India Washing Machine Market Size, Share, Trends, Growth 2032

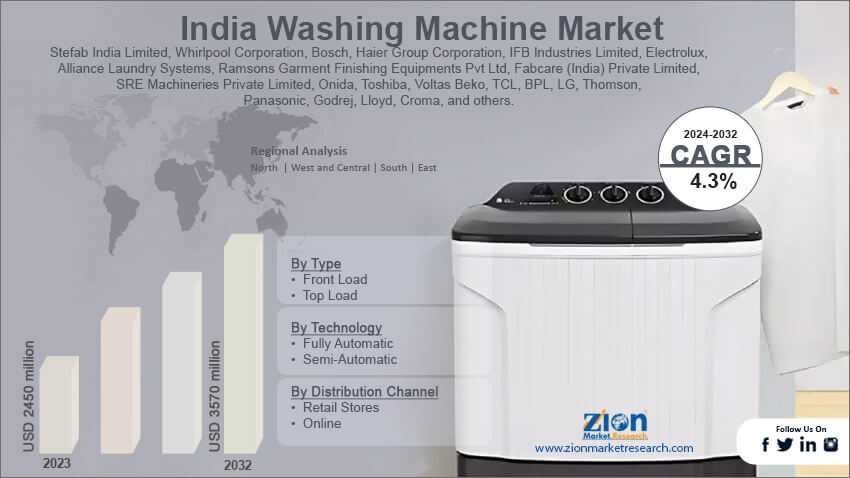

India Washing Machine Market By Type (Front Load and Top Load), By Technology (Fully Automatic and Semi-Automatic), By Distribution Channel (Retail Stores and Online), and By Region- Country and State Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

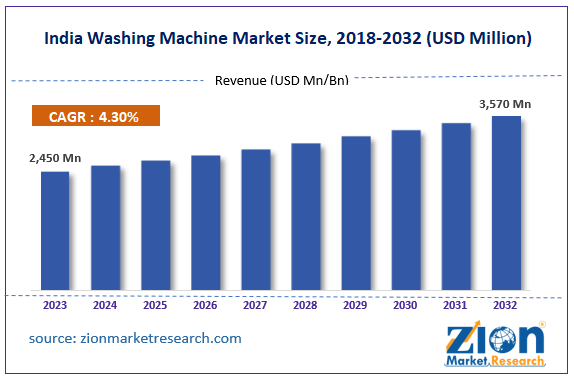

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 2450 million | USD 3570 million | 4.3% | 2023 |

India Washing Machine Industry Prospective:

India's washing machine market size was worth around USD 2,450 million in 2023 and is predicted to grow to around USD 3,570 million by 2032 with a compound annual growth rate (CAGR) of roughly 4.3% between 2024 and 2032.

India Washing Machine Market: Overview

An appliance used in homes to clean laundry, including clothes, linens, and other materials, is the washing machine. It works by agitating the objects in detergent-infused water, washing them with clean water, and then spinning the objects quickly to remove surplus water. The many settings that modern washing machines frequently offer for adjusting spin speed, water temperature, and wash cycles let consumers tailor the washing experience to the kind of laundry being washed. Smart technology features like automatic detergent delivery and Wi-Fi connectivity are also included in certain advanced versions.

Key Insights

- As per the analysis shared by our research analyst, India's washing machine market is estimated to grow annually at a CAGR of around 4.3% over the forecast period (2024-2032).

- In terms of revenue, the India washing machine market size was valued at around USD 2,450 million in 2023 and is projected to reach USD 3,570 million by 2032.

- The rising disposable income is expected to propel India washing machine market growth over the projected period.

- Based on the type, the top load segment is expected to dominate the market during the forecast period.

- Based on its technology, the semi-automatic segment is expected to hold a significant market share over the forecast period.

- Based on the distribution channel, the online segment is expected to grow at the highest CAGR during the forecast period.

- Based on the region, South India is expected to dominate the market over the projected period.

Request Free Sample

Request Free Sample

India Washing Machine Market: Growth Drivers

Enhancement of smart home technology drives market growth

The demand for washing machines is shaped by several factors. These include the increasing number of smart house installations, the growth in home remodeling projects, and the rapid advancement of wireless & information technology. An increasing number of smart home technologies are finding homes in Western countries because of the boom in home repair initiatives. In addition, the increasing amount of money spent on house improvements is increasing demand for goods, especially because mortgage and housing costs are rising. With 35.3% of the market share in the current year, the smart washing machine segment is expected to continue to have a leading position in the years to come. This area is primarily driven by consumers' increasing awareness of new technologies, which has resulted in a significant increase in the use of smart gadgets in homes. In addition, it is anticipated that changing lifestyles, rising per capita income, and an increasing focus on lowering energy expenses would fuel demand for these products. Thus driving the India washing machine market.

India Washing Machine Market: Restraints

High electricity consumption impedes market growth

The expansion of India washing machines market is severely hindered by high electricity usage. Consumers and regulatory agencies are placing a higher priority on energy efficiency as energy costs rise and environmental concerns grow. The amount of electricity used in homes can be greatly increased by washing machines, especially the older or non-energy-efficient ones. Worries about rising utility costs may prevent consumers from upgrading or buying new washing machines. Furthermore, the growth of the market is further impacted by strict energy efficiency rules and labeling requirements in different areas. To meet consumer needs and regulatory regulations, manufacturers are under pressure to develop and offer more energy-efficient washing machines.

India Washing Machine Market: Opportunities

Rising innovative product launch offers an attractive opportunity for market growth

The growing innovative product launch is expected to offer a lucrative opportunity to India washing machine industry over the projected period. For instance, in November 2023, the launch of the company's new AI-enabled 959 Direct Motion Motor Fully Automatic Front Load Washing Machines in India was announced by Haier Appliances India (Haier India), the world leader in home appliances and the world's top brand in major appliances for 14 years running. In keeping with its brand mission of "Made in India, Made for India," Haier plans to launch smart home, AI, and IoT-enabled laundry solutions that are ready for the future. These solutions will offer premium wash and fabric care using cutting-edge technologies for INR 56,990 and will be available through the company's official online store and retail locations. At the heart of Haier's operations is its dedication to bringing customer-inspired products to India, and the brand has developed over time to satisfy the needs of consumers seeking inspired living.

India Washing Machine Market: Challenges

Water scarcity poses a major challenge to market expansion

In many areas of India, there is a serious water shortage, which makes it difficult to use washing machines because they need a lot of water to function properly. Customers who live in areas with limited water supplies can be reluctant to buy washing machines because of worries about water usage. Thus, the water scarcity in some parts of India might be a major challenge for the growth of India washing machine industry.

India Washing Machine Market: Segmentation

India's washing machine industry is segmented based on type, technology, distribution channel, and region.

Based on the type, India's washing machine market is bifurcated into front load and top load. The top load segment is expected to dominate the market during the forecast period. Because they are more accessible, user-friendly, and well-known to customers, top load washing machines continue to dominate the market for washing machines. They include benefits like easier maintenance, faster wash cycles, and the option to add laundry in between cycles. The market for top load washing machines is growing because manufacturers frequently release new models with cutting-edge features to draw in customers. Additionally, top load washers are the industry standard in developing nations where infrastructure constraints can make front load models inaccessible, offering consumers looking for reliable laundry appliances a workable option.

Based on technology, India washing machine industry is segmented into fully automatic and semi-automatic. The semi-automatic segment is expected to hold a significant market share over the forecast period. The Indian market has always been dominated by semi-automatic washing machines because of their reasonable price and appropriateness for areas with erratic energy and water supplies. These machines are more affordable than fully automatic models; therefore, price-conscious consumers like them even though they need human involvement to fill and empty the water.

Based on distribution channels, India washing machine market is segmented into retail stores and online. The online segment is expected to grow at the highest CAGR during the forecast period. India's online sales of washing machines have increased dramatically as a result of the growth of e-commerce sites like Amazon, Flipkart, and others. These marketplaces appeal to customers because they provide a large selection of goods, affordable prices, simple comparisons, and several payment choices. Additionally, more people are purchasing washing machines online thanks to the ease of internet shopping, which allows you to browse different models, read reviews, and compare costs without having to leave your house. This is particularly true in places with a high internet penetration rate, such as cities and semi-urban areas.

India Washing Machine Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Washing Machine Market |

| Market Size in 2023 | 2,450 Mn |

| Market Forecast in 2032 | 3,570 Mn |

| Growth Rate | CAGR of 4.3% |

| Number of Pages | 213 |

| Key Companies Covered | Stefab India Limited, Whirlpool Corporation, Bosch, Haier Group Corporation, IFB Industries Limited, Electrolux, Alliance Laundry Systems, Ramsons Garment Finishing Equipments Pvt Ltd, Fabcare (India) Private Limited, SRE Machineries Private Limited, Onida, Toshiba, Voltas Beko, TCL, BPL, LG, Thomson, Panasonic, Godrej, Lloyd, Croma, and others. |

| Segments Covered | By Type, By Technology, By Distribution Channel, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Washing Machine Market: Region Analysis

South India is expected to lead the market over the forecast period

South India is expected to lead the India washing machine market over the forecast period. The washing machine market is largely driven by South India for several reasons. First, the area is densely populated, and the middle class is expanding, raising household earnings and purchasing power. As customers seek ease and efficiency in their daily duties, this generational shift drives demand for household equipment, especially washing machines. In addition, South India has rainy seasons and high humidity, which need frequent laundry. The year-round demand for washing machines is partly attributed to this climatic condition. Furthermore, the increasing number of homes switching to automated laundry solutions is driving the use of washing machines in places like Bengaluru, Chennai, and Hyderabad due to modernization and urbanization activities.

India Washing Machine Market: Competitive Analysis

India's washing machine market is dominated by players like:

- Stefab India Limited

- Whirlpool Corporation

- Bosch

- Haier Group Corporation

- IFB Industries Limited

- Electrolux

- Alliance Laundry Systems

- Ramsons Garment Finishing Equipments Pvt Ltd

- Fabcare (India) Private Limited

- SRE Machineries Private Limited

- Onida

- Toshiba

- Voltas Beko

- TCL

- BPL

- LG

- Thomson

- Panasonic

- Godrej

- Lloyd

- Croma

India's washing machine market is segmented as follows:

By Type

- Front Load

- Top Load

By Technology

- Fully Automatic

- Semi-Automatic

By Distribution Channel

- Retail Stores

- Online

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

An appliance used in homes to clean laundry, including clothes, linens, and other materials, is the washing machine. It works by agitating the objects in detergent-infused water, washing them with clean water, and then spinning the objects quickly to remove surplus water. The many settings that modern washing machines frequently offer for adjusting spin speed, water temperature, and wash cycles let consumers tailor the washing experience to the kind of laundry being washed. Smart technology features like automatic detergent delivery and Wi-Fi connectivity are also included in certain advanced versions.

Technological improvements and changing consumer tastes are driving significant changes in the Indian washing machine market. Primarily, the growing emphasis on sustainability and energy efficiency is driving the market expansion. Additionally, because customers are becoming more environmentally conscious, manufacturers all over the nation are releasing washing machines with cutting-edge features like low power consumption and water-saving options, which is favorably affecting the market growth throughout India.

According to the report, India's washing machine market size was worth around USD 2,450 million in 2023 and is predicted to grow to around USD 3,570 million by 2032.

India's washing machine market is expected to grow at a CAGR of 4.3% during the forecast period.

India's washing machine market growth is driven by South India. It is currently the nation's highest revenue-generating market due to the rising disposable income.

India's washing machine market is dominated by players like Stefab India Limited, Whirlpool Corporation, Bosch, Haier Group Corporation, IFB Industries Limited, Electrolux, Alliance Laundry Systems, Ramsons Garment Finishing Equipments Pvt Ltd, Fabcare (India) Private Limited, SRE Machineries Private Limited, Onida, Toshiba, Voltas Beko, TCL, BPL, LG, Thomson, Panasonic, Godrej, Lloyd and Croma among others.

India's washing machine market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTLE analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five forces analysis, and value chain analysis.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed