India Utility Pump Market Size, Share, Industry Analysis, Trends, Growth, 2032

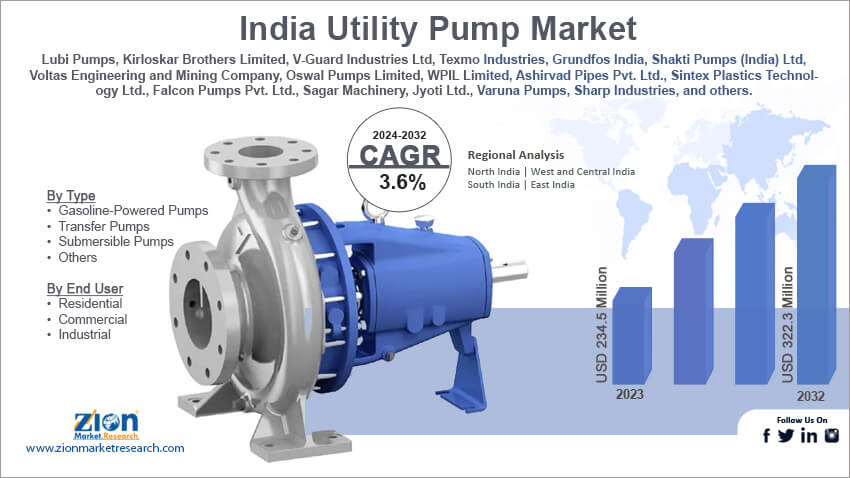

India Utility Pump Market By Type (Gasoline-Powered Pumps, Transfer Pumps, Submersible Pumps, and Others), By End-user (Residential, Commercial, and Industrial), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

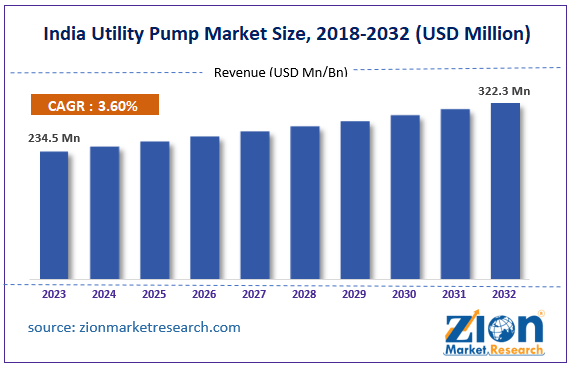

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 234.5 Million | USD 322.3 Million | 3.6% | 2023 |

India Utility Pump Industry Prospective:

India utility pump market size was worth around USD 234.5 million in 2023 and is predicted to grow to around USD 322.3 million by 2032 with a compound annual growth rate (CAGR) of roughly 3.6% between 2024 and 2032.

India Utility Pump Market: Overview

A portable, adaptable pump with several uses, mostly related to moving or extracting water, is called a utility pump. In general, these pumps are not meant for permanent installations; rather, they are meant for occasional use. Among its many important features are portability and versatility in utility pumps. Because of their versatility, efficiency, and ease of use, utility pumps are highly priced. Driven by the increasing requirement for effective water management systems as well as the fast-paced urbanization and industrialization, the India utility pump industry is expanding steadily. Another factor driving market expansion is the growing need for submersible pumps in wastewater treatment and water supply projects.

Key Insights

- As per the analysis shared by our research analyst, India's utility pump market is estimated to grow annually at a CAGR of around 3.6% over the forecast period (2024-2032).

- In terms of revenue, the India utility pump market size was valued at around USD 234.5 million in 2023 and is projected to reach USD 322.3 million, by 2032.

- The rising product launch is expected to propel India utility pump market growth over the projected period.

- Based on the type, the submersible pumps segment is expected to hold a prominent market share during the forecast period.

- Based on the end user, the commercial segment is expected to hold the largest market share over the projected period.

- Based on the region, West and Central India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Utility Pump Market: Growth Drivers

Rising demand for efficient water management drives market growth

The India utility pump market is expected to increase favorably due to the increasing demand for effective water management systems. There is a growing need for efficient wastewater management and water supply due to urbanization and industrialization. To provide dependable drainage and water distribution, submersible pumps are essential. These pumps are utilized for municipal water delivery in metropolitan areas, guaranteeing a steady and uninterrupted supply of clean water to homes and businesses. Additionally, wastewater treatment facilities use submersible pumps to effectively remove sewage and clean wastewater before disposal. Submersible pumps are essential for irrigation systems in agricultural operations because they enable farmers to maximize water use and raise crop yields.

India Utility Pump Market: Restraints

High maintenance and repair costs impede market growth

The India utility pump market can be severely hindered by maintenance and repair costs, which raise the total cost of ownership and turn off potential buyers. Utility pumps are necessary for several tasks in both domestic and commercial contexts, including irrigation, drainage, and water transfer. However, consumers' operating costs may increase due to the necessity for routine maintenance and sporadic repairs. If customers expect large recurring expenditures for maintenance and problem-solving, they could be reluctant to invest in utility pumps. Furthermore, the need for frequent maintenance might result in downtime, which can disrupt operations and cause inconvenience to users who depend on these pumps for essential duties. High maintenance and repair costs might push customers away from competitive marketplaces where consumers have options, such as renting pumps or choosing other solutions. Thus, this is expected to hamper the market growth during the forecast period.

India Utility Pump Market: Opportunities

Rising product launch offers an attractive opportunity for market growth

The increasing product launches in India by the key market players are expected to offer a potential opportunity for India utility pump market growth during the projected period. For instance, in April 2023, the DB xe Pump, a new product from one of India's top pump manufacturers, Kirloskar Brothers Limited (KBL), was recently introduced. With a wide range of expanded features and unique design factors, the pump is intended to raise the bar in the pump business. Similarly, in January 2024, a pioneer in the field of Fast-Moving Electrical Goods (FMEG), Havells India Limited announced its most recent invention, a Made in India heat pump water heater, for the first time. Designed to satisfy home needs, this state-of-the-art technology sets new benchmarks in water heating with energy savings of up to 75%. With its innovative design aimed at tackling issues related to energy loss and sufficient hot water supply, the Havells Heat Pump provides a flawless bathing experience at a mere ¼ of the energy cost of traditional water heaters.

India Utility Pump Market: Challenges

High initial cost and lack of awareness pose a major challenge to market expansion

For small-scale farmers and companies, the upfront cost of buying and installing utility pumps—especially sophisticated or energy-efficient models—can be prohibitive. Widespread adoption may also be hampered by a lack of technical understanding and awareness regarding the advantages and maintenance of utility pumps in rural areas.

India Utility Pump Market: Segmentation

India's utility pump industry is segmented based on type, end-user, and region.

Based on the type, India's utility pump market is bifurcated into gasoline-powered pumps, transfer pumps, submersible pumps, and others. The submersible pumps segment is expected to hold a prominent market share during the forecast period. The market for utility pumps has been greatly impacted by submersible pumps, which have revolutionized fluid transfer systems and water management in a variety of industries. Unmatched efficiency, dependability, and versatility are provided by these pumps, which are made to function even when completely submerged in liquid. They can be inserted straight into fluid reservoirs due to their compact design, which reduces the need for priming and the amount of space needed. Applications including irrigation, sewage systems, drainage, and groundwater management that need constant, high-volume pumping perform exceptionally well with submersible pumps. They are essential in industrial environments like mining, construction, and wastewater treatment plants because of their capacity to handle corrosive or abrasive fluids.

Based on end users, India's utility pump industry is segmented into residential, commercial, and industrial. The commercial segment is expected to hold the largest market share over the projected period. Numerous important reasons are driving the dynamic and expanding commercial drive utility pump industry. Global urbanization and industrialization are driving up demand for utility pumps across a range of industries, including construction, agriculture, and municipal services. The fact that these pumps are necessary for jobs like irrigation, water transport, and dewatering has led to their widespread use. Furthermore, the need for effective water management strategies and growing worries about water shortages are driving up demand for utility pumps with cutting-edge features like automation, remote monitoring, and energy efficiency. Furthermore, the performance and dependability of utility pumps are being improved by technological developments, such as the incorporation of smart sensors and IoT (Internet of Things) capabilities, which are propelling market expansion.

India Utility Pump Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Utility Pump Market |

| Market Size in 2023 | 234.5 Mn |

| Market Forecast in 2032 | 322.3 Mn |

| Growth Rate | CAGR of 3.6% |

| Number of Pages | 207 |

| Key Companies Covered | Lubi Pumps, Kirloskar Brothers Limited, V-Guard Industries Ltd, Texmo Industries, Grundfos India, Shakti Pumps (India) Ltd, Voltas Engineering and Mining Company, Oswal Pumps Limited, WPIL Limited, Ashirvad Pipes Pvt. Ltd., Sintex Plastics Technology Ltd., Falcon Pumps Pvt. Ltd., Sagar Machinery, Jyoti Ltd., Varuna Pumps, Sharp Industries, and others. |

| Segments Covered | By Type, By End User, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Utility Pump Market: Region Analysis

West and Central India is expected to lead the market over the forecast period

West and Central India is expected to lead the India utility pump market over the forecast period. Utility pumps are greatly needed in West India because of the region's intense industrial and agricultural activity in states like Maharashtra, Gujarat, and Rajasthan, which places a high demand on effective water management systems. These pumps are necessary for handling wastewater, supplying water to industries, and irrigation. Utility pump demand is further increased by the need for dependable water supply and sewage management systems brought on by the fast urbanization and infrastructure development projects in places like Mumbai, Pune, and Ahmedabad. Moreover, utility pumps are required for jobs like dewatering building sites and making sure appropriate drainage systems are in place because West India has a booming construction industry with a lot of residential and commercial developments. Thus, driving the market growth in the region.

India Utility Pump Market: Competitive Analysis

India's utility pump market is dominated by players like:

- Lubi Pumps

- Kirloskar Brothers Limited

- V-Guard Industries Ltd

- Texmo Industries

- Grundfos India

- Shakti Pumps (India) Ltd

- Voltas Engineering and Mining Company

- Oswal Pumps Limited

- WPIL Limited

- Ashirvad Pipes Pvt. Ltd.

- Sintex Plastics Technology Ltd.

- Falcon Pumps Pvt. Ltd.

- Sagar Machinery

- Jyoti Ltd.

- Varuna Pumps

- Sharp Industries

India's utility pump market is segmented as follows:

By Type

- Gasoline-Powered Pumps

- Transfer Pumps

- Submersible Pumps

- Others

By End User

- Residential

- Commercial

- Industrial

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

A portable, adaptable pump with several uses, mostly related to moving or extracting water, is called a utility pump. In general, these pumps are not meant for permanent installations; rather, they are meant for occasional use. Among its many important features are portability and versatility in utility pumps. Because of their versatility, efficiency, and ease of use, utility pumps are highly prized.

The India utility pump is driven by the increasing requirement for effective water management systems as well as the fast-paced urbanization and industrialization, the industry is expanding steadily. Another factor driving market expansion is the growing need for submersible pumps in wastewater treatment and water supply projects.

According to the report, India's utility pump market size was worth around USD 234.5 million in 2023 and is predicted to grow to around USD 322.3 million by 2032.

India's utility pump market is expected to grow at a CAGR of 3.6% during the forecast period.

India's utility pump market growth is driven by West and Central India. It is currently the nation's highest revenue-generating market due to industrialization.

India's utility pump market is dominated by players like Lubi Pumps, Kirloskar Brothers Limited, V-Guard Industries Ltd, Texmo Industries, Grundfos India, Shakti Pumps (India) Ltd, Voltas Engineering and Mining Company, Oswal Pumps Limited, WPIL Limited, Ashirvad Pipes Pvt. Ltd., Sintex Plastics Technology Ltd., Falcon Pumps Pvt. Ltd., Sagar Machinery, Jyoti Ltd., Varuna Pumps and Sharp Industries among others.

India's utility pump market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed