India Water Purifier Market Size, Share, Analysis, Trends, Growth Report, 2032

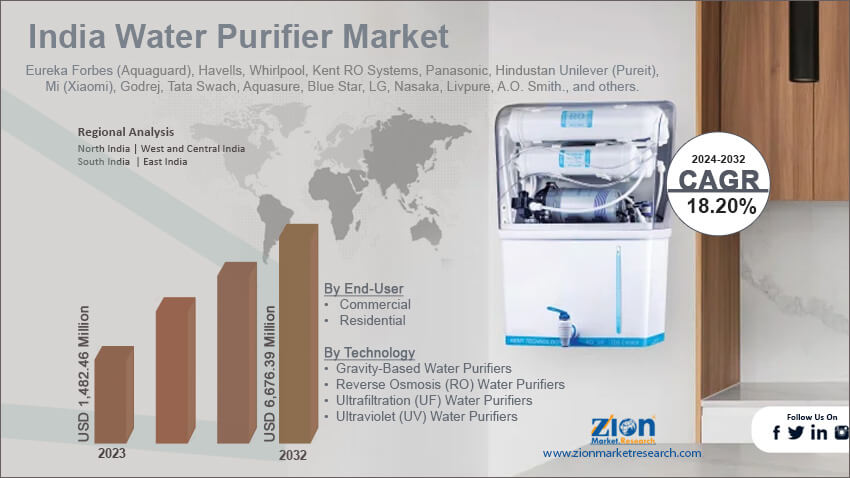

India Water Purifier Market By End-User (Commercial and Residential), By Technology (Gravity-Based Water Purifiers, Reverse Osmosis (RO) Water Purifiers, Ultrafiltration (UF) Water Purifiers, and Ultraviolet (UV) Water Purifiers), and By Region - Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032-

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

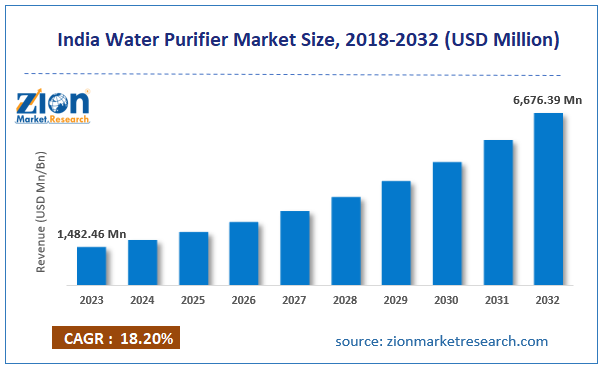

| USD 1,482.46 Million | USD 6,676.39 Million | 18.20% | 2023 |

India Water Purifier Industry Prospective:

The India water purifier market size was worth around USD 1,482.46 million in 2023 and is predicted to grow to around USD 6,676.39 million by 2032 with a compound annual growth rate (CAGR) of roughly 18.20% between 2024 and 2032.

India Water Purifier Market: Overview

India’s water purifier industry is a growing market that deals with developing, distributing, and applying water purifiers across the country. The growing need for clean water across India is driving the demand for efficient water purification solutions. According to the official definition, a water purifier is a tool or a machine that assists in removing unwanted materials and contaminants from water to make it safe for drinking. Water purifiers rely on several different types of technologies to remove and destroy contaminants from the water. Water filters and water purifiers are two separate technologies. While both aid the removal of contaminants from water, the former only filters the unwanted material, while the latter filters and destroys contaminating agents. One of the main drawbacks of a water purifier is associated with the device eliminating essential minerals from water during the purification process. The demand for water purifiers is growing in India due to a surge in consumer awareness and increasing health consciousness. However, the high price of water purifiers and other competing technologies may limit the industry’s growth rate, as per market research.

Key Insights:

- As per the analysis shared by our research analyst, the India water purifier market is estimated to grow annually at a CAGR of around 18.20% over the forecast period (2024-2032)

- In terms of revenue, the India water purifier market size was valued at around USD 1,482.46 million in 2023 and is projected to reach USD 6,676.39 million by 2032.

- The India water purifier market is projected to grow at a significant rate due to the rising number of diseases caused by impure water

- Based on the end-user, the residential segment is growing at a high rate and will continue to dominate the regional market as per industry projection

- Based on the technology, the reverse osmosis (RO) water purifiers segment is anticipated to command the largest market share

- Based on region, Northern states in India are projected to dominate the regional market during the forecast period

Request Free Sample

Request Free Sample

India Water Purifier Market: Growth Drivers

Rising number of diseases caused by impure water will drive the market demand rate

The India water purifier market is expected to be driven by the rising number of medical conditions caused by drinking impure water. Consuming contaminated water over a long period is associated with several mild to serious conditions. According to the World Health Organization, contaminated water can cause diseases such as dysentery, cholera, typhoid, hepatitis A, and polio. Water pollution and contamination rates in India are growing at an alarming rate. As per official statistics published by the World Economic Forum, around 70% of India’s water is considered unfit for drinking. As per the National Institutes of Health (NIH), between 2011 and 2020, India reported nearly 565 outbreaks of cholera, resulting in more than 200 deaths. Consumer awareness around the importance of drinking clean water has been growing steadily, resulting in greater use of water purifiers. The rise in awareness drives managed by government agencies and regional welfare organizations is fueling the use of water purifying tools.

Increased spending on marketing and advertisement will promote market expansion

Companies developing water purifiers are excessively investing in the marketing and advertising of the products. These advertisements are drafted to generate product awareness and educate the consumers. Moreover, the regional market players are adopting creative ways of generating acceptance and demand for water purifiers. The reach of social media platforms has helped market players reach remote consumers. In addition to this, the sale of water purifiers through e-commerce channels has been influential in shaping the regional industry. India has one of the world’s largest consumer groups with increasing disposable income and changing lifestyles. The India water purifier market can benefit from the growing revenue reported in the regional online sales platforms and e-commerce channels.

India Water Purifier Market: Restraints

Concerns over the destruction of essential minerals during the purification process may limit the industry’s expansion rate

The water purifier industry in India is projected to be restricted due to the growing concerns over the destruction of essential minerals present in water during the purification process. For instance, water purifiers with reverse osmosis (RO) technology use a semipermeable membrane for filtering impurities. However, essential minerals such as magnesium, potassium, and calcium may also get destroyed during the process, leading to the availability of drinking water that is low in vital minerals. Soft water is associated with medical conditions such as poor bone health and electrolyte imbalance.

India Water Purifier Market: Opportunities

Increasing the launch of advanced water purifiers with cutting-edge designs and technologies will generate more growth opportunities

The India water purifier market is expected to generate more growth opportunities during the projection period due to the surge in the launch of new solutions in the commercial market. Water purifier developing companies are increasingly spending on developing smarter systems that are easy to manage and equipped with automated solutions for intelligent handling. For instance, Livpure, a leading player in the regional market, currently offers 8 types of water purifiers boasting technologies such as UF, UV, and RO filtration. Additionally, the company also offers alkaline filtration systems for improved performance. In July 2024, Lustral Water, an Indian business-to-consumer (B2C) company, announced the launch of the world’s first Internet of Things (IoT) and Artificial Intelligence (AI) enabled water purifier. The technology is equipped to remove harmful bacteria and toxins while ensuring zero damage to the vitamins and minerals present in the water. The availability of several financial schemes, such as equated monthly installments (EMIs) and other forms of monetary loans, will promote more buyers for water purifiers.

India Water Purifier Market: Challenges

High cost of the devices and regular maintenance may challenge the market expansion trend

The India water purifier industry is expected to be challenged by the high cost of the machines. For instance, the cost of RO purifiers can range between INR 10,000 to INR 20,000. The cost increases further with the addition of smart technologies. In addition, the disruptions in the supply chain of raw materials could hinder a smooth market growth rate. The Indian market is also dominated by several other alternatives to modern water purifiers. Water filters, for instance, are widely popular in certain parts of the country, limiting demand for water purifiers.

India Water Purifier Market: Segmentation

The India water purifier market is segmented based on end-user, technology, and region.

Based on the end-user, the regional market divisions are commercial and residential. In 2023, the highest demand was observed in the residential segment. India’s growing urbanization rate is one of the major segmental growth propellers. Citizens in India are increasingly moving toward urban areas influenced by higher job opportunities and infrastructure development. In addition, the rising disposable income of an average Indian citizen is further promoting segmental demand, as per market research. As per official records, the monthly per capita consumption expenditure (MPCE) in urban India is over INR 6000.

Based on the technology, the India water purifier divisions are gravity-based water purifiers, reverse osmosis (RO) water purifiers, ultrafiltration (UF) water purifiers, and ultraviolet (UV) water purifiers. In 2023, India registered higher demand in the reverse osmosis (RO) water purifiers segment. The technology is highly effective in eliminating water contaminants. RO systems can remove around 90% to 99% of total dissolved solids (TDS). Moreover, RO systems are highly versatile and hence preferred among common buyers in India.

India Water Purifier Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | India Water Purifier Market |

| Market Size in 2023 | 1,482.46 Mn |

| Market Forecast in 2032 | 6,676.39 Mn |

| Growth Rate | CAGR of 18.20% |

| Number of Pages | 225 |

| Key Companies Covered | Eureka Forbes (Aquaguard), Havells, Whirlpool, Kent RO Systems, Panasonic, Hindustan Unilever (Pureit), Mi (Xiaomi), Godrej, Tata Swach, Aquasure, Blue Star, LG, Nasaka, Livpure, A.O. Smith., and others. |

| Segments Covered | By End-User, By Technology, and By Region |

| Regions Covered in India | North India, West and Central India, South India, and East India |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

India Water Purifier Market: Regional Analysis

Northern states in India to deliver exceptional results during the projection period

The India water purifier market is expected to be driven by Northern states during the projection period. The demand for water purifiers will be higher in states such as Gujarat, Maharashtra, Rajasthan, and others. Northern states are witnessing greater rates of internal immigration led by the surge in infrastructure development projects and job opportunities. In addition to this, water pollution levels in Northern regions are growing at a significant rate due to the development and operations of several factories involved in the production of harmful materials. For instance, the Yamuna River in India’s Capital Delhi is currently contaminated with high levels of ammonia that is reported to be over 2.5 parts per million. Between May 2023 and June 2024, the Maharashtra Pollution Control Board (MPCB) issued around 20 directives to sugar industries for controlling water pollution in regions around them. Southern states will also play a critical role in fueling the market expansion trend. The higher consumer awareness regarding the benefits of clean water as well as the rising construction of commercial establishments in southern cities will influence regional demand over the projection period.

India Water Purifier Market: Competitive Analysis

The India water purifier market is led by players like:

- Eureka Forbes (Aquaguard)

- Havells

- Whirlpool

- Kent RO Systems

- Panasonic

- Hindustan Unilever (Pureit)

- Mi (Xiaomi)

- Godrej

- Tata Swach

- Aquasure

- Blue Star

- LG

- Nasaka

- Livpure

- A.O. Smith.

The India water purifier market is segmented as follows:

By End-User

- Commercial

- Residential

By Technology

- Gravity-Based Water Purifiers

- Reverse Osmosis (RO) Water Purifiers

- Ultrafiltration (UF) Water Purifiers

- Ultraviolet (UV) Water Purifiers

By Region

- North India

- West and Central India

- South India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

India’s water purifier industry is a growing market that deals with the development, distribution, and application of water purifiers across the country.

The India water purifier market is expected to be driven by the rising number of medical conditions caused by drinking impure water.

According to study, the India water purifier market size was worth around USD 1,482.46 million in 2023 and is predicted to grow to around USD 6,676.39 million by 2032.

The CAGR value of India water purifier market is expected to be around 18.20% during 2024-2032.

The India water purifier market is expected to be driven by Northern states during the projection period.

The India water purifier market is led by players like Eureka Forbes (Aquaguard), Havells, Whirlpool, Kent RO Systems, Panasonic, Hindustan Unilever (Pureit), Mi (Xiaomi), Godrej, Tata Swach, Aquasure, Blue Star, LG, Nasaka, Livpure and A.O. Smith.

The report explores crucial aspects of the India water purifier market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed