Injection Pen Market Size, Share, Trends and Forecast, 2034

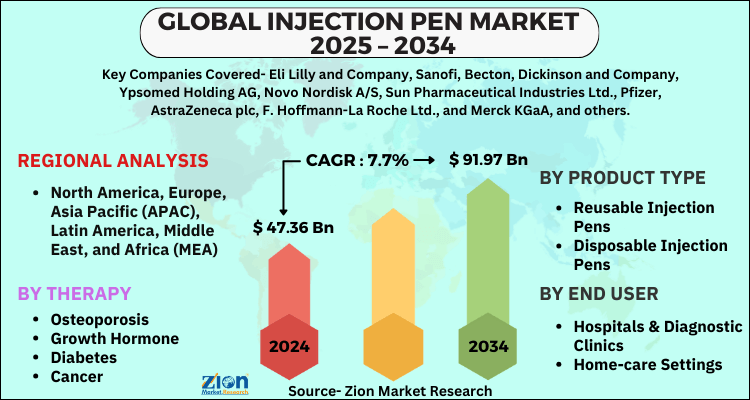

Injection Pen Market By Therapy (Osteoporosis, Growth Hormone, Diabetes, Cancer, Auto-immune Diseases, Fertility, and Other Therapies), By Product Type (Reusable Injection Pens and Disposable Injection Pens), By End-User (Hospitals & Diagnostic Clinics and Home-care Settings), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

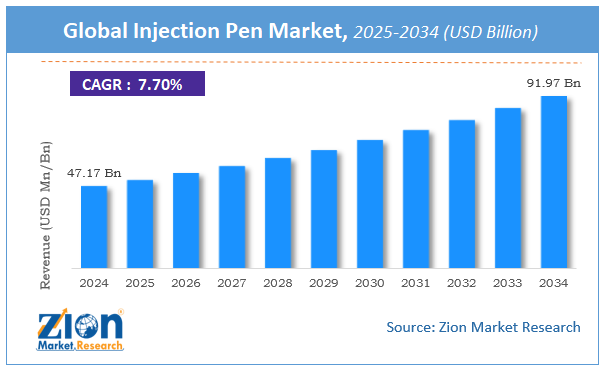

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 47.17 Billion | USD 91.97 Billion | 7.7% | 2024 |

Injection Pen Market: Industry Size

The global injection pen market size was worth around USD 47.17 Billion in 2024 and is predicted to grow to around USD 91.97 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 7.7% between 2025 and 2034. The report analyzes the global injection pen market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the injection pen industry.

Injection Pen Market: Overview

An injection pen is used to deliver drugs to the patient's body. Patients can stick to their treatment plans with the aid of injectable pens. This procedure has aided in the improvement of the patient's quality of life as well as the lowering of healthcare costs. The injection pen approach is widely utilized as a self-management therapy option for diabetes and multiple sclerosis, and it is widely used as a drug delivery system by prominent pharmaceutical companies.

Injection pens are specially designed injection used to inject a small amount of hormone or drugs into the patient body for the treatment of various diseases. As compared to conventional injections, injection pens are easy to use and are portable. The small needle has also decreased the amount of pain which have provided larger social acceptability among people. Injection pens are easy to use and provide accuracy with regards to the quantity of injectable, especially for diabetes patient. Injection pens are mostly used by diabetes patient for injecting insulin. Its ergonomic designs have also increased its usage and popularity among people.

Key Insights

- As per the analysis shared by our research analyst, the global injection pen market is estimated to grow annually at a CAGR of around 7.7% over the forecast period (2025-2034).

- Regarding revenue, the global injection pen market size was valued at around USD 47.17 Billion in 2024 and is projected to reach USD 91.97 Billion by 2034.

- The injection pen market is projected to grow at a significant rate due to increasing demand for self-administered drug delivery solutions, especially for diabetes and autoimmune diseases.

- Based on Therapy, the Osteoporosis segment is expected to lead the global market.

- On the basis of Product Type, the Reusable Injection Pens segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-User, the Hospitals & Diagnostic Clinics segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Injection Pen Market: Growth Drivers

The increasing prevalence of diabetes is predicted to foster the market growth

In recent years, the incidence of diabetes has risen dramatically. In 2021, according to International Diabetes Federation, around 537 million persons aged 20 to 79 are affected by diabetes. By 2030, the overall number of diabetics is expected to reach 643 million, and by 2045, it will reach 783 million. Diabetes necessitates the administration of injectable drugs on a daily or weekly basis. Due to such a frequent need for drug administration in diabetic patients, injector pens emerged as the best solution.

For injectable drug delivery devices, injection pens are becoming the new norm. Because of their simplicity, dependability, and ability to be directly taken by the patients without the assistance of a physician, their popularity has skyrocketed. As a result of the rising incidence of diabetes and other chronic diseases, more attention is being paid to injectable pen technologies in order to efficiently manage the expanding patient pool and improve patient adherence to treatments. All such factors have led to an increase in demand for injection pens, thereby boosting the global injection pen market growth.

One of the major factors driving the growth of the injection pen market over the forecast period is the increased prevalence of chronic diseases such as diabetes, rheumatoid arthritis, and others. As per the America Diabetes Association 2015 report, there were around 30.3 million people in America who were suffering from diabetes that is almost 9.4% of the American population. Increased use of home health care has also increased the demand for easy instruments for the administration of drugs on a daily basis, thus increasing the popularity of injection pen market. Moreover, major players involved in the injection pen market are constantly working for various technological developments which are also expected to increase the demand of the injection pen market over the forecast period. However, alternative modes of drug delivery and poor reimbursement policies in the developing countries are expected to hamper the growth of the injection pen market.

Injection Pen Market: Restraints

Growing preference for alternative modes of drug delivery may hinder the growth of the market.

Injection pen devices are not the only option. Needlestick fear and injury are the biggest deterrents to using injection pens. As a result, there are a variety of needle-free devices that have an extra benefit: they do not cause needle phobia, which is a major obstacle to the widespread use of injectable drug therapies. The discomfort associated with daily injections and the necessity of long-term therapy are the main causes of non-complacence in both children and adults. Insulin pen treatment has also been linked to hyperglycemia in certain individuals due to the inability to control the dosage. As a result of their capacity to execute automatic insulin suspension and reduce the danger of hypoglycemia, there has been a change in treatments that deal with diabetes in Europe shifting from insulin pens to insulin pumps. In addition to this, oral insulin administration is favored in developing nations such as Brazil, China, and India because it is simple to use, acceptable, safe, cost-effective, and practical.

Injection Pen Market: Opportunities

High demand for biosimilars to generate ample opportunities for the market during the estimated period.

Biosimilar has seen a considerable surge in demand as a result of their reduced costs when compared to their patented equivalents. Many biologic compounds' patents are about to expire, which will increase demand for biosimilars. Biosimilars and generics are preferred by insurance companies and governments. As many injectables used to treat chronic diseases are biologics, the expiration of patents and rising backing from governments and insurance companies present a chance for the injection pens market to flourish during the projected period. Additionally, the emergence of smart inject pens is also likely to fuel the global injection pen market growth.

Injection Pen Market: Challenges

The lack of trained professionals for innovative delivery methods pose major challenge for market expansion

Inadequate training and learning for the use of innovative delivery methods like injectable pens lead to incorrect use, which puts personnel and patients at risk. In a hospital context, such procedures may have an impact on the use of injectable pens. Furthermore, because the strength of insulin in the injection pen fluctuates, there is a risk of overdosing if the dose strength is not taken into account. Patients neglected to remove the inside cover of a conventional insulin pen needle, resulting in no insulin being given, according to the ISMP's National Medication Errors Reporting Program (MERP). Patients have also been reported to be using normal pen needles without removing the inner needle cover, according to the FDA.

Injection Pen Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Injection Pen Market |

| Market Size in 2024 | USD 47.17 Billion |

| Market Forecast in 2034 | USD 91.97 Billion |

| Growth Rate | CAGR of 7.7% |

| Number of Pages | 180 |

| Key Companies Covered | Eli Lilly and Company, Sanofi, Becton, Dickinson and Company, Ypsomed Holding AG, Novo Nordisk A/S, Sun Pharmaceutical Industries Ltd., Pfizer, AstraZeneca plc, F. Hoffmann-La Roche Ltd., and Merck KGaA, and others. |

| Segments Covered | By Therapy, By Product Type, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Injection Pen Market: Segmentation

The global injection pen market is classified based on therapy, product type, end-user, and region. Based on the therapy, the global market is split into osteoporosis, growth hormone, diabetes, cancer, auto-immune diseases, fertility, and other therapies. By product type, the market is divided into reusable injection pens and disposable injection pens. The end-user segment is divided into hospitals & diagnostic clinics and home-care settings.

Recent Developments

- In March 2022, Novo Nordisk launched its first smart insulin pens. The NovoPen Echo Plus and NovoPen 6 are insulin self-injection pens that collect data such as how much and when insulin is injected, then upload the data to an app through near-field communication (NFC) link so that healthcare professionals and patients may examine it.

- In April 2021, Roche Diabetes Care France and BioCorp unveiled the smart insulin pen device Mallya in France.

Injection Pen Market: Regional Landscape

Asia Pacific to rule the global market during the forecast period

Asia Pacific is estimated to contribute a major share of the global injection pen market during the forecast period. The rising incidence of diabetes, advantageous reimbursement scenarios, and an expanding number of awareness campaigns are all contributing to the Asia Pacific injection pens market's high share. In addition to this, developing healthcare infrastructure and growing acceptance of biosimilars are also adding up to the growth of the market in this region. North America is estimated to account for a significant share of the market owing to the increase in the adoption of injection pens in homecare settings and the growing prevalence of chronic diseases. Europe is also expected to hold a substantial share in the market.

Injection Pen Market: Competitive Landscape

- Eli Lilly and Company

- Sanofi

- Becton

- Dickinson and Company

- Ypsomed Holding AG

- Novo Nordisk A/S

- Sun Pharmaceutical Industries Ltd.

- Pfizer

- AstraZeneca plc

- F. Hoffmann-La Roche Ltd.

- and Merck KGaA

- among others

Global injection pen market is segmented as follows:

By Therapy

- Osteoporosis

- Growth Hormone

- Diabetes

- Cancer

- Auto-immune Diseases

- Fertility

- Other Therapies

By Product Type

- Reusable Injection Pens

- Disposable Injection Pens

By End User

- Hospitals & Diagnostic Clinics

- Home-care Settings

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global injection pen market is expected to grow due to increasing adoption of self-administration drug delivery devices, rising prevalence of diabetes and chronic diseases, and technological advancements in pen injectors.

According to a study, the global injection pen market size was worth around USD 47.17 Billion in 2024 and is expected to reach USD 91.97 Billion by 2034.

The global injection pen market is expected to grow at a CAGR of 7.7% during the forecast period.

North America is expected to dominate the injection pen market over the forecast period.

Leading players in the global injection pen market include Eli Lilly and Company, Sanofi, Becton, Dickinson and Company, Ypsomed Holding AG, Novo Nordisk A/S, Sun Pharmaceutical Industries Ltd., Pfizer, AstraZeneca plc, F. Hoffmann-La Roche Ltd., and Merck KGaA, among others.

The report explores crucial aspects of the injection pen market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed