Insurance Broker And Agents Market Size Report, Share, Industry Analysis, Forecast 2034

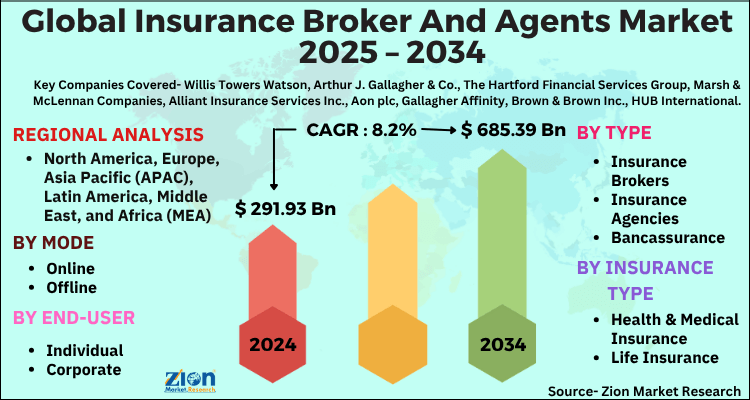

Insurance Broker And Agents Market By Insurance Type (Life Insurance, Health Insurance, Property & Casualty Insurance, Auto Insurance, Travel Insurance, Others), By Distribution Channel (Online, Offline), By End-user (Individuals, SMEs, Large Enterprises, Government), By Service Type (Retail Brokerage, Wholesale Brokerage, Reinsurance Brokerage), and By Region: Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data, and Forecasts 2025 - 2034

| Market Size in 2024 | Market Forecast in 2034 | CAGR (in %) | Base Year |

|---|---|---|---|

| USD 291.93 Billion | USD 685.39 Billion | 8.2% | 2024 |

Insurance Broker And Agents Market: Industry Perspective

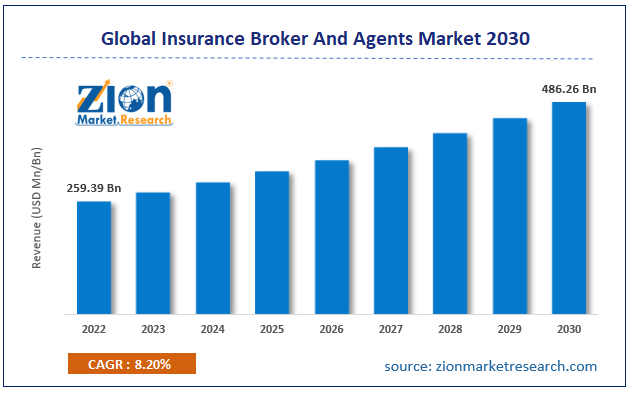

The global insurance broker and agents market size was worth around USD 291.93 Billion in 2024 and is predicted to grow to around USD 685.39 Billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.2% between 2025 and 2034. The report analyzes the global insurance broker and agents market's drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the insurance broker and agents industry.

Insurance Broker And Agents Market: Overview

Insurance brokers and agents are individuals working in the larger financial services industry. Insurance, by definition, is a method of protection against financial loss caused by an unprecedented situation and in exchange for a fixed fee or premium. It is a contractual obligation between parties where the one offering the services is obligated to pay the service user a fixed sum of money in the event of a loss, injury, or damage. Insurance is considered an excellent form of risk management and applies to humans and objects where people can either insure the life and health of themselves or their loved ones and they can also insure a prized possession.

Insurance brokers and agents act as the mediators between the parties involved in the transaction. The main difference between an insurance broker and an insurance agent is determined by the party they are representing. For instance, an insurance broker works toward the exact financial needs of the clients and offers a range of options suiting their needs while an insurance agent works for an insurance-providing company or organization. They act as sales representatives for a brand. The insurance broker and agent industry is growing at a rapid rate and will continue the same trend in the coming years.

Key Insights

- As per the analysis shared by our research analyst, the global insurance broker and agents market is estimated to grow annually at a CAGR of around 8.2% over the forecast period (2025-2034).

- Regarding revenue, the global insurance broker and agents market size was valued at around USD 291.93 Billion in 2024 and is projected to reach USD 685.39 Billion by 2034.

- The insurance broker and agents market is projected to grow at a significant rate due to rising awareness of insurance benefits, regulatory support for intermediaries, increasing demand for risk management advice, and growth of digital brokerage platforms.

- Based on Insurance Type, the Life Insurance segment is expected to lead the global market.

- On the basis of Distribution Channel, the Online segment is growing at a high rate and will continue to dominate the global market.

- Based on the End-user, the Individuals segment is projected to swipe the largest market share.

- By Service Type, the Retail Brokerage segment is expected to dominate the global market.

- Based on region, North America is predicted to dominate the global market during the forecast period.

Insurance Broker And Agents Market: Growth Drivers

Growing number of policy and insurance holders to drive market growth

The global insurance broker and agents market is projected to grow owing to the increasing number of people investing in life, health, and property insurance. There are several personal, psychological, and environmental factors that have resulted in an increased demand for comprehensive insurance policies. In Europe alone, more than 9000 insurance companies are providing insurance-related services whereas over 200 million European citizens are claimed to be insured as per the European Health Insurance Card (EHIC).

One of the primary drivers for life or health insurance policies is the growing prevalence of medical diseases especially during and after COVID-19. Medical conditions have evolved over the years and every individual is at risk of contracting some form of serious medical disease. The growing pollution rate, changing food habits, poor lifestyle, lack of exercise, and a generally weak immune system along with genetic factors have resulted in extreme pressure on the global healthcare sector. In addition to this, with the rising inflation rate, medical expenses have reached new heights. This includes treatment, medicine, and post-treatment care expenses. The American Cancer Society claims that nearly 6 lakh people died in 2022 in the US alone due to cancer.

Rising demand for improved employee benefits to create a higher demand

Employees across the world are demanding better compensation & benefits and company-covered insurance policies are an important aspect of employee benefits. Businesses are investing more in these rights to ensure retaining good talent and attracting prospective employees. Expanding insurance benefits to employee family members is an excellent strategy adopted by several corporate houses to ensure employee satisfaction.

Insurance Broker And Agents Market: Restraints

Existing prejudices against insurance brokers and agents to restrict market growth

Due to a lack of awareness and accurate information, there are widespread prejudices and perceptions against insurance brokers and agents. Although the exact mindset of a person may differ depending on past experiences and awareness, however; many people associate insurance agents or brokers with high commissions. In addition to this, insurance policies in general are too complex for common people to understand since they consist of several terms and conditions that are not evident. In the past few years, several incidents of claim rejection have been reported owing to these complex conditions resulting in failure to generate confidence amongst the general population. This could severely impact the global insurance brokers and agents market growth during the forecast period.

Insurance Broker And Agents Market: Opportunities

Growing adoption of digital technology and systems in the industry to create growth opportunities

The insurance broker and agents industry is likely to be revolutionized owing to the rising trend of digital transformation in the sector. Insurance companies are leveraging the benefits of advanced technologies such as Blockchain and Artificial Intelligence (AI) technologies to provide enhanced customer experience. Companies providing insurance are investing in training insurance agents to use new-age systems that allow them access to a broad group of potential customers. Agents can use these tools to create an effective pitch and deliver services using digital mediums. This allows them to save resources and perform better. On the other hand, information technology (IT) professionals are working on developing applications where insurance buyers can talk to a large number of brokers and choose the one that meets their requirements.

Increased demand for product insurance to create higher growth possibilities

There has been a steady increase in the demand for product insurance policies where people protect themselves against financial loss due to damage to a product or property. For instance, home insurance protects policyholders against damage to property, loss or theft of the insured product, or damages caused by natural disasters. The growing frequency of damage caused by floods, tornadoes, and other natural calamities has created a broader market for insurance brokers and agents.

Insurance Broker And Agents Market: Challenges

Industry players are likely to deal with multifaceted challenges

The insurance brokers and agents industry size is plagued with several challenges. For instance, the insurance brokers and agents sector is highly regulated as there are several guidelines for companies to provide financial services. In addition to this, the competition is extremely intense as there are multiple service providers present in the market which directly impacts profit margins for all players involved in the business. Companies that have adopted digital systems are vulnerable to cyber-crimes requiring them to invest in protection measures leading to increased expense.

Insurance Broker And Agents Market: Segmentation

The global insurance brokers and agents market is segmented based on insurance type, type, end-user, mode, and region.

Based on insurance type, the global market divisions are health & medical insurance, life insurance, and property & casualty insurance. In 2022, the highest demand was observed for health & medical insurance. Research and studies indicate that COVID-19 played a crucial role in segmental growth. Growing healthcare expenses, an increasing number of patients, and rising demand for corporate health insurance are expected to push the segment toward new growth avenues during the projection period. In India, there are around 30 most promising health insurance companies catering to the needs of the growing population.

Based on type, the insurance brokers and agents industry segments are insurance brokers, insurance agencies, bancassurance, and other intermediaries.

Based on the end-user, the insurance brokers and agents industry divisions are individual and corporate. In 2022, the individual segment controlled around 52% of the segmental share. The driving factors were options to customize individual healthcare policies, tax rebates and subsidies provided by the government for undertaking insurance from state-owned agencies and increasing initiatives by regional governments to develop national healthcare insurance schemes.

Based on mode, the global market divisions are online and offline.

Insurance Broker And Agents Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Broker And Agents Market |

| Market Size in 2024 | USD 291.93 Billion |

| Market Forecast in 2034 | USD 685.39 Billion |

| Growth Rate | CAGR of 8.2% |

| Number of Pages | 226 |

| Key Companies Covered | Willis Towers Watson, Arthur J. Gallagher & Co., The Hartford Financial Services Group, Marsh & McLennan Companies, Alliant Insurance Services Inc., Aon plc, Gallagher Affinity, Brown & Brown Inc., HUB International, Lockton Companies, USI Insurance Services, NFP (National Financial Partners), Jardine Lloyd Thompson Group (JLT), and others., and others. |

| Segments Covered | By Insurance Type, By Distribution Channel, By End-user, By Service Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insurance Broker And Agents Market: Regional Analysis

North America to maintain its lead during the forecast period

The global insurance brokers and agents market will be dominated by North America during the forecast period with the US acting as the most dominant region. The growth trajectory can be attributed to the prevalence and acceptance of insurance policies for life, health, property, and private possessions. North American countries are filled with multiple insurance companies employing agents to sell insurance schemes to potential buyers. These companies have entered new markets, especially targeting emerging economies with rising middle-income groups. Another key contributor is the growing integration of modern tools and digital systems to improve customer experience. The presence of an expansive public healthcare system and several insurance policies concerning the health of the general population is likely to trigger higher regional growth. Europe is projected to grow at a steady pace. These agents help the common man understand the complex insurance structure in Europe and make informed decisions.

Insurance Broker And Agents Market: Competitive Analysis

The report provides a company market share analysis to give a broader overview of the key market players. In addition, the report also covers key strategic developments of the market, including acquisitions & mergers, new product launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the insurance broker and agents market on a global and regional basis.

The global insurance brokers and agents market is led by players like:

- Willis Towers Watson

- Arthur J. Gallagher & Co.

- The Hartford Financial Services Group

- Marsh & McLennan Companies

- Alliant Insurance Services Inc.

- Aon plc

- Gallagher Affinity

- Brown & Brown Inc.

- HUB International

- Lockton Companies

- USI Insurance Services

- NFP (National Financial Partners)

- Jardine Lloyd Thompson Group (JLT)

The global insurance brokers and agents market is segmented as follows:

By Insurance Type

- Health & Medical Insurance

- Life Insurance

- Property & Casualty Insurance

By Type

- Insurance Brokers

- Insurance Agencies

- Bancassurance

- Other Intermediaries

By End-User

- Individual

- Corporate

By Mode

- Online

- Offline

By Region

- North America

- The U.S.

- Canada

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of Middle East & Africa

Table Of Content

Methodology

FrequentlyAsked Questions

Insurance brokers and agents are individuals working in the larger financial services industry.

The global insurance broker and agents market is expected to grow due to rising awareness of insurance benefits, regulatory support for intermediaries, increasing demand for risk management advice, and growth of digital brokerage platforms.

According to a study, the global insurance broker and agents market size was worth around USD 291.93 Billion in 2024 and is expected to reach USD 685.39 Billion by 2034.

The global insurance broker and agents market is expected to grow at a CAGR of 8.2% during the forecast period.

North America is expected to dominate the insurance broker and agents market over the forecast period.

The global insurance brokers and agents market is led by players like Willis Towers Watson, Arthur J. Gallagher & Co., The Hartford Financial Services Group, Marsh & McLennan Companies, Alliant Insurance Services, Inc., Aon plc, Gallagher Affinity, Brown & Brown, Inc., HUB International, Lockton Companies, USI Insurance Services, NFP (National Financial Partners), and Jardine Lloyd Thompson Group (JLT) among many others.

The report explores crucial aspects of the insurance brokers and agents market including a detailed discussion of existing growth factors and restraints while also browsing future growth opportunities and challenges that impact the market.

HappyClients

Zion Market Research

Tel: +1 (302) 444-0166

USA/Canada Toll Free No.+1 (855) 465-4651

3rd Floor,

Mrunal Paradise, Opp Maharaja Hotel,

Pimple Gurav, Pune 411061,

Maharashtra, India

Phone No +91 7768 006 007, +91 7768 006 008

US OFFICE NO +1 (302) 444-0166

US/CAN TOLL FREE +1 (855) 465-4651

Email: sales@zionmarketresearch.com

We have secured system to process your transaction.

Our support available to help you 24 hours a day, five days a week.

Monday - Friday: 9AM - 6PM

Saturday - Sunday: Closed