Insulated Packaging Market Size, Share Report, Analysis, Trends, Growth 2034

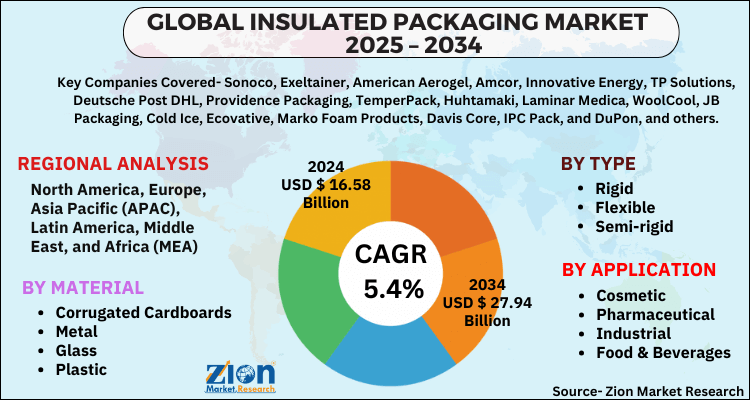

Insulated Packaging Market By Material (Corrugated Cardboards, Metal, Glass, Plastic and Others), By Type (Rigid, Flexible, and Semi-rigid), By Application (Cosmetic, Pharmaceutical, Industrial, Food & Beverages, and Others), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

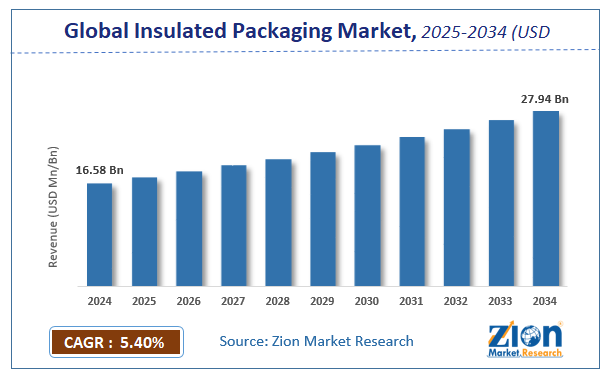

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 16.58 Billion | USD 27.94 Billion | 5.4% | 2024 |

Insulated Packaging Industry Perspective:

The global insulated packaging market size was worth around USD 16.58 Billion in 2024 and is predicted to grow to around USD 27.94 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 5.4% between 2025 and 2034. The report analyzes the global insulated packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the insulated packaging market.

Insulated Packaging Market: Overview

Insulation materials resist the heat transfer from one object to another with two different temperatures having low thermal conductivity. Thermal fluctuations commonly occur during the transportation of temperature-sensitive products. This is the main reason behind many companies majorly use insulated materials for packaging. Insulated packaging provides better protection from damage, maintaining the product specifications. It keeps the product warm, refrigerated, and frozen and reduces the effect of variable temperature.

Key Insights

- As per the analysis shared by our research analyst, the global insulated packaging market is estimated to grow annually at a CAGR of around 5.4% over the forecast period (2025-2034).

- Regarding revenue, the global insulated packaging market size was valued at around USD 16.58 Billion in 2024 and is projected to reach USD 27.94 Billion by 2034.

- The insulated packaging market is projected to grow at a significant rate due to growing demand for temperature-sensitive packaging in food, pharmaceuticals, and e-commerce logistics.

- Based on Material, the Corrugated Cardboards segment is expected to lead the global market.

- On the basis of Type, the Rigid segment is growing at a high rate and will continue to dominate the global market.

- Based on the Application, the Cosmetic segment is projected to swipe the largest market share.

- Based on region, North America is predicted to dominate the global market during the forecast period.

To know more about this report, request a sample copy.

Insulated Packaging Market: Growth Drivers

Rising automotive manufacturing to drive the market growth

Every high-value part, component, and surface in the automotive and transportation industries are packaged and safeguarded throughout import and export. Insulated packaging effectively reduces costs, improves manufacturing efficiency, and guarantees a supply chain free of errors. The International Trade Administration (ITA) states that China is the world's largest automobile market, and the Chinese government projects that 35 million cars will be produced there by 2025. Additionally, according to OICA, the production of passenger cars increased in the new member region of the European Union from 4,131,358 in 2018 to 4,149,935 in 2019, an increase of 0.4%, as a result of the rising per capita income of the populace, which also contributed to the enormous demand for insulated packaging manufacturing in the APAC region. As a result, as vehicle manufacturing grows, so will the demand for insulated packages, which will propel the global insulated packaging market.

Insulated Packaging Market: Restraints

Rising raw material costs hampering the market growth

Primary raw materials including plastic, glass, paper, and metal are in short supply, which is a problem for the manufacturers of insulating materials. The price of raw materials from international markets increases as a result of volatile currency exchange rates. The fierce competition for profit margins among raw material producers is brought on by the fluctuating cost of raw materials and chemicals. Thus, acting as a major restraint for the market growth over the forecast period.

Insulated Packaging Market: Opportunities

The increasing consumer electronics market provides lucrative opportunities for the market expansion

Electronics must be carefully packaged and shipped because they are frequently expensive and relatively fragile. Almost all battery connections must be protected from short-circuiting when being shipped. To do this, they are completely wrapped in an insulating wrapping to shield the exposed terminals. According to the United States International Trade Commission, the total amount of electronic products exported from the United States increased by $7.9 billion (3%) to $268 billion in 2017.

According to the Department for International Trade, the UK economy benefits from the electronics sector to the extent of USD 17 billion annually. By 2025, the Consumer Electronics and Appliances Industry in India is projected to grow to be the fifth-largest in the world, according to Invest India. By 2025, India is expected to have an $800 billion to $1 trillion digital economy, which could account for 18 to 23% of the country's total economic activity. Additionally, the electronics industry, which is booming, is a major driver for the insulated packaging market due to the increase in demand for insulated packaging.

Insulated Packaging Market: Challenges

Volatility in crude oil prices acts as a major challenge for the market expansion

Upstream petroleum products including polystyrene, EPS Styrofoam, polyethylene, and polyurethane are frequently utilized as raw ingredients in the manufacture of insulated packaging. Therefore, the volatility in crude oil prices also affects the cost of raw materials for insulated packaging. The price of crude oil has fluctuated in recent years, according to BP's Statistical Review of World Energy. For instance, the price of crude oil went from $98.95 per barrel in 2014 to $52.39 per barrel in 2015, then rose from $43.73 per barrel in 2016 to $71.31 per barrel in 2018, before falling to $64.21 per barrel in 2019. And the cost of insulated packaging also rises as a result of the volatility in crude oil prices. As a result, the fluctuation in crude oil prices is anticipated to be a significant issue for the makers of insulated packaging, which would impede the growth of the insulated packaging market during the forecast period.

Insulated Packaging Market: Segmentation

The global insulated packaging market is segmented based on material, type, application, and region

Based on material, the global market is bifurcated into corrugated cardboard, metal, glass, plastic, and others. Corrugated cardboard held the largest market share in 2021 and is expected to continue this pattern during the forecast period. The growth in the segment is attributed to the various benefits such as high bending resistance, burst strength, tear resistance, impact strength, and others. Moreover, insulated packaging made of corrugated cardboard protects delivered goods. The combination of stiffness and cushioning properties makes them physically strong to withstand impact during transit and movement. Additionally, they are very cost-effective because the raw materials needed to produce corrugated cardboard are inexpensive and widely accessible.

On the other hand, the metal segment is expected to grow at a significant rate during the forecast period. Foam is sandwiched between the two metal sheets that make up the Metal IP. Metal sheets can be altered as needed depending on the application. The metal panels used in the production of IP products operate as a moisture and air barrier and produce a vapor that improves the thermal stability of the stiff core. These metal panels are quite strong and come in a variety of hues and shapes. Thus, these facts drive the market expansion during the forecast period.

Based on type, global insulated packaging is categorized into rigid, flexible, and semi-rigid. The flexible segment accounted for the largest revenue share in 2021 and is expected to show its dominance during the forecast period. Flexible packaging is increasingly in demand because of its appropriate shape, simplicity of use, ability to be resold, lightweight, and reduced environmental impact. Additionally, the expansion of the market is fueled by the usage of flexible packaging in ready-to-eat food products and vegetables. According to the Flexible Packaging Association (FPA), flexible packaging accounted for nearly 59 percent of shipments in the United States $170 billion packaging market in June 2019. Besides, the rigid segment is anticipated to grow at a fast rate during the forecast period. Paperboard, fiberboard, plastics, corrugated cardboard, and paper are all used to make rigid packing goods. Rigid items like cases, trays, bottles, cans, cups, pots, and cartons are made from the materials. Using tapes, staples, and adhesives, rigid items are sealed. RFID and different color printing techniques can be used to make the items.

Recent Developments:

- In December 2021, a new range of bio-based foams made from wood is being added by Stora Enso to its packaging offering. The products can be used for thermal and protective packing and are completely recyclable. Lightweight wood foams meet the demand for regenerative, circular, and environmentally friendly cushioning materials in inner packaging. The products offered by Stora Enso are Papira® and FibreaseTM. Customers can choose the best foam based on their unique packaging needs because both foams have a variety of technical and sustainable features. The foams are ideal for the thermal packing of temperature-sensitive products and can be used to safeguard fragile goods.

- In September 2021, Cryopak, a market leader in temperature assurance packaging and temperature monitoring equipment, unveils the one-of-a-kind BOXEDin, which uses a box-in-box idea. This new pre-qualified EPS shipper line provides exceptional thermal insulation, making it an ideal alternative for safeguarding temperature-sensitive biologic goods against environmental hazards.

Insulated Packaging Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insulated Packaging Market |

| Market Size in 2024 | USD 16.58 Billion |

| Market Forecast in 2034 | USD 27.94 Billion |

| Growth Rate | CAGR of 5.4% |

| Number of Pages | 288 |

| Key Companies Covered | Sonoco, Exeltainer, American Aerogel, Amcor, Innovative Energy, TP Solutions, Deutsche Post DHL, Providence Packaging, TemperPack, Huhtamaki, Laminar Medica, WoolCool, JB Packaging, Cold Ice, Ecovative, Marko Foam Products, Davis Core, IPC Pack, and DuPon, and others. |

| Segments Covered | By Material, By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insulated Packaging Market: Regional Analysis

The Asia Pacific region is expected to hold the largest market share during the forecast period

The Asia Pacific region is expected to hold the largest global insulated packaging market share during the forecast period. The growth in the region is attributable to the growing use of online grocery shopping platforms and websites, as well as the rising demand for insulated packaging solutions from the regional food & beverage and pharmaceutical industries. For instance, according to the India Brand Equity Foundation, by 2034, it is anticipated that the Indian e-commerce market will surpass the US to take it as the second-largest e-commerce market in the world.

The e-commerce market in India is predicted to develop at a 19.24% CAGR from US$ 46.20 billion in 2020 to US$ 111.40 billion by 2025, with groceries and clothing/apparel set to be the main drivers of additional expansion. From US$ 3.95 billion in FY21 to US$ 26.93 billion in 2027, the Indian online grocery market is predicted to grow at a CAGR of 33%. Moreover, according to the Indian Institute of Packaging (IIP), packaging consumption in India has increased 200% in the past decade, rising from 4.3 kg per person per annum (pppa) to 8.6 kg pppa as of FY20. The food & beverage and pharmaceutical sectors hold the largest market share in the Asia Pacific region. Thus, the aforementioned facts drive market expansion during the forecast period.

Besides, North America is expected to grow significantly over the forecast period. In the region, the United States holds the prominent market share in the insulated packaging market owing to the expanding retail food chains, a rising e-commerce market, and an increase in the number of such chains. Traditional retail is under pressure from the country's continued rapid growth of eCommerce. For instance, According to the U.S. Department of Commerce's quarterly e-commerce statistics, consumers spent USD 601.75 billion online with American merchants in 2019, an increase of 14.9% from USD 523.64 billion the previous year. That represented a somewhat faster growth rate than that of 2018 when the Commerce Department reported an increase in online sales of 13.6% year over year.

Additionally, sales of consumer packaged goods—long restricted to conventional retail channels—are surging online, with growth rates frequently exceeding 50% year over year. Additionally, the existence of large organizations like Amazon and Walmart has substantially altered the purchasing habits of American supermarket buyers. Insulated packaging also commands a visible presence in various high-growth industries in the nation, including healthcare, food, beverage, etc., due to its capacity to avoid damage to temperature-sensitive products including medications, meals, and cosmetics. During the projected period, this factor will propel the market for insulating packaging.

Insulated Packaging Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the insulated packaging market on a global and regional basis.

The global Insulated Packaging market is dominated by players like:

- Sonoco

- Exeltainer

- American Aerogel

- Amcor

- Innovative Energy

- TP Solutions

- Deutsche Post DHL

- Providence Packaging

- TemperPack

- Huhtamaki

- Laminar Medica

- WoolCool

- JB Packaging

- Cold Ice

- Ecovative

- Marko Foam Products

- Davis Core

- IPC Pack

- DuPont

The global insulated packaging market is segmented as follows:

By Material

- Corrugated Cardboards

- Metal

- Glass

- Plastic

- Others

By Type

- Rigid

- Flexible

- Semi-rigid

By Application

- Cosmetic

- Pharmaceutical

- Industrial

- Food & Beverages

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

Insulated packaging is designed to maintain a consistent temperature inside a container, protecting temperature-sensitive products from external heat or cold during storage and transportation. It is commonly used for

The global insulated packaging market is expected to grow due to rising demand for temperature-sensitive products in pharmaceuticals, food, and beverage industries, coupled with growing e-commerce and cold chain logistics.

According to a study, the global insulated packaging market size was worth around USD 16.58 Billion in 2024 and is expected to reach USD 27.94 Billion by 2034.

The global insulated packaging market is expected to grow at a CAGR of 5.4% during the forecast period.

North America is expected to dominate the insulated packaging market over the forecast period.

Leading players in the global insulated packaging market include Sonoco, Exeltainer, American Aerogel, Amcor, Innovative Energy, TP Solutions, Deutsche Post DHL, Providence Packaging, TemperPack, Huhtamaki, Laminar Medica, WoolCool, JB Packaging, Cold Ice, Ecovative, Marko Foam Products, Davis Core, IPC Pack, and DuPon, among others.

The report explores crucial aspects of the insulated packaging market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Industry Perspective:OverviewKey InsightsTo know more about this report,request a sample copy.Growth DriversRestraintsOpportunitiesChallengesVolatility in crude oil prices acts as a major challenge for the market expansionSegmentationRecent Developments:Report Scope Regional AnalysisCompetitive AnalysisThe global insulated packaging market is segmented as follows:RelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed