Infrared Detectors Market Size, Share, Trends, Growth and Forecast 2028

Infrared Detectors Market By Technology (Cooled, Uncooled, Mercury Cadmium Telluride, Indium Gallium Arsenide, Pyroelectric, Thermopile, Microbolometer, Others). By Application (People and Motion Sensing, Temperature Measurement, Security and Surveillance, Gas & Fire Detection, Spectroscopy, Biomedical Imaging, and Scientific Applications) By Wavelength (NIR & SWIR, MWIR, and LWIR). By Vertical (Industrial, and Nonindustrial.) and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2022 - 2028

| Market Size in 2021 | Market Forecast in 2028 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 421.7 Million | USD 615.3 Million | 6.5% | 2021 |

Infrared Detectors Market Size And Industry Analysis

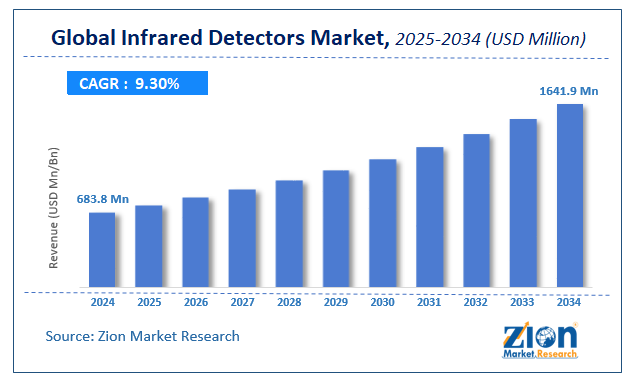

The Infrared Detectors Market size was worth around USD 421.7 million in 2021 and is estimated to grow to about USD 615.3 million by 2028, with a compound annual growth rate (CAGR) of approximately 6.5 percent over the forecast period. The report analyzes the private hospital market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the private hospital market.

Infrared Detectors Market: Overview

An infrared sensor is a type of electronic equipment that detects and/or emits infrared radiation to sense particular features of its surroundings. Infrared sensors can also detect motion and measure the heat radiated by an item. They are components that can detect and produce light in the infrared wavelength range. One of the primary reasons driving market expansion in the forecast period is the increased demand for motion- and people-sensing devices. In addition, the growing use of the product in the military and defense industries for surveillance, target detection, and target tracking due to its compact size and ability to detect light from a distance is boosting market growth in the coming years. The extensive use of products in industrial facilities to monitor the operation of boilers, motors, electrical peripherals, and bearings is favorably influencing the market growth. Other factors, such as increased product deployment in smart homes and increased use of IR detectors at airports and railway stations, are expected to drive the market in the forthcoming years. Moreover, product developments such as the introduction of revolutionary infrared sensors for phone cameras, augmented reality (AR) glasses, and driverless vehicles that allow users to see through fog and smoke are propelling market expansion in the approaching years.

COVID-19 Impact:

The pandemic struck the global economy as a whole at the start of 2020, causing unprecedented turbulence and change for individuals and organizations all across the world. The COVID-19 pandemic has had far-reaching consequences on the macroeconomic, technical, and demographic aspects that shape the growth dynamics of businesses across industries. The pandemic has caused workplace closures, travel restrictions, and the introduction of a work-from-home option for practically all employees, making it difficult for businesses to operate. According to the realistic scenario, the infrared detector market would have sluggish growth in the first three quarters of FY 20–21, followed by a solid comeback in the fourth quarter of FY 20–21. The positive growth is expected to come from the rapidly rising future demand for sensors in smart devices used in industrial applications. The growth in the infrared detectors market is expected to come from the use of infrared detectors in human body detection. Demands are predicted to rise sharply as a result of the expanding trend of industrial automation.

Infrared Detectors Market: Driver

Infrared detectors in motion and people sensing technologies are becoming more popular.

The market for motion- and people-sensing devices is expanding. People and motion-sensing have always been important applications for infrared detectors. Increasing building automation and widespread implementation of people/object counting systems in commercial buildings are two important factors driving up demand for motion- and people-sensing devices. The ability to detect motion in both the presence and absence of light, as well as non-contact detection, has led to the widespread use of infrared technology in motion and people-sensing applications. Moreover, infrared detectors are gaining popularity in the field of robotics since they are utilised to detect the relative motion of IR emitting bodies and calculate distance. This can be achieved using both proximity IR sensor and passive IR (PIR) sensor. These detectors are also employed in the automotive sector for people and motion sensing, primarily to improve driver safety.

Infrared Detectors Market: Restraint

Camera import and export laws are subject to restrictions.

According to the International Traffic in Arms Regulations (ITAR) imposed by the US Department of State, the sale of prohibited infrared cameras in the US requires commodity jurisdiction permission. Manufacturers of infrared cameras are prohibited from exchanging their products with any person or entity, whether within the United States or overseas, without first obtaining export authorization, and are subject to penalties if they do so. Distributors must additionally obtain commodity jurisdiction clearance in order to sell these products. This complicates and increases the cost of selling and purchasing infrared cameras in the United States. This legislation makes it difficult for US-based infrared camera manufacturers to grow their operations outside of the country. It also prevents infrared camera producers based outside the United States from expanding their presence in the country. Some manufacturers, like Sensors Unlimited (US), FLIR Systems (US), and Xenics (Belgium), sell infrared cameras that do not require commodity jurisdiction clearance. However, due to the crucial nature of infrared camera applications, many manufacturers and distributors must obtain permission more than once.

Infrared Detectors Market: Opportunity

In emerging markets, there is a growing demand for infrared detectors.

The expanding markets of APAC, the Middle East, and South America are increasing their demand for infrared detectors. Building automation is one of the primary elements driving up demand for infrared detectors in emerging markets. Smart buildings that use IoT connectivity, sensors, and the cloud to remotely monitor and operate a variety of building functions such as heating and air conditioning, lighting, and security systems are opening up new opportunities. Infrared sensors allow smart buildings to self-regulate by monitoring and regulating temperature, controlling lighting, security cameras, and burglar alarm systems and boosting the intelligence and autonomy of various smart gadgets. Increasing government-led investments and incentives for military and defense industry modernization are also fuelling demand for infrared detectors in emerging markets.

Infrared Detectors Market: Challenge

Availability of substitute technologies

Infrared detectors are utilized in most chemical and petrochemical facilities to detect or identify gas leakage from the facility to the outside atmosphere or within the plant. A catalytic detector, on the other hand, is a popular replacement for infrared detectors in gas detection applications. Catalytic detectors have a significant advantage over infrared detectors in that they can easily recognize hydrogen gas. Furthermore, these detectors are convenient to use, simple to install, standardized, and have a long lifespan with low replacement costs. Catalytic detectors can detect flammable hydrocarbons and gases such as methane, ethane, propane, butane, hexane, butadiene, propylene, ethylene oxide, propylene oxide, isopropylamine, ethanol, and methanol in dusty and humid situations and at high temperatures. These variables are causing an increase in the penetration of catalytic detectors in gas detection applications, which is influencing the sale of infrared detectors.

Infrared Detectors Market: Segmentation

The Infrared Detectors Market is segregated based on Technology, Application, Wavelength, and Vertical.

By Technology, the market is classified into Cooled, Uncooled, Mercury Cadmium Telluride, Indium Gallium Arsenide, Pyroelectric, Thermopile, Microbolometer, Others. During the forecast period, the market for cooled infrared detectors will develop at the fastest rate. The cooled infrared detectors are typically cooled thermoelectrically or cryogenically. Liquid nitrogen is also used to cool detectors in some circumstances. Cooled infrared detectors are used in scientific research, astronomy, security and surveillance, and spectroscopy, among other fields where great accuracy is critical. In general, cooled infrared detectors work in the mid-wave infrared (MWIR) spectral band.

By Application, the market is classified into People and Motion Sensing, Temperature Measurement, Security and Surveillance, Gas & Fire Detection, Spectroscopy, and Biomedical Imaging, and Scientific Applications. The infrared detector is mostly utilised in people and motion sensing applications, and it is expected to dominate the total market over the projection period. The rising usage of infrared detectors for counting people and motion detection in areas such as retail stores, airports, houses, museums, and libraries have contributed to its market dominance. The increased adoption of smart home gadgets may raise the demand for infrared detectors. Infrared detectors in homes offer two basic functions: intrusion detection and occupancy detection.

By Wavelength, the market is classified into NIR & SWIR, MWIR, and LWIR. Because of its wide application range and inexpensive price, the LWIR market is predicted to be the largest and most appealing market segment over the projection period.

By Vertical, the market is classified into Industrial, and Nonindustrial. The non-industrial category is expected to remain the market's largest end-user during the forecast period, owing to strong demand from the military & defense and residential & commercial sectors.

Infrared Detectors Market: Report Scope:

| Report Attributes | Report Details |

|---|---|

| Report Name | Infrared Detectors Market Size Report |

| Market Size in 2021 | USD 421.7 Million |

| Market Forecast in 2028 | USD 615.3 Million |

| Growth Rate | CAGR of 6.5% |

| Number of Pages | 188 |

| Forecast Units | Value (USD Billion), and Volume (Units) |

| Key Companies Covered | Murata Manufacturing, Excelitas Technologies, Hamamatsu Photonics, and FLIR Inc. |

| Segments Covered | By Technology, By Application, By Wavelength, By Vertical And By Region |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Recent Development

- In 2021, Excelitas Technologies has released a new OnLine Lens Configurator tool for vision system designers and engineers. The tool identifies and configures all essential lens solutions and mechanical attachments.

- In 2021, Hamamatsu Photonics has created a novel profile sensor for position sensing that has an embedded computing capability. The model S15366-256 sensor is specifically developed to calculate signals from the incident light spot within its processor chip and output incident light location information.

Infrared Detectors Market: Regional Landscape

North America is expected to remain the largest market over the forecast period, with the United States serving as the region's primary growth engine. The region's domination is due to the huge defense industry of the United States and the rapid adoption of technology by the region's other non-industrial sectors. The market growth can be attributed to the growing use of spectroscopy and the rising use of biomedical devices.

The Asia Pacific is expected to grow at a considerable growth due to the presence of a large number of manufacturers in the region. In addition, the increasing focus on the enhancement of security in retail stores and shopping malls is expected to fuel the market growth in the region. China is expected to dominate the regional market for IR detectors in terms of volume export due to high volume production and low pricing. Moreover, an increase in investment by the government in defense and increased demand for consumer electronics, in turn, are expected to drive the growth of the infrared detector market in the near future.

Infrared Detectors Market: Competitive Landscape

Some of the main competitors dominating the Infrared Detectors Market include -

- Murata Manufacturing

- Excelitas Technologies

- Hamamatsu Photonics

- FLIR Inc.

The infrared Detectors Market is segmented as follows:

By Technology

- Cooled

- Uncooled

- Mercury Cadmium Telluride

- Indium Gallium Arsenide

- Pyroelectric

- Thermopile

- Microbolometer

- Others

By Application

- People and Motion Sensing

- Temperature Measurement

- Security and Surveillance

- Gas & Fire Detection

- Spectroscopy and Biomedical Imaging

- Scientific Applications

By Wavelength

- NIR & SWIR

- MWIR

- LWIR

By Vertical

- Industrial

- Nonindustrial

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

One of the primary reasons driving market expansion in the forecast period is the increased demand for motion- and people-sensing devices. In addition, the growing use of the product in the military and defense industries for surveillance, target detection, and target tracking due to its compact size and ability to detect light from a distance is boosting market growth in the coming years.

According to the Market Research report, the Infrared Detectors Market size was worth about 421.7 (USD million) in 2021 and is predicted to grow to around 615.3 (USD million) by 2028, with a compound annual growth rate (CAGR) of around 6.5 percent.

North America is expected to remain the largest market over the forecast period, with the United States serving as the region's primary growth engine. The region's domination is due to the huge defense industry of the United States and the rapid adoption of technology by the region's other non-industrial sectors. The market growth can be attributed to the growing use of spectroscopy and the rising use of biomedical devices.

Some of the main competitors dominating the Infrared Detectors Market include - Murata Manufacturing, Excelitas Technologies, Hamamatsu Photonics, and FLIR Inc.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed