Indian Spice Market Size, Share, Analysis, Trends, Growth 2030

Indian Spice Market - By Product (Pure Spices and Blended Spices), By Application (Vegetable Curries, Snacks & Convenience Foods, Meat & Poultry Products, Bakery & Confectionery, Sauces & Dressings, Frozen Foods, Soups, Beverages, and Others), By Form (Packets, Crusher, and Sprinkler), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

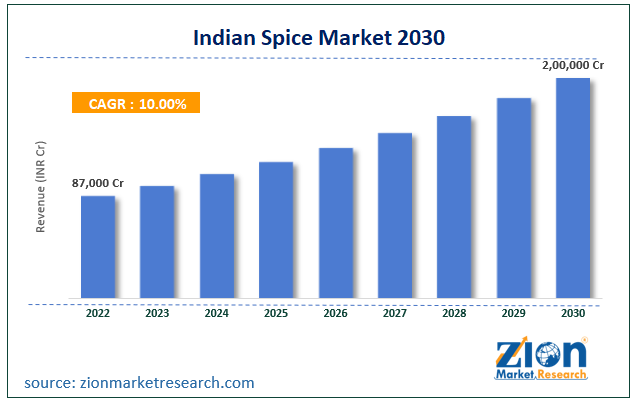

| INR 87,000 Million | INR 2,00,000 Million | 10% | 2022 |

Indian Spice Industry Prospective:

The Indian spice market size was evaluated at INR 87,000 Cr in 2022 and is slated to hit INR 2,00,000 Cr by the end of 2030 with a CAGR of nearly 10% between 2023 and 2030.

Indian Spice Market: Overview

Spices are an integral part of any Indian dishes which are used for flavoring, seasoning, pungency, and coloring. The government (Spices Board of India) is also propelling aggressively to export Indian spices to gain market share and market value prominently with the help of promotions and brandings during international fairs. Around 1.08 billion kgs of total spices have been exported by India during the 2017-2018 year, valued at approximately USD 3.11 billion.

Reportedly, Indian spices are known for their taste, texture, flavor, and aroma as well as improving food quality. In addition to this, exotic spices such as Italian and Mexican species have gained traction in India. A diverse range of spices in India finds a slew of applications as flavoring agents, curries, and snacks in the form of turmeric and chilies. For the record, India is one of the major producers of spices across the globe.

Key Insights

- As per the analysis shared by our research analyst, the Indian spice market is projected to expand annually at the annual growth rate of around 10% over the forecast timespan (2023-2030)

- In terms of revenue, the Indian spice market size was evaluated at nearly INR 87,000 Cr in 2022 and is expected to reach INR 2,00,000 Cr by 2030.

- The Indian spice market is anticipated to grow rapidly over the forecast timeline owing to a surge in the use of value-added spices such as infused oils, spice blends, and flavoured salts.

- In terms of product, the pure spices segment is slated to register the highest CAGR over the forecast period.

- Based on the application, the vegetable curries segment is predicted to dominate the segmental surge over the forecast period.

- Based on the form, the packets segment is set to lead the segmental space over the forecast timeline.

- Region-wise, the North Indian spice industry is projected to register the fastest CAGR during the assessment timeline.

Request Free Sample

Request Free Sample

Indian Spice Market: Growth Factors

Large-scale availability of eatables in retail stores to elevate the growth of the Indian spice market over the forecast period

The growing availability of perishable consumer goods in retail stores and the thriving e-commerce sector in India will drive the growth of the Indian spice market. Furthermore, the Government of India is offering a large number of initiatives for promoting the use of spices in various foods to improve the taste of food. Such initiatives will augment the scope of growth of the market in India.

With a rise in globalization, consumers globally are developing a preference for various Indian cuisines and flavors. This has prompted the demand for Indian spices across the globe. A surge in the use of value-added spices such as infused oils, spice blends, and flavored salts has embellished the growth of the spice business in India.

Indian Spice Market: Restraints

An increase in product exports to other countries leading to massive price rise can be a key restraining factor for the market growth

A rise in the exports of products and changes in the costs of spices in India can put brakes on the growth of the Indian spice industry. In addition to this, differing GSTs on spices in various states of India can further decimate the expansion of the spice business in India.

Indian Spice Market: Opportunities

Thriving food processing activities can generate new growth opportunities for the spice market in India

The rapid expansion of the food processing sector and intake of organic as well as sustainable food items will open new avenues of growth for the Indian spice market.

Indian Spice Market: Challenges

Ongoing regional conflicts in Europe and the Middle East region can pose a huge challenge to the spice business growth in India

The ongoing conflicts between Russia and Ukraine and Israel & Hamas have resulted in a blockade of the sea route, thereby posing a huge challenge for exporting the spices made in India to other countries via the sea route. This has posed a huge threat to the demand for Indian spices across the globe and hence hindered the growth of the Indian spice industry.

Indian Spice Market: Segmentation

The Indian spice market is sectored into product, application, form, and region.

In product terms, the Indian spice market is segregated into pure spices and blended spices segments. Furthermore, the pure spices segment, which acquired nearly 69% of the Indian spice market proceeds in 2022, is anticipated to record the highest gains over the forecast timeframe. The expansion of the segment during the period from 2023 to 2030 can be due to a rise in the demand for pure spices with surging customer awareness and inclination towards the use of natural ingredients as spices in food. Moreover, consumers are growingly becoming aware of health & fitness and hence avoiding preservatives and artificial additives. This aspect is likely to boost the demand for pure spices in the coming years.

Based on the application, the Indian spice industry is divided into vegetable curries, snacks & convenience foods, meat & poultry products, bakery & confectionery, sauces & dressings, frozen foods, soups, beverages, and other segments. Moreover, the vegetable curries segment, which led the application space in 2022, is expected to dominate the segmental growth during the forecast timeline. The growth of the segment over the forecast period can be subject to the massive use of spices in vegetable curries in various Indian cuisines for adding rich flavor and color to vegetable curries.

Based on the form, the Indian spice market is sectored into packets, crusher, and sprinkler segments. In addition to this, the packets segment, which contributed majorly towards the market share in India in 2022, is anticipated to lead the segmental growth in the coming seven years. The segmental surge over the forecast period can be attributed to the ability of packets to retain the vitality and freshness of spices in an elongated period as packets offer airtight packaging. Apart from this, packets help prevent spices from getting exposed to moisture, light, chemicals, and heat along with preventing the spices from getting spoiled due to rapidly changing climatic conditions in tropical countries like India.

Indian Spice Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Indian Spice Market |

| Market Size in 2022 | INR 87,000 Crore |

| Market Forecast in 2030 | INR 2,00,000 Crore |

| Growth Rate | CAGR of 10% |

| Number of Pages | 222 |

| Key Companies Covered | Everest Food Products Pvt. Ltd., LIFESTYLE FOODS PVT LTD., Mahashian Di Hatti Pvt. Ltd., Patanjali Ayurved Limited, Ashok Masale, Badshah Masala Private Limited, Goldiee Group, Aachi Masala Foods (P) Ltd, ITC Limited, Ushodaya Enterprises Pvt. Ltd. (Priya), Sakthi Masala Private Limited, Eastern Condiments Pvt. Ltd., Tata Consumer Products Limited, MTR Foods Pvt Ltd, DS Group (Catch), Zoff Foods Private Limited., and others. |

| Segments Covered | By Product, By Application, By Form, and By Region |

| Countries Covered In India | South India, North India, West & Central India), and East India |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Indian Spice Market: Regional Insights

South Indian region is predicted to lead the Indian Spice market over the forecast timeline

South Indian region, which contributed about half of the Indian spice market earnings in 2022, is likely to be a leading region over the forecast timeframe. Moreover, the regional market expansion over the upcoming years can be attributed to its apt tropical climatic conditions for cultivating key spices. The availability of fertile soils along with abundant rainfall has accounted for massive cultivation of the major species such as turmeric, black pepper, cinnamon, cardamom, cloves, and turmeric. Furthermore, farmers in the Southern part of India pass their know-how for producing high-quality spices which will help in catering to various culinary preferences of people.

The North Indian spice industry is set to record the fastest CAGR in the next seven years. The growth of the industry in the sub-continent over the forecast timeframe can be subject to the presence of key product manufacturers in the region along with large-scale consumption of foods made up of spice in the states such as Uttar Pradesh, Delhi, Madhya Pradesh, and Jammu & Kashmir.

Key Developments

- In May 2022, Jhaveri Spices Private Limited, a key Mumbai-based manufacturer of spices, launched a slew of flavours such as Pav Bhaji Masala, Rajashahi Garam Masala, and Kitchen King Masala.

- In the first quarter of 2023, VAHDAM® India, a global wellness firm and leader in the manufacture of organic as well as premium teas in India, launched VAHDAM® Spices, a new category of products with a view of expanding its foothold in food & wellness sector.

- In September 2022, Dabur India, an FMCG firm based in India, declared expansion of its Hommade Foods product line by launching Dabur Hommade Tasty Masala. For the record, the launching of a new product demonstrates the company’s entry into the spices business in India.

- In November 2022, ITC Limited, a key Indian firm in the FMCG business, introduced a new spices processing unit in Andhra Pradesh. The move is likely to boost the production and sale of spices in India.

Indian Spice Market: Competitive Space

The Indian spice market profiles key players such as:

- Everest Food Products Pvt. Ltd.

- LIFESTYLE FOODS PVT LTD.

- Mahashian Di Hatti Pvt. Ltd.

- Patanjali Ayurved Limited

- Ashok Masale

- Badshah Masala Private Limited

- Goldiee Group

- Aachi Masala Foods (P) Ltd

- ITC Limited

- Ushodaya Enterprises Pvt. Ltd. (Priya)

- Sakthi Masala Private Limited

- Eastern Condiments Pvt. Ltd.

- Tata Consumer Products Limited

- MTR Foods Pvt Ltd

- DS Group (Catch)

- Zoff Foods Private Limited.

The Indian spice market is segmented as follows:

By Product

- Pure Spices

- Blended Spices

By Application

- Vegetable Curries

- Snacks & Convenience Foods

- Meat & Poultry Products

- Bakery & Confectionery

- Sauces & Dressings

- Frozen Foods

- Soups

- Beverages

- Others

By Form

- Packets

- Crusher

- Sprinkler

By Region

- South India

- North India

- West & Central India

- East India

Table Of Content

Methodology

FrequentlyAsked Questions

Spices are an integral part of any Indian dishes which are used for flavouring, seasoning, pungency, and colouring. The government (Spices Board of India) is also propelling aggressively to export Indian spices to gain market share and market value prominently with the help of promotions and brandings during international fairs.

The Indian spice market growth over forecast period can be owing to a surge in the use of value-added spices such as infused oils, spice blends, and flavoured salts.

According to a study, the Indian spice industry size was in INR 87,000 Cr 2022 and is projected to reach INR 2,00,000 Cr by the end of 2030.

The Indian spice market is anticipated to record a CAGR of nearly 10% from 2023 to 2030.

The North Indian spice industry is set to register the fastest CAGR over the forecasting timeline can be owing to the presence of key product manufacturers in the region along with large-scale consumption of foods made up of spice in the states such as Uttar Pradesh, Delhi, Madhya Pradesh, and Jammu & Kashmir.

The Indian spice market is led by players such as Everest Food Products Pvt. Ltd., LIFESTYLE FOODS PVT LTD., Mahashian Di Hatti Pvt. Ltd., Patanjali Ayurved Limited, Ashok Masale, Badshah Masala Private Limited, Goldiee Group, Aachi Masala Foods (P) Ltd, ITC Limited, Ushodaya Enterprises Pvt. Ltd. (Priya), Sakthi Masala Private Limited, Eastern Condiments Pvt. Ltd., Tata Consumer Products Limited, MTR Foods Pvt Ltd, DS Group (Catch), and Zoff Foods Private Limited.

The Indian spice market report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, sentiment analysis, PESTEL analysis, trend analysis, SWOT analysis, trade area analysis, demand & supply analysis, Porter’s five force analysis, and value chain analysis.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed