Industrial Automation Cable Market Size, Share, Trends, Growth and Forecast 2034

Industrial Automation Cable Market By Cable Type (Power Cable, Control Cable, Fieldbus Cable, Sensor Cable, and Data Cable), By Material Type (Copper, Aluminum, and Fiber Optic), By End-User Industry (Automotive, Food & Beverage, Oil & Gas, Chemical & Petrochemical, Pharmaceutical, Mining, Manufacturing, and Others), By Installation Type (Fixed Installation, Flexible Installation), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

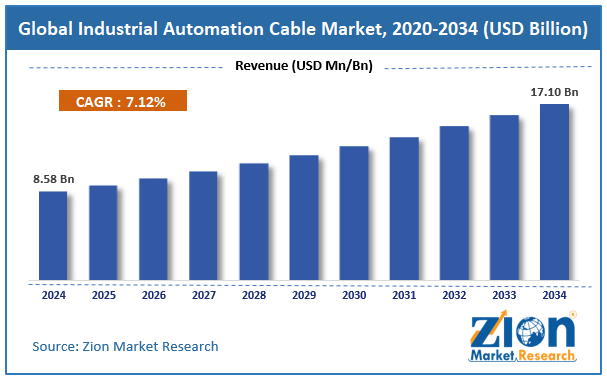

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 8.58 Billion | USD 17.10 Billion | 7.12% | 2024 |

Industrial Automation Cable Industry Prospective:

The global industrial automation cable market was valued at approximately USD 8.58 billion in 2024 and is expected to reach around USD 17.10 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 7.12% between 2025 and 2034.

Industrial Automation Cable Market: Overview

Industrial automation cables are specialized electrical and communication cables designed to withstand the harsh industrial environment and transmit power and data for automated systems. This growing sector has changed manufacturing processes, production efficiency, and operational reliability across various industries. Industrial automation cables are the backbone of modern factory automation, providing solutions through durable insulation, high-grade conductors, and better shielding to enable machines, sensors, controllers, and other automated equipment to communicate in harsh conditions.

Factory digitalization, increasing manufacturing automation, and the need for connectivity in an industrial environment drive the industrial automation cable industry.

Implementation of Industry 4.0 technologies, demand for high-performance cables in manufacturing facilities, and increasing emphasis on system reliability and uptime across industries are expected to drive the market's growth over the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial automation cable market is estimated to grow annually at a CAGR of around 7.12% over the forecast period (2025-2034)

- In terms of revenue, the global industrial automation cable market size was valued at around USD 8.58 billion in 2024 and is projected to reach USD 17.10 billion by 2034.

- The industrial automation market is projected to grow significantly due to the increasing adoption of industrial automation systems, rising demand for intelligent manufacturing solutions, and expanding implementation of IIoT (Industrial Internet of Things) technologies across production facilities.

- Based on cable type, control cables lead the segment and will continue to dominate the global market.

- Based on material type, copper cables are anticipated to command the largest market share.

- Based on the end-user industry, automotive manufacturing is expected to lead the market during the forecast period.

- Based on installation type, fixed installation cables will remain the dominant segment during the forecast period.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Industrial Automation Cable Market: Growth Drivers

Rising demand for smart manufacturing and factory automation

In the industrial automation cable market, as industrial processes get more digitalized, there is more emphasis on high-quality, reliable cables for automation systems. Manufacturers seek industrial automation cable solutions that perform better, last longer, and transmit data consistently to maximize productivity and minimize downtime.

According to recent industry surveys, companies with complete automation systems report up to 45% productivity gain, and reliable cabling infrastructure is a key success factor.

Technological advancements in cable design and materials

Technological advances drive the industrial automation cable market, with manufacturers developing new insulation materials, shielding technologies, and cables for specific industrial applications. Modern industrial automation cables are more resistant to oils, chemicals, extreme temperatures, and mechanical stress than traditional cables.

72% of industrial facility managers list cable durability and performance specifications as the top criteria when selecting components for automation systems. Cable manufacturers are allocating more of their R&D budget to develop specialized industrial cables, with investment in new cable technologies growing by 16% annually.

Industrial Automation Cable Market: Restraints

Price sensitivity and cost pressures

Budget constraints, cost competition, and ROI considerations are significant challenges to the industrial automation cable industry. As manufacturers are forced to reduce costs while upgrading their facilities, cable investments must be justified. Industry reports show that 65% of project managers cite cable costs as essential in automation system design decisions, especially for large-scale projects requiring extensive cabling infrastructure.

Industrial Automation Cable Market: Opportunities

Integration of fiber optic technology for industrial applications

Fiber optic technology is changing the industrial automation cable market by offering better electromagnetic interference immunity, longer transmission distance, and higher data bandwidth. Fiber optic industrial automation cables can now deliver reliable communication in high-noise environments and provide the speed for advanced automation applications.

For example, manufacturing facilities using fiber optic industrial automation cables report 45% fewer communication errors and 30% faster system response time than traditional copper-based installations.

Industrial Automation Cable Market: Challenges

Complexity in cable selection and compatibility requirements

The industrial automation cable industry is big, but system integration complexity is a significant barrier to optimal implementation. 58% of system integrators identify cable selection as one of the biggest challenges in automation projects because of the many protocols, specifications, and environmental requirements.

42% of facility managers say cable compatibility with connected equipment is a common cause of implementation delay. International standards and certification requirements also add to the complexity of specifications for global manufacturers.

Many industrial facilities struggle to balance cabling needs today with future-proofing for future upgrades. As production environments move to mixed automation technologies, the demand for versatile, hybrid cables supporting multiple protocols and power requirements is growing.

Industrial Automation Cable Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Automation Cable Market |

| Market Size in 2024 | USD 8.58 Billion |

| Market Forecast in 2034 | USD 17.10 Billion |

| Growth Rate | CAGR of 7.12% |

| Number of Pages | 217 |

| Key Companies Covered | Belden Inc., Prysmian Group, Nexans, Southwire Company LLC, Lapp Group, Anixter International (WESCO International), TPC Wire & Cable Corp., Helukabel GmbH, SAB Bröckskes GmbH & Co. KG, Leoni AG, Eland Cables, Lutze Inc., Sumitomo Electric Industries Ltd., TE Connectivity, Alpha Wire, General Cable (Prysmian Group), Encore Wire Corporation, Hitachi Metals Ltd., Allied Wire & Cable, Teldor Cables, and others. |

| Segments Covered | By Cable Type, By Material Type, By End-User Industry, By Installation Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Automation Cable Market: Segmentation

The global industrial automation cable market is segmented into cable type, material type, end-user industry, installation type, and region.

Based on cable type, the market is segregated into power, control, fieldbus, sensor, and data cables. Control cables lead the market by providing essential connectivity for industrial control systems, machine interfaces, and automated equipment. Control cables account for approximately 36% of industrial automation cable installations.

Based on material type, the industrial automation cable market is divided into copper, aluminum, and fiber optic. Copper cables are expected to lead the market during the forecast period as they provide excellent conductivity, reliability, and cost-effectiveness, accounting for over 68% of revenue across manufacturing and process automation applications.

Based on the end-user industry, the industrial automation cable industry is categorized into automotive, food & beverage, oil & gas, chemical & petrochemical, pharmaceutical, mining, manufacturing, and others. The automotive industry is expected to lead the market since it represents the highest level of manufacturing automation with extensive robotic systems and assembly line technologies, accounting for approximately 22% of industrial automation cable consumption.

Based on installation type, the market is segregated into fixed and flexible installation. Fixed installation cables dominate the market due to their widespread use in permanent machinery installations, control panels, and infrastructure wiring, accounting for approximately 76% of global industrial automation cable deployments.

Industrial Automation Cable Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific is the largest industrial automation cable market due to its large manufacturing base, rapid industrialization programs, and increasing investments in factory automation in China, Japan, South Korea, and India.

China alone accounts for around 38% of global industrial automation cable consumption as manufacturers adopt advanced production technologies. The region has a strong electronics manufacturing sector, which is creating a massive demand for high-performance automation cables for production equipment and assembly systems.

Major cable manufacturers have established significant regional production capacities, ensuring product availability and competitive pricing. Asian manufacturers are investing 20-25% more in factory automation upgrades than global peers, which will continue to drive growth in the industrial automation cable industry.

Europe to show steady growth.

Europe is a strong industrial automation cable industry player due to its advanced manufacturing base, high-quality standards, and leadership in Industry 4.0. Germany’s automotive and machine-building sectors have seen a 15% increase in automation investments over the past three years, driving demand for special industrial cables.

Countries like France, Italy, and Sweden are upgrading industrial infrastructure, focusing on innovative manufacturing technologies that require advanced cabling. The UK has seen significant automated warehousing and logistics growth, and annual spending on associated cabling infrastructure has grown by 18%. The region’s stringent safety and performance standards drive the adoption of premium industrial cables, especially in hazardous and critical applications.

Recent Market Developments:

- In January 2025, Belden introduced its next-generation industrial Ethernet cables with enhanced electromagnetic compatibility specifications and extended temperature range capabilities that improve reliability in challenging factory environments.

- In February 2025, Prysmian Group launched a specialized series of automation cables featuring eco-friendly materials and reduced carbon footprint while fully complying with industrial performance requirements.

- In March 2025, Nexans unveiled an innovative range of hybrid fiber-copper cables designed specifically for industrial automation applications requiring power delivery and high-speed data transmission in a single-cable solution.

Industrial Automation Cable Market: Competitive Analysis

The global industrial automation cable market is led by players like:

- Belden Inc.

- Prysmian Group

- Nexans

- Southwire Company LLC

- Lapp Group

- Anixter International (WESCO International)

- TPC Wire & Cable Corp.

- Helukabel GmbH

- SAB Bröckskes GmbH & Co. KG

- Leoni AG

- Eland Cables

- Lutze Inc.

- Sumitomo Electric Industries Ltd.

- TE Connectivity

- Alpha Wire

- General Cable (Prysmian Group)

- Encore Wire Corporation

- Hitachi Metals Ltd.

- Allied Wire & Cable

- Teldor Cables

The global industrial automation cable market is segmented as follows:

By Cable Type

- Power Cable

- Control Cable

- Fieldbus Cable

- Sensor Cable

- Data Cable

By Material Type

- Copper

- Aluminum

- Fiber Optic

By End-User Industry

- Automotive

- Food & Beverage

- Oil & Gas

- Chemical & Petrochemical

- Pharmaceutical

- Mining

- Manufacturing

- Others

By Installation Type

- Fixed Installation

- Flexible Installation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial automation cables are specialized electrical and communication cables designed to withstand the harsh industrial environment and transmit power and data for automated systems.

The industrial automation cable market is expected to be driven by increasing factory automation investments, rising implementation of IIoT technologies, growing demand for reliable industrial connectivity solutions, technological advancements in cable design, and expansion of innovative manufacturing initiatives across global industries.

According to our study, the global industrial automation cable market was worth around USD 8.58 billion in 2024 and is predicted to grow to around USD 17.10 billion by 2034.

The CAGR value of the industrial automation cable market is expected to be around 7.12% during 2025-2034.

The global industrial automation cable market will register the highest growth in Asia Pacific during the forecast period.

Key players in the industrial automation cable market include Belden Inc., Prysmian Group, Nexans, Southwire Company, LLC, Lapp Group, Anixter International (WESCO International), TPC Wire & Cable Corp., Helukabel GmbH, SAB Bröckskes GmbH & Co. KG, Leoni AG, Eland Cables, Lutze Inc., Sumitomo Electric Industries, Ltd., TE Connectivity, Alpha Wire, General Cable (Prysmian Group), Encore Wire Corporation, Hitachi Metals, Ltd., Allied Wire & Cable, and Teldor Cables.

The report comprehensively analyzes the industrial automation cable market, including an in-depth discussion of market drivers, restraints, emerging trends, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, and the evolving landscape of cable specifications, performance requirements, and application demands shaping the industrial automation ecosystem.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed