Industrial X-ray Inspection Systems Market Growth, Size, Share, Trends, and Forecast 2030

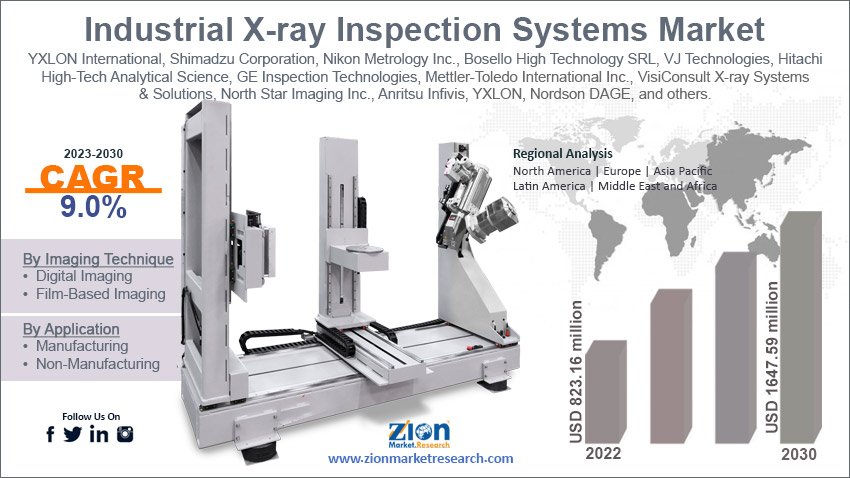

Industrial X-ray Inspection Systems Market By Dimension (3D and 2D), By Imaging Technique (Digital Imaging and Film-Based Imaging), By Application (Manufacturing and Non-Manufacturing), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2023 - 2030

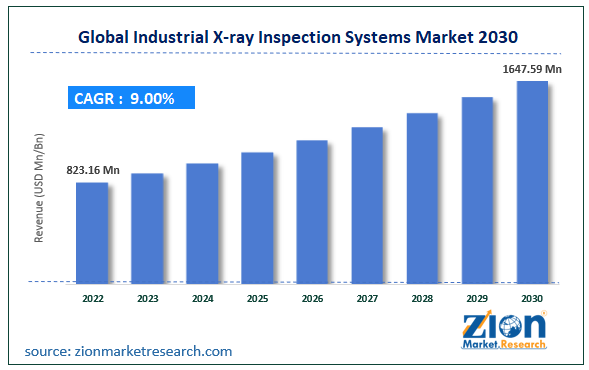

| Market Size in 2022 | Market Forecast in 2030 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 823.16 million | USD 1647.59 million | 9% | 2022 |

Industrial X-ray Inspection Systems Industry Prospective:

The global industrial X-ray inspection systems market size was worth around USD 823.16 million in 2022 and is predicted to grow to around USD 1647.59 million by 2030 with a compound annual growth rate (CAGR) of roughly 9% between 2023 and 2030.

Industrial X-ray Inspection Systems Market: Overview

Industrial X-ray inspection systems are machines used for managing product quality across end-user verticals. These devices use X-ray imaging technology to develop images of scanned items and determine any defect or presence of a contaminant or unwanted object in the material. In modern times, consumers expect top-notch quality in all products being used resulting in greater emphasis on deployment of efficient quality-control measures. Industrial X-ray inspection systems are such tools as they are used in a wide range of manufacturing facilities for the identification of products that do not conform to quality standards. These machines are specially used for analyzing and measuring concealed defects that are otherwise not visible to the naked eye or may pass other superficial faults, defects, and latent problems. Industrial X-ray inspection systems can be integrated at different points in the manufacturing line but they are generally used after packaging or at the end of the production line.

Key Insights:

- As per the analysis shared by our research analyst, the global industrial X-ray inspection systems market is estimated to grow annually at a CAGR of around 9% over the forecast period (2023-2030)

- In terms of revenue, the global industrial X-ray inspection systems market size was valued at around USD 823.16 million in 2022 and is projected to reach USD 1647.59 million, by 2030.

- The industrial X-ray inspection system market is projected to grow at a significant rate due to the rising stringency in maintaining food quality

- Based on dimension segmentation, 2D was predicted to show maximum market share in the year 2022

- Based on application segmentation, manufacturing was the leading segment in 2022

- On the basis of region, Asia-Pacific was the leading revenue generator in 2022

Request Free Sample

Request Free Sample

Industrial X-ray Inspection Systems Market: Growth Drivers

Rising stringency in maintaining food quality to drive market growth

The global industrial X-ray inspection systems market is projected to grow owing to the existing and growing strict guidelines dictating food manufacturers to ensure quality control, especially in modern times. The global food industry is one of the most strictly regulated industries as there are several international and regional laws that govern food quality before the products are made available in the commercial market. Some of these agencies include the World Health Organization (WHO), Food and Agriculture Organization (FAO), International Food Safety Authorities Network (INFOSAN), World Trade Organization (WTO), Codex Alimentarius Commission, and International Organization for Standardization (ISO) among others. Furthermore, the growing incidences of food recalls due to contamination threats have further resulted in food manufacturers improving measures adopted for food quality management. In 2020, more than 418 food products were recalled by the Food and Drugs Administration (FDA) authorities. Industrial X-ray inspection systems are widely used by companies operational in the global food & beverages (F&B) sector as these machines help in identifying the presence of concrete contaminants such as stones, plastic, glass, and fragments of metal.

Increasing launch of new X-ray inspection systems targeting the F&B sector may fuel market growth

The market growth will be further fueled by the increasing launch of new X-ray inspection systems with industry-specific features. For instance, in April 2019, Ricoh Co., Ltd. announced its entry into the X-ray inspection systems market for the food sector. The company established a joint venture with South Korea-based XAVIS Co., Ltd., manufacturers of industrial X-ray inspection systems. Ricoh intends to target the extensive food industry in Japan by leveraging the technologies developed by both companies.

Industrial X-ray Inspection Systems Market: Restraints

Concerns over X-ray inspection systems being occupational hazards may restrict market growth

The global industrial X-ray inspection system market growth is anticipated to be restricted due to the increasing concerns over occupational hazards associated with the use of industrial X-ray inspection systems for the people who work in proximity to these devices. Studies indicate that regular exposure to X-rays is a cancer risk even though in small margins. If the operators do not have safety protocols in place, they are more vulnerable to the health impacts of X-ray inspection systems. Additionally, research points out that the current main concern is the efficient disposal of unused or older systems since improper disposal can be harmful to the environment.

Industrial X-ray Inspection Systems Market: Opportunities

Growing market for electric vehicles (EVs) is showing promising signs for future growth in the market

During the projection period, the rapidly expanding EV sector is likely to create more growth opportunities for manufacturers of industrial X-ray inspection systems. These machines are widely used for managing quality control in the automotive sector as they are used for the detection of faults and defects in the parts of automobile vehicles. The growing proliferation of EV segments including passenger cars and public transport systems holds tremendous potential for further use of these imaging systems. As of 2023, the global EV market is valued at USD 500.5 billion and by the end of the projection period, it is anticipated to grow three-fold. Factors such as rising public awareness, reducing EV prices, access to government subsidies, and rapidly changing prices of traditional fuel are leading reasons for the growing shift toward the EV market. In May 2023, Varex Imaging Corporation announced the launch of the XRD 3131N digital X-ray detector influenced by the expanding need for more comprehensive and faster inspection of high-paced Electric Vehicle (EV) battery manufacturing. The new machine provides high inspection throughput in 24/7 manufacturing cycles and provides premium quality imaging. It can handle continuous high-dose radiation and also offers flexible shielding options.

Industrial X-ray Inspection Systems Market: Challenges

Significant market share enjoyed by competing solutions may challenge market growth

The industrial X-ray inspection systems industry is projected to face challenges due to the increasing market share for other quality control techniques available across end-user industries. For instance, ultrasound testing (UT) is also a non-destructive testing (NDT) technique that relies on ultrasonic waves by passing them through an object to determine faults and the presence of contaminants. This method is a widely accepted measure for fault detection. Radiography testing leverages neutron or gamma radiation during the inspection of thick materials.

Industrial X-ray Inspection Systems Market: Segmentation

The global industrial X-ray inspection systems market is segmented based on dimension, imaging technique, application, and region.

Based on dimension, the global market segments are 3D and 2D. In 2022, the latter segment enjoyed a higher market share mainly because 2D systems have an existing and well-established consumer group. 2D systems have been used for a longer time and are well-studied. The higher number of 2D industrial X-ray inspection system providers, excellent affordability, availability of repair & maintenance services, and easier user interface are the factors responsible for higher segmental growth. The average cost of 2D systems is around USD 20,000 to USD 200,000,.However, the demand for 3D systems is rapidly expanding.

Based on imaging technique, the industrial X-ray inspection system industry divisions are digital imaging and film-based imaging.

Based on application, the global market segments are manufacturing and non-manufacturing. In 2022, the highest growth rate was listed in the manufacturing segment as it is used during the production of several end-products including aircraft, automobile vehicles, food products, power plants, and electronic products. Growing investments in industry-specific industrial X-ray inspection systems and increasing use of digital technology for image generation and analysis may push segmental growth to new heights. In 2022, the global electronic manufacturing market was valued at USD 504 billion.

Industrial X-ray Inspection Systems Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Industrial X-ray Inspection Systems Market |

| Market Size in 2022 | USD 823.16 Billion |

| Market Forecast in 2030 | USD 1647.59 Billion |

| Growth Rate | CAGR of 9.0% |

| Number of Pages | 208 |

| Key Companies Covered | YXLON International, Shimadzu Corporation, Nikon Metrology Inc., Bosello High Technology SRL, VJ Technologies, Hitachi High-Tech Analytical Science, GE Inspection Technologies, Mettler-Toledo International Inc., VisiConsult X-ray Systems & Solutions, North Star Imaging Inc., Carestream NDT, ZEISS Industrial Quality Solutions, Anritsu Infivis, YXLON, Nordson DAGE, and others. |

| Segments Covered | By Dimension, By Imaging Technique, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2022 |

| Historical Year | 2017 to 2021 |

| Forecast Year | 2023 - 2030 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Industrial X-ray Inspection Systems Market: Regional Analysis

Asia-Pacific to register the highest growth rate during the projected time period

Asia-Pacific is projected to act as the leading region in the global market with South Korea, Japan, and China leading the regional growth rate. The surging proliferation of industrial X-ray inspection systems in the electronics sector is a crucial revenue contributor. In November 2021, Japan-based OMRON Corporation launched the VT-X750-V3 system for electronics substrates quality check. It is the world's fastest CT-type X-ray inspection device and delivers highly accurate, advanced, and true 3D inspection. The company intends to meet the demands of electric vehicles (EVs), 5G telecommunication systems, and autonomous driving application products.

Growth in North America may be the result of the existence of several quality control policies governing all end-user verticals. North American manufacturers of industrial X-ray inspection systems are investing in constant research and development aimed at device improvement. Systems aspects such as sources, tubes, detectors, and software are all being worked on to improve device performance. Additionally, the growing demand for 3D X-ray inspection systems in growing F&B, automotive, and aerospace sectors may assist in delivering better results.

Industrial X-ray Inspection Systems Market: Competitive Analysis

The global industrial X-ray inspection systems market is led by players like:

- YXLON International

- Shimadzu Corporation

- Nikon Metrology Inc.

- Bosello High Technology SRL

- VJ Technologies

- Hitachi High-Tech Analytical Science

- GE Inspection Technologies

- Mettler-Toledo International Inc.

- VisiConsult X-ray Systems & Solutions

- North Star Imaging Inc.

- Carestream NDT

- ZEISS Industrial Quality Solutions

- Anritsu Infivis

- YXLON

- Nordson DAGE

The global industrial X-ray inspection systems market is segmented as follows:

By Dimension

- 3D

- 2D

By Imaging Technique

- Digital Imaging

- Film-Based Imaging

By Application

- Manufacturing

- Non-Manufacturing

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Industrial X-ray inspection systems are machines used for managing product quality across end-user verticals.

The global industrial X-ray inspection systems market is projected to grow owing to the existing and growing strict guidelines dictating food manufacturers to ensure quality control, especially in modern times.

According to study, the global industrial X-ray inspection systems market size was worth around USD 823.16 million in 2022 and is predicted to grow to around USD 1647.59 million by 2030.

The CAGR value of the industrial X-ray inspection systems market is expected to be around 9% during 2023-2030.

Asia-Pacific is projected to act as the leading region in the global industrial X-ray inspection system market with South Korea, Japan, and China leading the regional growth rate.

The global industrial X-ray inspection systems market is led by players like YXLON International, Shimadzu Corporation, Nikon Metrology, Inc., Bosello High Technology SRL, VJ Technologies, Hitachi High-Tech Analytical Science, GE Inspection Technologies, Mettler-Toledo International, Inc., VisiConsult X-ray Systems & Solutions, North Star Imaging, Inc., Carestream NDT, ZEISS Industrial Quality Solutions, Anritsu Infivis, YXLON, and Nordson DAGE.

The report explores crucial aspects of the industrial X-ray inspection systems market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed