region.

Based on the type of vehicle, the regional market segments are sports utility vehicles (SUV), passenger vehicles, electric vehicles (EV), luxury vehicles, and others. In 2023, the highest demand was observed in the passenger vehicle segment. The growth rate is a result of higher demand for vehicles in urban areas for small families. As of 2024, more than 45 lakh people in the city of Mumbai owned a private vehicle. The luxury vehicle sector has been growing at a rapid pace. The surge in buyers wanting to experience driving luxury vehicles at affordable prices is fueling the segmental demand.

Based on the mode of service, the India used car vehicle industry is divided into offline and online. In 2023, the highest return was observed in the offline segment. The considerably high growth rate is a result of an increase in the count of offline car retailers. Most buyers prefer to inspect the vehicle in person before making the purchase. In addition to this, the growing cases of online fraud have resulted in higher demand for offline services. As per official records, India has recorded an increase of more than 700% in the rate of online fraud in two years.

India Used Car Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Used Car Market |

| Market Size in 2023 | 561.13 Mn |

| Market Forecast in 2032 | 738.57 Mn |

| Growth Rate | CAGR of 3.10% |

| Number of Pages | 219 |

| Key Companies Covered | Maruti Suzuki True Value, Tata Motors Assured, CarTrade, Cars24, Ford Assured, Audi Approved Plus, Spinny, Hyundai H Promise, CarDekho, Big Boy Toyz, Mahindra First Choice Wheels, BMW Premium Selection, Droom, Toyota U Trust, Honda Auto Terrace., and others. |

| Segments Covered | By Type of Vehicle, By Mode of Service, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Used Car Market: Regional Analysis

Maharashtra to lead the regional economy during the projection period

The India used car market will be led by Maharashtra state during the forecast period. Maharashtra has recorded high demand for used cars in the previous years. It will continue the same trend during the projection period. In 2023, it dominated nearly 35.01% of the total regional market revenue. Some of the critical factors driving demand for use in Maharashtra include a sharp decline in the final price of high-end luxurious vehicles as well as an increase in the spending capacity of state buyers. Moreover, the growing rate of young population with evolved consumption behavior such as frequently changing cars every 2 to 3 years has helped the region thrive in the past. The demand for good quality used cars in Maharashtra is high in urban areas such as Mumbai, Pune, and other cities. Other Indian states are also steadily recording higher demand for pre-owned vehicles. Delhi, Bengaluru, Hyderabad, Gujarat, and Uttar Pradesh are contributing to the overall regional revenue. The emergence of novel concepts such as vehicle-sharing between people living in proximity, especially in densely populated regions is gaining attention among new buyers.

India Used Car Market: Competitive Analysis

India used car market is led by players like:

- Maruti Suzuki True Value

- Tata Motors Assured

- CarTrade

- Cars24

- Ford Assured

- Audi Approved Plus

- Spinny

- Hyundai H Promise

- CarDekho

- Big Boy Toyz

- Mahindra First Choice Wheels

- BMW Premium Selection

- Droom

- Toyota U Trust

- Honda Auto Terrace.

The India used car market is segmented as follows:

By Type of Vehicle

- Sports Utility Vehicle (SUV)

- Passenger Vehicle

- Electric Vehicle (EV)

- Luxury Vehicle

- Others

By Mode of Service

- Offline

- Online

By Region

- India

Table Of Content

Methodology

FrequentlyAsked Questions

Used cars in India have high demand. Vehicles that have been previously used by separate sets of owners are known as used cars.

The India used car market is expected to grow due to the changing consumer preferences and buying patterns.

According to study, the India used car market size was worth around USD 561.13 million in 2023 and is predicted to grow to around USD 738.57 million by 2032.

The CAGR value of India used car market is expected to be around 3.10% during 2024-2032.

The India used car market will be led by Maharashtra state during the forecast period.

The India used car market is led by players like Maruti Suzuki True Value, Tata Motors Assured, CarTrade, Cars24, Ford Assured, Audi Approved Plus, Spinny, Hyundai H Promise, CarDekho, Big Boy Toyz, Mahindra First Choice Wheels, BMW Premium Selection, Droom, Toyota U Trust and Honda Auto Terrace.

The report explores crucial aspects of the India used car market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed