Global Industrial Control And Factory Automation Market Size, Share, Trends, Forecasts, 2034

Industrial Control And Factory Automation Market By Component (Industrial Robots, Machine Vision Systems, Control Valves, Sensors, Industrial PCs, HMI, and MES), By Solution (SCADA, PLC, DCS, MES, Industrial Safety, and PAM), By Industry Vertical (Process Industry, Discrete Industry), By Technology (Artificial Intelligence, Cloud Computing, Industrial IoT, and Digital Twin), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical data, and Forecasts 2025 - 2034

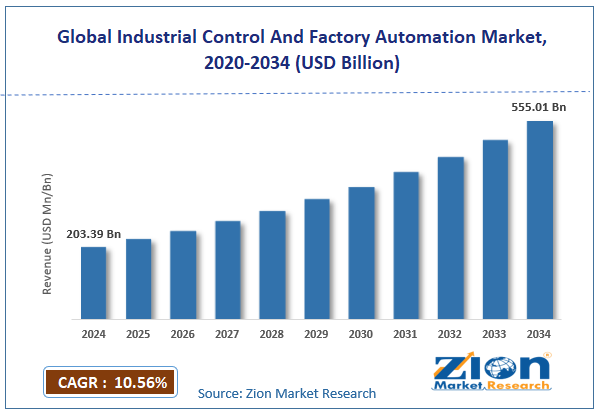

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 203.39 Billion | USD 555.01 Billion | 10.56% | 2024 |

Industrial Control and Factory Automation Industry Prospective:

The global industrial control and factory automation market size was valued at approximately USD 203.39 billion in 2024 and is expected to reach around USD 555.01 billion by 2034, growing at a compound annual growth rate (CAGR) of roughly 10.56% between 2025 and 2034.

Industrial Control and Factory Automation Market: Overview

Industrial control and factory automation encompasses technologies, systems, and solutions designed to monitor, control, and automate manufacturing processes while minimizing human intervention. This market has changed production, quality management, and operational efficiency in many manufacturing industries.

Industrial control and factory automation are the backbones of modern manufacturing, providing powerful monitoring capabilities, process optimization tools, and automated workflows to produce with precision, resource efficiency, and data-driven operations.

Industry 4.0, labor shortages, efficiency requirements, and competition drive the industrial control and factory automation industry. Digital transformation initiatives, advanced analytics adoption, AI-integrated automation solutions, and growing implementation of industrial IoT across various manufacturing segments will drive the market during the forecast period.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial control and factory automation market is estimated to grow annually at a CAGR of around 10.56% over the forecast period (2025-2034)

- In terms of revenue, the global industrial control and factory automation market size was valued at around USD 203.39 billion in 2024 and is projected to reach USD 555.01 billion by 2034.

- The industrial control and factory automation market is projected to grow significantly due to accelerating digital transformation initiatives, persistent labor shortages driving automation adoption, rising focus on manufacturing efficiency and sustainability, and expanding implementation of industrial IoT and AI-driven solutions.

- Based on components, industrial robots lead the segment and will continue to dominate the global market.

- Based on the solution, programmable logic controllers (PLCs) are anticipated to command the largest market share.

- Based on industry verticals, the discrete industry is expected to lead the market during the forecast period.

- Based on technology, industrial IoT will remain the dominant segment during the forecast period.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Industrial Control and Factory Automation Market: Growth Drivers

Rising labor costs and workforce shortages

In the industrial control and factory automation industry, with skilled labor becoming more scarce and expensive, there’s more focus on automation systems that deliver cost-effective manufacturing solutions. Manufacturers seek automation technologies that offer more flexibility, scalability, and faster ROI to increase operational efficiency.

According to recent industry surveys, manufacturing labor costs have risen in the last 5 years, and automation adoption has grown proportionally to offset these costs.

Digital transformation and innovative manufacturing initiatives

Technology is driving the industrial control and factory automation market, with manufacturers introducing features like predictive maintenance, digital twin capabilities, and AI-powered operational optimization. Modern automation systems offer data-driven insights, remote monitoring, and seamless integration with enterprise systems.

Digital transformation priorities drive 76% of new automation investments, and real-time analytics is one of the top 3 requested features. Manufacturers are allocating more of their R&D budget to connected factory solutions.

Industrial Control and Factory Automation Market: Restraints

High initial investment and implementation complexity

Infrastructure costs, system integration, and specialized skills are considerable barriers to the industrial control and factory automation market. As processes become more digitalized, the complexity of implementation grows. Industry reports mention high upfront costs are the main challenge to automation adoption, especially for small and medium-sized businesses with limited capital expenditure budgets.

Industrial Control and Factory Automation Market: Opportunities

Integration of AI and machine learning technologies

Artificial intelligence transforms the industrial control and factory automation industry by offering predictive capabilities, autonomous decision-making, and operational optimization. AI-enabled automation systems can now deliver self-optimizing workflows, anomaly detection, and process improvements that were previously impossible.

For example, companies using AI-enabled automation solutions see higher operational efficiency and lower maintenance costs than traditional automation methods.

Industrial Control and Factory Automation Market: Challenges

Cybersecurity concerns and legacy system integration

The industrial control and factory automation market is advancing rapidly, but cybersecurity vulnerabilities and legacy infrastructure integration present significant implementation barriers. Industrial operations managers identify cybersecurity risks as the primary concern delaying their automation initiatives.

Manufacturers report that integrating new automation technologies with legacy systems significantly increases project complexity and costs. Supply chain disruptions and component shortages make it challenging for automation providers to maintain consistent delivery timelines. Many regions have differing industrial safety standards that impact automation solution design and certification requirements.

Industrial Control And Factory Automation Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial Control And Factory Automation Market |

| Market Size in 2024 | USD 203.39 Billion |

| Market Forecast in 2034 | USD 555.01 Billion |

| Growth Rate | CAGR of 10.56% |

| Number of Pages | 212 |

| Key Companies Covered | ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., Rockwell Automation Inc., Honeywell International Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, General Electric Company, OMRON Corporation, Fanuc Corporation, KUKA AG, Bosch Rexroth AG, Endress+Hauser AG, Beckhoff Automation GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, B&R Industrial Automation GmbH, WAGO Kontakttechnik GmbH & Co. KG, Yaskawa Electric Corporation, Delta Electronics Inc., and others. |

| Segments Covered | By Component, By Solution, By Industry Vertical, By Technology, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial Control and Factory Automation Market: Segmentation

The global industrial control and factory automation market is segmented into components, solutions, industry verticals, technology, and regions.

Based on components, the industry is segregated into industrial robots, machine vision systems, control valves, sensors, industrial PCs, human-machine interface (HMI), and manufacturing execution systems (MES). Industrial robots lead the market by offering enhanced production capabilities, labor replacement solutions, and operational consistency.

Based on solution, the industrial control and factory automation industry is divided into SCADA (Supervisory Control and Data Acquisition), PLC (Programmable Logic Controller), DCS (Distributed Control System), MES (Manufacturing Execution System), industrial safety, and PAM (Plant Asset Management). Programmable logic controllers are expected to lead the market during the forecast period, as these systems provide an optimal balance of control capabilities and implementation flexibility.

Based on industry verticals, the industrial control and factory automation industry is categorized into process and discrete industries. Discrete industry applications are expected to lead the market since they represent the most extensive implementation base, seeking automation for assembly, manufacturing, and production line operations.

Based on technology, the industry is segregated into artificial intelligence, cloud computing, industrial IoT, and digital twins. Industrial IoT dominates the market due to the widespread adoption of connected sensor technologies for operational monitoring and data collection.

Industrial Control and Factory Automation Market: Regional Analysis

Asia Pacific to lead the market

Asia Pacific dominates the industrial control and factory automation market due to its massive manufacturing base, rising labor costs driving automation adoption, and strong government initiatives promoting industrial digitalization in China, Japan, South Korea, and emerging economies.

China alone accounts for 37% of global industrial automation equipment demand, as manufacturing modernization is a key part of national development strategies. The region’s growing electronics, automotive, and consumer goods manufacturing industries have built up automation implementation expertise and regional supply chains.

Major manufacturers like ABB, Siemens, Mitsubishi Electric, and Fanuc have set up significant regional production and support operations to ensure the availability of solutions and technical expertise.

Asian manufacturers invest more in automation technologies than their global peers, hence a thriving industrial technology ecosystem. The region also benefits from government policies supporting manufacturing digitalization through subsidies, tax incentives, and technical assistance programs, further driving demand.

North America to grow significantly.

North America is growing fast in the industrial control and factory automation industry, driven by reshoring, advanced manufacturing, and next-generation automation technologies. U.S. manufacturing has seen growth in automation investments over the last 3 years, mainly in robotics, vision systems, and AI-powered controls.

Countries like the U.S., Canada, and Mexico are developing integrated manufacturing corridors with advanced automation capabilities, expanding the market for high-value industrial technology implementations. The region has seen significant growth in collaborative robot adoption, especially in automotive, electronics, and medical device manufacturing.

Regional focus on manufacturing data analytics and operational intelligence drives the adoption of connected automation systems, especially in industries with complex processes and high-value production.

Recent Market Developments:

- In January 2025, ABB introduced new specialized automation solutions, including the GoFa CRB 15000 collaborative robot and the PixelPaint Pro painting system, targeting high-mix production environments with advanced flexibility features.

- In February 2025, Siemens launched the all-new SIMATIC S7-1600 controller family with integrated AI capabilities, setting new benchmarks for industrial control performance.

Industrial control and factory automation market: Competitive Analysis

The global industrial control and factory automation market is led by players like:

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Emerson Electric Co.

- Rockwell Automation Inc.

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Yokogawa Electric Corporation

- General Electric Company

- OMRON Corporation

- Fanuc Corporation

- KUKA AG

- Bosch Rexroth AG

- Endress+Hauser AG

- Beckhoff Automation GmbH & Co. KG

- Phoenix Contact GmbH & Co. KG

- B&R Industrial Automation GmbH

- WAGO Kontakttechnik GmbH & Co. KG

- Yaskawa Electric Corporation

- Delta Electronics Inc.

The global industrial control and factory automation market is segmented as follows:

By Component

- Industrial robots

- Machine vision systems

- Control valves

- Sensors

- Industrial PCs

- Human-machine interface (HMI)

- Manufacturing execution systems (MES)

By Solution

- SCADA (Supervisory Control and Data Acquisition)

- PLC (Programmable Logic Controller)

- DCS (Distributed Control System)

- MES (Manufacturing Execution System)

- Industrial safety

- PAM (Plant Asset Management)

By Industry Vertical

- Process industry

- Discrete industry

By Technology

- Artificial intelligence

- Cloud computing

- Industrial IoT

- Digital twin

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial control and factory automation encompasses technologies, systems, and solutions designed to monitor, control, and automate manufacturing processes while minimizing human intervention.

The industrial control and factory automation market is expected to be driven by persistent labor shortages, acceleration of Industry 4.0 initiatives, rising emphasis on manufacturing resilience, integration of AI and machine learning capabilities, expansion of industrial IoT implementations, and growing focus on sustainable manufacturing practices.

According to our study, the global industrial control and factory automation market was worth around USD 203.39 billion in 2024 and is predicted to grow to around USD 555.01 billion by 2034.

The CAGR value of the industrial control and factory automation market is expected to be around 10.56% during 2025-2034.

The global industrial control and factory automation market will register the highest growth in Asia Pacific during the forecast period.

Key players in the industrial control and factory automation market include ABB Ltd., Siemens AG, Schneider Electric SE, Emerson Electric Co., Rockwell Automation, Inc., Honeywell International Inc., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, General Electric Company, OMRON Corporation, Fanuc Corporation, KUKA AG, Bosch Rexroth AG, Endress+Hauser AG, Beckhoff Automation GmbH & Co. KG, Phoenix Contact GmbH & Co. KG, B&R Industrial Automation GmbH, WAGO Kontakttechnik GmbH & Co. KG, Yaskawa Electric Corporation, and Delta Electronics, Inc.

The report comprehensively analyses the industrial control and factory automation market, including an in-depth discussion of market drivers, restraints, emerging technologies, regional dynamics, and future growth opportunities. It also examines competitive dynamics, technological innovations, the evolving landscape of automation capabilities, implementation challenges, and regulatory requirements shaping the industrial automation ecosystem.

Choose License Type

List of Contents

Industrial Control and Factory AutomationIndustry Prospective:Industrial Control and Factory Automation OverviewKey Insights:Industrial Control and Factory Automation Growth DriversIndustrial Control and Factory Automation RestraintsIndustrial Control and Factory Automation OpportunitiesIndustrial Control and Factory Automation ChallengesReport ScopeIndustrial Control and Factory Automation SegmentationIndustrial Control and Factory Automation Regional AnalysisRecent Market Developments:Industrial control and factory automation market: Competitive AnalysisHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed