Global Insulation Products Market Size, Share, Growth Analysis Report - Forecast 2034

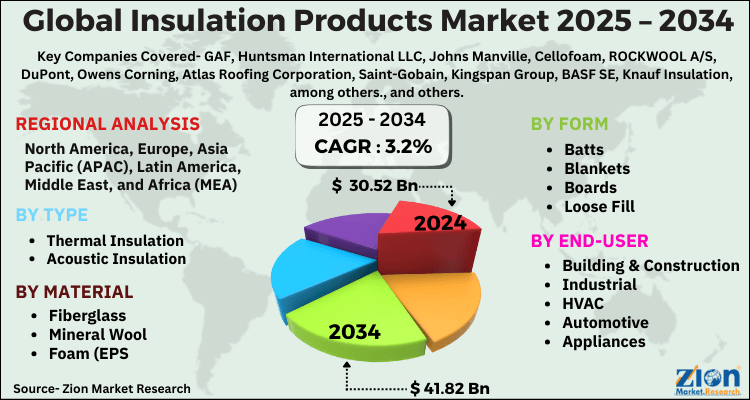

Insulation Products Market By Type (Thermal Insulation, Acoustic Insulation, Electrical Insulation), By Material (Fiberglass, Mineral Wool, Foam (EPS, XPS, PU), Aerogel, Others), By Form (Batts, Blankets, Boards, Loose Fill, Spray Foam), By End-user (Building & Construction, Industrial, HVAC, Automotive, Appliances), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

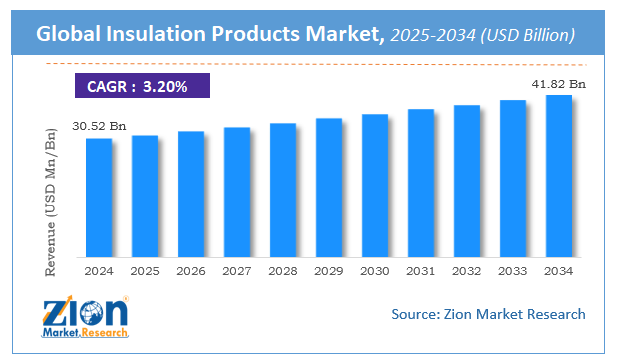

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 30.52 Billion | USD 41.82 Billion | 3.2% | 2024 |

Insulation Product Market Size & Industry Analysis:

The global insulation products market size was worth around USD 30.52 Billion in 2024 and is predicted to grow to around USD 41.82 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 3.2% between 2025 and 2034. The report analyzes the global insulation products market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the insulation products industry.

Insulation Product Market: Overview

Insulation is the technique of preventing sound, heat, and electricity from entering or leaving a physical space. It is accomplished by installing insulating materials that serve as a barrier to the flow of energy. Mineral wool, polyethylene, polystyrene, and other insulators are available and typically have poor thermal conductivity. Hardboard and wooden doors, as well as other wood-based items, help with insulation, and the spaces between tiles and windows are filled with spray foam and adhesive strips. An area's insulation helps save energy costs, prevent moisture condensation, and improves people's sense of safety and protection. Along with lowering noise pollution, it helps to reduce heat loss from exposed pipes and uninsulated valves inside buildings.

Key Insights

- As per the analysis shared by our research analyst, the global insulation products market is estimated to grow annually at a CAGR of around 3.2% over the forecast period (2025-2034).

- Regarding revenue, the global insulation products market size was valued at around USD 30.52 Billion in 2024 and is projected to reach USD 41.82 Billion by 2034.

- The insulation products market is projected to grow at a significant rate due to Rising demand for energy-efficient buildings and industrial systems drives growth. Stringent building codes and green construction trends also contribute.

- Based on Type, the Thermal Insulation segment is expected to lead the global market.

- On the basis of Material, the Fiberglass segment is growing at a high rate and will continue to dominate the global market.

- Based on the Form, the Batts segment is projected to swipe the largest market share.

- By End-user, the Building & Construction segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Insulation Product Market: Growth Drivers

Rising building and construction activities across the globe to drive the market

Due to economic changes and increased per capita incomes, building and construction activity are expanding in several regions. For instance, the government of India has launched schemes like "Housing for All by 2024" and "100 Smart Cities" that are predicted to propel the Indian residential building market throughout the projection period.

The Australian construction sector is estimated to be worth USD 112 billion yearly, or around 9% of GDP, by the International Trade Administration (ITA). According to the Building and Construction Authority (BCA), Construction demand is predicted to continue constantly over the medium term. Demand is anticipated to be between $27 billion and $34 billion annually for 2021 and 2022, and between $28 billion and $35 billion annually for 2023 and 2024.

Additionally, there has been substantial investment in residential development in the United States, and this trend is anticipated to continue soon. For instance, the value of construction put in place in residential and nonresidential construction grew to $567,555 million and $470,986 million in January 2020 from $546,532 million and $466,436 million in December 2019, respectively, according to the U.S. Census Bureau.

To maintain the proper temperature inside the building, insulation materials are frequently employed in the building and construction details of floors, walls, roofs, and ceilings for new building constructions as well as for retrofitting existing buildings. Thus, the rising building and construction activities across the globe are expected to drive the market during the forecast period.

Insulation Product Market: Restraints

Price volatility of raw materials to restrain the market growth

The market hasn't been able to expand as much as it should due to rising prices for the raw chemicals used to make polyurethane foam, including succinic acid, toluene diisocyanate, and polyols. Adipic acid serves as a feedstock for the polyester polyols that are used to make insulation materials made of polyurethane foam. Adipic acid's supply has also tightened over the previous few months. Therefore, the global insulation product market expansion over the forecast period may be constrained by the price volatility of insulating materials.

Insulation Product Market: Opportunities

Stringent regulations mandating the use of insulation materials for energy conservation provide a lucrative opportunity

Globally, nations have recognized the importance of taking aggressive measures to address the growing global warming problem. Although the idea of energy efficiency is not new, it was not always as universally recognized as it is now. For applications like building insulation and automotive insulation, industries are creating more effective energy-conserving insulations.

Both reducing fuel usage and eliminating energy loss are objectives. Insulation is used to promote comfort and improve safety measures in addition to avoiding energy loss. The use of insulation is now required by building codes in both Europe and North America. Thus, stringent regulations across the globe are expected to provide lucrative opportunities for market expansion.

Insulation Product Market: Segmentation

The global insulation product market is segmented based on the product, end-use, and region

Based on the product, the global market is bifurcated into glass wool, mineral wool, EPS, XPS, CMS fiber, calcium silicate, aerogel, cellulose, PIR, phenolic foam, and polyurethane. The polyurethane segment is expected to hold the largest market share during the forecast period.

The growth in the segment is attributed to its several features, including superior thermal insulating capabilities, low moisture vapor permeability, high resistance to water absorption, relatively high mechanical strength, and low density and it has a large proportion of unconnected closed microcells packed with inert gas, and polyurethane foam is an excellent insulator (minimum 90 percent). In addition, it is also relatively simple and inexpensive to install. As a result, the better properties of polyurethane foam over other materials are expected to drive demand for polyurethane foam-based insulation over the projection period.

Based on end-use, the market is segmented into construction, industrial, HVAC & OEM, transportation, appliances, furniture/bedding, and packaging. The construction segment is expected to lead the market during the forecast period. The market is predicted to rise as the number of insulation-intensive structures in metropolitan areas increases.

The Indian government intends to build roughly 100 airports over the next 15 years as part of its Regional Air Connectivity initiative. Due to increased demand from industrial facilities, industrial construction is expected to show profitable growth in the market in various regions. On the other hand, Transportation covers the automotive, maritime, and aerospace industries. In 2021, the sector represented a large market share of the worldwide market. Automobile manufacturers are continuously seeking ways to improve passenger safety and comfort, which is a primary factor driving demand for insulation products in this sector.

On the basis of Material, the global insulation products market is bifurcated into Fiberglass, Mineral Wool, Foam (EPS, XPS, PU), Aerogel, Others.

By Form, the global insulation products market is split into Batts, Blankets, Boards, Loose Fill, Spray Foam.

Recent Developments:

- In August 2022, by utilizing NyRock technology, ROCKWOOL introduced its new product line, which includes NyRock Rainscreen 032 and Frame Slab 032. This range of products offers the lowest lambda stone wool insulation available in Britain. The NyRock Rainscreen 032 product series is especially made for ventilated cladding, including curtain walling, and sealed constructions.

- In November 2021, CFI Insulation, Inc. ("CFI") has been acquired by Installed Building Products, Inc. (the "Company" or "IBP"), an industry-leading installer of insulation and related building products. Through this acquisition, CFI expands their presence to residential, multifamily and commercial customers throughout Tennessee.

Insulation Products Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insulation Products Market |

| Market Size in 2024 | USD 30.52 Billion |

| Market Forecast in 2034 | USD 41.82 Billion |

| Growth Rate | CAGR of 3.2% |

| Number of Pages | 199 |

| Key Companies Covered | GAF, Huntsman International LLC, Johns Manville, Cellofoam, ROCKWOOL A/S, DuPont, Owens Corning, Atlas Roofing Corporation, Saint-Gobain, Kingspan Group, BASF SE, Knauf Insulation, among others., and others. |

| Segments Covered | By Type, By Material, By Form, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

To know more about this report, request a sample copy.

Insulation Product Market: Regional Analysis

The Asia Pacific region is expected to dominate the market during the forecast period

The Asia Pacific region accounted to hold the largest revenue share of more than 40% in 2021 in the global insulation product market and is expected to show its dominance during the forecast period. The growth in the region is attributed to the rapid population growth, as well as rapid urbanization and industrialization, which are paving the way for infrastructure expansion. The adoption of energy-efficient insulating solutions has been sparked by the region's improving economic outlook and significant growth in living standards. Furthermore, the governments of regional economies like China, India, and Japan may alter the dynamics of the regional market by placing a greater focus on expanding infrastructure and constructing better road. For instance, according to Invest India, the Indian government has forecasted an investment of $350 bn towards road infrastructure in the North-East region of India during 2024-2034.

Insulation Products Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the insulation products market on a global and regional basis.

The global insulation products market is dominated by players like:

- GAF

- Huntsman International LLC

- Johns Manville

- Cellofoam

- ROCKWOOL A/S

- DuPont

- Owens Corning

- Atlas Roofing Corporation

- Saint-Gobain

- Kingspan Group

- BASF SE

- Knauf Insulation

- among others.

The global insulation products market is segmented as follows;

By Type

- Thermal Insulation

- Acoustic Insulation

- Electrical Insulation

By Material

- Fiberglass

- Mineral Wool

- Foam (EPS

- XPS

- PU)

- Aerogel

- Others

By Form

- Batts

- Blankets

- Boards

- Loose Fill

- Spray Foam

By End-user

- Building & Construction

- Industrial

- HVAC

- Automotive

- Appliances

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table Of Content

Methodology

FrequentlyAsked Questions

The global insulation products market is expected to grow due to Rising demand for energy-efficient buildings and industrial systems drives growth. Stringent building codes and green construction trends also contribute.

According to a study, the global insulation products market size was worth around USD 30.52 Billion in 2024 and is expected to reach USD 41.82 Billion by 2034.

The global insulation products market is expected to grow at a CAGR of 3.2% during the forecast period.

North America is expected to dominate the insulation products market over the forecast period.

Leading players in the global insulation products market include GAF, Huntsman International LLC, Johns Manville, Cellofoam, ROCKWOOL A/S, DuPont, Owens Corning, Atlas Roofing Corporation, Saint-Gobain, Kingspan Group, BASF SE, Knauf Insulation, among others., among others.

The report explores crucial aspects of the insulation products market, including a detailed discussion of existing growth factors and restraints, while also examining future growth opportunities and challenges that impact the market.

List of Contents

Insulation Product MarketSize Industry Analysis:Insulation Product OverviewKey InsightsInsulation Product Growth DriversInsulation Product RestraintsInsulation Product OpportunitiesInsulation Product SegmentationRecent Developments:Report ScopeTo know more about this report,request a sample copy.Insulation Product Regional AnalysisCompetitive AnalysisRelatedNews

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed