Inlay Papers Market Growth, Size, Share, Trends, and Forecast 2032

Inlay Papers Market By Product Type (Dry Inlay Paper and Wet Inlay Paper), By Material (Recycled Paper and Synthetic Paper), By End-Use (Banking, Stationary, Retail, Logistics & Transportation, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2024 - 2032

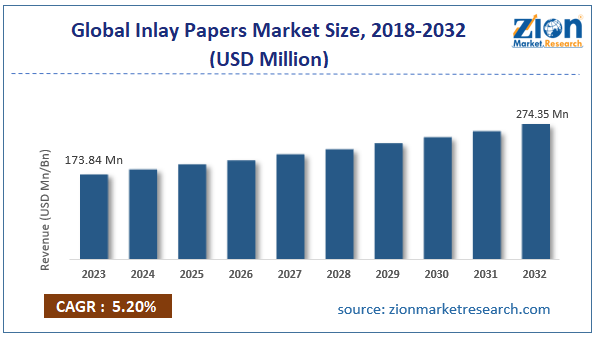

| Market Size in 2023 | Market Forecast in 2032 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 173.84 million | USD 274.35 million | 5.20% | 2023 |

Inlay Papers Industry Prospective:

The global inlay papers market size was worth around USD 173.84 million in 2023 and is predicted to grow to around USD 274.35 million by 2032 with a compound annual growth rate (CAGR) of roughly 5.20% between 2024 and 2032.

Inlay Papers Market: Overview

Inlay papers are innovative packaging materials. They are either used for protective purposes or to impart a higher aesthetic appeal to an object or a product. Inlay papers have several applications ranging from use as decorative packaging solutions to more functional uses such as acting as a base for printing instructional manuals for electronic products. Inlay papers are extremely versatile and hence have wider applications across dynamic industries. For instance, they can be embedded with advanced technologies such as sensors to deliver higher security to the packaged product. Additionally, they can be customized to meet the client’s or user’s requirements. Inlay papers are highly durable. They can not only protect packaged goods from external damage, but the papers are also extremely resistant to the impact of severe environmental conditions such as excess heat or temperature. The growing demand for decorative papers in the home decor segment as well as the superior versatility of the papers is driving the revenue in the inlay papers industry. The forecast period is expected to register higher growth driven by the growing experiments in end-user verticals to improve the overall application of the papers across the industry, especially electronics and clothing sectors.

Key Insights:

- As per the analysis shared by our research analyst, the global inlay papers market is estimated to grow annually at a CAGR of around 5.20% over the forecast period (2024-2032)

- In terms of revenue, the global inlay papers market size was valued at around USD 173.84 million in 2023 and is projected to reach USD 274.35 million, by 2032.

- The inlay paper market is projected to grow at a significant rate due to the increasing demand for inlay papers in the electronics sector

- Based on the product type, the dry inlay paper segment is growing at a high rate and will continue to dominate the global market as per industry projection

- Based on the end-use, the retail segment is anticipated to command the largest market share

- Based on region, North America is projected to dominate the global market during the forecast period

Request Free Sample

Request Free Sample

Inlay Papers Market: Growth Drivers

Increasing demand for inlay papers in the electronics sector to drive the market growth rate

The global inlay papers market is expected to witness high growth due to the growing demand for effective packaging solutions in the electronics & electrical industry. Inlay papers have extensive applications in the consumer electronics sector since the product is extremely versatile. It is used in the sector for several purposes including packaging, labeling, and as an informative tool. For instance, inlay papers are used for packaging delicate electronic components of a device especially to prevent the building-up of static energy. Electrical device components are at the risk of developing static energy when stored close to one another and it can damage the overall function of the device. Additionally, inlay papers are used for labeling activities, especially in expensive products such as laptops, smartphones, and other devices.

Inlay papers can be embedded with features that impart higher security to the device against counterfeiting. Electronic items are extremely vulnerable to forgery, especially smaller items such as earphones and chargers. Inlay papers can be used to protect electronic devices against such activities. In addition to this, modern consumers have high expectations from brands in terms of user experience. Inlay papers are used by electronic device producers for developing instructional manuals that are required to be highly durable. Printing warranty cards and other instructions related to the correct way of using the electronic item may help drive the demand for inlay papers.

Clothing industry is likely to contribute heavily to the industry’s growth rate

Inlay papers have found massive consumption in one of the fastest-growing industries globally. The clothing sector is a crucial driver of the growing demand for inlay papers. These versatile printing solutions are used for adding labels to clothing items including information such as prices, brand name, size, place of manufacturing, and other details that a customer uses to make an informed decision. The fast fashion segment of the clothing industry has revolutionized customer shopping trends. The fast fashion sector deals with the production of highly disposable and affordable clothing items. In January 2024, fast fashion brand Newme raised over USD 5.4 million in seed funding. The company is now backed by Fireside Ventures. Such massive investments in the clothing sector are expected to cause higher demand in the global inlay paper industry.

Inlay Papers Market: Restraints

Availability of alternate solutions with affordable pricing may restrict the market expansion

The global industry for inlay papers is expected to be restricted due to the presence of several other alternatives in the commercial market. This includes products such as plastic bags, polyester-based labels, barcodes, embossing, and custom packaging depending on the product. In addition to this, some of these alternatives have wide consumer awareness due to the higher maturity level of the respective industries. The attracting cost-efficiency of polyester-based labels or plastic packaging may limit the demand for inlay papers.

Inlay Papers Market: Opportunities

Focusing on responsible inlay paper sourcing may help the industry players generate a higher growth rate during the projection period

The global inlay papers market players may generate a higher growth rate by focusing on responsible sourcing for inlay papers. Customers are increasingly making environmentally conscious choices. There is a growing number of buyers who make purchases from brands that are environmentally responsible. Companies using inlay papers for product packaging or other applications must invest in souring these products in accountable ways. This can be achieved by obtaining papers from regions that are certified by official authorities such as Programs for the Endorsement of Forest Certification (PEFC) and others. Additionally, the use of chemical components during the production of inlay papers will further reduce the environmental impact on the environment.

Rising launch of new inlay paper solutions will contribute to extended market expansion

In recent times, research & development surrounding inlay papers has increased at a rapid rate. This can be witnessed in the growing launch of new solutions with digital features. In May 2023, Tageos, a leading provider of high-performance and sustainable radio-frequency identification (RFID tags), announced the launch of EOS-261 inlays thus producing a more industry-specific range of products. The next generation of the older EOS-261 is equipped with an ultra-compact footprint and power antenna design. They are powered by RAIN RFID Integrated Circuit (IC) by Impinj. In September 2023, Avery Dennison launched the AD Pure™ range. It is the recent range of tags and inlays that are free of Polyethylene Terephthalate plastics. The new launch has applications across retail, apparel, and the supply chain industry thus contributing to the revenue in the global inlay papers market.

Inlay Papers Market: Challenges

Constant requirement to innovate amidst high competition from other companies could be challenging for the industry players

The global inlay paper industry is expected to be challenged due to the constant demand for innovation as the industry is heavily competitive. It faces tough competition from alternate solutions as well as from the companies operating in the sector. The growing supply chain issues and concerns associated with raw material procurement may add to the existing problems.

Inlay Papers Market: Segmentation

The global inlay papers market is segmented based on product type, material, end-use, and region.

Based on the product type, the global market divisions are dry inlay paper and wet inlay paper. In 2023, the highest demand was observed in the dry inlay paper segment. The segmental growth rate is a result of the extended use of dry inlay papers across end-user verticals, especially the crafts segment. Wet inlay papers are produced using a substrate material while the dry version deals with paper-based RFID solutions. The growing demand for 100% safe food packaging solutions may fuel the demand rate in the industry.

Based on material, the global inlay papers industry is divided into recycled paper and synthetic paper.

Based on the end-use, the global market segments are banking, stationary retail, logistics & transportation, and others. In 2023, the highest growth was witnessed in the retail segment. The growing revenue in the textile and clothing sector driven by the increasing demand for affordable items and the rise of the textile-oriented e-commerce sector is likely to fuel the industry’s growth rate. By the end of the decade, the global fast fashion market is expected to cross USD 168 billion as per market research.

Inlay Papers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Inlay Papers Market |

| Market Size in 2023 | USD 173.87 Million |

| Market Forecast in 2032 | USD 274.35 Million |

| Growth Rate | CAGR of 5.20% |

| Number of Pages | 216 |

| Key Companies Covered | Tageos, SML Group, Confidex, Omni-ID, RFID Global Solution, Avery Dennison, NXP Semiconductors, Invengo, Zebra Technologies, Identiv, HUAYUAN, Impinj, Smartrac, Thinfilm Electronics, Alien Technology, and others. |

| Segments Covered | By Product Type, By Material, By End-Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Inlay Papers Market: Regional Analysis

North America to witness the highest growth during the projection period

The global inlay papers market will be led by North America during the forecast period. In 2023, the US held control over more than 79% of the North American market. One of the leading reasons for higher regional market dominance is the growing demand for RFID-based solutions across industries. For instance, there has been a rise in the number of international travelers in the US resulting in greater demand for RFID-tagged passports that serve the purpose of individual authentication. In addition to this, the growing rate of the consumer electronics market will fuel the demand for associated inlay papers used for packaging and drafting instruction manuals. The US and Canadian population segments have a keen interest in smart gadgets facilitated by the extensive presence of key technology companies in the region including Apple, Microsoft, Google, and others. In addition to this, the higher disposable income further allows an increase in the purchase of smart electronics resulting in greater consumption of inlay papers. The regional food market is helping the region thrive. Food safety regulations in North America are extremely strict requiring food manufacturers to use superior quality and safe food packaging solutions.

Inlay papers Market: Competitive Analysis

The global inlay papers market is led by players like:

- Tageos

- SML Group

- Confidex

- Omni-ID

- RFID Global Solution

- Avery Dennison

- NXP Semiconductors

- Invengo

- Zebra Technologies

- Identiv

- HUAYUAN

- Impinj

- Smartrac

- Thinfilm Electronics

- Alien Technology

The global inlay papers market is segmented as follows:

By Product Type

- Dry Inlay Paper

- Wet Inlay Paper

By Material

- Recycled Paper

- Synthetic Paper

By End-Use

- Banking

- Stationary

- Retail

- Logistics & Transportation

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Inlay papers are innovative packaging materials. They are either used for protective purposes or to impart a higher aesthetic appeal to an object or a product.

The global inlay papers market is expected to witness high growth due to the growing demand for effective packaging solutions in the electronics & electrical industry.

The global inlay papers market size was valued USD 173.84 million in 2023 and anticipates growing to USD 274.35 million by 2032 at a CAGR of 5.20%.

The CAGR value of the inlay papers market is expected to be around 5.20% during 2024-2032.

The global inlay papers market will be led by North America during the forecast period.

The global inlay papers market is led by players like Tageos, SML Group, Confidex, Omni-ID, RFID Global Solution, Avery Dennison, NXP Semiconductors, Invengo, Zebra Technologies, Identiv, HUAYUAN, Impinj, Smartrac, Thinfilm Electronics and Alien Technology.

The report explores crucial aspects of the inlay papers market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

Choose License Type

List of Contents

Inlay PapersIndustry Prospective:OverviewKey Insights:Growth DriversRestraintsOpportunitiesRising launch of new inlay paper solutions will contribute to extended market expansionChallengesSegmentationReport ScopeRegional AnalysisInlay papers Competitive AnalysisThe global inlay papers market is segmented as follows:By RegionHappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed